Harry Pangas, Esq. Gregory A. Schernecke, Esq. Dechert LLP 1900 K Street, N.W. Washington, DC 20006 Telephone: (202) 261-3300 Fax: (202) 261-3333 | | | George M. Silfen, Esq. Terrence Shen, Esq. Kramer Levin Naftalis & Frankel LLP 1177 Avenue of the Americas New York, NY 10036 Telephone: (212) 715-9100 Fax: (212) 715-8422 |

Title of Securities Being Registered | | | Amount Being Registered(1) | | | Proposed Maximum Offering Price per Share of Common Stock | | | Proposed Maximum Aggregate Offering Price(2) | | | Amount of Registration Fee(3) |

Common Stock, par value $0.001 per share | | | 17,157,300 shares | | | N/A | | | $141,623,692.82 | | | $18,382.76(4) |

(1) | The number of shares to be registered represents the maximum number of shares of the registrant’s common stock estimated to be issuable in connection with the merger agreement described in the enclosed document. Pursuant to Rule 416, this registration statement also covers additional securities that may be issued as a result of stock splits, stock dividends or similar transactions. |

(2) | Estimated solely for the purpose of calculating the registration fee and calculated pursuant to Rules 457(c) and 457(f)(1) under the Securities Act of 1933, as amended, the proposed maximum aggregate offering price is equal to: (1) $7.99, the average of the high and low prices per share of MVC Capital, Inc.’s common stock (the securities to be cancelled in the transaction) on September 9, 2020, as reported on the New York Stock Exchange, multiplied by (2) 17,725,118, the number of shares of MVC Capital, Inc.’s common stock that will be exchanged for shares of the registrant’s common stock in accordance with the terms of the merger agreement. |

(3) | Based on a rate of $129.80 per $1,000,000 of the proposed maximum aggregate offering price. |

(4) | Previously paid. |

(1) | approve the issuance of shares of Barings BDC common stock, $0.001 par value per share (“Barings BDC Common Stock”), pursuant to the Agreement and Plan of Merger, dated as of August 10, 2020 (as may be amended from time to time, the “Merger Agreement”), by and among Barings BDC, Mustang Acquisition Sub, Inc., a Delaware corporation and a direct wholly-owned subsidiary of Barings BDC (“Acquisition Sub”), MVC Capital, Inc., a Delaware corporation (“MVC”), and Barings LLC, a Delaware limited liability company and the external investment adviser to Barings BDC (“Barings”) (such proposal, the “Merger Stock Issuance Proposal”); |

(2) | approve the issuance of shares of Barings BDC Common Stock pursuant to the Merger Agreement at a price below its then-current net asset value (“NAV”) per share, if applicable (such proposal, the “Barings BDC Below NAV Issuance Proposal”); |

(3) | approve an amended and restated investment advisory agreement between Barings BDC and Barings (the “New Barings BDC Advisory Agreement”), to among other things, (a) reduce the annual base management fee payable to Barings from 1.375% to 1.250% of Barings BDC’s gross assets, (b) reset the commencement date for the rolling 12-quarter “look-back” provision used to calculate the income incentive fee and incentive fee cap to January 1, 2021 from January 1, 2020 and (c) describe the fact that Barings BDC may enter into guarantees, sureties and other credit support arrangements with respect to one or more of its investments, including the impact of these arrangements on the income incentive fee cap (such proposal, the “Barings BDC Advisory Agreement Amendment Proposal”); and |

(4) | approve the adjournment of the Barings BDC Special Meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are insufficient votes at the time of the Barings BDC Special Meeting to approve the Merger Stock Issuance Proposal, the Barings BDC Below NAV Issuance Proposal or the Barings BDC Advisory Agreement Amendment Proposal (such proposal, the “Barings BDC Adjournment Proposal” and together with the Merger Stock Issuance Proposal, the Barings BDC Below NAV Issuance Proposal, and the Barings BDC Advisory Agreement Amendment, the “Barings BDC Proposals”). |

| | | Barings BDC Common Stock | |

Closing Sales Price at August 7, 2020 | | | $8.24 |

Closing Sales Price at [•], 2020 | | | $[•] |

Barings BDC, Inc. 300 South Tryon Street, Suite 2500 Charlotte, North Carolina 28202 (704) 805-7200 | | | MVC Capital, Inc. 287 Bowman Avenue, 2nd Floor Purchase, New York 10577 (914) 701-0310 |

(1) | to consider and vote upon a proposal to approve the issuance of shares of Barings BDC common stock, $0.001 par value per share (“Barings BDC Common Stock”), pursuant to the Agreement and Plan of Merger, dated as of August 10, 2020 (as may be amended from time to time, the “Merger Agreement”), by and among Barings BDC, Mustang Acquisition Sub, Inc., a Delaware corporation and a direct wholly-owned subsidiary of Barings BDC (“Acquisition Sub”), MVC Capital, Inc., a Delaware corporation (“MVC”), and Barings LLC, a Delaware limited liability company and the external investment adviser to Barings BDC (“Barings”) (such proposal, the “Merger Stock Issuance Proposal”); |

(2) | to consider and vote upon a proposal to approve the issuance of shares of Barings BDC Common Stock pursuant to the Merger Agreement at a price below its then-current net asset value (“NAV”) per share, if applicable (such proposal, the “Barings BDC Below NAV Issuance Proposal”); |

(3) | to consider and vote upon a proposal to approve an amended and restated investment advisory agreement between Barings BDC and Barings (the “New Barings BDC Advisory Agreement”) to, among other things, (a) reduce the annual base management fee payable to Barings from 1.375% to 1.250% of Barings BDC’s gross assets, (b) reset the commencement date for the rolling 12-quarter “look-back” provision used to calculate the income incentive fee and incentive fee cap to January 1, 2021 from January 1, 2020 and (c) describe the fact that Barings BDC may enter into guarantees, sureties and other credit support arrangements with respect to one or more of its investments, including the impact of these arrangements on the income incentive fee cap (such proposal, the “Barings BDC Advisory Agreement Amendment Proposal”); and |

(4) | to consider and vote upon a proposal to approve the adjournment of the Barings BDC Special Meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are insufficient votes at the time of the Barings BDC Special Meeting to approve the Merger Stock Issuance Proposal, the Barings BDC Below NAV Issuance Proposal and the Barings BDC Advisory Agreement Amendment Proposal (such proposal, the “Barings BDC Adjournment Proposal” and together with the Merger Stock Issuance Proposal, the Barings BDC Below NAV Issuance Proposal, or the Barings BDC Advisory Agreement Amendment, the “Barings BDC Proposals”). |

| | | By Order of the Board of Directors, | |

| | | ||

| | | Ashlee Steinnerd | |

| | | Secretary of Barings BDC, Inc. |

(1) | adopt the Agreement and Plan of Merger, dated as of August 10, 2020 (as may be amended from time to time, the “Merger Agreement”), by and among Barings BDC, Inc., a Maryland corporation (“Barings BDC”), Mustang Acquisition Sub, Inc., a Delaware corporation and a direct wholly-owned subsidiary of Barings BDC (“Acquisition Sub”), MVC, and Barings LLC, a Delaware limited liability company and the external investment adviser to Barings BDC (“Barings”) (such proposal, the “Merger Proposal”); and |

(2) | approve the adjournment of the MVC Special Meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are insufficient votes at the time of the MVC Special Meeting to approve the Merger Proposal (such proposal, the “MVC Adjournment Proposal” and together with the Merger, the “MVC Proposals”). |

| | | Barings BDC Common Stock | |

Closing Sales Price at August 7, 2020 | | | $8.24 |

Closing Sales Price at [•], 2020 | | | $[•] |

MVC Capital, Inc. 287 Bowman Avenue, 2nd Floor Purchase, New York 10577 (914) 701-0310 | | | Barings BDC, Inc. 300 South Tryon Street, Suite 2500 Charlotte, North Carolina 28202 (704) 805-7200 |

(1) | to consider and vote upon a proposal to adopt the Agreement and Plan of Merger, dated as of August 10, 2020 (as may be amended from time to time, the “Merger Agreement”), by and among Barings BDC, Inc., a Delaware corporation (“Barings BDC”), Mustang Acquisition Sub, Inc., a Delaware corporation and a direct wholly-owned subsidiary of Barings BDC (“Acquisition Sub”), MVC, and Barings LLC, a Delaware limited liability company and the external investment adviser to Barings BDC (“Barings”) (such proposal, the “Merger Proposal”); and |

(2) | to consider and vote upon a proposal to approve the adjournment of the MVC Special Meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are insufficient votes at the time of the MVC Special Meeting to approve the Merger Proposal (such proposal, the “MVC Adjournment Proposal” and together with the Merger Proposal, the “MVC Proposals”). |

| | | By Order of the Board of Directors, | |

| | | ||

| | | Michael Tokarz | |

| | | ||

| | | Chairman of MVC Capital, Inc. |

Q: | Why am I receiving these materials? |

A: | Barings BDC is furnishing these materials to Barings BDC stockholders in connection with the solicitation of proxies by the board of directors of Barings BDC (the “Barings BDC Board”) for use at the Barings BDC Special Meeting to be held virtually at 8:00 a.m., Eastern Time, on December 17, 2020 at the following website: www.virtualshareholdermeeting.com/BBDC2020SM, and any adjournments or postponements thereof. |

Q: | What items will be considered and voted on at the Barings BDC Special Meeting? |

