40-APP/A: Applications under the Investment Company Act other than those reviewed by Office of Insurance Products

Published on November 30, 2012

Table of Contents

File No. 812-14077

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO APPLICATION FOR AN AMENDED ORDER PURSUANT TO

SECTION 6(c) OF THE INVESTMENT COMPANY ACT OF 1940 (1940 ACT) GRANTING

AN EXEMPTION FROM SECTIONS 23(a), 23(b) AND 63 OF THE 1940 ACT, AND PURSUANT

TO SECTIONS 57(a)(4) and 57(i) OF THE 1940 ACT AND RULE 17d-1 UNDER THE 1940 ACT

AUTHORIZING CERTAIN JOINT TRANSACTIONS OTHERWISE PROHIBITED BY

SECTION 57(a)(4) OF THE 1940 ACT

TRIANGLE CAPITAL CORPORATION

3700 Glenwood Avenue, Suite 530

Raleigh, NC 27612

(919) 719-4770

All Communications, Notices and Orders to:

Garland S. Tucker, III and Steven C. Lilly

Triangle Capital Corporation

3700 Glenwood Avenue, Suite 530

Raleigh, NC 27612

Telephone: (919) 719-4770

Copies to:

John A. Good, Esq.

Helen W. Brown, Esq.

Bass, Berry & Sims PLC

100 Peabody Place, Suite 900

Memphis, Tennessee 38103

Telephone: (901) 543-5918

As filed with the Securities and Exchange Commission

On November 30, 2012

Page 1 of 41

Table of Contents

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 |

Page 2 of 41

Table of Contents

UNITED STATES OF AMERICA

BEFORE THE

SECURITIES AND EXCHANGE COMMISSION

| In the Matter of

Triangle Capital Corporation 3700 Glenwood Avenue, Suite 530 Raleigh, NC 27612

File No. 812-14077 Investment Company Act of 1940 |

|

: : : : : : : : : : |

|

AMENDMENT NO. 1 TO APPLICATION FOR AN AMENDED ORDER PURSUANT TO SECTION 6(c) OF THE INVESTMENT COMPANY ACT OF 1940 GRANTING AN EXEMPTION FROM SECTIONS 23(a), 23(b) AND 63 OF THE 1940 ACT; AND PURSUANT TO SECTIONS 57(a)(4) AND 57(i) OF THE 1940 ACT AND RULE 17d-1 UNDER THE 1940 ACT TO PERMIT CERTAIN JOINT |

Triangle Capital Corporation (Triangle or the Company), an internally managed, non-diversified, closed-end investment company that has elected to be regulated as a business development company (BDC) under Section 54(a) of the Investment Company Act of 1940, as amended (the 1940 Act), hereby applies for an amended order (the Amended Order) of the U.S. Securities and Exchange Commission (the Commission) pursuant to Section 6(c) of the 1940 Act1 granting an exemption from Sections 23(a), 23(b) and 63 and pursuant to Sections 57(a)(4) and 57(i) and Rule 17d-1 under the 1940 Act2. The Amended Order would amend the exemptive order issued by the Commission on March 18, 20083 (as amended by the exemptive order issued by the Commission on May 5, 2009,4 collectively, the Prior Order) only to permit Triangle to increase the maximum number of shares of restricted common stock (Restricted Stock)5 issued to non-employee directors under its Amended and Restated 2007 Equity Incentive Plan (the Plan). Except for the requested changes with respect to the annual grants to non-employee directors, all other terms and conditions of the Prior Order will continue to apply to Triangle.

1 Unless otherwise indicated, all section references herein are to the 1940 Act.

2 Unless otherwise indicated, all rule references herein are to rules under the 1940 Act.

3 Triangle Capital Corporation, Investment Company Act Release Nos. 28165 (February 20, 2008) (notice) and 28196 (March 18, 2008) (order).

4 Triangle Capital Corporation, Investment Company Act Release Nos. 28692 (April 13, 2009) (notice) and 28718 (May 5, 2009) (order).

5 Under both, the Plan and Amended and Restated Plan, Restricted Stock means an award of Triangles shares of common stock for so long as the common stock remains subject to restrictions requiring that it be forfeited to Triangle if the conditions stipulated in the Plan are not met.

Page 3 of 41

Table of Contents

BACKGROUND AND SUMMARY OF APPLICATION

In this application (Application), Triangle respectfully requests an Amended Order to amend the Prior Order as set forth herein. The Prior Order permits Triangle, pursuant to the Plan, to permit an annual grant of Restricted Stock to each of its non-employee directors (the Annual Grant) of $30,000 worth of shares of common stock taken at the market value at the close of the exchange on the date of the Annual Grant. Pursuant to the Plan and the Prior Order, the Annual Grant, including the amount of Restricted Stock awarded under the Annual Grant, is automatic and cannot be changed without prior SEC approval. This Annual Grant is part of the compensation that non-employee directors earn for their service on Triangles Board of Directors (the Board of Directors or the Board) and respective Board committees.

Subsequent to the Prior Order, Triangle has increased its operations while continuing its effort to hire and retain qualified directors for its Board. In order to accomplish its goal to hire and retain qualified directors for its Board, Triangle believes that it is in the best interests of Triangle and its stockholders to increase the maximum number of shares of Restricted Stock it is able to issue to non-employee directors pursuant to the Plan to appropriately compensate non-employee directors for their services in proportion to Triangles growth. Triangle proposes to amend the Plan (the Amended and Restated Plan) to allow for each non-employee director to receive an Annual Grant, the amount of which to be determined by the Board annually, provided that, in no event shall the number of Restricted Shares subject to an Annual Grant exceed the lesser of (i) 5,000 shares of Restricted Stock or (ii) $90,000 worth of shares of common stock (based on the closing stock price of Triangles common stock on the grant date) (such limitation is referred to herein as the Annual Grant Cap). Under the Amended and Restated Plan, the maximum amount of Restricted Stock that may be awarded under the Annual Grant will not be changed without SEC approval.

The Amended Order would (1) enable Triangle to appropriately compensate its non-employee directors in the form of Restricted Stock in proportion to their responsibilities and Triangles growth as a publically-traded business development company and (2) allow Triangle to remain competitive within the relevant financial services industry to attract and retain qualified non-employee directors. In addition, the Amended Order would give Triangles Board the ability to grant more shares to each non-employee director without having to amend the Plan each time the Company seeks to increase the amount of shares to be granted, which in turn would require the filing of an amended application.

The terms and conditions of the Prior Order will continue to apply to Triangle, except as described in this Application. In addition, any other existing or future entities that may rely on the Amended Order in the future would comply with its terms and conditions.

GENERAL DESCRIPTION OF TRIANGLE

Triangle was organized under the General Corporation Law of the State of Maryland on October 10, 2006, for the purpose of operating as an internally-managed, non-diversified, closed-end management investment company that has elected to be regulated as a BDC within the meaning of Section 2(a)(48) of the 1940 Act. In addition, Triangle has elected to be treated for tax purposes as a regulated investment company (RIC) as defined under Subchapter M of the Internal Revenue Code of 1986, as amended (the Code).

Triangle first offered its common stock to the public (IPO) pursuant to an effective Registration Statement on Form N-2 on February 13, 2007. Triangles common stock is listed on the New York Stock Exchange (NYSE) and trades under the ticker symbol TCAP.

Page 4 of 41

Table of Contents

Triangle operates as a specialty finance company that provides customized financing solutions to lower middle market companies that have annual revenues between $20.0 million and $200.0 million. Triangles investment objective is to seek attractive returns by generating current income from debt investments and capital appreciation from equity related investments. Triangles investment philosophy is to partner with business owners, management teams and financial sponsors to provide flexible financing solutions to fund growth, changes of control, or other corporate events. Triangle invests primarily in senior and subordinated debt securities secured by first and second lien security interests in portfolio company assets, coupled with equity interests. Triangles investments generally range from $5.0 million to $25.0 million per portfolio company. In certain situations, Triangle has partnered with other unaffiliated funds to provide larger financing commitments.

