MVC CAPITAL, INC.

287 Bowman Avenue, 2nd Floor

Purchase, New York 10577

MERGER PROPOSED—YOUR VOTE IS VERY IMPORTANT

November 24, 2020

Dear Stockholder:

You are cordially invited to attend the Special Meeting of Stockholders (the “MVC Special Meeting”) of MVC Capital, Inc., a Delaware corporation (“MVC”), to be held virtually on December 23, 2020, at 9:00 a.m., Eastern Time, at the following website: www.virtualshareholdermeeting.com/MVC2020SM.

The notice of special meeting and the joint proxy statement/prospectus accompanying this letter provide an outline of the business to be conducted at the MVC Special Meeting. At the MVC Special Meeting, you will be asked to consider and vote upon a proposal to:

(1)

|

adopt the Agreement and Plan of Merger, dated as of August 10, 2020 (as may be amended from time to time, the “Merger Agreement”), by and among Barings BDC, Inc., a Maryland corporation (“Barings BDC”), Mustang Acquisition Sub, Inc., a Delaware corporation and a direct wholly-owned subsidiary of Barings BDC (“Acquisition Sub”), MVC, and Barings LLC, a Delaware limited liability company and the external investment adviser to Barings BDC (“Barings”) (such proposal, the “Merger Proposal”); and |

(2)

|

approve the adjournment of the MVC Special Meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are insufficient votes at the time of the MVC Special Meeting to approve the Merger Proposal (such proposal, the “MVC Adjournment Proposal” and together with the Merger, the “MVC Proposals”). |

