DEF 14A: Definitive proxy statements

Published on March 10, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

Barings BDC, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount previously paid: | |

| (2) | Form, schedule or registration statement no.: | |

| (3) | Filing party: | |

| (4) | Date filed: | |

![[MISSING IMAGE: lg_barings-w1.jpg]](lg_barings-w1.jpg)

Charlotte, North Carolina 28202

(704) 805-7200

![[MISSING IMAGE: sg_ericlioyd-bw.jpg]](sg_ericlioyd-bw.jpg)

Chief Executive Officer

Charlotte, North Carolina 28202

(704) 805-7200

To Be Held On Thursday, April 30, 2020

Barings BDC, Inc.:

Board of Directors,

Secretary

March 10, 2020

Charlotte, North Carolina 28202

(704) 805-7200

2020 Annual Meeting of Stockholders

|

Name, Address and Age(1)

|

| | |

Position(s)

Held with Company |

| | |

Term and

Length of Time Served |

| | |

Principal Occupations

During Past 5 Years |

| | |

Number of

Portfolios Overseen in Fund Complex |

| | |

Other Directorships of Public or Registered Investment

Companies Held by Director or Nominee for Director During Past 5 Years |

|

| Interested Director | | | | | | | | | | | | | | | | | | | | | |

|

Michael Freno(2) (44)

|

| | |

Chairman of the Board of Directors

|

| | |

Class II Director; Term Expires 2020; Director since August 2018

|

| | |

President (since February 2020), Head of Global Markets and Head of Investments (2017-2019), Chairman of Global High Yield Allocation Committee and member of Global Distressed Committee, Managing Director (since 2010), Barings LLC; Vice President (since 2012), Barings Global Short Duration High Yield Fund (closed-end investment company managed by Barings); Vice President (since 2013), Barings Funds Trust (open-end investment company managed by Barings).

|

| | |

1

|

| | | None | |

| Non-Interested Director | | | | | | | | | | | | | | | | | | | | | |

|

John A. Switzer (63)

|

| | |

Director

|

| | |

Class II Director; Term Expires 2020; Director since August 2018

|

| | |

Director, Carolina Tractor and Equipment Company (since 2017); Managing Partner (1988-2016), KPMG LLP; Board Member, The Foundation for the Mint Museum; Board Member National Association of Corporate Directors (Carolinas Chapter).

|

| | |

1

|

| | |

Director and Audit Committee member (since 2019), HomeTrust Bancshares, Inc.

|

|

|

Name, Address and Age(1)

|

| | |

Position(s)

Held with Company |

| | |

Term and

Length of Time Served |

| | |

Principal Occupations

During Past 5 Years |

| | |

Number of

Portfolios Overseen in Fund Complex |

| | |

Other Directorships of Public or Registered Investment

Companies Held by Director or Nominee for Director During Past 5 Years |

|

| Interested Director | | | | | | | | | | | | | | | | | | | | | |

|

Eric Lloyd(2) (51)

|

| | |

Chief Executive Officer and Director

|

| | |

Class I Director; Term Expires 2022; Director since August 2018

|

| | |

Head of Global Private Investments (since February 2020); Head Global Private Finance Group (2013-2020) and Managing Director, Barings LLC; From 1995-2012 various roles at Wells Fargo and predecessor firms including Head of Market and Institutional Risk, Member of Management Committee Wells Fargo; Head of Global Leveraged Finance Group Wachovia and other positions.

|

| | |

1

|

| | | None | |

| Non-Interested Director | | | | | | | | | | | | | | | | | | | | | |

|

Mark F. Mulhern (60)

|

| | |

Director

|

| | |

Class I Director; Term Expires 2022; Director since October 2016

|

| | |

Senior Vice President and Chief Financial Officer (since 2014), Highwood Properties, Inc.; Executive Vice President and Chief Financial Officer (2012-2014), Duke Energy Corporation; Vice President Controller and other roles (1996-2012), Progress Energy.

|

| | |

1

|

| | |

Director and Audit Committee member (2012-2014), Highwood Properties (real estate investment trust).