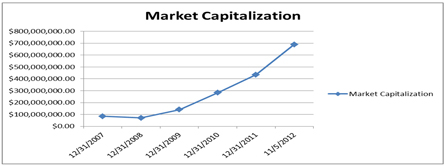

Triangles market capitalization has grown significantly since its initial public offering in 2007. The following chart shows Triangles growth.

TRIANGLES BOARD STRUCTURE AND COMPENSATION PRACTICES

Triangles Board currently consists of eight members, five of whom are not interested persons of Triangle within the meaning of Section 2(a)(19) of the 1940 Act. Triangle is internally managed by its executive officers under the supervision of the Board. As a result, Triangle does not pay external investment advisory fees, but instead incurs operating costs associated with employing investment and portfolio management professionals.

The Board has established an Audit Committee, Compensation Committee and a Nominating and Corporate Governance Committee. During 2011, the Board held five board meetings, the Audit Committee held five meetings, the Compensation Committee held three meetings and the Nominating and Corporate Governance Committee held one meeting. From January 1, 2012 through the date hereof, the Board held five board meetings, the Audit Committee held five meetings, the Compensation Committee held four meetings and the Nominating and Corporate Governance Committee held one meeting.

For fiscal year 2011, each non-employee director was paid a $20,000 annual cash retainer fee. Also in 2011, each of the non-employee directors earned an annual fee of $30,000 worth of Restricted Stock, calculated based on the share price of Triangles common stock as of the close of the NYSE on May 4, 2011, the date of grant. Based on this calculation, each of Triangles independent directors received 1,679 shares of restricted stock, which vested on May 4, 2012.

For fiscal year 2012, each non-employee director was paid a $20,000 annual cash retainer fee. Also in 2011, each of the non-employee directors earned an annual fee of $30,000 worth of Restricted Stock, calculated based on the share price of Triangles common stock as of the close of the NYSE on May 2, 2012, the date of grant. Based on this calculation, each of Triangles independent directors received 1,491 shares of restricted stock, which will vest on May 2, 2013.

Page 5 of 41

Table of Contents

In addition, each non-employee director receives a fee of $2,500 for each Board meeting attended in person and $1,250 for each Board meeting attended by conference telephone or similar communications equipment; each Audit Committee member receives a fee of $1,500 for each Audit Committee meeting attended in person and $750 for each Audit Committee meeting attended by conference telephone or similar communication equipment; and each member of the Compensation Committee and Nominating and Corporate Governance Committee receives a fee of $1,000 for each committee meeting attended in person and $500 for each committee meeting attended by conference telephone or similar communication equipment. Finally, the Audit Committee chairman receives an annual fee of $20,000, the Compensation Committee chairman receives an annual fee of $10,000 and the Nominating and Corporate Governance Committee chairman receives an annual fee of $5,000 for their services as chairmen of their respective committees. The Company also reimburses its independent directors for all reasonable direct out-of-pocket expenses incurred in connection with their service on the Board. In 2011, total compensation for each of the Companys non-employee directors averaged $72,400, including an average of $42,400 in cash compensation and $30,000 in equity compensation.

Internally and externally managed BDCs have varied compensation practices for non-employee directors. The Company reviewed compensation practices for non-employee directors within the BDC industry and found that total annual compensation for a non-employee director (including cash and equity components) ranges from $50,000 to almost $250,000. This total annual compensation amount includes cash compensation ranging from $30,000 to almost $175,000 and equity compensation awards ranging from $30,000 to almost $85,000.6 The compensation received by Triangles non-employee directors is therefore relatively low compared to other BDCs and an increase in the Annual Grant in the amount requested by the Application will allow Triangle to provide more competitive compensation to its non-employee directors.

In addition, because of the small peer group of publicly traded BDCs, Triangle also looks at the compensation practices of other publicly traded companies with substantially the same market capitalization. Triangle reviewed compensation practices for non-employee directors within the greater financial industry and found that total annual compensation for a non-employee director (including cash and equity components) of an entity that has a similar market capitalization as Triangle can range from $60,000 to over $2,000,000. This total annual compensation amount includes cash compensation ranging from $30,000 to almost $315,000 and equity compensation awards ranging from $20,000 to almost $1,900,000.7 The compensation received by Triangles non-employee directors is therefore relatively low compared to the greater financial industry and an increase in the Annual Grant in the amount requested by the Application will allow Triangle to provide more competitive compensation to its non-employee directors.

TRIANGLES CURRENT EQUITY COMPENSATION PLAN

Triangles Board and sole stockholder approved Triangles 2007 Equity Incentive Plan (the Original Plan) effective February 13, 2007, for the purpose of attracting and retaining the services of executive officers, other key employees and directors. On February 6, 2008, the Board voted to approve the Amended and Restated 2007 Equity Incentive Plan (the Plan), and to recommend approval of the

6 Triangles review of compensation practices included the following companies: Capital Southwest Corporation, Harris & Harris Group, Inc., Hercules Technology

Growth Capital, Inc., KCAP Financial (formerly Kohlberg Capital Corporation), Main Street Capital Corporation, MCG Capital Corporation and Medallion

Financial Corporation.

7 Triangles review of compensation practices included the following financial entities with similar market capitalizations: First Commonwealth Financial Corporation,

HFF, Inc., KBW, Inc., NetSpend Holdings, Inc., Oriental Financial Group Inc., Oritani Financial Corp., Pinnacle Financial Partners, Inc. and Walker & Dunlop, Inc.

Page 6 of 41

Table of Contents

Plan by Triangles stockholders, subject to an order from the Commission granting exemptive relief. On March 18, 2008, Triangle received an order from the SEC authorizing such issuance of restricted stock to Triangles employees and non-employee directors and on May 7, 2008, Triangles stockholders approved the Plan and the 2008 Annual Meeting of Stockholders. Pursuant to the Plan, up to 900,000 shares of common stock were initially reserved for issuance. On March 7, 2012, Triangles Board approved, and on May 2, 2012 at the 2012 Annual Stockholders Meeting, Triangles stockholders approved, an increase in the number of shares reserved for issuance under the Plan by 1,500,000 shares, increasing the total number of shares currently reserved for issuance to 2,400,000 shares of common stock. As of the date of this Application, Triangle has 1,592,484 shares of common stock available for issuance under the Plan.

Subject to the provisions of the 1940 Act and the Prior Order, Triangle may award stock options, stock appreciation rights, shares of restricted stock, restricted stock units, performance awards and other stock-based awards pursuant to the Plan. Awards may be made under the Plan to officers, other employees and directors of Triangle. Unless terminated sooner by the Board, the Plan will terminate on February 13, 2017, and no additional awards may be made after that date.

The Plan is subject to the following conditions, as stipulated by the 1940 Act and the Prior Order:

| |

The total number of shares that may be outstanding as restricted shares under the Plan may not exceed 10% of the total number of the Companys shares of common stock authorized and outstanding at any time. |

| |

No one person will be granted awards of restricted stock relating to more than 25% of the shares available for issuance under the Plan. |

| |

The amount of voting securities that would result from the exercise of all Triangles outstanding warrants, options and rights, together with any restricted stock issued pursuant to the Plan, at the time of issuance will not exceed 25% of Triangles outstanding voting securities. |

| |

Notwithstanding the immediately preceding limitation, if the amount of voting securities that would result from such exercise of all of Triangles outstanding warrants, options and rights issued to Triangles directors, officers and employees, together with any restricted stock issued pursuant to the Plan, would exceed 15% of our outstanding voting securities, then the total amount of voting securities that would result from the exercise of all outstanding warrants, options and rights, together with any restricted stock issued pursuant to the Plan, at the time of issuance will not exceed 20% of Triangles outstanding voting securities. |

| |

An employee participating in the Plan may not receive options to purchase in excess of 100,000 shares of Triangles common stock in any single calendar year. |

| |

Non-employee directors receive an automatic grant of Restricted Stock at the beginning of each one-year term of service on the Board, for which forfeiture restrictions will lapse one year from the grant date. The number of shares granted to each non-employee director will be the equivalent of $30,000 worth of shares taken at the market value at the close of the New York Stock Exchange on the date of grant. The grants of restricted stock to non-employee directors under the Plan are automatic and not subject to change without SEC approval. |

Shares granted pursuant to a Restricted Stock award are not be transferable until such shares have vested in accordance with the terms of the award agreement, unless the transfer is by will or by the laws of descent and distribution.