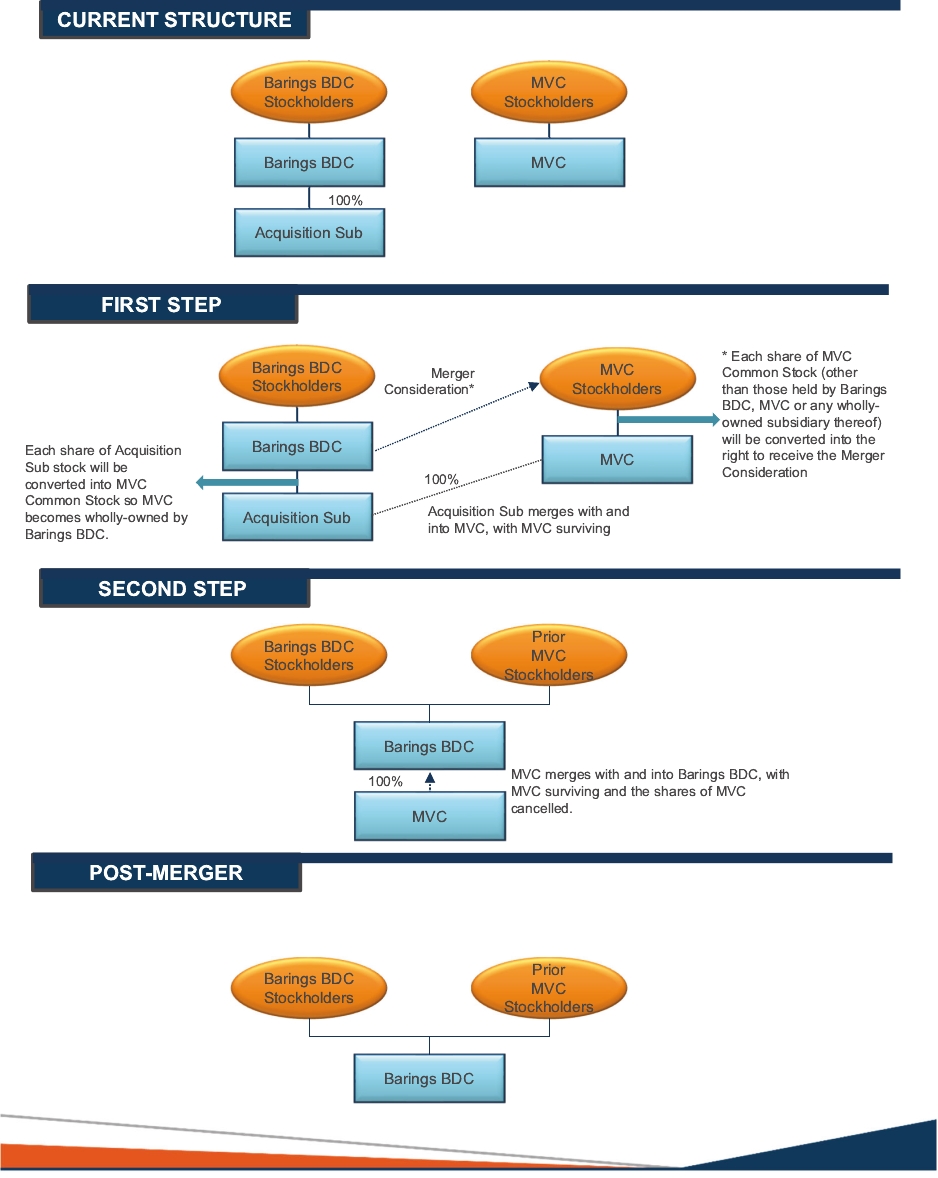

MVC and Barings BDC are proposing a combination of both companies by a merger and related transactions pursuant to the Merger Agreement in which Acquisition Sub would merge with and into MVC (the “First Step”), with MVC continuing as the surviving corporation and as a wholly-owned subsidiary of Barings BDC. Immediately after the effectiveness of the First Step, MVC, as the surviving corporation, will merge with and into Barings BDC (together with the First Step, the “Merger”), with Barings BDC continuing as the surviving corporation.

Subject to the terms and conditions of the Merger Agreement, at the effective time of the First Step, each share of common stock, par value $0.01 per share, of MVC (“MVC Common Stock”) issued and outstanding immediately prior to the effective time of the First Step (excluding the Canceled Shares (as defined below)) will be converted into the right to receive (i) $0.39492 per share in cash, without interest, from Barings (such amount of cash, the “Cash Consideration”), and (ii) 0.94024 (the “Exchange Ratio”) of a validly issued, fully paid and non-assessable share of Barings BDC Common Stock, plus any cash in lieu of fractional shares (the “Share Consideration” and together with the Cash Consideration, the “Merger Consideration”). For purposes of the Merger Agreement, “Canceled Shares” means all shares of MVC Common Stock issued and outstanding immediately prior to the effective time of the First Step that are held by a subsidiary of MVC or held, directly or indirectly, by Barings BDC or Acquisition Sub. Pursuant to the Merger Agreement, the total value of the consideration to be received by MVC stockholders at closing is subject to adjustment as set forth in the Merger Agreement and may be different than the estimated total consideration described herein depending on a number of factors, including the number of outstanding shares of Barings BDC and MVC common stock, the payment of certain dividends by and tax liability of MVC, undistributed investment company taxable income and undistributed net capital gains of MVC and changes of the Euro-to-U.S. dollar exchange rate between April 30, 2020 and the closing date relating to certain of MVC’s investments.

The market value of the Merger Consideration will fluctuate with changes in the market price of Barings BDC Common Stock. Barings BDC urges you to obtain current market quotations of Barings BDC Common Stock. Barings BDC Common Stock trades on The New York Stock Exchange (“NYSE”) under the ticker symbol “BBDC.” The following table shows the closing sale prices of Barings BDC Common Stock, as reported on the NYSE on August 7, 2020, the last trading day before the execution of the Merger Agreement, and on November 23, 2020, the last trading day before printing this document.

Closing Sales Price at August 7, 2020

|

|

|

$8.24 |

Closing Sales Price at November 23, 2020

|

|

|

$8.82 |

Your vote is extremely important. At the MVC Special Meeting, you will be asked to vote on the Merger Proposal, and, if necessary or appropriate, the MVC Adjournment Proposal. The approval of the Merger Proposal requires the affirmative vote of the holders of at least a majority of the outstanding shares of MVC Common Stock entitled to vote at the MVC Special Meeting. The approval of the MVC Adjournment Proposal requires the affirmative vote of the holders of at least a majority of votes cast by holders of shares of MVC Common stock present at the MVC Special Meeting, virtually or represented by proxy, and entitled to vote thereat.

Abstentions and broker non-votes (which occur when a beneficial owner does not instruct its broker, bank, trustee or nominee holding its shares of MVC Common Stock how to vote such shares on its behalf) will not count as affirmative votes cast and will therefore have the effect as votes “against” the Merger Proposal. Abstentions and broker non-votes will not be included in determining the number of votes cast, and, as a result, will have no effect on the voting outcome of the MVC Adjournment Proposal.