A: | At the Barings BDC Special Meeting, Barings BDC stockholders will be asked to approve: (1) the issuance of shares of Barings BDC Common Stock pursuant to the Merger Agreement (such proposal, the “Merger Stock Issuance Proposal”), (2) the issuance of shares of Barings BDC Common Stock pursuant to the Merger Agreement at a price below its then-current NAV per share, if applicable (such proposal, the “Barings BDC Below NAV Issuance Proposal”), and (3) an amended and restated investment advisory agreement between Barings BDC and Barings (the “New Barings BDC Advisory Agreement”) to, among other things, (a) reduce the annual base management fee payable to Barings from 1.375% to 1.250% of Barings BDC’s gross assets, (b) reset the commencement date for the rolling 12-quarter “look-back” provision used to calculate the income incentive fee and incentive fee cap to January 1, 2021 from January 1, 2020 and (c) describe the fact that Barings BDC may enter into guarantees, sureties and other credit support arrangements with respect to one or more of its investments, including the impact of these arrangements on the income incentive fee cap (such proposal, the “Barings BDC Advisory Agreement Amendment Proposal”), and (4) if necessary or appropriate, to solicit additional proxies, in the event that there are insufficient votes at the time of the Barings BDC Special Meeting to approve the Merger Stock Issuance Proposal, the Barings BDC Below NAV Issuance Proposal or the Barings BDC Advisory Agreement Amendment Proposal (such proposal, the “Barings BDC Adjournment Proposal” and together with the Merger Stock Issuance Proposal, the Barings BDC Below NAV Issuance Proposal, and the Barings BDC Advisory Agreement Amendment Proposal, the “Barings BDC Proposals”). No other matters will be acted upon at the Barings BDC Special Meeting without further notice. |

Q: | What items will be considered and voted on at the MVC Special Meeting? |

A: | At the MVC Special Meeting, MVC stockholders will be asked to: (1) adopt the Merger Agreement (such proposal, the “Merger Proposal”), and (2) approve the adjournment of the MVC Special Meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are insufficient votes at the time of the MVC Special Meeting to approve the Merger Proposal (such proposal, the “MVC Adjournment Proposal” and together with the Merger Proposal, the “MVC Proposals”). No other matters will be acted upon at the MVC Special Meeting without further notice. |

Q: | How does the Barings BDC Board recommend voting on the Barings BDC Proposals at the Barings BDC Special Meeting? |

A: | The Barings BDC Board believes that the transactions contemplated by the Merger Agreement are in the best interests of the Barings BDC stockholders and unanimously approved the Merger Agreement and the transactions contemplated thereby, and therefore unanimously recommends that Barings BDC stockholders vote “FOR” the Merger Stock Issuance Proposal, “FOR” the Barings Below NAV Issuance Proposal, “FOR” the Barings BDC Advisory Agreement Amendment Proposal, and, if necessary or appropriate, “FOR” the Barings BDC Adjournment Proposal. |

Certain material factors considered by the Barings BDC Board, including the directors that are not “interested persons,” as defined in Section 2(a)(19) of the Investment Company Act, of Barings BDC or Barings (the “Barings BDC Independent Directors”), that favored the conclusion of the Barings BDC Board that the Merger is in the best interests of Barings BDC and Barings BDC stockholders included, among others: |

• | the combined company’s increased scale and liquidity; |

• | the expected accretion to Barings BDC stockholders; |

• | the alignment of Barings and Barings BDC stockholders as a result of Barings agreeing to (1) fund the cash portion of the purchase price of $0.39492 per share, or approximately $7 million and (2) provide up to $23 million of credit support pursuant to a credit support agreement (the “Credit Support Agreement”) designed to limit downside to Barings BDC stockholders from net cumulative realized and unrealized losses on the acquired MVC portfolio relative to purchase price while also allowing Barings BDC stockholders to benefit from long-term MVC portfolio appreciation; and |

• | the combined company’s economies of scale and the other factors disclosed under “The Merger—Reasons for the Merger—Barings BDC.” |

The Barings BDC Board considered that while the Merger could cause dilution to Barings BDC stockholders’ voting interests and the NAV per share of the combined company’s common stock, the potential benefits of the Merger (including each of the foregoing) outweighed this cost. |

Q: | How does the MVC Board recommend voting on the MVC Proposals at the MVC Special Meeting? |

A: | The MVC Board, acting on the recommendation of a special committee (the “MVC Strategic Review Committee”) of the MVC Board, consisting of Michael Tokarz, Robert Knapp and Scott Krase, believes the Merger Agreement and the transactions contemplated thereby are in the best interests of MVC stockholders, and unanimously approved the Merger Agreement and the transactions contemplated thereby, including the Merger, and therefore unanimously recommends that MVC stockholders vote “FOR” the Merger Proposal and, if necessary or appropriate, “FOR” the MVC Adjournment Proposal. |

Certain material factors considered by the MVC Board, including MVC directors who are not “interested persons” as defined by the Investment Company Act (the “MVC Independent Directors”) and the MVC Strategic Review Committee, that favored the conclusion of the MVC Board that the Merger is in the best interests of MVC and MVC stockholders included, among others: |

• | Barings BDC’s more diverse credit portfolio with less non-accruing loans; |

• | the fact that Barings BDC is managed by a large global asset manager, whereas MVC has key-man risk; |

• | Barings BDC’s greater scale and thus the potential to be better able to successfully compete for investment opportunities and have access to lower cost financing sources than MVC; |

• | the combined portfolio’s greater potential to grow cash net investment income with a larger portion consisting of cash interest payments as opposed to payment in kind interest; and |

• | the combined company having more than four (4) times the market capitalization of MVC, which is expected to improve liquidity for MVC stockholders, and the other factors described under “The Merger—Reasons for the Merger—MVC.” |

Q: | If I am a Barings BDC stockholder, what is the “Record Date” and what does it mean? |

A: | The record date for the Barings BDC Special Meeting is October 29, 2020 (the “Barings BDC Record Date”). The Barings BDC Record Date was established by the Barings BDC Board, and only holders of record of shares of Barings BDC Common Stock at the close of business on the Barings BDC Record Date are entitled to receive notice of the Barings BDC Special Meeting and vote at the Barings BDC Special Meeting. As of the Barings BDC Record Date, there were 47,961,753 shares of Barings BDC Common Stock outstanding. |

Q: | If I am an MVC stockholder, what is the “Record Date” and what does it mean? |

A: | The record date for the MVC Special Meeting is October 29, 2020 (the “MVC Record Date”). The MVC Record Date was established by the MVC Board, and only holders of record of shares of MVC Common Stock at the close of business on the MVC Record Date are entitled to receive notice of the MVC Special Meeting and vote at the MVC Special Meeting. As of the MVC Record Date, there were 17,725,118 shares of MVC Common Stock outstanding. |

Q: | If I am a Barings BDC stockholder, how many votes do I have? |

A: | Each share of Barings BDC Common Stock held by a holder of record as of the Barings BDC Record Date has one vote on each matter to be considered at the Barings BDC Special Meeting. |

Q: | If I am an MVC stockholder, how many votes do I have? |

A: | Each share of MVC Common Stock held by a holder of record as of the MVC Record Date has one vote on each matter to be considered at the MVC Special Meeting. |

Q: | If I am a Barings BDC stockholder, how do I vote? |

A: | The Barings BDC Special Meeting will be hosted live via Internet audio webcast. Any Barings BDC stockholder can attend the Barings BDC Special Meeting live at www.virtualshareholdermeeting.com/BBDC2020SM. A Barings BDC stockholder should follow the instructions on the accompanying proxy card and authorize a proxy via the Internet or telephone to vote in accordance with the instructions provided below. Authorizing a proxy by telephone or through the Internet requires you to input the control number located on your proxy card. After inputting the control number, you will be prompted to direct your proxy to vote on each proposal. You will have an opportunity to review your directions and make any necessary changes before submitting your directions and terminating the telephone call or Internet link. If you are the beneficial owner of your shares, you will need to follow the instructions provided by your broker, bank, trustee or nominee regarding how to instruct your broker, bank, trustee or nominee to vote your shares at the Barings BDC Special Meeting. |

• | By Internet: www.proxyvote.com |

• | By telephone: (800) 690-6903 to reach a toll-free, automated touchtone voting line, or (877) 777-4652 Monday through Friday 9:00 a.m. until 10:00 p.m. Eastern Time to reach a toll-free, live operator line. |

• | By mail: You may vote by proxy, after you request the hard copy materials, by following the directions and indicating your instructions on the enclosed proxy card, dating and signing the proxy card, and promptly returning the proxy card in the envelope provided, which requires no postage if mailed in the United States. Please allow sufficient time for your proxy card to be received on or prior to 11:59 p.m., Eastern Time, on December 16, 2020. |

Q: | If I am an MVC stockholder, how do I vote? |

A: | The MVC Special Meeting will be hosted live via Internet audio webcast. Any MVC stockholder can attend the MVC Special Meeting live at www.virtualshareholdermeeting.com/MVC2020SM. An MVC stockholder should follow the instructions on the accompanying proxy card and authorize a proxy via the Internet or telephone to vote in accordance with the instructions provided below. Authorizing a proxy by telephone or |

• | By Internet: www.proxyvote.com |

• | By telephone: (800) 322-2885 |

• | By mail: You may vote by proxy, after you request the hard copy materials, by following the directions and indicating your instructions on the enclosed proxy card, dating and signing the proxy card, and promptly returning the proxy card in the envelope provided, which requires no postage if mailed in the United States. Please allow sufficient time for your proxy card to be received on or prior to 11:59 p.m., Eastern Time, on December 16, 2020. |