Page 7 of 41

Table of Contents

Triangle proposes to amend and restate the Plan to increase the amount of the Annual Grant to its non-employee directors. All other terms governing the grant of Restricted Stock to Triangles directors and employees specified under the Plan and previously approved by the Commission and the Companys stockholders shall remain the same. Subject to approval of the requested Amended Order, Triangle will present the Amended and Restated Plan to its stockholders at the 2013 Annual Meeting for their approval. The purpose of the increased amount of Restricted Stock available under the Plan is to give the Board the ability to grant more shares to each non-employee director without having to amend the Plan each time the Company seeks to increase the amount of shares to be granted, which in turn would require the filing of an amended application. The Amended and Restated Plan is attached to this application as Exhibit A.

Compensation Practices in the Asset Management Industry

Triangle believes that the market for superior investment professionals is highly competitive. Triangle must compete for talent with commercial banks, investment banks, as well as other publicly traded companies, which are generally able to award many different types of stock-based compensation to their directors. Moreover, Triangle must compete for leadership with private equity funds, which generally have the discretion to offer a portion of their various carried interests to induce professional talent to associate with their funds without being required to obtain Commission approval each time. Triangles success depends largely on its ability to attract top professional talent, which requires it to offer fair compensation packages to its Board of Directors that are competitive with those offered by the types of competitors mentioned above. Triangle believes that the highly specialized nature of its business, the competitiveness of its market and its significant growth make retention of its Board of Directors even more critical for Triangle. In that regard, the ability to offer additional equity-based compensation to its Board of Directors, which both aligns better the behavior of the Board of Directors with stockholder interests and provides a retention tool, is vital to Triangles future growth and success.

Triangle wishes to increase the amount of the Annual Grant to its non-employee directors.8 The Amended and Restated Plan would enable Triangle to offer non-employee directors compensation packages that are competitive with those offered by its competitors and other investment management businesses, which would enhance the ability of Triangle to hire and retain highly experienced individuals to serve as non-employee directors.

Triangle believes that the particular characteristics of its business, the dependence Triangle has on its Board of Directors to conduct its business effectively and the competitive environment in which it operates require the use of equity-based compensation in its compensation system. Retention and recruitment of the best people is vital to the future success and growth of Triangles business and is in the best interests of Triangles stockholders. Appropriate compensation plans that support the companys objectives and align the interests of stockholders and employees are essential to long term success in the investment business in general and critical to Triangles business in particular.

Triangle strongly believes that the most appropriate form of equity-based compensation that it can continue to offer is Restricted Stock. Relative to other forms of equity-based compensation, Restricted Stock allows Triangle to (1) develop superior alignment to business plan, stockholder interests

8 Triangle requests that the Amended Order also permit the grant of Restricted Stock to its future non-employee directors.

Page 8 of 41

Table of Contents

and interests of the Board of Directors; (2) match the return expectations of the business more closely with its equity-based compensation plan and (3) manage dilution associated with equity-based compensation. Triangle continues to believe that granting Restricted Stock awards to its non-employee directors will have a clear and meaningful benefit to its stockholders and its business prospects that supports approval of this Application. Triangle believes the ability to issue more shares of Restricted Stock pursuant to the Annual Grant will enable it to continue to use the most appropriate form of equity-based compensation in such amounts that will enable Triangle to retain and recruit the most qualified individuals for its Board of Directors.

Restricted Stock motivates behavior that is more consistent with the type of return expectations that Triangle has established for its stockholders. Triangles strategy is to originate high quality, long-term assets and to support the risk management activity of its portfolio companies over a long period of time. Further, Triangles business plan is to execute a methodical and conservative accumulation of assets that have a risk-based pricing premium relative to similar securities. To this end, Restricted Stock places more value on the quality of originated assets over the quantity of originated assets, and thus, Restricted Stock is an appropriate compensation tool for Triangle to align Board interests with stockholder interests. Shares of Restricted Stock that vest over time will continue to allow Triangle to provide meaningful rewards over time to non-employee directors.

Dilution is an important consideration for stockholders. Because Restricted Stock has intrinsic value, it takes fewer shares of Restricted Stock to generate a similar level of economic benefit to the recipient. This is particularly true given the high level of dividend statutorily embedded in the Companys business model and regulatory structure, which does not accrue to the benefit of the option holder. In other words, the Company believes that the additional number of shares of Restricted Stock that it will grant will continue to be only a fraction of the number of shares that would be subject to stock options were the Company to offer equivalent economic incentives through a stock option plan.

The Companys management and the Board, including the Compensation Committee of the Board, have considered each of the factors discussed above and believe that the ability to issue shares of Restricted Stock pursuant to the Annual Grant (subject to the Annual Grant Cap) is in the best interest of the Companys stockholders and business.

Subject to the granting of this Amended Order and to stockholder approval of the Amended and Restated Plan at the 2013 Annual Meeting of Stockholders, pursuant to Section 9 of the Amended and Restated Plan, the Board will be authorized to award each non-employee director an Annual Grant of Restricted Stock. The number of shares of Restricted Stock awarded under the Annual Grant will be determined by the Board annually based on several factors, but in no event will such Annual Grant exceed the Annual Grant Cap. All other terms and conditions of the Prior Order will continue to apply to Triangle. Pursuant to the Amended and Restated Plan, the maximum number of shares of Restricted Stock available for the Annual Grant pursuant to the Annual Grant Cap will not be changed without SEC approval.

As set out in the Prior Order, the maximum amount of Restricted Stock that may be issued under the Amended and Restated Plan is limited to 10% of the outstanding shares of common stock of Triangle on the effective date of the Plan plus 10% of the number of shares of Triangles common stock issued or

Page 9 of 41

Table of Contents

delivered by Triangle (other than pursuant to compensation plans) during the term of the Amended and Restated Plan.9 In addition, no recipient may be granted more than 25% of the shares of common stock reserved for issuance under the Amended and Restated Plan.

The number of shares awarded pursuant to the Annual Grant will be an amount set by the Compensation Committee (the Committee) of Triangles Board of Directors (which is comprised solely of non-employee, disinterested directors) each year, but in no event will such amount exceed the Annual Grant Cap. Under the Plan, the Annual Grant is currently the equivalent of $30,000 worth of shares taken at the market value at the close of the exchange on the date of grant. Just like the Plan, the Amended and Restated Plan will be administered by the Committee, and reviewed periodically by the Committee and the full Board. Each Annual Grant awarded to non-employee directors will be approved by the Committee and a required majority, as defined in Section 57(o) of the 1940 Act (the required majority)10 of the Companys directors on the basis that such issuance is in the best interests of the Company and its stockholders. The Committee will have the responsibility to ensure that the Amended and Restated Plan is operated in a manner that best serves the interests of the Company and its stockholders. The maximum number of shares of Restricted Stock awarded to non-employee directors pursuant to the Annual Grant will not be changed following Commission approval, without further Commission approval. All non-employee directors will receive an equal number of shares of Restricted Stock under the Annual Grant each year.

As of November 5, 2012, Triangle had outstanding 27,320,385 shares of common stock at a closing price of $25.10 per share. As of the date of this Application, Triangle has issued a total of 807,516 shares under the Plan, of which 755,909 shares were granted to employees and 51,607 shares were granted to non-employee directors. To date, no stock options have been granted under the Plan. A breakdown of Triangles annual grants pursuant to the Plan is listed below:

| Year |

Employees |

Non-Employee Directors |

||

| 2008 |

100,000 |

13,500 |

||

| 2009 |

133,000 |

11,812 |

||

| 2010 |

142,499 |

10,445 |

||

| 2011 |

152,779 |

8,395 |

||

| 2012 |

227,631 |

7,455 |

||

|

Total |

755,909 |

51,607 |

Until the expiration of the Plan, Triangle will be able to issue 1,592,484 shares of common stock, or an average of approximately 318,496 shares each year over the next five years to all officers, employees and directors. The average amount of shares that Triangle is currently able to grant under the Amended and Restated Plan each year, therefore, is not significantly more than the amounts it has recently granted to its officers, employees and directors.

