40-33: Copies of all stockholder derivative actions filed with a court against an investment company or an affiliate thereof pursuant to Section 33 of the Investment Company Act of 1940

Published on April 20, 2018

|

Eversheds Sutherland (US) LLP 700 Sixth

Street, NW, Suite 700

D: +1 202.383.0176

stevenboehm@ eversheds-sutherland.com |

April 20, 2018

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Form 40-33 Civil Action Documents Filed Against Triangle Capital Corporation et al. (File No. 814-00733) |

Ladies and Gentlemen:

On behalf of Triangle Capital Corporation (the Company), and pursuant to Section 33 of the Investment Company Act of 1940, as amended (the 1940 Act), enclosed for filing please find a copy of the First Consolidated Amended Complaint, which relates to the matter captioned In Re Triangle Capital Corp. Securities Litigation (the Amended Complaint), as filed on April 10, 2018 in the United States District Court for the Eastern District of North Carolina, Western Division, against the Company and certain officers and directors of the Company. The Company and the officers and directors named as defendants in the Amended Complaint intend to respond to the Amended Complaint by May 25, 2018.

Note that the Amended Complaint amends and consolidates two prior complaints previously filed by the Company on December 29, 2017 pursuant to Section 33 of the 1940 Act:

| | the class action complaint filed by Elias Dagher, Individually and on Behalf of All Others Similarly Situated, Plaintiff, vs. Triangle Capital Corporation, E. Ashton Poole, Steven C. Lilly and Garland S. Tucker, III, Defendants in the United States District Court for the Southern District of New York, involving the Company and certain officers and directors of the Company; and |

| | the class action complaint filed by Gary W. Holden, Individually and on Behalf of All Others Similarly Situated, Plaintiff, vs. Triangle Capital Corporation, E. Ashton Poole, Steven C. Lilly and Garland S. Tucker, III, Defendants in the United States District Court for the Southern District of New York, involving the Company and certain officers and directors of the Company. |

|

U.S. Securities and Exchange Commission Division of Investment Management April 20, 2018 Page 2 |

If you have any questions regarding this submission, please do not hesitate to call Harry Pangas at (202) 383-0805 or me at (202) 383-0176.

| Sincerely, |

| /s/ Steven B. Boehm |

| Steven B. Boehm |

| cc: | E. Ashton Poole, Triangle Capital Corporation | |

| Steven C. Lilly, Triangle Capital Corporation | ||

| Garland S. Tucker, III, Triangle Capital Corporation | ||

| Harry Pangas, Eversheds Sutherland (US) LLP |

IN THE UNITED STATES DISTRICT COURT

FOR THE EASTERN DISTRICT OF NORTH CAROLINA

WESTERN DIVISION

| IN RE TRIANGLE CAPITAL CORP. | ||

| SECURITIES LITIGATION | FIRST CONSOLIDATED AMENDED COMPLAINT | |

| This Document Relates to: | Master File No. 5:18-CV-10-FL | |

| ALL ACTIONS | ||

FIRST CONSOLIDATED AMENDED COMPLAINT

Court-appointed Lead Plaintiff LifeWise Family Financial Security Inc., (LifeWise) individually and on behalf of all others similarly situated, by its undersigned attorneys, alleges the following upon personal knowledge as to itself and its own acts, and upon information and belief as to all other matters based on, inter alia, the investigation conducted by and through its attorneys, which included, among other things, a review of the defendants public documents, announcements made by defendants, U.S. Securities and Exchange Commission (SEC) filings, wire and press releases published by and regarding Triangle Capital Corporation (Triangle or the Company), and information readily available on the internet. Plaintiff believes that additional, substantial evidentiary support will exist for these allegations after a reasonable opportunity for discovery.

NATURE OF THE ACTION

1. This is a federal securities class action on behalf of all persons or entities who purchased or otherwise acquired Triangle securities between May 7, 2014 and November 1, 2017, inclusive (the Class Period), seeking to recover damages caused by Defendants (defined below) violations of the federal securities laws and to pursue remedies under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 (the Exchange Act) and Rule 10b-5 promulgated thereunder, against the Company and certain of its top officers.

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 1 of 56

2. Triangle is a specialty finance company that provides customized financing to lower middle market companies located primarily in the United States. The Company focuses on lending to private companies with annual revenues between $10.0 million and $250.0 million. The Company is regulated as a business development company, or BDC, under the Investment Company Act of 1940.