Q: | What if a Barings BDC stockholder does not specify a choice for a matter when authorizing a proxy? |

A: | All properly executed proxies representing shares of Barings BDC Common Stock at the Barings BDC Special Meeting will be voted in accordance with the directions given. If the enclosed proxy card is signed and returned without any directions given, the shares of Barings BDC Common Stock will be voted “FOR” the Barings BDC Proposals. |

Q: | What if an MVC stockholder does not specify a choice for a matter when authorizing a proxy? |

A: | All properly executed proxies representing shares of MVC Common Stock at the MVC Special Meeting will be voted in accordance with the directions given. If the enclosed proxy card is signed and returned without any directions given, the shares of MVC Common Stock will be voted “FOR” the MVC Proposals. |

Q: | If I am a Barings BDC stockholder, how can I change my vote or revoke a proxy? |

A: | You may revoke your proxy and change your vote by giving notice at any time before your proxy is exercised. A revocation may be effected by submitting new voting instructions via the Internet voting site, by telephone, by obtaining and properly completing another proxy card that is dated later than the original proxy card and returning it, by mail, in time to be received before the Barings BDC Special Meeting, by attending the Barings BDC Special Meeting and voting virtually or by a notice, provided in writing and signed by you, delivered to Barings BDC’s Secretary on any business day before the date of the Barings BDC Special Meeting. |

Q: | If I am an MVC stockholder, how can I change my vote or revoke a proxy? |

A: | You may revoke your proxy and change your vote by giving notice at any time before your proxy is exercised. A revocation may be effected by submitting new voting instructions via the Internet voting site, by telephone, by obtaining and properly completing another proxy card that is dated later than the original proxy card and returning it, by mail, in time to be received before the MVC Special Meeting, by attending the MVC Special Meeting and voting virtually or by a notice, provided in writing and signed by you, delivered to MVC’s Secretary on any business day before the date of the MVC Special Meeting. |

Q: | If my shares of Barings BDC Common Stock or MVC Common Stock, as applicable, are held in a broker-controlled account or in “street name,” will my broker vote my shares for me? |

A: | No. You should follow the instructions provided by your broker on your voting instruction form. It is important to note that your broker will vote your shares only if you provide instructions on how you would like your shares to be voted at the applicable special meeting. |

Q: | What constitutes a “quorum” for the Barings BDC Special Meeting? |

A: | The presence at the Barings BDC Special Meeting, virtually or represented by proxy, of the holders of a majority of the shares of Barings BDC Common Stock, issued and outstanding and entitled to vote at the |

Q: | What constitutes a “quorum” for the MVC Special Meeting? |

A: | The presence at the MVC Special Meeting, virtually or represented by proxy, of the holders of a majority of the shares of MVC Common Stock, issued and outstanding and entitled to vote at the MVC Special Meeting, will constitute a quorum. Shares held by a broker, bank, trustee or nominee for which the broker, bank, trustee or nominee has not received voting instructions from the record holder as to how to vote such shares and does not have discretionary authority to vote the shares on non-routine proposals (which are considered “broker non-votes” with respect to such proposals) will not be treated as shares present for quorum purposes. |

Q: | What vote is required to approve each of the proposals being considered at the Barings BDC Special Meeting? |

A: | The Merger Stock Issuance Proposal requires the affirmative vote of the holders of at least a majority of the votes cast by holders of shares of Barings BDC Common Stock present at the Barings BDC Special Meeting, virtually or represented by proxy, entitled to vote thereat. Abstentions and broker non-votes (if any) will not be counted as votes cast and will have no effect on the result of the vote of the Merger Stock Issuance Proposal. |

Q: | What vote is required to approve each of the proposals being considered at the MVC Special Meeting? |

A: | The affirmative vote of the holders of at least a majority of the outstanding voting securities of MVC Common Stock entitled to vote at the MVC Special Meeting is required to approve the Merger Proposal. The affirmative vote of the holders of at least a majority of the votes cast by holders of the shares of MVC Common Stock present at the MVC Special Meeting, virtually or represented by proxy, and entitled to vote thereat is required to approve the MVC Adjournment Proposal. |

Q: | What will happen if the Barings BDC Proposals being considered at the Barings BDC Special Meeting and/or the MVC Proposals being considered at the MVC Special Meeting is not approved by the required vote? |

A: | The Merger Stock Issuance Proposal and the Barings BDC Below NAV Proposals with respect to Barings BDC, and the Merger Proposal with respect to MVC, are conditions precedent to the closing of the Merger. If the Merger does not close because Barings BDC stockholders do not approve the Merger Stock Issuance Proposal or the Barings BDC Below NAV Proposal (the “Barings BDC Stockholder Approval”) and MVC stockholders do not approve the Merger Proposal (the “MVC Stockholder Approval”) or any of the other conditions to closing of the Merger are not satisfied or, if legally permissible, waived, Barings BDC and MVC will continue to operate independently under the management of their respective investment advisers, and Barings BDC’s and MVC’s respective directors and officers will continue to serve in such roles until their respective successors are duly elected and qualify or their resignation. Furthermore, neither Barings BDC nor MVC will benefit from the expenses incurred in their pursuit of the Merger and, under certain circumstances, MVC may be required to pay Barings BDC’s and Barings’ expenses incurred in connection with the Merger, subject to a cap of $1,175,175. See “Description of the Merger Agreement—Termination of the Merger Agreement” below for a more detailed discussion. The MVC Board would also expect to consider other alternatives, which may include liquidation among other options, based on then-current market circumstances, the performance of the MVC portfolio and financial position of MVC. |

Q: | How will the final voting results be announced? |

A: | Preliminary voting results may be announced at each special meeting. Final voting results will be published by Barings BDC and MVC in a current report on Form 8-K within four business days after the date of the Barings BDC Special Meeting and the MVC Special Meeting, respectively. |

Q: | Are the proxy materials available electronically? |

A: | Barings BDC and MVC have made the registration statement (of which this joint proxy statement/prospectus forms a part), the applicable notice of special meeting of stockholders and the applicable proxy card available to stockholders of Barings BDC and MVC on the Internet. stockholders may (i) access and review the proxy materials of Barings BDC and MVC, as applicable,(ii) authorize their proxies, as described in “The Barings BDC Special Meeting—Voting of Proxies” and “The MVC Special Meeting—Voting of Proxies” and/or (iii) elect to receive future proxy materials by electronic delivery via the Internet address provided below. |

Q: | Will my vote make a difference? |

A: | Yes. Your vote is needed to ensure that the proposals can be acted upon. Your vote is very important. Your immediate response will help avoid potential delays and may save significant additional expenses associated with soliciting stockholder votes, and potentially adjourning the Special Meetings. |

Q: | Whom can I contact with any additional questions? |

A: | If you are a Barings BDC stockholder, you can contact Barings BDC by calling Barings BDC collect at (888) 401-1088, by sending an e-mail to Barings BDC at BDCinvestorrelations@barings.com, or by writing to Barings BDC at 300 South Tryon Street, Suite 2500, Charlotte, North Carolina 28202, Attention: Investor Relations, or by visiting Barings BDC’s website at www.baringsbdc.com or you may contact Broadridge Inc., Barings BDC’s proxy solicitor, toll-free at 1-877-777-4652. |

Q: | Where can I find more information about Barings BDC and MVC? |

A: | You can find more information about Barings BDC and MVC in the documents described under the section entitled “Where You Can Find More Information.” |

Q: | What do I need to do now? |

A: | Barings BDC and MVC urge you to carefully read this entire document, including its annexes. You should also review the documents referenced under “Where You Can Find More Information” and consult with your accounting, legal and tax advisors. |