|

|

|

Name, Address and Age(1)

|

| | |

Position(s)

Held with Company |

| | |

Term and

Length of Time Served |

| | |

Principal Occupations

During Past 5 Years |

| | |

Number of

Portfolios Overseen in Fund Complex |

| | |

Other Directorships of Public or Registered Investment

Companies Held by Director or Nominee for Director During Past 5 Years |

|

| Interested Director | | | | | | | | | | | | | | | | | | | | | |

|

Thomas M. Finke(2) (55)

|

| | |

Director

|

| | |

Class III Director; Term expires 2021; Director since August 2018

|

| | |

Chairman and Chief Executive Officer (since 2008), Member of the Board of Managers (since 2006), President (2007-2008), Managing Director (2002-2008), Barings; Chief Investment Officer and Executive Vice President (2008-2011), Massachusetts Mutual Life Insurance Company.

|

| | |

10

|

| | |

Trustee (since 2013), Barings Funds Trust (open-end investment company advised by Barings); Trustee (since 2012), Barings Global Short Duration High Yield Fund (closed-end investment company advised by Barings); Chairman (2012-2015), Director (since 2008), Barings (U.K.) Limited (investment advisory firm); Director (since 2008), Barings Guernsey Limited (holding company); Vice Chairman and Manager (since 2011), MM Asset Management Holding LLC (holding company); Director (since 2004), Jefferies Finance LLC (finance company); Manager (since 2005), Loan Strategies Management, LLC (general partner of an investment fund); Manager (since 2005), Jefferies Finance CP Funding LLC (investment company); Chairman and Director (2012-2015), Barings Global Advisers Limited (investment advisory firm); Manager (2011-2016), Wood Creek Capital Management, LLC (investment advisory firm); Chairman and Manager (2007-2016), Barings Real Estate Advisers LLC (real estate advisory firm); Manager (2007-2015), Credit Strategies Management LLC (general partner of an investment fund).

|

|

|

Name, Address and Age(1)

|

| | |

Position(s)

Held with Company |

| | |

Term and

Length of Time Served |

| | |

Principal Occupations

During Past 5 Years |

| | |

Number of

Portfolios Overseen in Fund Complex |

| | |

Other Directorships of Public or Registered Investment

Companies Held by Director or Nominee for Director During Past 5 Years |

|

|

Non-Interested Directors

|

| | | | | | | | | | | | | | | | | | | | |

|

Thomas W. Okel (57)

|

| | |

Director

|

| | |

Class III Director; Term expires 2021; Director since August 2018

|

| | |

Executive Director (2011-2019), Catawba Lands Conservancy; Global Head of Syndicated Capital Markets (1998-2010), Bank of America Merrill Lynch.

|

| | |

10

|

| | |

Trustee (since 2012), Barings Global Short Duration High Yield Fund (closed-end investment company advised by Barings); Trustee (since 2013), Barings Funds Trust (open-end investment company advised by Barings); Trustee (since 2015), Horizon Funds (mutual fund complex).

|

|

|

Jill Olmstead (56)

|

| | |

Director

|

| | |

Class III Director; Term expires 2021; Director since August 2018

|

| | |

Chief Human Resources Officer, (since 2018), LendingTree, Inc.; Founding Partner (2010-2018), Spivey & Olmstead, LLC (talent and leadership consulting firm); Managing Director and Head of Human Resources for Corporate and Investment Bank and International Businesses (2006-2009), Executive Vice President (2000-2006), Wachovia Corporation (now Wells Fargo).