Under the Amended and Restated Plan, should the Committee grant 3,585 shares of common stock at a price of $25.10 per share to each non-employee director, the total dollar value of the Annual Grant will be $89,983.50, which constitutes less than 0.07% of the total number of shares of the Companys common stock as of November 5, 2012.

9 For purposes of calculating compliance with this limit, Triangle will count as Restricted Stock all shares of Triangles common stock that are issued pursuant to the

Amended and Restated Plan less any shares that are forfeited back to Triangle and cancelled as a result of forfeiture restrictions not lapsing.

10 The term required majority, when used with respect to the approval of a proposed transaction, plan, or arrangement, means both a majority of a BDCs directors or

general partners who have no financial interest in such transaction, plan, or arrangement and a majority of such directors or general partners who are not interested

persons of such company.

Page 10 of 41

Table of Contents

The Amended and Restated Plan has been approved by the Board as a whole, including a majority of the disinterested directors and the required majority. Just like the Plan, the date on which the required majority approves an issuance of Restricted Stock will be deemed the date on which the Restricted Stock is granted. The Amended and Restated Plan will be submitted for approval to Triangles stockholders at the 2013 Annual Meeting, and will become effective upon such approval, subject to the issuance of the Amended Order.

The Board, including the required majority, found that permitting an Annual Grant to each non-employee director, subject to the Annual Grant Cap, is essential to long term success in the investment business in general and critical to Triangles business in particular and will have a clear and meaningful benefit to Triangle and its stockholders. The Board, including the required majority, also found that having the ability to increase the amount of the Annual Grant (subject to the Annual Grant Cap) will allow Triangle to better align its business plan, stockholder interests and Board interests based on the nature of Triangles business as well as the characteristics of Restricted Stock, allowing Triangles non-employee directors to become owners of additional stock with an interest in increasing market value of the Companys common stock. The Board, including the required majority, considered, among other things, the impact of the Annual Grant on outside stockholders, including the impact of dilution that the Amended and Restated Plan would have with the limit on outstanding Restricted Stock of 10% of Triangles outstanding common stock.

Triangle will continue to comply with all disclosure requirements applicable to BDCs, including the disclosure requirements for director compensation, related party transactions, director independence and other corporate governance matters, and security ownership of officers and directors.11

APPLICABLE LAW AND NEED FOR RELIEF

Under Section 63, the provisions of Section 23(a) generally prohibiting a registered closed-end investment company from issuing securities for services or for property other than cash or securities are made applicable to BDCs. This provision would prohibit the issuance of Restricted Stock pursuant to the Annual Grant as provided under the Amended and Restated Plan.

Section 23(b) prohibits a registered closed-end investment company from selling any common stock of which it is the issuer at a price below the common stocks current net asset value, except with the consent of a majority of the companys common stockholders at the time of issuance or under certain other enumerated circumstances not applicable to the subject of this Application. Section 63(2) provides that, notwithstanding Section 23(b), a BDC may sell any common stock of which it is the issuer at a price below the current net asset value of such stock and may sell warrants, options, or rights to acquire any such common stock at a price below the current net asset value of such stock if, generally (1) a majority of the BDCs outstanding voting securities, and the holders of a majority of the BDCs voting securities who are not interested persons of the BDC, approved the BDCs policy and practice of making such sales of securities at the last annual meeting of stockholders within one year immediately prior to any such sale; (2) a required majority of the BDCs directors (i.e., a majority of directors who have no financial interest in the transaction, plan or arrangement and who are not interested persons of the BDC) have determined that such sale would be in the best interests of the BDC and its stockholders; and (3) a required majority of the BDCs directors have determined immediately prior to the issuance of such securities that the price

11 See Executive Compensation and Related Party Disclosure, Securities Act Release No. 8655 (Jan. 27, 2006) (Proposed Rule); Executive Compensation and Related

Party Disclosure, Securities Act Release No. 8732A (Aug. 29, 2006) (Final Rule and Proposed Rule), as amended by Executive Compensation Disclosure,

Securities Act Release No. 8765 (Dec. 22, 2006) (adopted as interim final rules with request for comments).

Page 11 of 41

Table of Contents

at which such securities are to be sold is not less than a price which closely approximates the market value of those securities.

Because the issuance of additional shares of Restricted Stock for the Annual Grant that would be permitted under the Amended and Restated Plan would not meet the terms of Section 63(2), Sections 23(b) and 63 would prevent the Board from increasing the amount of the Annual Grant, or changing any of the terms of the Annual Grant, from the terms previously set forth in the Prior Order.

Section 57(a) proscribes certain transactions between a BDC and persons related to the BDC in the manner described in Section 57(b) (57(b) persons), absent a Commission order. Section 57(a)(4) generally prohibits a 57(b) person from effecting a transaction in which the BDC is a joint participant absent such order. Rule 17d-1, the analog to Section 57(a)(4) for registered investment companies, is made applicable to BDCs by Section 57(i). Rule 17d-1 proscribes participation in a joint enterprise or other joint arrangement or profit-sharing plan, which includes, pursuant to paragraph 17d- 1(c), a stock option or purchase plan. Employees and directors of a BDC are 57(b) persons. Thus, although a compensation plan involving grants of restricted stock is not specifically covered by Section 57(a)(4) or Rule 17d-l, the issuance of shares of Restricted Stock could be deemed to involve a joint transaction involving a BDC and a 57(b) person in contravention of Section 57(a)(4).

Section 6(c) provides, in part, that the Commission may, by order upon application, conditionally or unconditionally exempt any person, security, or transaction, or any class or classes thereof, from any provision of the 1940 Act, if and to the extent that the exemption is necessary or appropriate in the public interest and consistent with the protection of investors and the purposes fairly intended by the policy and provisions of the 1940 Act.

Section 57(a)(4) and Rule 17d-1, made applicable to BDCs by Section 57(i), provide that the Commission may, by order upon application, grant relief under Section 57(a)(4) and Rule 17d-1 permitting certain joint enterprises or arrangements and profit-sharing plans. Rule 17d-1(b) further provides that in passing upon such an application, the Commission will consider (i) whether the participation of the BDC in such enterprise, arrangement, or plan is consistent with the policies and purposes of the 1940 Act and (ii) the extent to which such participation is on a basis different from or less advantageous than that of other participants.

Triangle requests an Amended Order of the Commission pursuant to Section 6(c) of the 1940 Act granting an exemption from Sections 23(a), 23(b) and 63, and pursuant to Sections 57(a)(4) and 57(i) and Rule 17d-l under the 1940 Act authorizing certain joint transactions otherwise prohibited by Section 57(a)(4), to permit Triangle to amend and restate the Plan to increase the amount of shares of Restricted Stock that may be granted to non-employee directors under the Annual Grant.12 All other terms and conditions of the Prior Order will continue to apply to Triangle.

STANDARDS FOR EXEMPTION UNDER SECTION 6(c)

Section 6(c), which governs Triangles request for exemptive relief from Sections 23 and 63 provides, in part, that the Commission may, by order upon application, conditionally or unconditionally exempt any person, security, or transaction, or any class or classes thereof, from any provisions of the 1940 Act, if and to the extent that such exemption is necessary or appropriate in the public interest and

12 Triangle asks that the Amended Order also apply to future non-employee directors of Triangle that are eligible to receive Restricted Stock.

Page 12 of 41

Table of Contents

consistent with the protection of investors and the purposes fairly intended by the 1940 Acts policy and provisions.

Necessary or Appropriate in the Public Interest

Triangle submits that maintaining the ability of a BDC that identifies, invests in and actively works with lower middle market companies to attract and retain highly qualified non-employee members for its Board is in the public interest, including the interests of Triangles stockholders. These directors, in turn, are likely to increase Triangles performance and stockholder value. Triangle competes for experienced directors with banks, private equity funds, other financial services companies and other publicly traded companies that are not investment companies regulated by the 1940 Act. These organizations are able to offer all types of equity-based compensation to their directors, including a discretionary amount of restricted stock, and, therefore, have an advantage over Triangle in attracting and retaining highly qualified individuals. For Triangle to compete on a more equal basis with such organizations, it must be able to attract and retain experienced directors and offer them comparable compensation packages. Having the flexibility to issue more shares of Restricted Stock under the Annual Grant (subject to the Annual Grant Cap) will allow Triangle to competitively compensate its Board while also aligning the interests of its Board with the success of Triangle and the interests of its stockholders and preserving cash for further investment. Triangle acknowledges that, while a potentially higher Restricted Stock award granted under the Amended and Restated Plan would have a dilutive effect on the stockholders equity in Triangle, that effect would be outweighed by the anticipated benefits of the Amended and Restated Plan to Triangle and its stockholders and minimized by Triangles large number of shares currently outstanding.