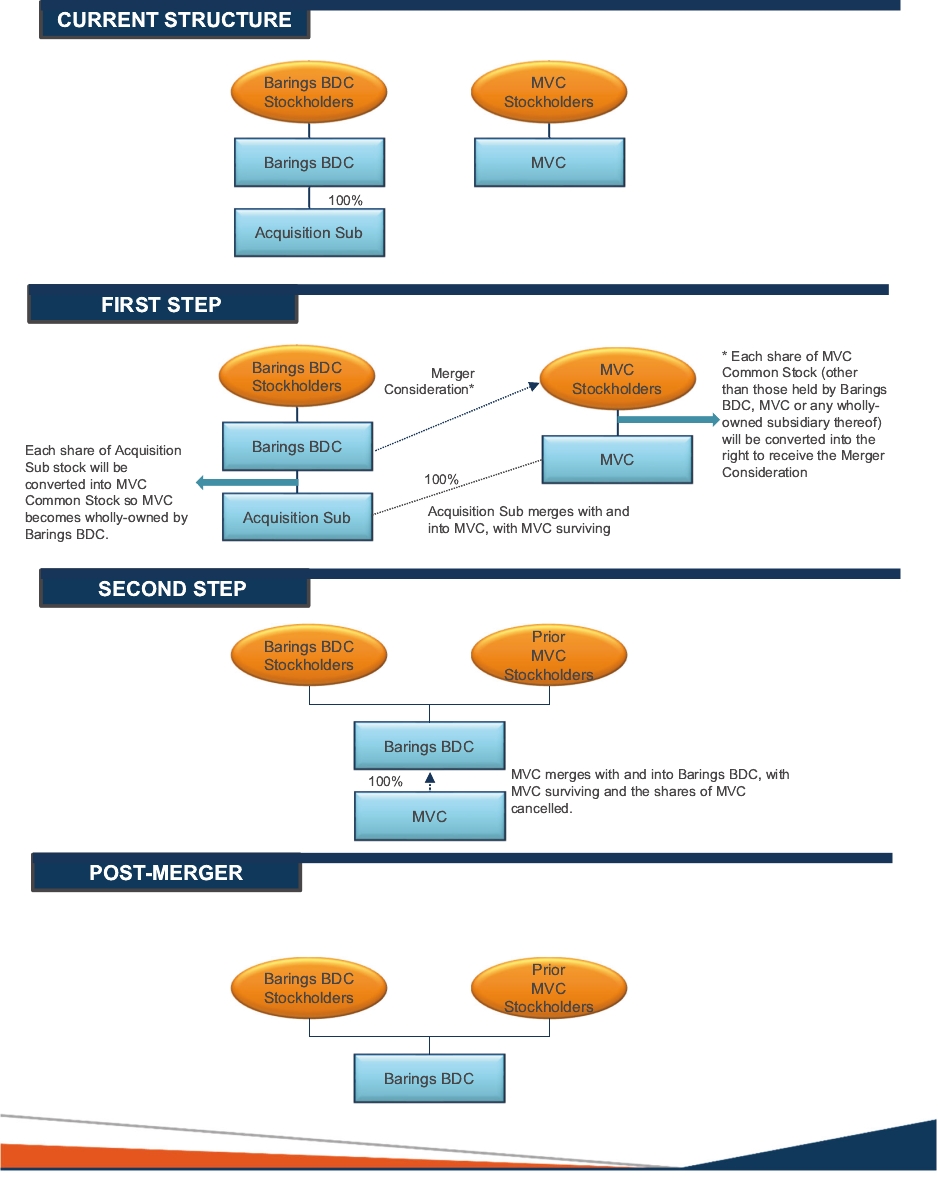

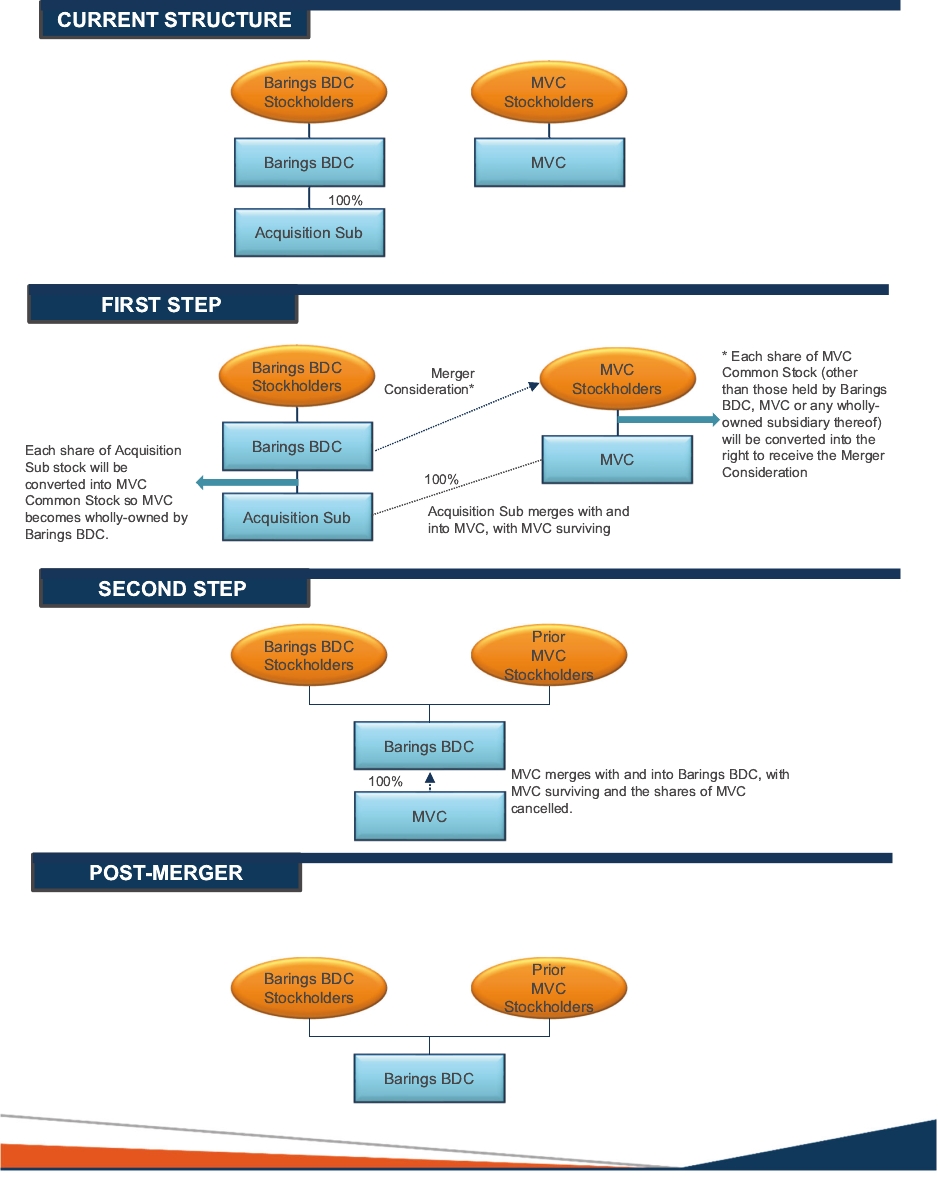

Q: | What will happen in the Merger? |

A: | As of the Effective Time, the separate corporate existence of Acquisition Sub will cease. MVC will be the surviving corporation of the First Step and will continue its existence as a corporation under the laws of the State of Delaware until the Second Step. Immediately after the Effective Time, MVC, as the surviving corporation in the First Step, will merge with and into Barings BDC, with Barings BDC as the surviving corporation in the Second Step (the “Second Step” and together with the First Step, the “Merger”). |

Q: | What will MVC stockholders receive in the Merger? |

A: | Subject to the terms and conditions of the Merger Agreement, at the Effective Time, each share of MVC Common Stock issued and outstanding immediately prior to the Effective Time (excluding Canceled Shares) will be converted into the right to receive (1) $0.39492 per share in cash, without interest, from Barings (such amount of cash, the “Cash Consideration”) and (2) 0.94024 (as may be adjusted pursuant to the Merger Agreement) of a validly issued, fully paid and non-assessable share of Barings BDC Common Stock (and, if applicable, cash in lieu of fractional shares of Barings BDC Common Stock payable in accordance the Merger Agreement) (the “Share Consideration,” together with the Cash Consideration, the “Merger Consideration”). For purposes of the Merger Agreement, “Canceled Shares” means all treasury shares and all shares of MVC Common Stock issued and outstanding immediately prior to the Effective Time that are owned by Barings BDC, MVC or any wholly-owned subsidiary thereof. |

Q: | How will the Exchange Ratio be determined? |

A: | The Exchange Ratio was fixed at the signing of the Merger Agreement at 0.94024. As described below, the Exchange Ratio is subject to adjustment based on changes in the number of outstanding shares of Barings BDC Common Stock and MVC Common Stock, the payment of MVC Tax Dividends (as defined under “Description of the Merger Agreement — Additional Covenants — Tax Dividends; Coordination of Dividends”) by MVC, any undistributed “investment company taxable income” (“ICTI”) within the meaning of Section 852(b) of the Internal Revenue Code of 1986, as amended (the “Code”) of MVC, and undistributed “net capital gain” within the meaning of Section 1222(11) of the Code (“Net Capital Gain”) of MVC, the RIC Tax Liability (as defined under “Description of the Merger Agreement — Additional |

Q: | Who is responsible for paying the expenses relating to completing the Merger? |

A: | In general, all fees and expenses incurred in connection with the Merger will be paid by the party incurring such fees and expenses, whether or not the Merger or any of the transactions contemplated in the Merger Agreement are consummated, provided that each of Barings BDC and MVC agreed to be responsible for one-half of all filing fees incurred in connection with the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), and for one-half of the costs of any independent accounting firm engaged to resolve any disagreements regarding certain tax matters. However, MVC will be required to pay Barings BDC’s expenses incurred in connection with the Merger, subject to a maximum reimbursement payment of $1,175,175, if MVC terminates the Merger Agreement, prior to receiving the required MVC Stockholder Approval, to enter into an Alternative Acquisition Agreement providing for a Superior Proposal (each as is defined under “Description of the Merger Agreement — Additional Covenants — No Solicitation.” It is expected that Barings BDC will incur approximately $5.0 million, or $1.04 per share of Barings BDC Common Stock, and MVC will incur approximately $2.3 million, or $0.13 per share of MVC Common Stock, of fees and expenses in connection with completing the Merger. While Barings BDC does not anticipate material portfolio repositioning following the Merger, these costs described above do not reflect commissions or other transaction fees that may be incurred by Barings BDC as a result of any such portfolio repositioning. |

Q: | Will I receive distributions after the Merger? |

A: | Each MVC stockholder will become a stockholder of Barings BDC in the Merger. MVC stockholders who participate in MVC’s dividend reinvestment plan will receive any future distributions paid to Barings BDC stockholders with respect to shares of Barings BDC Common Stock received in the Merger. MVC stockholders who do not participate in MVC’s dividend reinvestment plan will receive such future distributions with respect to shares of Barings BDC Common Stock received in the Merger in cash (unless such distributions are made in shares of stock). |