|

| | |

1

|

| | | None | |

|

Name

|

| | Fees Earned or Paid in Cash |

| | All Other Compensation(1) |

| |

Total

|

| |||||||||

|

Mark Mulhern

|

| | | $ | 120,000 | | | | | $ | 2,204 | | | | | $ | 122,204 | | |

|

Thomas W. Okel

|

| | | $ | 120,000 | | | | | $ | 0 | | | | | $ | 120,000 | | |

|

Jill A. Olmstead

|

| | | $ | 120,000 | | | | | $ | 0 | | | | | $ | 120,000 | | |

|

John A. Switzer

|

| | | $ | 120,000 | | | | | $ | 0 | | | | | $ | 120,000 | | |

|

Name of Beneficial Owner

|

| | Number of Shares Beneficially Owned(1) |

| | Percentage of Class(2) |

| | Dollar Range of Equity Securities Beneficially Owned(3) |

| ||||||

| Directors and Executive Officers: | | | | | | | | | | | | | | | | |

| Interested Directors | | | | | | | | | | | | | | | | |

|

Tom Finke

|

| | | | 10,000 | | | | | | * | | | | $50,001-$100,000 | |

|

Michael Freno

|

| | | | 10,537 | | | | | | * | | | | over $100,000 | |

|

Eric Lloyd

|

| | | | 15,448 | | | | | | * | | | | over $100,000 | |

| Independent Directors | | | | | | | | | | | | | | | | |

|

Mark F. Mulhern

|

| | | | 14,855 | | | | | | * | | | | over $100,000 | |

|

Thomas W. Okel

|

| | | | 5,500 | | | | | | * | | | | $50,001-$100,000 | |

|

Jill Olmstead

|

| | | | 4,000 | | | | | | * | | | | $10,001-$50,000 | |

|

John A. Switzer

|

| | | | 5,000 | | | | | | * | | | | $10,001-$50,000 | |

| Executive Officers Who Are Not Directors | | | | | | | | | | | | | | | | |

|

Ian Fowler

|

| | | | — | | | | | | | | | | — | |

|

Jonathan Bock

|

| | | | 16,200 | | | | | | * | | | | over $100,000 | |

|

Michael Cowart

|

| | | | — | | | | | | | | | | — | |

|

Janice Bishop

|

| | | | — | | | | | | | | | | — | |

|

Elizabeth Murray

|

| | | | 12,034 | | | | | | * | | | | over $100,000 | |

|

All directors and executive officers as a group (twelve persons)

|

| | | | 93,574 | | | | | | * | | | | over $100,000 | |

| Five-Percent Stockholders: | | | | | | | | | | | | | | | | |

| Barings LLC | | | | | 13,639,681 | | | | | | 27.9% | | | | over $100,000 | |

| UBS Group AG(4) | | | | | 2,618,691 | | | | | | 5.3% | | | | over $100,000 | |

| RiverNorth Capital Management, LLC(5) | | | | | 2,815,252 | | | | | | 5.7% | | | | over $100,000 | |

| | | | Fiscal Year Ended December 31, 2018 |

| | Fiscal Year Ended December 31, 2019 |

| ||||||

|

Audit Fees

|

| | | $ | 811,437(1) | | | | | $ | 751,562 | | |

|

Audit Related Fees

|

| | | | 0 | | | | | | 14,000 | | |

|

Tax Fees

|

| | | | 93,000 | | | | | | 54,500 | | |

|

Other Fees

|

| | | | 0 | | | | | | 0 | | |

|

TOTAL FEES

|

| | | $ | 904,437 | | | | | $ | 820,062 | | |

| | John A. Switzer, Chair Mark F. Mulhern Thomas W. Okel Jill Olmstead |

|

BELOW NET ASSET VALUE (BOOK VALUE)

| | | |

Net

Asset Value |

| |

Closing Sales Price

|

| |

Premium

(Discount) of High Closing Sales Price to Net Asset Value |

| |

Premium

(Discount) of Low Closing Sales Price to Net Asset Value |

| ||||||||||||||||||

| | | |

High

|

| |

Low

|

| ||||||||||||||||||||||||

|

Year ended December 31, 2017

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

First Quarter

|

| | | $ | 15.29 | | | | | $ | 20.13 | | | | | $ | 8.31 | | | | | | 31.7% | | | | | | 19.8% | | |

|

Second Quarter

|

| | | $ | 14.83 | | | | | $ | 19.03 | | | | | $ | 17.38 | | | | | | 28.3% | | | | | | 17.2% | | |

|

Third Quarter

|

| | | $ | 13.20 | | | | | $ | 17.76 | | | | | $ | 13.00 | | | | | | 34.5% | | | | | | -1.5% | | |