Consistency with the Protection of Investors

Just like the Plan, investors will be protected to at least the same extent that they are currently protected under Section 61(a)(3). The Amended and Restated Plan has been approved by the Board and will be submitted to Triangles stockholders for their approval or disapproval at the 2013 Annual Meeting. A proxy statement submitted to Triangles stockholders will contain a concise plain English description of the proposed changes to the Plan and its potential dilutive effect. Triangle also states that it will comply with the proxy disclosure requirements in Item 10 of Schedule 14A under the Exchange Act. If the Amended and Restated Plan is not approved by stockholders, it will not be implemented and the Plan will stay in place as currently authorized. Thus, Triangles stockholders will have the opportunity to decide for themselves whether the prospective benefits offered by Triangles ability to increase the amount of the Annual Grant, subject in each case to the Annual Grant Cap, are worth the dilution that will result from its operation. In addition, Triangles stockholders will be further protected by the conditions as currently set out under the Plan that assure continuing oversight of the operation of the Amended and Restated Plan by Triangles Board.

Page 13 of 41

Table of Contents

Consistency with the Purposes of the 1940 Act

The Commission previously recognized the problem of restricting equity compensation in the context of SBICs in 1971 and granted a limited exemption from the 1940 Acts provisions to permit SBICs to issue qualified stock options. Congress amended the 1940 Act in 1980 to permit BDCs also to issue warrants, options, and rights subject to certain conditions and limitations. The Commission again recognized these problems in the context of closed-end investment companies in 1985 and granted a limited exemption from the 1940 Acts provisions to permit certain internally managed closed-end investment companies to issue incentive stock options. Finally, in 1998, the Commission issued the Baker Fentress Order and in 2005, the Commission issued the Adams Express Order, both orders permitting numerous types of equity compensation, including the issuance of restricted stock by a registered closed-end investment company. In each of these instances, it was found that equity compensation would not offend the 1940 Acts policies and purposes.

As indicated earlier, Triangle competes with banks, private equity funds, other financial services companies and other publicly traded companies that are not investment companies regulated by the 1940 Act and may be disadvantaged in attracting and retaining directors because the Annual Grant is currently a fixed amount of $30,000 shares of Restricted Stock as part of a compensation plan to non-employee directors. This fixed dollar amount does not take into consideration Triangles growth since it last sought exemptive relief to issue Restricted Stock to non-employee directors.13 The Commission has expressed approval for direct stock grants to non-employee directors without requiring exemptive relief.14 Triangle may, like other BDCs,15 seek to make a direct stock grant consistent with the Commissions express approval.

Internally and externally managed BDCs have varied compensation practices for non-employee directors. The Company reviewed compensation practices for non-employee directors within the BDC industry and found that total annual compensation for a non-employee director (including cash and equity components) ranges from $50,000 to almost $250,000. This total annual compensation amount includes cash compensation ranging from $30,000 to almost $175,000 and equity compensation ranging from $30,000 to almost $85,000.16 The compensation received by Triangles non-employee directors is therefore relatively low compared to other BDCs and an increase in the Annual Grant in the amount requested by the Application will allow Triangle to provide more competitive compensation to its non-employee directors.

In addition, because of the small peer group of publicly traded BDCs, Triangle also looks at the compensation practices of other publicly traded companies with substantially the same market capitalization. Triangle reviewed compensation practices for non-employee directors within the greater financial industry and found that total annual compensation for a non-employee director (including cash and equity components) of an entity that has a similar market capitalization as Triangle can range from $60,000 to over $2,000,000. This total annual compensation amount includes cash compensation

13 See Triangle Capital Corporation, Investment Company Act Release Nos. 28165 (February 20, 2008) (Notice) and 28196 (March 18, 2008) (Order).

14 See Commission Release No. IC-24083, SEC Interpretation: Matters Concerning Independent Directors of Investment Companies, October 14, 1999. In this release,

the Staff stated that it would not recommend enforcement action to the Commission under section 23(a) if closed-end funds directly compensate their directors with

fund shares, provided that the directors services are assigned a fixed dollar value prior to the time that the compensation is payable.

15 See Kohlberg Capital , et al., Investment Company Act Release Nos. 29376 (August 3, 2010) (Notice); and 29407 (August 31, 2010) (Order).

16 Triangles review of compensation practices included the following companies: Capital Southwest Corporation, Harris & Harris Group, Inc., Hercules Technology

Growth Capital, Inc., KCAP Financial (formerly Kohlberg Capital Corporation), Main Street Capital Corporation, MCG Capital Corporation and Medallion

Financial Corporation.

Page 14 of 41

Table of Contents

ranging from $30,000 to almost $315,000 and equity compensation awards ranging from $20,000 to almost $1,900,000.17 The compensation received by Triangles non-employee directors is therefore relatively low compared to the greater financial industry and an increase in the Annual Grant in the amount requested by the Application will allow Triangle to provide more competitive compensation to its non-employee directors.

STANDARDS FOR AN ORDER UNDER RULE 17d-1

Section 57(a)(4) and Rule 17d-1, made applicable to BDCs by Section 57(i), provide that the Commission may, by order upon application, grant relief under Section 57(a)(4) and rule 17d-1 permitting certain joint enterprises or arrangements and profit-sharing plans. Rule l7d-1(b) further provides that in passing upon such an application, the Commission will consider (i) whether the participation of the BDC in such enterprise, arrangement, or plan is consistent with the policies and purposes of the 1940 Act and (ii) the extent to which such participation is on a basis different from or less advantageous than that of other participants.

Consistency with the 1940 Acts Policies and Purposes

The arguments as to why the Amended and Restated Plan is consistent with the 1940 Act are almost identical to the standards for exemptions under Section 6(c) and have been set forth above. Additionally, Section 57(j)(1) expressly permits any director, officer, or employee of a BDC to acquire warrants, options, and rights to purchase voting securities of such BDC, and the securities issued upon the exercise or conversion thereof, pursuant to an executive compensation plan which meets the requirements of Section 61(a)(3)(B). Triangle submits that the ability to issue more shares of Restricted Stock under the Annual Grant (subject in each case to the Annual Grant Cap) poses no greater risk to stockholders than the issuances currently permitted by the Plan and under Section 57(j)(1).

Triangles role is necessarily different from that of the non-employee directors in the arrangement at issue. The respective rights and duties of Triangle and its non-employee directors are different and not comparable. However, Triangles participation with respect to the Amended and Restated Plan will not be less advantageous than that of the non-employee directors. Triangle, either directly or indirectly, is responsible for the compensation of the non-employee directors and the Amended and Restated Plan, just like the Plan, is simply Triangles chosen method of providing such compensation. Moreover, the Amended and Restated Plan will provide the benefit to Triangle of enhancing its ability to attract and retain highly qualified non-employee directors. The Amended and Restated Plan will help align the interests of Triangles directors with those of its stockholders, which will encourage conduct on the part of the non-employee directors designed to produce a better return for the Companys stockholders.

CONSISTENCY WITH SECTIONS 23(a) AND 23(b)

Triangle further submits that the Amended and Restated Plan would not violate the purposes behind Sections 23(a) and (b). The concerns underlying the enactment of those provisions included (i) preferential treatment of investment company insiders and the use of options and other rights by insiders to obtain control of the investment company; (ii) complication of the investment companys structure that

17 Triangles review of compensation practices included the following financial entities with similar market capitalizations: First Commonwealth Financial Corporation,

HFF, Inc., KBW, Inc., NetSpend Holdings, Inc., Oriental Financial Group Inc., Oritani Financial Corp., Pinnacle Financial Partners, Inc. and Walker & Dunlop, Inc.