Prior to the entry into the Merger Agreement and as a condition to the willingness of Barings BDC to enter into the Merger Agreement, Leon G. Cooperman, Michael T. Tokarz, certain affiliates of Wynnefield Capital, Inc. and West Family Investments, Inc., stockholders of MVC which collectively owned approximately 31% of MVC Common Stock issued and outstanding as of the date of the Merger Agreement, entered into voting agreements with Barings BDC (collectively, the “Voting Agreements”), pursuant to which, among other things, such stockholders of MVC have, subject to the terms and conditions set forth in the Voting Agreements, agreed to support the Merger and the transactions contemplated by the Merger Agreement and to vote all their shares of MVC Common Stock in favor of the Merger Proposal. The Voting Agreements’ obligations to vote in favor of the Merger Proposal terminate upon certain events, including the effective time of the First Step, the valid termination of the Merger Agreement in accordance with its terms, the termination of the Voting Agreements by mutual consent of the parties thereto or a change in the recommendation of the MVC Board to MVC stockholders pursuant to the Merger Agreement.

After careful consideration, the MVC Board unanimously approved the Merger Agreement and the transactions contemplated thereby, including the Merger, and unanimously recommends that MVC stockholders vote “FOR” the Merger Proposal and, if necessary or appropriate, “FOR” the MVC Adjournment Proposal.

It is important that your shares be represented at the MVC Special Meeting. You have the right to receive notice of, and to vote at the MVC Special Meeting if you were a stockholder of record of MVC Common stock at the close of business on October 29, 2020 (the “MVC Record Date”). Each MVC stockholder is invited to attend the MVC Special Meeting virtually. You or your proxy holder will be able to attend the MVC Special Meeting online, vote and submit questions by visiting www.virtualshareholdermeeting.com/MVC2020SM and using a control number assigned by Broadridge Financial Solutions Inc. To reserve access to the virtual MVC Special Meeting, you will need to follow the instructions provided in the Notice of Special Meeting of Stockholders and the joint proxy statement/prospectus that follow. Please follow the instructions on the accompanying proxy card and authorize a proxy via the Internet, by telephone or by mail to vote your shares. MVC encourages you to vote via the Internet as it saves MVC significant time and processing costs. If you are the beneficial owner of your shares, you will need to follow the instructions provided by your broker, bank, trustee or nominee regarding how to instruct your broker, bank, trustee or nominee to vote your shares at the MVC Special Meeting. Voting by proxy does not deprive you of your right to participate in the virtual MVC Special Meeting.

The joint proxy statement/prospectus accompanying this letter describes the MVC Special Meeting, the Merger, and the documents related to the Merger (including the Merger Agreement) that MVC stockholders should review before voting on the Merger Proposal and the MVC Adjournment Proposal and should be retained for future reference. Please carefully read this entire document, including “

Risk Factors” beginning on page

28 and as otherwise incorporated by reference herein, for a discussion of the risks relating to the Merger, MVC and Barings BDC. MVC files annual, quarterly and current reports, proxy statements and other information about itself with the SEC. MVC maintains a website at

www.mvccapital.com and makes all of its annual, quarterly and current reports, proxy statements and other publicly filed information available on or through its website. Information contained on MVC’s website is not incorporated by reference into the joint proxy statement/prospectus accompanying this letter, and you should not consider information contained on MVC’s website to be part of the joint proxy statement/prospectus accompanying this letter. You may also obtain such information, free of charge, and make stockholder inquiries by calling MVC at (914) 510-9400 or by writing to MVC at 287 Bowman Avenue, 2nd Floor, Purchase, New York 10577, Attention: Investor Relations. The SEC also maintains a website at

www.sec.gov that contains such information.

Sincerely yours,

Michael Tokarz

Chairman of MVC Capital, Inc.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the shares of Barings BDC Common Stock to be issued under the joint proxy statement/prospectus accompanying this letter or determined if the joint proxy statement/prospectus accompanying this letter is truthful or complete. Any representation to the contrary is a criminal offense.

Important Notice Regarding the Availability of Proxy Materials for the MVC Special Meeting to Be Held on December 23, 2020

The date of the accompanying joint proxy statement/prospectus is November 24, 2020 and it is first being mailed or otherwise delivered to Barings BDC stockholders and MVC stockholders on or about November 24, 2020.

|

MVC Capital, Inc.

287 Bowman Avenue, 2nd Floor

Purchase, New York 10577

(914) 701-0310

|

|

|

Barings BDC, Inc.

300 South Tryon Street, Suite 2500

Charlotte, North Carolina 28202

(704) 805-7200

|