|

Fourth Quarter

|

| | | $ | 13.43 | | | | | $ | 14.31 | | | | | $ | 9.25 | | | | | | 6.6% | | | | | | -31.1% | | |

|

Year ended December 31, 2018

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

First Quarter

|

| | | $ | 13.36 | | | | | $ | 12.08 | | | | | $ | 9.41 | | | | | | -9.6% | | | | | | -29.6% | | |

|

Second Quarter

|

| | | $ | 13.70 | | | | | $ | 12.05 | | | | | $ | 10.98 | | | | | | -12.0% | | | | | | -19.9% | | |

|

Third Quarter

|

| | | $ | 11.91 | | | | | $ | 12.34 | | | | | $ | 9.99 | | | | | | 3.6% | | | | | | -16.1% | | |

|

Fourth Quarter

|

| | | $ | 10.98 | | | | | $ | 10.20 | | | | | $ | 8.83 | | | | | | -7.1% | | | | | | -19.6% | | |

|

Year ended December 31, 2019

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

First Quarter

|

| | | $ | 11.52 | | | | | $ | 10.00 | | | | | $ | 9.28 | | | | | | -13.2% | | | | | | -19.4% | | |

|

Second Quarter

|

| | | $ | 11.59 | | | | | $ | 10.33 | | | | | $ | 9.81 | | | | | | -10.9% | | | | | | -15.4% | | |

|

Third Quarter

|

| | | $ | 11.58 | | | | | $ | 10.24 | | | | | $ | 9.65 | | | | | | -11.6% | | | | | | -16.7% | | |

|

Fourth Quarter

|

| | | $ | 11.66 | | | | | $ | 10.49 | | | | | $ | 9.94 | | | | | | -10.0% | | | | | | -14.8% | | |

|

Year ending December 31, 2020

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

First Quarter (through March 3, 2020)

|

| | | | * | | | | | $ | 10.54 | | | | | $ | 9.44 | | | | | | * | | | | | | * | | |

| | | | | | | | | |

Example 1

5% Offering at 5% Discount |

| |

Example 2

10% Offering at 10% Discount |

| |

Example 3

20% Offering at 20% Discount |

| |

Example 4

25% Offering at 100% Discount |

| ||||||||||||||||||||||||||||||||||||

| | | | Prior to Sale Below NAV |

| | Following Sale |

| | % Change |

| | Following Sale |

| | % Change |

| | Following Sale |

| | % Change |

| | Following Sale |

| | % Change |

| |||||||||||||||||||||||||||

| Offering Price | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Price per Share to Public | | | | | — | | | | | $ | 10.00 | | | | | | — | | | | | $ | 9.47 | | | | | | — | | | | | $ | 8.42 | | | | | | — | | | | | $ | 0.01 | | | | | | — | | |

| Net Proceeds per Share to Issuer | | | | | — | | | | | $ | 9.50 | | | | | | — | | | | | $ | 9.00 | | | | | | — | | | | | $ | 8.00 | | | | | | — | | | | | $ | 0.01 | | | | | | — | | |

| Decrease to NAV | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Shares Outstanding | | | | | 1,000,000 | | | | | | 1,050,000 | | | | | | 5.00% | | | | | | 1,100,000 | | | | | | 10.00% | | | | | | 1,200,000 | | | | | | 20.00% | | | | | | 1,250,000 | | | | | | 25.00% | | |

| NAV per Share | | | | $ | 10.00 | | | | | $ | 9.98 | | | | | | (0.24)% | | | | | $ | 9.91 | | | | | | (0.91)% | | | | | $ | 9.67 | | | | | | (3.33)% | | | | | $ | 8.00 | | | | | | (19.98)% | | |

| Dilution to Stockholder | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares Held by Stockholder A | | | | | 10,000 | | | | | | 10,000 | | | | | | — | | | | | | 10,000 | | | | | | — | | | | | | 10,000 | | | | | | — | | | | | | 10,000 | | | | | | — | | |