Page 15 of 41

Table of Contents

made it difficult to determine the value of the companys shares; and (iii) dilution of shareholders equity in the investment company.

The ability to issue more shares of Restricted Stock under the Annual Grant (subject in each case to the Annual Grant Cap) does not raise concern about preferential treatment of Triangles insiders because the Amended and Restated Plan is a bona fide compensation plan of the type that is common among corporations generally, and that are contemplated by Section 61 of the 1940 Act and approved by the Commission in the Companys Prior Order and by the orders given to MCG Capital Corporation,18 Hercules Technology Growth Capital, Inc.,19 Main Street Capital Corporation,20 Harris & Harris Group, Inc.,21 Baker Fentress,22 and Adams Express23. Triangle also asserts that the Amended and Restated Plan would not become a means for insiders to obtain control of Triangle because the maximum amount of Restricted Stock that may be issued under the Amended and Restated Plan will continue to be 10% of the outstanding shares of common stock of Triangle on the effective date of the Plan plus 10% of the number of shares of Triangles common stock issued or delivered by Triangle (other than pursuant to compensation plans) during the term of the Amended and Restated Plan.24 Triangle further states that the ability to issue more shares of Restricted Stock under the Annual Grant (subject in each case to the Annual Grant Cap) will not unduly complicate Triangles structure because all other terms under the Plan will remain the same.

PRIOR COMMISSION ORDERS RELATING TO USE OF EQUITY-BASED COMPENSATION BY BUSINESS DEVELOPMENT COMPANIES

The 1980 Amendments also permit BDCs to issue warrants, options, and rights to purchase voting securities to non-employee directors if that BDC complies with certain conditions and if the issuance to the non-employee directors is approved by order of the Commission, upon application, on the basis that the terms of the proposal are fair and reasonable and do not involve overreaching of such company or its stockholders or partners. The Commission has approved a number of equity compensation plans pursuant to Section 61(a)(3)(B).25

18 See MCG Capital Corporation, Investment Company Act Release Nos. 29191 (March 25, 2010) (Notice); 29210 (April 20, 2010) (Order); 27258 (March 8, 2006) (Notice) and 27280 (April 4, 2006) (Order).

19 See Hercules Technology Growth Capital Inc., Investment Company Act Release Nos. 29287 (May 26, 2010) (Notice); 29303 (June 22, 2010) (Order); 27815

(May 2, 2007) (Notice) and 27838 (May 23, 2007) (Order).

20 See Main Street Capital Corporation et al, Investment Company Act Release Nos. 28726 (May 19, 2009) (Notice) and 29768 (June 16, 2009) (Order).

21 See Harris & Harris Group, Inc., Release No. IC-29976 (March 3, 2012) (Notice), Release No. IC-30027 (April 25, 2012) (Order).

22 See Baker, Fentress & Company, Release No. IC-23619 (Dec. 22, 1998).

23 See Adams Express Company, et. al., Release No. IC-26780 (March 8, 2005).

24 For purposes of calculating compliance with this limit, Triangle will count as Restricted Stock all shares of Triangles common stock that are issued pursuant to the

Plan less any shares that are forfeited back to Triangle and cancelled as a result of forfeiture restrictions not lapsing.

25 See, e.g. Gladstone Capital Corporation, Release No. IC-25881 (Jan. 3, 2003) (Notice), Release No. IC-25917 (Jan. 29, 2003) (Order); UTEK Corporation, Release

No. IC-25468 (March 20, 2002) (Notice), Release No. IC-25529 (April 6, 2002) (Order); Medallion Financial Corp., Release No. IC-24342 (March 17, 2000)

(Notice), Release No. IC-24390 (April 12, 2000) (Order); Franklin Capital Corporation, Release No. IC-24254 (Jan. 18, 2000) (Notice), Release No. IC-24287

(Feb. 14, 2000) (Order); Elk Associations Funding Corporation, Release No. IC-23934 (Aug. 3, 1999) (Notice), Release No. IC-23984 (Aug. 31, 1999) (Order);

Allied Capital Corporation, Release No. IC-23946 (Aug. 12, 1999) (Notice), Release No. IC-24000 (Sept. 8, 1999) (Order); American Capital Strategies, Release

No. IC-23785 (April 14, 1999) (Notice), Release No. IC-23830 (May 11, 1999) (Order); Brantley Capital Corporation, Release No. IC-23766 (March 30, 1999)

(Notice), Release No. IC-23812 (April 28, 1999) (Order); Sirrom Capital Corporation, Release No. IC-23228 (May 29, 1998) (Notice), Release No. IC-23271

(June 24, 1998) (Order); Equus II Incorporated, Release No. IC-22853 (Oct. 10, 1997) (Notice), Release No. IC-22874 (Nov. 4, 1997) (Order); Harris & Harris

Group, Inc., Release NO. IC-21755 (Feb. 15, 1996) (Notice), Release No. IC-21822 (March 12, 1996) (Order); and Medallion Financial Corp., Release No.

IC-22350 (Nov. 25, 1996) (Notice), Release No. IC-22417 (Dec. 23, 1996) (Order).

Page 16 of 41

Table of Contents

The important role that equity compensation can play in attracting and retaining qualified leadership has also been expressly recognized by the Commission in connection with Triangles Prior Order and with respect to other internally managed BDCs specifically.

Hercules Technology Growth Capital, Inc. Hercules Technology Growth Capital, Inc., an internally managed BDC, filed an application on July 7, 2006, and amendments to the application on April 4, 2007 and May 1, 2007, requesting an order under Section 6(c) of the 1940 Act granting an exemption from Sections 23(a), 23(b) and 63 of the 1940 Act; and under Sections 57(a)(4) and 57(i) of the 1940 Act and Rule 17d-1 under the 1940 Act. The order granted on May 23, 2007 (the Hercules Order) permits the applicant to issue Restricted Stock as compensation to its employees and non-employee directors and to employees of certain subsidiaries.26

MCG Capital Corporation. MCG Capital Corporation, an internally managed BDC, filed an application on September 2, 2005, and an amendment to the application on January 31, 2006, requesting an order under Section 6(c) of the 1940 Act granting an exemption from Sections 23(a), 23(b) and 63 of the 1940 Act; and under Sections 57(a)(4) and 57(i) of the 1940 Act and rule 17d-1 under the 1940 Act. The order granted on April 4, 2006 (the MCG Order) permits the applicant to issue 7,500 shares of Restricted Stock as compensation to its non-employee directors.27

Main Street Capital Corporation. Main Street Capital Corporation (Main Street), an internally managed BDC filed an application on July 27, 2007, and an amendment to the application on December 5, 2007, requesting an order under Section 6(c) of the 1940 Act granting an exemption from Sections 23(a), 23(b) and 63 of the 1940 Act; and under Sections 57(a)(4) and 57(i) of the 1940 Act and Rule 17d-1 under the 1940 Act. The order granted on January 16, 2008 (the Main Street Order) permits the applicant to issue $30,000 worth of Restricted Stock based on the market value at the close of the NYSE on the date of grant as compensation to its non-employee directors.28 Similar to Triangle, Main Street subsequently filed an application on July 16, 2012 requesting an order under Section 6(c) of the 1940 Act granting an exemption from Sections 23(a), 23(b) and 63 of the 1940 Act; and under Sections 57(a)(4) and 57(i) of the 1940 Act and Rule 17d-1 under the 1940 Act to permit, among other things, the issuance of up to 10,000 shares of restricted stock to each of its non-employee directors.29

KCAP Financial, Inc. KCAP Financial, Inc. (formerly Kohlberg Capital Corporation) (KCAP) filed a similar application on February 27, 2007, and subsequent amendments to the application on February 13, 2008, February 22, 2008, March 10, 2008 and July 29, 2010, requesting an order under Section 6(c) granting an exemption from Sections 23(a), 23(b) and 63; and under Sections 57(a)(4) and 57(i) and Rule 17d-1. The order granted on March 24, 2008 (the KCAP Order) permits KCAP to issue 4,000 shares of restricted stock each year to its non-employee directors.30

Harris & Harris Group, Inc. Harris & Harris Group, Inc. (Harris) filed a similar application on July 11, 2006 and amendments to the application on May 24, 2010, October 25, 2011, February 29, 2012 and March 7, 2012 requesting an order under Section 6(c) granting an exemption from Sections 23(a),

26 See Hercules Technology Growth Capital Inc., Investment Company Act Release Nos. 29287 (May 26, 2010) (Notice); 29303 (June 22, 2010) (Order); 27815

(May 2, 2007) (Notice) and 27838 (May 23, 2007) (Order).