Q: | Is the Merger subject to any third-party consents? |

A: | Under the Merger Agreement, MVC and Barings BDC have agreed to cooperate with each other and use their reasonable best efforts to take promptly, or cause to be taken promptly, all actions to do, or cause to be |

How does Barings BDC’s investment objective and strategy differ from MVC’s? |

A: | Barings BDC’s primary investment objective is to generate income by investing directly in privately-held middle-market companies to help these companies fund acquisitions, growth or refinancing. Barings BDC seeks to achieve its investment objective by investing in senior secured private debt investments in well-established middle-market businesses that operate across a wide range of industries. MVC’s investment objective has been to seek to maximize total return from capital appreciation and/or income, though MVC’s current focus is on yield generating investments. MVC seeks to achieve its investment objective by providing debt and equity financing to companies that are, for the most part, privately owned. MVC’s current investments in portfolio companies consist principally of senior and subordinated loans, mezzanine and preferred instruments and private equity investments. |

| | | Barings BDC | | | MVC | |

Primary Investment Objective | | | To generate income by investing directly in privately-held middle-market companies to help these companies fund acquisitions, growth or refinancing. | | | To seek to maximize total return from capital appreciation and/or income, though MVC’s current focus has been on yield generating investments. |

| | | | | |||

Investment Focus | | | Senior secured private debt investments in well-established middle-market businesses that operate across a wide range of industries. | | | Principally of senior and subordinated loans, mezzanine and preferred instruments and private equity investments, though MVC’s current focus has been on yield generating investments. |

| | | | | |||

Target Borrower | | | Middle market companies, which tend to be privately owned, often by a private equity sponsor, and are companies that typically generate annual Adjusted EBITDA of $10.0 million to $75.0 million. | | | Small and middle-market privately-held companies, which tend to be privately owned companies that typically generate annual (1) revenues of $10 million to $150 million, or (2) EBITDA of $3 million to $25 million (with a focus on companies with EBITDA of $2 million to $10 million). |

| | | | | |||

Equity Investments | | | On a limited basis, Barings BDC may acquire equity interests in portfolio companies. In such cases, Barings BDC generally seeks to structure equity investments as non-control investments that provide Barings BDC with minority rights. | | | Investments can include senior and subordinated loans, convertible securities, common and preferred stock, other forms of equity interests and warrants or rights to acquire equity interests, though MVC’s current focus has been on yield generating investments. |

Q: | How will the combined company be managed following the Merger? |

A: | The directors of Barings BDC immediately prior to the Merger will remain the directors of Barings BDC and will hold office until their respective successors are duly elected and qualify, or their earlier death, resignation or removal. In addition, pursuant to the Merger Agreement, one current MVC director mutually selected by Barings BDC and MVC will be added to the Barings BDC Board effective as of the closing. Barings BDC and MVC have not yet determined which MVC director will be appointed. The officers of Barings BDC immediately prior to the Merger will remain the officers of Barings BDC and will hold office until their respective successors are duly appointed and qualify, or their earlier death, resignation or removal. Following the Merger, Barings BDC will continue to be managed by Barings, and there are not expected to be any material changes in Barings BDC’s investment objective or strategy. |

Q: | Are Barings BDC stockholders able to exercise appraisal rights in connection with the Merger? |

A: | No. Barings BDC stockholders will not be entitled to exercise appraisal rights with respect to any matter to be voted upon at the Barings BDC Special Meeting. |

Q: | Are MVC stockholders able to exercise appraisal rights in connection with the Merger? |

A: | Yes. MVC stockholders will be entitled to exercise appraisal rights with respect to the Merger in accordance with Section 262 of the Delaware General Corporation Law (the “DGCL”). For more information, see “Appraisal Rights of MVC stockholders” and “Description of the Merger Agreement—Appraisal Rights.” |

Q: | When do the parties expect to complete the Merger? |

A: | While there can be no assurance as to the exact timing, or that the Merger will be completed at all, Barings BDC and MVC are working to complete the Merger in the fourth quarter of 2020. It is currently expected that the Merger will be completed promptly following receipt of the Barings BDC Stockholder Approval (as defined below) at the Barings BDC Special Meeting and the MVC Stockholder Approval (as defined below) at the MVC Special Meeting, along with the satisfaction or (to the extent legally permissible) waiver of the other closing conditions set forth in the Merger Agreement. |

Q: | Is the Merger expected to be taxable to MVC stockholders? |

A: | The Merger is intended to qualify as a “reorganization,” within the meaning of Section 368(a) of the Code. If the Merger qualifies as a reorganization, then generally, for U.S. federal income tax purposes, U.S. stockholders (as defined herein under the heading “Certain Material U.S. Federal Income Tax Consequences of the Merger”) of MVC Common Stock who receive a combination of shares of Barings BDC Common Stock and cash, other than cash in lieu of a fractional share of Barings BDC Common Stock, in exchange for their MVC Common Stock, will recognize gains, but will not recognize any losses, equal to the lesser of (1) the amount of cash received in exchange for MVC Common Stock (including any cash paid to U.S. stockholders as the result of fluctuations in the Euro-to-U.S. dollar exchange rate), and excluding cash received in lieu of a fractional share of Barings BDC Common Stock) and (2) the excess, if any, of (a) the sum of the amount of cash received in exchange for MVC Common Stock (including cash received in lieu of a fractional share of Barings BDC Common Stock) and the fair market value of the |

Q: | What happens if the Merger is not consummated? |

A: | If the Merger is not completed for any reason, MVC stockholders will not receive any payment for their shares of MVC Common Stock in connection with the Merger. Instead, MVC will remain an independent company. In addition, MVC may, under certain circumstances specified in the Merger Agreement, be required to pay Barings BDC a termination fee of $2,937,938 and, under certain circumstances, reimburse Barings BDC for its out-of-pocket expenses incurred in connection with the transactions, subject to a maximum reimbursement amount of $1,175,175, or Barings BDC may be required to pay or cause to be paid to MVC a termination fee of $4,700,701. See “Description of the Merger Agreement—Termination of the Merger Agreement.” The MVC Board would also expect to consider other alternatives, which may include liquidation among other options, based on then-current market circumstances, the performance of the MVC portfolio and financial position of MVC. |

Q: | Is the approval of the New Barings BDC Advisory Agreement a condition precedent to the closing of the Merger and vice versa? |

A: | No. The closing of the Merger is not a condition to the adoption of the New Barings BDC Advisory Agreement. Similarly, the approval of the New Barings BDC Advisory Agreement is not a condition to the closing of the Merger. If the New Barings BDC Advisory Agreement is approved by Barings BDC stockholders, it will become effective as of January 1, 2021. If the New Barings BDC Advisory Agreement is not approved by Barings BDC stockholders, the existing investment advisory agreement, dated as of August 2, 2018, by and between Barings BDC and Barings (the “Existing Barings BDC Advisory Agreement”) will continue in effect and the Barings BDC Board will consider various alternatives, including seeking subsequent approval of a new investment advisory agreement by Barings BDC stockholders. |

Q: | Will stockholders of the Barings BDC following the Merger pay a higher base management fee than stockholders of Barings BDC and MVC prior to the Merger? |

| | | Barings BDC Common Stock | | | MVC Common Stock | |

Closing Sales Price at August 7, 2020 | | | $8.24 | | | $6.63 |

Closing Sales Price at [•], 2020 | | | $[•] | | | $[•] |

• | Because the market price of Barings BDC Common Stock will fluctuate, MVC stockholders cannot be sure of the market value of the Merger Consideration they will receive until the Closing Date. |

• | The total value of consideration to be received by MVC stockholders cannot be determined until the Closing Date. |

• | Sales of shares of Barings BDC Common Stock after the completion of the Merger may cause the market price of Barings BDC Common Stock to decline. |

• | MVC stockholders and Barings BDC stockholders will experience a reduction in percentage ownership and voting power in the combined company as a result of the Merger. |

• | Barings BDC may be unable to realize the benefits anticipated by the Merger, including estimated cost savings, or it may take longer than anticipated to realize such benefits. |

• | The announcement and pendency of the proposed Merger could adversely affect both Barings BDC’s and MVC’s business, financial results and operations. |

• | If the Merger does not close, neither Barings BDC nor MVC will benefit from the expenses incurred in their pursuit of the Merger. |

• | The termination of the Merger Agreement could negatively impact MVC and Barings BDC. |

• | Under certain circumstances, MVC or Barings BDC may be obligated to pay a termination fee upon termination of the Merger Agreement. |

• | Except in specified circumstances, if the Merger is not completed by February 10, 2021, either MVC or Barings BDC may choose not to proceed with the Merger. |

• | The Merger is subject to closing conditions, including stockholder approvals, that, if not satisfied or waived, will result in the Merger not being completed, which may result in material adverse consequences to MVC’s and Barings BDC’s business and operations. |

• | MVC and Barings BDC will be subject to contractual restrictions while the Merger is pending, including restrictions on pursuing alternatives to the Merger. |

• | The Merger Agreement contains provisions that could discourage or make it difficult for a third party to acquire MVC prior to the completion of the proposed Merger. |

• | If the Merger is not completed or MVC is not otherwise acquired, MVC may consider other strategic alternatives, which are subject to risks and uncertainties. |

• | Subject to applicable law, each party may waive one or more conditions to the Merger without resoliciting approval from its respective stockholders. |