| Percentage Held by Stockholder A | | | | | 1.0% | | | | | | 0.95% | | | | | | (4.76)% | | | | | | 0.91% | | | | | | (9.09)% | | | | | | 0.83% | | | | | | (16.67)% | | | | | | 0.80% | | | | | | (20.00)% | | |

| Total Asset Values | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total NAV Held by Stockholder A | | | | $ | 100,000 | | | | | $ | 99,762 | | | | | | (0.24)% | | | | | $ | 99,091 | | | | | | (0.91)% | | | | | $ | 96,667 | | | | | | (3.33)% | | | | | $ | 80,020 | | | | | | (19.98)% | | |

|

Total Investment by Stockholder A (Assumed to Be $10.00 per Share)

|

| | | $ | 100,000 | | | | | $ | 100,000 | | | | | | — | | | | | $ | 100,000 | | | | | | — | | | | | $ | 100,000 | | | | | | — | | | | | $ | 100,000 | | | | | | — | | |

|

Total Dilution to Stockholder A (Total NAV Less Total Investment)

|

| | | | — | | | | | $ | (238) | | | | | | — | | | | | $ | (909) | | | | | | — | | | | | $ | (3,333) | | | | | | — | | | | | $ | (19,980) | | | | | | — | | |

| Per Share Amounts | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NAV per Share Held by Stockholder A | | | | | — | | | | | $ | 9.98 | | | | | | — | | | | | $ | 9.91 | | | | | | — | | | | | $ | 9.67 | | | | | | — | | | | | $ | 8.00 | | | | | | — | | |

|

Investment per Share Held by Stockholder A (Assumed to be $10.00 per Share on Shares Held Prior to Sale)

|

| | | $ | 10.00 | | | | | $ | 10.00 | | | | | | — | | | | | $ | 10.00 | | | | | | — | | | | | $ | 10.00 | | | | | | — | | | | | $ | 10.00 | | | | | | — | | |

|

Dilution per Share Held by Stockholder A (NAV per Share Less Investment per Share)

|

| | | | — | | | | | $ | (0.02) | | | | | | — | | | | | $ | (0.09) | | | | | | — | | | | | $ | (0.33) | | | | | | — | | | | | $ | (2.00) | | | | | | — | | |

|

Percentage Dilution to Stockholder A (Dilution per Share Divided by Investment per Share)

|

| | | | — | | | | | | — | | | | | | (0.24)% | | | | | | — | | | | | | (0.91)% | | | | | | — | | | | | | (3.33)% | | | | | | — | | | | | | (19.98)% | | |