27 See MCG Capital Corporation, Investment Company Act Release Nos. 29191 (March 25, 2010) (Notice); 29210 (April 20, 2010) (Order); 27258 (March 8, 2006)

(Notice) and 27280 (April 4, 2006) (Order).

28 See Main Street Capital Corporation et al, Investment Company Act Release Nos. 28726 (May 19, 2009) (Notice) and 29768 (June 16, 2009) (Order).

29 See Main Street Capital Corporation et al. Request for Exemptive Relief, File No. 812-14057 (July 16, 2012).

30 See Kohlberg Capital Corporation, Investment Company Act Release Nos. 29376 (Aug. 23, 2010) (Notice) and 29407 (Aug. 31, 2010) (Order).

Page 17 of 41

Table of Contents

23(b) and 63 and under Sections 57(a)(4) and 57(i) of the 1940 Act and under Rule 17d-1 under the 1940 Act. The order granted on April 25, 2012 (the Harris Order) permits Harris to issue up to 2,000 shares of restricted stock each year to its non-employee directors, officers and employees.31

Triangle believes that the ability to issue more shares of Restricted Stock, subject to the Annual Grant Cap, to non-employee directors is substantially similar, for purposes of investor protection under the 1940 Act, to the issuance of warrants, options, and rights as contemplated by Section 61. Triangle further believes that the terms of its proposal are fair and reasonable and do not involve any overreaching.

Triangle believes that having the flexibility to increase the amount of the Annual Grant for non-employee directors (subject to the Annual Grant Cap) is fair and reasonable because of the skills and experience such directors provide to Triangle. Such skills and experience are critical for the management and oversight of Triangles investments and operations. Furthermore, as noted above, the ability to offer its non-employee directors, equity-based compensation is appropriate to enhance Triangles ability to obtain and retain high quality individuals to serve on its Board. As described above, Triangles current non-employee director compensation packages are relatively low compared to other BDCs and an increase in the Annual Grant in the amount requested by the Application will allow Triangle to provide more competitive compensation to its non-employee directors. It is also appropriate to provide fair and reasonable compensation for the services and attention the non-employee directors devote to Triangle as Triangle continues to grow. Triangles non-employee directors actively participate in service on committees of the Board, including the Nominating and Corporate Governance, Compensation and Audit committees, and other aspects of corporate governance, as well as make a meaningful contribution to Triangles business.

GENERAL RECOGNITION BY THE COMMISSION AND CONGRESS

The Commission and Congress have recognized the need for certain types of investment companies, including closed-end investment companies, small business investment companies (SBICs), and BDCs, to offer their employees equity-based compensation. The Commission and Congress have also recognized the need for certain types of investment companies, including closed-end investment companies and BDCs, to offer their non-employee directors equity based-compensation.

The Staff has recognized the importance of permitting investment companies to align the interests of management with those of its shareholders through the issuance of equity compensation. In an interpretive release issued by the Division of Investment Management, the Staff considered the question of compensating the directors of an open-end fund with shares of the open-end fund. In this context, Section 22(g) (which Section 23(a) mirrors) generally prohibits an open-end fund from issuing any of its securities: (1) for services; or (2) for property other than cash or securities (including securities of which such registered company is the issuer), except as a dividend or distribution to its security holders or in connection with a reorganization. The Staff reasoned that compensating open-end fund directors with equity would provide them with a tangible stake in the financial performance of the funds. This aligning of interests between directors and the funds stockholders also serves to protect the interests of stockholders. The foregoing analysis is applicable in the context of a BDC that would like to use its equity securities to compensate its directors.

In the present case, Triangle is merely requesting the flexibility to determine the appropriate number of shares of Restricted Stock to be granted to non-employee directors annually, subject in each case to the Annual Grant Cap, in substantially the same manner and subject to substantially similar

31 See Harris & Harris Group, Inc., Release No. IC-29976 (March 3, 2012) (Notice), Release No. IC-30027 (April 25, 2012) (Order).

Page 18 of 41

Table of Contents

restrictions under which it is currently permitted to issue an Annual Grant of $30,000 worth of Restricted Stock measured by the market value on the date of the Annual Grant. The purpose of this request is to give the Board the ability to grant more shares to each non-employee director without having to amend the Plan each time the Company seeks to increase the amount of shares to be granted, which in turn would require the filing of an amended application with the SEC. Under the Amended and Restated Plan, each year, the Committee (which is comprised of a majority of disinterested directors) would consider the appropriate amount of shares of Restricted Stock to grant to each non-employee director under the Annual Grant and would only authorize such grant if the required majority approved it.

The exact number of shares to be granted each year will be determined by the Committee and required majority and will be dependent on a number of factors, including but not limited to, total directors compensation to be paid (including meeting fees), director compensation packages available to other publicly traded companies or other companies in general that Triangle competes with, shares available under the Plan and other market conditions. The value of grants of Restricted Stock to non-employee directors under the Amended and Restated Plan, combined with other compensation such directors receive as permitted by applicable law and regulation,32 is well within the range of reasonable director compensation in consideration of the commitments non-employee directors are expected to undertake and the compensation practices of the Companys competitors.

The ability to issue more shares of Restricted Stock for the Annual Grant would permit Triangle to devote more of its cash resources to additional investments. Perhaps most importantly, however, as a method of compensation which is of most value if Triangles stock continues to increase in value, the increased Restricted Stock awards serve the best interest of stockholders of Triangle by reinforcing the alignment of the interests of the non-employee directors and stockholders of Triangle. Triangle believes that having the ability to award more shares of Restricted Stock under the Annual Grant (subject to the Annual Grant Cap) will provide significant incentives for non-employee directors to remain on the Board and to devote their best efforts to the success of Triangles performance and growth in the future, as they have done in the past. The ability to issue more shares of Restricted Stock under the Annual Grant will also provide a means for Triangles non-employee directors to increase their ownership interest in Triangle, thereby helping to ensure a close identification of their interests with those of Triangle and its stockholders. Finally, the ability to issue more shares of Restricted Stock under the Annual Grant will encourage non-employee directors to commit their talent and resources to Triangle rather than a competitor that may offer a larger equity incentive award. The Amended Order would amend the Prior Order only to permit Triangle to increase the maximum number of shares of Restricted Stock issued for the Annual Grant, subject in each case to the Annual Grant Cap. All other terms and conditions of the Prior Order will continue to apply to Triangle.

Triangle agrees that the Amended Order granting the requested relief will continue to be subject to the following conditions of the Prior Order:

1. The Amended and Restated Plan will be approved by Triangles stockholders in accordance with Section 61(a)(3)(A)(iv) of the 1940 Act.

32 We note that the Staff has previously stated that it would not recommend enforcement action to the Commission under section 23(a) if closed-end funds directly

compensate their directors with fund shares, provided that the directors services are assigned a fixed dollar value prior to the time that the compensation is

payable. See Commission Release No. IC-24083, SEC Interpretation: Matters Concerning Independent Directors of Investment Companies, October 14, 1999. In

the event that Triangle relies on this Staff position, any shares issued in reliance on this Staff position will be subject to the 10% limitation on outstanding Restricted Stock.

Page 19 of 41

Table of Contents

2. Each issuance of Restricted Stock to non-employee directors for the Annual Grant will be approved by the required majority of Triangles directors, as defined in Section 57(o) of the 1940 Act, on the basis that such issuance is in the best interests of Triangle and its stockholders.