• | The shares of Barings BDC Common Stock to be received by MVC stockholders as a result of the Merger will have different rights associated with them than shares of MVC Common Stock currently held by them, including the fact that (1) Barings BDC is a Maryland corporation subject to the MGCL and MVC is a Delaware corporation subject to the DGCL, (2) Barings BDC has a classified board of directors consisting of three (3) classes of directors each of which consists of directors who serve three (3) year terms while MVC has a single class of directors each of whom holds office until the next annual meeting of stockholders after his/her election and (3) Barings BDC and MVC’s bylaws provide for different requirements for the submission of stockholder proposals at stockholders meetings. For a more detailed discussion comparing the rights of Barings BDC stockholders and MVC stockholders, see section entitled “Comparison of Barings BDC and MVC Stockholder Rights.” |

• | The market price of Barings BDC Common Stock after the Merger may be affected by factors different from those affecting Barings BDC Common Stock or MVC Common Stock currently. |

• | The Merger may trigger certain “change of control” provisions and other restrictions in certain of Barings BDC’s and MVC’s contracts and the failure to obtain any required consents or waivers could adversely impact the combined company. |

• | The opinion delivered to the by Barings BDC Board by its financial advisor and the opinion delivered to the MVC Board and the MVC Strategic Review Committee by MVC’s financial advisor will not reflect any changes in circumstances that may occur since the opinions were delivered prior to signing the Merger Agreement. |

• | Certain persons related to MVC and Barings BDC have interests in the Merger that differ from the interests of MVC and Barings BDC stockholders. For example, MVC directors and officers are entitled to post-closing indemnification by Barings BDC under the Merger Agreement, Barings BDC has agreed to maintain a directors and officers’ liability insurance policy covering current and former MVC directors and officers for six (6) years following the closing of the Merger and one (1) MVC director will be appointed to the Barings BDC Board following the Merger. In addition, Barings, the investment adviser of Barings BDC, has indirect financial interests in the transactions contemplated by the Merger Agreement that are different from, and/or in addition to, the interests of Barings BDC stockholders. For more information, see “The Merger—Interests of Certain Persons Related to Barings BDC in the Merger” and “The Merger—Interests of Certain Persons Related to MVC in the Merger.” |

• | The combined company may not be able to obtain financing for additional capital requirements. |

• | MVC and Barings BDC have incurred and expect to incur substantial transaction fees and costs in connection with the Merger, whether or not the Merger is completed. |

• | Any litigation which may be filed against MVC and Barings BDC in connection with the Merger, regardless of its merits, could result in substantial costs and could delay or prevent the Merger from being completed. |

• | The Merger may not be treated as a tax-free reorganization under Section 368(a) of the Code. |

• | The U.S. federal income tax treatment of the Cash Consideration is not entirely clear, and the position taken that the Cash Consideration is treated as ordinary income to the holders of MVC Common Stock might be challenged by the IRS. |

• | the combined company’s increased scale and liquidity; |

• | the expected accretion to Barings BDC stockholders; |

• | the alignment of Barings and Barings BDC stockholders as a result of Barings agreeing to (1) fund the cash portion of the purchase price of $0.39492 per share, or approximately $7 million and (2) provide up to $23 million of credit support pursuant to the Credit Support Agreement designed to limit downside to Barings BDC stockholders from net cumulative realized and unrealized losses on the acquired MVC portfolio relative to purchase price while also allowing Barings BDC stockholders to benefit from long-term MVC portfolio appreciation; |

• | the combined company’s economies of scale; |

• | the combined company’s quality of holdings and diversification of assets and liabilities; |

• | the combined company’s increased market capitalization and commensurate increased trading volume; |

• | the structure and tax consequences of the Merger; |

• | the opinion of Barings BDC’s financial advisor; |

• | the terms of the Merger Agreement, including (1) provisions relating to the adjustment of the Exchange Ratio in respect of (a) any MVC Tax Dividends paid by MVC, (b) any contributed ICTI and/or undistributed Net Capital Gain of MVC or (c) any RIC Tax Liability of MVC, (2) the interim operating covenants applicable to MVC's portfolio, (3) the non-solicitation covenants and (4) the provisions relating to MVC termination fee and MVC's reimbursement of Barings BDC’s and Barings’ expenses up to a cap under certain circumstances; and |

• | the fact that the Voting Agreements were executed with four of MVC's largest stockholders in connection with the signing of the Merger Agreement, representing approximately 31% of the outstanding shares of MVC Common Stock. |

• | Barings BDC’s more diverse credit portfolio with less non-accruing loans; |

• | the fact that Barings BDC is managed by a large global asset manager, whereas MVC has key-man risk; |

• | Barings BDC’s greater scale and thus the potential to be better able to successfully compete for investment opportunities and have access to lower cost financing sources than MVC; |

• | the combined portfolio’s greater potential to grow cash net investment income with a larger portion consisting cash interest payments as opposed to payment in kind interest; |

• | the combined company having more than four (4) times the market capitalization of MVC, which is expected to improve liquidity for MVC stockholders; |

• | the proposed Merger Consideration market value representing a substantial implied premium over the market value of MVC Common Stock based on the closing share prices of MVC Common Stock and Barings BDC Common Stock on August 7, 2020; |

• | the Credit Support Agreement is expected to give stockholders of the combined company downside protection on the MVC portfolio and insulate the combined company’s stockholders from certain losses in MVC’s portfolio for the ten (10) years following the completion of the Merger; |

• | inherent uncertainties and a protracted timeline associated with liquidations, an alternative to a business combination, as well as risks that per share liquidation values would be below the implied per share Merger Consideration value; |

• | consideration of estimates of the then-current value of MVC’s net assets and Barings BDC’s net assets and the historical trading prices of MVC Common Stock and Barings BDC Common Stock compared to such estimates of NAV in determining the exchange ratio; |

• | the terms of the Merger Agreement, including (1) a provision that permits MVC, under specified circumstances, to respond to and engage in discussions with third parties regarding unsolicited proposals to acquire MVC ; (2) a provision that permits the MVC Board and the MVC Strategic Review Committee, under specified circumstances in connection with an intervening event, to change their recommendation that MVC stockholders vote in favor of the adoption of the Merger Agreement; (3) a provision whereby an additional director, who is currently a director on the MVC Board and mutually selected by MVC and Barings BDC, would be appointed to the Barings BDC Board following the closing of the Merger; and (4) that Barings BDC’s obligation to complete the Merger is not conditioned on Barings BDC receiving any third-party financing; and |

• | the opinion of MVC’s financial advisor. |

• | changes in the business, operations or prospects of Barings BDC; |

• | the financial condition of current or prospective portfolio companies of Barings BDC; |

• | interest rates or general market or economic conditions; |

• | market assessments of the likelihood that the Merger will be completed and the timing of completion of the Merger; |

• | market perception of the future profitability of the combined company; |

• | the duration and effects of the COVID-19 pandemic on Barings BDC’s portfolio companies; and |

• | the duration and effects of the COVID-19 pandemic on equity trading prices generally, and specifically on the trading price of Barings BDC Common Stock and the common stock of the surviving corporation following the Merger. |

• | MVC’s and Barings BDC’s businesses may have been adversely impacted by the failure to pursue other beneficial opportunities due to the focus of management on the Merger, without realizing any of the anticipated benefits of completing the Merger; |

• | the market prices of MVC Common Stock and Barings BDC Common Stock might decline to the extent that the market price prior to termination reflects a market assumption that the Merger will be completed; |

• | MVC may not be able to find a party willing to pay an equivalent or more attractive price than the price Barings BDC agreed to pay in the Merger; and |

• | the payment of any termination fee or reimbursement of expenses, if required under the circumstances, could adversely affect the financial condition and liquidity of MVC. |

• | a larger stockholder base; |

• | a different portfolio composition; and |

• | a different capital structure. |

| | | Actual | | | Pro Forma if the New Barings BDC Advisory Agreement is Not Adopted | | | Pro Forma if the New Barings BDC Advisory Agreement is Adopted | ||||

Stockholder transaction expenses | | | Barings BDC (acquiring fund) | | | MVC (target fund) | | | | |||

Sales load (as a percentage of offering price) | | | None(1) | | | None(1) | | | None(1) | | | None(1) |

Offering expenses (as a percentage of offering price) | | | None(1) | | | None(1) | | | None(1) | | | None(1) |

Dividend reinvestment plan expenses | | | None(2) | | | None(2) | | | None(2) | | | None(2) |

Total stockholder transaction expenses (as a percentage of offering price) | | | None | | | None | | | None | | | None |

| | | Actual | | | Pro Forma if the New Barings BDC Advisory Agreement is Not Adopted | | | Pro Forma if the New Barings BDC Advisory Agreement is Adopted | ||||

Estimated annual expenses (as a percentage of net assets attributable to common stock):(3) | | | Barings BDC (acquiring fund) | | | MVC (target fund) | | | | |||

Base management fees | | | 2.6%(4) | | | 2.3%(5) | | | 2.2%(4) | | | 2.0%(11) |

Incentive fees | | | 0.0%(6) | | | 0.7%(7) | | | 0.0%(6) | | | 0.0%(12) |

Interest payments on borrowed funds(8) | | | 2.8% | | | 4.2% | | | 2.1%(10) | | | 2.1%(10) |