MEETING TO BE HELD ON THURSDAY, APRIL 30, 2020

Secretary

March 10, 2020

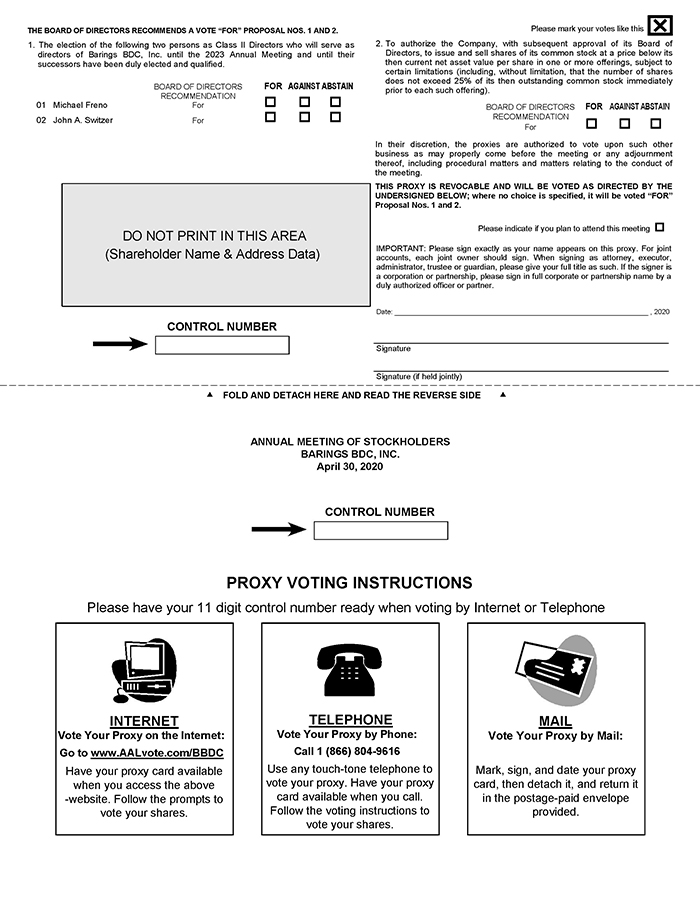

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF BARINGS BDC, INC. FOR THE 2020 ANNUAL MEETING OF STOCKHOLDERS The undersigned stockholder of Barings BDC, Inc. (the “Company”) acknowledges receipt of the Notice of Annual Meeting of Stockholders of the Company and hereby appoints Janice Bishop and Chris Cary, or any one of them, and each with full power of substitution, to act as attorneys and proxies for the undersigned to vote all the shares of common stock of the Company that the undersigned is entitled to vote at the Annual Meeting of Stockholders of the Company to be held on April 30, 2020, at 8:00 a.m., Eastern Time, at the offices of Barings, LLC, 300 South Tryon Street, 25th Floor, Sky Room, Charlotte, North Carolina 28202, and at any adjournment thereof, as indicated in this proxy. THIS PROXY IS REVOCABLE AND WILL BE VOTED AS DIRECTED BY THE UNDERSIGNED BELOW; where no choice is specified, it will be voted “FOR” Proposal Nos. 1 and 2. Please sign and date this proxy on the reverse side and return it in the enclosed envelope. (CONTINUED ON REVERSE SIDE) FOLD AND DETACH HERE AND READ THE REVERSE SIDE Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held April 30, 2020. The Proxy Statement and our 2019 Annual Report to Stockholders are available at: https://ir.barings.com/annual-shareholder-meeting-materials

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL NOS. 1 AND 2. 1. The election of the following two persons as Class II Directors who will serve as directors of Barings BDC, Inc. until the 2023 Annual Meeting and until their successors have been duly elected and qualified. Please mark your votes like this 2. To authorize the Company, with subsequent approval of its Board of Directors, to issue and sell shares of its common stock at a price below its then current net asset value per share in one or more offerings, subject to certain limitations set herein (including, without limitation, that the number of shares does not exceed 25% of its then outstanding common stock immediately prior to each such offering). 01 Michael Freno 02 John A. Switzer BOARD OF DIRECTORS RECOMMENDATION For For FOR AGAINST ABSTAIN BOARD OF DIRECTORS RECOMMENDATION For FOR AGAINST ABSTAIN In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment thereof, including procedural matters and matters relating to the conduct of the meeting. THIS PROXY IS REVOCABLE AND WILL BE VOTED AS DIRECTED BY THE UNDERSIGNED BELOW; where no choice is specified, it will be voted “FOR” Proposal Nos. 1 and 2. DO NOT PRINT IN THIS AREA (Shareholder Name & Address Data) Please indicate if you plan to attend this meeting IMPORTANT: Please sign exactly as your name appears on this proxy. For joint accounts, each joint owner should sign. When signing as attorney, executor, administrator, trustee or guardian, please give your full title as such. If the signer is a corporation or partnership, please sign in full corporate or partnership name by a duly authorized officer or partner. Date: , 2019 CONTROL NUMBER Signature Signature (if held jointly) FOLD AND DETACH HERE AND READ THE REVERSE SIDE ANNUAL MEETING OF STOCKHOLDERS BARINGS BDC, INC. April 30, 2020 CONTROL NUMBER PROXY VOTING INSTRUCTIONS Please have your 11 digit control number ready when voting by Internet or Telephone INTERNET Vote Your Proxy on the Internet: Go to www.AALvote.com/BBDC Have your proxy card available when you access the above website. Follow the prompts to vote your shares. TELEPHONE Vote Your Proxy by Phone: Call 1 (866) 804-9616 Use any touch-tone telephone to vote your proxy. Have your proxy card available when you call. Follow the voting instructions to vote your shares.