3. The amount of voting securities that would result from the exercise of all of Triangles outstanding warrants, options, and rights, together with any Restricted Stock issued pursuant to the Amended and Restated Plan, at the time of issuance shall not exceed 25% of the outstanding voting securities of Triangle, except that if the amount of voting securities that would result from the exercise of all of Triangles outstanding warrants, options, and rights issued to Triangles directors, officers, and employees, together with any Restricted Stock issued pursuant to the Amended and Restated Plan, would exceed 15% of the outstanding voting securities of Triangle, then the total amount of voting securities that would result from the exercise of all outstanding warrants, options, and rights, together with any Restricted Stock issued pursuant to the Amended and Restated Plan, at the time of issuance shall not exceed 20% of the outstanding voting securities of Triangle.

4. The maximum amount of Restricted Stock that may be issued under the Amended and Restated Plan will be 10% of the outstanding shares of common stock of Triangle on the effective date of the Plan plus 10% of the number of shares of Triangles common stock issued or delivered by Triangle (other than pursuant to compensation plans) during the term of the Amended and Restated Plan.

5. Both the full Board and the Committee will review periodically the potential impact that the issuance of Restricted Stock under the Amended and Restated Plan could have on Triangles earnings and net asset value per share, such review to take place prior to any decisions to grant Restricted Stock under the Amended and Restated Plan, but in no event less frequently than annually. Adequate procedures and records will be maintained to permit such review. The Board will be authorized to take appropriate steps to ensure that the grant of Restricted Stock under the Amended and Restated Plan would not have an effect contrary to the interests of Triangles stockholders. This authority will include the authority to prevent or limit the granting of additional Restricted Stock under the Amended and Restated Plan. All records maintained pursuant to this condition will be subject to examination by the Commission and its Staff.

Please address all communications concerning this Application and the Notice and Order to:

Triangle Capital Corporation

3700 Glenwood Avenue, Suite 530

Raleigh, North Carolina 27612

Attention: Garland S. Tucker, III and Steven C. Lilly

Telephone: (919) 719-4770; Facsimile: (919) 719-4777

Please address any questions, and a copy of any communications, concerning this Application, the Notice and Order to:

Helen W. Brown, Esq.

Bass, Berry & Sims PLC

100 Peabody Place, Suite 900

Memphis, Tennessee 38103

Telephone: (901) 543-5918; Facsimile: (888) 789-4123

Page 20 of 41

Table of Contents

The verification required by Rule 0-2(d) under the 1940 Act is attached as Exhibit B. The filing of this Application has been specifically authorized by a resolution of the Board of Directors of Triangle dated August 1, 2012. A copy of this resolution, which remains in full force and effect, is attached to this Application as Exhibit C.

The following documents are annexed to this Application as Exhibits and are incorporated by reference.

| Exhibit A |

Triangle Capital Corporations Amended and Restated 2007 Equity Incentive Plan, as amended and restated |

|

| Exhibit B |

Verification Required by Rule 0-2(d) of the 1940 Act |

|

| Exhibit C |

August 1, 2012 Resolutions Authorizing Application |

|

Page 21 of 41

Table of Contents

Triangle has caused this Application to be duly signed on its behalf on the 30th day of November, 2012.

| TRIANGLE CAPITAL CORPORATION |

||||

| By: |

/s/ Garland S. Tucker, III |

|||

| Name |

Garland S. Tucker, III |

|||

| Title |

Chairman of the Board, Chief Executive Officer and President |

|||

Page 22 of 41

Table of Contents

EXHIBIT A

Amended and Restated 2007 Equity Incentive Plan, as amended and restated

(see attached)

Page 23 of 41

Table of Contents

TRIANGLE CAPITAL CORPORATION

AMENDED AND RESTATED

2007 EQUITY INCENTIVE PLAN, AS AMENDED AND RESTATED

Page 24 of 41

Table of Contents

TABLE OF CONTENTS

| Tab | ||||

| Section 1. |

Purposes. |

1 |

||

| Section 2. |

Definitions. |

1 |

||

| Section 3. |

Administration. |

4 |

||

| Section 4. |

Shares Available For Awards. |

5 |

||

| Section 5. |

Eligibility. |

6 |

||

| Section 6. |

Stock Options. |

6 |

||

| Section 7. |

Restricted Shares. |

8 |

||

| Section 8. |

Performance Awards. |

9 |

||

| Section 9. |

Non-Employee Director Awards. |

9 |

||

| Section 10. |

Provisions Applicable To Covered Officers And Performance Awards. |

10 |

||

| Section 11. |

Termination Of Employment. |

10 |

||

| Section 12. |

Change In Control. |

11 |

||

| Section 13. |

Amendment And Termination. |

11 |

||

| Section 14. |

General Provisions. |

11 |

||

| Section 15. |

Term Of The Plan. |

14 |

Page 25 of 41

Table of Contents

TRIANGLE CAPITAL CORPORATION

AMENDED AND RESTATED

2007 EQUITY INCENTIVE PLAN, AS AMENDED AND RESTATED

| Section 1. |

Purposes. |

1.1. Generally. This plan shall be known as the Triangle Capital Corporation Amended and Restated 2007 Equity Incentive Plan (the Plan). The purpose of the Plan is to promote the interests of Triangle Capital Corporation, a Maryland corporation (the Company), its Affiliates (as defined herein) and its stockholders by (i) attracting and retaining key officers, employees, and directors of, the Company and its Affiliates; (ii) motivating such individuals by means of individual performance-related incentives to achieve long-range performance goals; (iii) encouraging ownership of stock in the Company by such individuals; and (iv) linking their compensation to the long-term interests of the Company and its stockholders. With respect to any awards granted under the Plan that are intended to comply with the requirements of performance-based compensation under Section 162(m) of the Code, the Plan shall be interpreted in a manner consistent with such requirements.

1.2. Amendment and Restatement. This Plan amends and restates the Triangle Capital Corporation 2007 Equity Incentive Plan, as Amended and Restated and further amended and adopted on May 2, 2012 (the Prior Plan) in its entirety. All Awards (as defined below) granted subsequent to the date of this Plans adoption by the Companys stockholders shall be subject to the terms of this Plan.

| Section 2. |

Definitions. |

As used in the Plan, the following terms shall have the meanings set forth below:

(a) 1940 Act means the Investment Company Act of 1940, as amended.

(b) Affiliate shall mean any wholly-owned consolidated subsidiary of the Company.

(c) Award shall mean any Option or Restricted Share Award granted under the Plan, whether singly, in combination or in tandem, to a Participant by the Board pursuant to such terms, conditions, restrictions and/or limitations, if any, as the Board may establish or which are required by applicable legal requirements.

(d) Award Agreement shall mean any written agreement, contract or other instrument or document evidencing any Award, which may, but need not, be executed or acknowledged by a Participant.

(e) Board shall mean the Board of Directors of the Company.

(f) Cause shall mean, unless otherwise defined in the applicable Award Agreement, (i) the engaging by the Participant in willful misconduct that is injurious to the Company or its Affiliates, or (ii) the embezzlement or misappropriation of funds or property of the Company or its Affiliates by the Participant. For purposes of this paragraph, no act, or failure to act, on the Participants part shall be considered willful unless done, or omitted to be done, by the Participant not in good faith and without reasonable belief that the Participants action or omission was in the best interest of the Company. Any determination of Cause for purposes of the Plan or any Award shall be made by the Board in its sole discretion. Any such determination shall be final and binding on a Participant.

Page 26 of 41

Table of Contents

(g) Change in Control shall mean, unless otherwise defined in the applicable Award Agreement, any of the following events:

(i) any person or entity, including a group as defined in Section 13(d)(3) of the Exchange Act, other than the Company or an Affiliate thereof or any employee benefit plan of the Company or any of its Affiliates, becomes the beneficial owner of the Companys securities having 35% or more of the combined voting power of the then outstanding securities of the Company that may be cast for the election of directors of the Company (other than as a result of an issuance of securities initiated by the Company in the ordinary course of business);

(ii) as the result of, or in connection with, any cash tender or exchange offer, merger or other business combination or contested election, or any combination of the foregoing transactions, less than a majority of the combined voting power of the then outstanding securities of the Company or any successor company or entity entitled to vote generally in the election of the directors of the Company or such other corporation or entity after such transaction are held in the aggregate by the holders of the Companys securities entitled to vote generally in the election of directors of the Company immediately prior to such transaction;