Other expenses(9) | | | 1.0% | | | 3.2% | | | 1.2% | | | 1.2% |

Acquired fund fees and expenses | | | 0.0% | | | 0.3% | | | 0.0% | | | 0.0% |

Total annual expenses | | | 6.4% | | | 10.7% | | | 5.5% | | | 5.3% |

* | Represents an amount less than 0.1%. |

(1) | Purchases of shares of common stock of Barings BDC or MVC on the secondary market are not subject to sales charges, but may be subject to brokerage commissions or other charges. The table does not include any sales load (underwriting discount or commission) that stockholders may have paid in connection with their purchase of shares of Barings BDC Common Stock or MVC Common Stock in a prior underwritten offering or otherwise. |

(2) | The estimated expenses associated with the respective distribution reinvestment plans are included in “Other expenses.” |

(3) | “Consolidated net assets attributable to common stock” equals Barings BDC net assets at September 30, 2020 and the average of |

(4) | For Barings BDC, pursuant to the Existing Barings BDC Advisory Agreement, the base management fee is 1.375% of Barings BDC’s average gross assets, excluding cash and cash equivalents, at the end of the two most recently completed calendar quarters prior to the quarter for which such fees are being calculated. The fee table above shows the base management fee as a percentage of net assets as required by the SEC. If the New Barings BDC Advisory Agreement is not adopted, then the base management fee under the Existing Barings BDC Advisory Agreement will continue to apply to Barings BDC as the surviving company following the Merger. |

(5) | For MVC, the amount shown reflects a base management fee rate of 2.00% based on MVC’s total assets, minus cash. For the fiscal year ended October 31, 2020, TTG Advisors had agreed to a reduced management fee structure that tied management fees to the average daily discount of the closing price of MVC Common Stock to MVC’s NAV for the prior fiscal quarter (“NAV discount”) as follows (the “Base Fee Reduction”): (1) if MVC’s NAV discount was greater than 20%, the management fee for the then-current quarter was reduced to 1.25% of total assets, less cash; (2) if the NAV discount was between 10% and 20%, the management fee was 1.50% of total assets, less cash; and (3) if the NAV discount was less than 10% or eliminated, the management fee of 1.50% of total assets, less cash, was re-examined, but in no event would it exceed 1.75% of total assets, less cash. Additionally, for fiscal years 2010 through 2020, TTG Advisers voluntarily agreed to waive $150,000 of expenses that MVC was obligated to reimburse to TTG Advisers under the Advisory Agreement (the “Voluntary Waiver”). Each of the Base Fee Reduction and Voluntary Waiver expired as of October 31, 2020. However, based on MVC’s July 31, 2020 NAV, and taking into account the Base Fee Reduction in effect prior to October 31, 2020, MVC’s base management fee for the quarter ended October 31, 2020 would be 1.25% of total assets, less cash. |

(6) | Barings BDC’s incentive fee consists of two parts: (1) a portion based on Barings BDC’s pre-incentive fee net investment income (the “Income-Based Fee”) and (2) a portion based on the net capital gains received on Barings BDC’s portfolio of securities on a cumulative basis for each calendar year, net of all realized capital losses and all unrealized capital depreciation for that same calendar year (the “Capital Gains Fee”). Pursuant to the Existing Barings BDC Advisory Agreement, Barings BDC pays an Income-Based Fee to Barings which is 100% of Barings BDC’s pre-incentive fee net investment income, if any, that exceeds the hurdle rate of 2.00% per quarter (8.00% annualized) but is less than 2.50% (10.00% annualized) (the “Catch-Up Amount”) and 20.00% of Barings BDC’s pre-incentive fee net investment income, if any, that exceeds the Catch-Up Amount. The Catch-Up Amount is intended to provide Barings with an Income-Based Fee of 20.00% on all of Barings BDC’s pre-incentive fee net investment income when Barings BDC’s pre-incentive fee net investment income reaches 2.00% per quarter (8.00% annualized). However, the Income-Based Fee will not be in excess of the incentive fee cap which is an amount equal to (1) 20.00% of the cumulative net return during the relevant trailing twelve quarters minus (2) the aggregate Income-Based Fee that was paid in respect of the first eleven calendar quarters (or the portion thereof) included in the relevant trailing twelve quarters. The incentive fee cap is not subject to recoupment. The Capital Gains Fee is determined and payable in arrears as of the end of each calendar year (or upon termination of the Existing Barings BDC Advisory Agreement), and is calculated at the end of each applicable year by subtracting (1) the sum of Barings BDC’s cumulative aggregate realized capital losses and aggregate unrealized capital depreciation from (2) Barings BDC’s cumulative aggregate realized capital gains, in each case calculated from August 2, 2018. If such amount is positive at the end of such year, then the Capital Gains Fee payable for such year is equal to 20% of such amount, less the cumulative aggregate amount of Capital Gains Fees paid in all prior years. If such amount is negative, then there is no Capital Gains Fee payable for such year. If the Existing Barings BDC Advisory Agreement is terminated as of a date that is not a calendar year end, the termination date will be treated as it were a calendar year end for purposes of calculating and paying a Capital Gains Fee. |

(7) | MVC’s incentive consists of two parts – an incentive fee on income and an incentive fee on capital gains. Pursuant to the MVC Investment Advisory Agreement, MVC pays an incentive fee to TTG Advisers which is generally: (1) 20% of pre-incentive fee net operating income (the “Income Incentive Fee”) and (2) 20% of cumulative aggregate net realized capital gains less aggregate unrealized depreciation (on MVC's portfolio securities acquired after November 1, 2003). TTG Advisers is entitled to an incentive fee with respect to MVC’s pre-incentive fee net operating income in each fiscal quarter as follows: no incentive fee in any fiscal quarter in which MVC's pre-incentive fee net operating income does not exceed the lower hurdle rate of 1.75% of net assets (the “Lower Hurdle Amount”), 100% of our pre-incentive fee net operating income with respect to that portion of such pre-incentive fee net operating income, if any, that exceeds the Lower Hurdle Amount but is less than 2.1875% of net assets in any fiscal quarter (the “Higher Hurdle Amount”) and 20% of the amount of MVC's pre-incentive fee net operating income, if any, that exceeds 2.1875% of net assets in any fiscal quarter. Under the Advisory Agreement, the accrual of the provision for incentive compensation for net realized capital gains is consistent with the accrual that was required under the employment agreement with Mr. Tokarz. |

(8) | The figure in the table for Barings BDC is derived by annualizing the actual three months ended September 30, 2020 borrowing costs of Barings BDC under all of its financing facilities, including amortized costs and expenses. |

(9) | In the case of Barings BDC, other expenses include expenses incurred under the administration agreement, by and between Barings BDC and Barings, as the administrator, Barings BDC Board fees, directors and officers insurance costs, as well as legal and accounting expenses. The percentage presented in the table reflects actual amounts incurred during the three months ended September 30, 2020 on an annualized basis. |

(10) | Figure is based on the assumption that Barings BDC’s interest costs (expressed at a percentage rate on the principal amount of debt) after the Merger will remain the same as its costs prior to the Merger. Barings BDC expects over time that as a result of additional investment purchases, and in turn, additional borrowings on the financing facilities after the Merger, the combined company’s interest payments on borrowed funds may be more than the principal amounts reflected in the section entitled “Capitalization” below and, accordingly, that estimated total expenses may be different than as reflected in the table above. However, the actual amount of leverage employed at any given time cannot be predicted. |

(11) | If the Barings BDC Advisory Agreement Amendment Proposal is approved and the New Barings BDC Advisory Agreement is adopted, Barings BDC’s base management fee will be decreased from 1.375% of Barings BDC’s average gross assets under the Existing Barings BDC Advisory Agreement to 1.250% of Barings BDC’s average gross assets under the New Barings BDC Advisory Agreement. |

(12) | If Barings BDC Advisory Agreement Amendment Proposal is approved and the New Barings BDC Advisory Agreement is adopted, the New Barings BDC Advisory Agreement (1) will not substantially modify the Capital Gains Fee and (2) will modify the Income-Based Fee set forth in the Existing Barings BDC Advisory Agreement as described under the caption “Barings BDC Proposal 3: The Barings BDC Advisory Agreement Amendment Proposal” on page 132. |

| | | 1 year | | | 3 years | | | 5 years | | | 10 years | |

You would pay the following expenses on a $1,000 investment: | | | | | | | | | ||||

Barings BDC, assuming a 5% annual return (assumes no return from net realized capital gains or net unrealized capital appreciation) | | | $64 | | | $189 | | | $311 | | | $609 |

MVC, assuming a 5% annual return (assumes no return from net realized capital gains or net unrealized capital appreciation) | | | $107 | | | $304 | | | $478 | | | $834 |

| | | | | | | | | |||||

Barings BDC, assuming a 5% annual return (assumes return entirely from realized capital gains and thus subject to the capital gains incentive fee) | | | $74 | | | $216 | | | $351 | | | $663 |

MVC, assuming a 5% annual return (assumes return entirely from realized capital gains and thus subject to the capital gains incentive fee) | | | $117 | | | $329 | | | $512 | | | $874 |

| | | | | | | | |

| | | 1 year | | | 3 years | | | 5 years | | | 10 years | |

Pro forma combined company following the Merger (if the New Barings BDC Advisory Agreement Is Adopted) | | | | | | | | | ||||

You would pay the following expenses on a $1,000 investment: | | | | | | | | | ||||

Assuming a 5% annual return (assumes no return from net realized capital gains or net unrealized capital appreciation) | | | $53 | | | $160 | | | $266 | | | $526 |

Assuming a 5% annual return (assumes return entirely from realized capital gains and thus subject to the capital gains incentive fee) | | | $63 | | | $188 | | | $309 | | | $598 |

| | | | | | | | | |||||

Pro forma combined company following the Merger (if the New Barings BDC Advisory Agreement Is Not Adopted) | | | | | | | | | ||||

You would pay the following expenses on a $1,000 investment: | | | | | | | | | ||||

Assuming a 5% annual return (assumes no return from net realized capital gains or net unrealized capital appreciation) | | | $55 | | | $166 | | | $274 | | | $541 |

Assuming a 5% annual return (assumes return entirely from realized capital gains and thus subject to the capital gains incentive fee) | | | $65 | | | $193 | | | $317 | | | $611 |

• | the timing or likelihood of the transaction closing; |

• | the combined company’s plans, expectations, objectives and intentions; |

• | the ability to realize the anticipated benefits for the proposed Merger; |

• | the expected synergies and savings associated with the transaction; |

• | the expected elimination of certain expenses and costs due to the transaction; |

• | the percentage of MVC stockholders voting in favor of the transaction; |

• | the percentage of Barings BDC stockholders voting in favor of the relevant proposals; |

• | the possibility that competing offers or acquisition proposals for MVC will be made; |

• | the possibility that any or all of the various conditions to the consummation of the Merger may not be satisfied or waived; |

• | risks related to diverting the attention of Barings BDC’s management or MVC’s management from ongoing business operations; |

• | the risk that stockholder litigation in connection with the transactions contemplated by the Merger Agreement may result in significant costs of defense and liability; |

• | the future operating results of the combined company or Barings BDC’s, MVC’s or the combined company’s portfolio companies; |

• | regulatory approvals and other factors; |

• | changes in regional or national economic conditions, including but not limited to the impact of the COVID-19 pandemic, and their impact on the industries in which Barings BDC and MVC invest; |

• | general economic and political trends and other external factors; |

• | the effect that the announcement or consummation of the Merger may have on the trading price of MVC Common Stock and Barings BDC Common Stock; |

• | changes to the form and amounts of MVC’s tax obligations; |

• | changes in the Euro-to-U.S. dollar exchange rate; |

• | fluctuations in the market price of Barings BDC Common Stock and MVC Common Stock; |

• | changes in MVC’s and/or Barings BDC’s NAV; |

• | potential litigation arising from the Merger Agreement and/or the Merger; |

• | the transaction’s effect on the relationships of Barings BDC or MVC with their respective investors, portfolio companies, lenders and service providers, whether or not the transaction is completed; |

• | the reduction in Barings BDC stockholders’ and MVC stockholders’ percentage ownership and voting power in the combined company; |

• | the challenges and costs presented by the integration of Barings BDC and MVC; |

• | the uncertainty of third-party approvals; |

• | the significant transaction costs; |

• | the effect of changes to tax legislation and MVC’s and Barings BDC’s respective tax positions; |

• | any potential termination of the Merger Agreement and the actions of MVC and Barings BDC stockholders with respect to any proposed transactions; |

• | the restrictions on Barings BDC’s and MVC’s conduct of business set forth in the Merger Agreement; |

• | MVC’s and/or Barings BDC’s ability to qualify and maintain their respective qualifications as a RIC and as a BDC; and |

• | other changes in the conditions of the industries in which Barings BDC and MVC invest and other factors enumerated in Barings BDC’s and MVC’s filings with the SEC. |

• | By Internet: www.proxyvote.com |

• | By telephone: (800) 690-6903 to reach a toll-free, automated touchtone voting line, or (877) 777-4652 Monday through Friday 9:00 a.m. until 10:00 p.m. Eastern Time to reach a toll-free, live operator line. |

• | By mail: You may vote by proxy, after you request the hard copy materials, by following the directions and indicating your instructions on the enclosed proxy card, dating and signing the proxy card, and promptly returning the proxy card in the envelope provided, which requires no postage if mailed in the United States. Please allow sufficient time for your proxy card to be received on or prior to 11:59 p.m., Eastern Time, on December 16, 2020. |

• | By Internet: www.proxyvote.com |

• | By telephone: (800) 322-2885 |

• | By mail: You may vote by proxy, after you request the hard copy materials, by following the directions and indicating your instructions on the enclosed proxy card, dating and signing the proxy card, and promptly returning the proxy card in the envelope provided, which requires no postage if mailed in the United States. Please allow sufficient time for your proxy card to be received on or prior to 11:59 p.m., Eastern Time, on December 16, 2020. |

| | | As of September 30, 2020 (unaudited, dollar amounts in thousands, except share and per share data) | ||||||||||

| | | Actual | | | Actual | | | Pro forma Adjustments | | | Pro Forma | |

| | | Barings BDC | | | MVC | | | Barings BDC | ||||

Cash, cash equivalents and restricted cash | | | $225,291(2) | | | $77,245 | | | $(84,983)(3) | | | $217,553 |

Debt less unamortized debt issuance costs | | | $686,333 | | | $93,676 | | | $(75,921)(4) | | | $704,088 |

Net Assets | | | $525,977 | | | $181,870 | | | $354(5) | | | $708,201 |

Total Capitalization | | | $1,437,601 | | | $352,791 | | | $(160,550) | | | $1,629,842 |

Number of common shares outstanding | | | 47,961,753 | | | 17,725,118 | | | (1,059,253)(6) | | | 64,627,618(7) |

NAV per common share | | | $10.97 | | | $10.26 | | | | | $10.96 | |

(1) | September 30, 2020 is not a fiscal quarter for MVC, its assets have not been revalued post July 31, 2020, and its full quarter-end close process was not completed. |

(2) | Includes $14.8 million of cash and $210.5 million of money market investments. |

(3) | Assumes all MVC cash is used to repay a portion of the $95.0 million of Existing MVC Notes (as defined under “Description of the Merger Agreement—Additional Covenants—Repayment of MVC Credit Facilities and Existing MVC Notes”), and Barings BDC cash is used to pay associated transaction expenses of approximately $5.0 million for Barings BDC and approximately $2.3 million for MVC as well as additional interest expenses on the Existing MVC Notes of approximately $0.5 million. |

(4) | Assumes the redemption of the MVC $95.0 million of the Existing MVC Notes, less extinguishment of debt issuance costs of $1.3 million and less additional borrowings on Barings BDC’s credit facility of approximately $17.8 million. |

(5) | Includes transaction expenses of Barings BDC of approximately $5.0 million; transaction expenses of MVC of approximately $1.8 million; write-off of prepaid expenses, write-off of MVC deferred financing costs, credit facility termination fee and interest on senior notes of approximately $3.2 million; and estimated initial value of the Credit Support Agreement (as defined under “The Merger—Reasons for the Merger—Barings BDC”) of $10.1 million. |

(6) | Represents the difference between the number of shares of MVC Common Stock issued and outstanding as of September 30, 2020 and the number of shares of Barings BDC Common Stock that Barings BDC expects to issue to MVC stockholders in connection with the Merger (as described in footnote 7 below). |

(7) | Represents 47,961,753 shares of Barings BDC Common Stock outstanding prior to the Merger plus 16,665,865 shares of Barings BDC Common Stock to be issued to MVC stockholders in connection with the Merger. The number of shares of Barings BDC Common Stock to be issued to MVC stockholders in the Merger was determined by multiplying 17,725,118 shares of MVC Common Stock outstanding prior to the Merger by the Exchange Ratio of 0.94024. |

• | The Merger Agreement includes an adjustment to the Exchange Ratio to provide for a dollar-to-dollar reduction to the value of Barings BDC Common Stock issued in the Barings BDC Stock Issuance for (1) any MVC Tax Dividends paid by MVC, (2) any undistributed ICTI and/or remaining undistributed Net Capital Gain of MVC, (3) any RIC Tax Liability of MVC or (4) the impact of the Euro-Dollar Exchange Rate Adjustment. |

• | The Merger Agreement imposes customary restrictions on MVC’s ability to operate outside the ordinary course of business between the date of the Merger Agreement and the Effective Time (or until the earlier termination of the Merger Agreement), including regarding MVC’s ability to transact with existing and future portfolio companies, issue equity securities, incur indebtedness and pay dividends. |

• | The Merger Agreement contains customary non-solicitation covenants. In particular, the Merger Agreement: |

• | requires MVC to immediately cease and cause to be terminated immediately any existing solicitation of, or discussions with, any third party relating to any Competing Proposal or any inquiry, discussion, offer or request that could reasonably be expected to lead to a Competing Proposal; |

• | prohibits MVC from directly or indirectly initiating, soliciting or knowingly encouraging or facilitating (including by way of furnishing or disclosing information) any inquiries or the making, submission or implementation of any Competing Proposal, or entering into any agreement, |

• | The Merger Agreement provides that MVC will be required to pay a customary termination fee to Barings BDC under certain circumstances if the transactions contemplated by the Merger Agreement are not consummated, along with Barings’ and Barings BDC’s expenses, subject to a cap of $1,175,175, in specific circumstances. |

• | that it would be possible that the Merger may not be completed or may be delayed; |

• | shares issued by Barings BDC in connection with the Merger may be issued below the then-current Barings BDC NAV and thus may result in a dilution of NAV to existing Barings BDC stockholders; |

• | certain restrictions may be imposed on the conduct of Barings BDC’s business prior to completion of the Merger, requiring Barings BDC to conduct its business only in the ordinary course of business in accordance with the Merger Agreement, subject to specific limitations, which could delay or prevent Barings BDC from taking advantage of business opportunities that may arise pending completion of the Merger; |