3. During the Class Period, as a loan provider to small-to-mid-size businesses, Triangle primarily provided mezzanine financing. The quality and robustness of Triangles underwriting and valuation policies, practices and procedures were imperative to investors when evaluating the Company because there is little publicly available information about the businesses in which Triangle invests. Thus, investors relied on Triangles ability to appropriately value and price the risks associated in investing in these companies and to identify profitable investment opportunities and avoid writing-down assets or placing loans on non-accrual.

4. However, during 2014 and 2015, there was a shift in the BDC market away from mezzanine financing and towards unitranche financing, which became the preferred avenue for sponsors and borrowers. As a result, the market for mezzanine financiers, such as Triangle, was diluted of the highest quality investment opportunities. Rather than adjust its strategy or disclose to the market the increased risk exposure from chasing high yield financing to riskier borrowers, Defendants continuously represented that its investments were of an extremely high quality and that its underwriting and risk assessment practices were airtight.

2

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 2 of 56

5. When the Companys risky bets in 2014 and 2015 started to turn and infect the Companys bottom line, the Companys senior management needed time to secure the Companys and their future as the storm approached. As is explained in greater detail below, rather than reveal to the market the significant issues with the loan portfolio originated in 2014 and 2015 (often referred to as the 2014 and 2015 vintage) arising from Triangles chasing high yields while sacrificing the investments quality (which, at times during the Class Period, was counter to the internal recommendations of the Companys investment officers), Defendants instead misleadingly quelled the markets concerns and were able to secure the financing necessary to weather the storm.

6. Throughout the Class Period, Defendants made materially false and misleading statements and failed to disclose material adverse information regarding the Companys business, the productivity and strength of its portfolio and its internal controls. Specifically, Defendants made false and/or misleading statements and/or failed to disclose that: (i) Triangles investment professionals internally recommended moving away from mezzanine loan deals due to changes in the market occurring as early as 2013, which no longer made those investments attractive risk-reward opportunities; (ii) the Companys former CEO, Defendant Garland S. Tucker, III (Tucker), ignoring the advice of Triangles investment professionals, caused the Company to continue to disproportionately invest in mezzanine debt to chase higher short-term yields, despite the increasingly poor quality of the loans and increasing risk of default and non-accruals, and had sole authority to approve or reject investment opportunities on behalf of Triangle; (iii) the Companys vintage of 2014 and 2015 investments was at substantial risk of non-accrual due to the poorer investment quality and deficient underwriting practices in place when the investments were made; (iv) Triangle failed to implement effective underwriting policies and practices to ensure that it received appropriate risk-adjusted returns on its investments; and (v) as a result of the foregoing, Triangle shares traded at artificially inflated prices during the Class Period and class members suffered significant losses and damages.

3

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 3 of 56

7. On November 1, 2017, Triangle came clean in issuing a press release announcing its financial results for the quarter ended September 30, 2017. The release revealed that the fair value of the Companys investment portfolio had declined to $1.09 billion, a decline of nearly 7% from the previous quarter. In addition, Triangle revealed that it had suffered $8.9 million in net realized losses and $65.8 million in net unrealized depreciation to its portfolio during the quarter. The Company also disclosed that it had only earned $0.36 per share in net investment income and that it was slashing its quarterly dividend, which had been critical to the Companys market value, by 33% to $0.30 per share.

8. Most shockingly, Triangle revealed that it had placed seven new investments on non-accrual status during the quarter, effectively acknowledging that those assets were unlikely to generate future returns, and that the amount of investments on non-accrual had ballooned to 13.4% and 4.7% of the Companys total portfolio at cost and at fair value, respectively. Approximately, 20% of Triangles investment portfolio from 2014 and 2015 would be written off as non-accruals.

9. On this revelation, Triangles share price fell $2.57, or 20.98%, to close at $9.68 on November 2, 2017, severely damaging the unsuspecting class members.

10. During the course of the Class Period, Triangle suffered a market capitalization loss of approximately $262 million, in substantial part as a consequence of Defendants continuing to mislead the market about the state of Triangles business and the quality of its investment pipeline.

4

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 4 of 56

JURISDICTION AND VENUE

11. The claims asserted herein arise under and pursuant to §§10(b) and 20(a) of the Exchange Act (15 U.S.C. §§78j(b) and 78t(a)) and Rule 10b-5 promulgated thereunder by the SEC (17 C.F.R. §240.10b-5).

12. This Court has jurisdiction over the subject matter of this action pursuant to 28 U.S.C. §1331 and Section 27 of the Exchange Act.

13. Venue is proper in this Judicial District pursuant to §27 of the Exchange Act (15 U.S.C. §78aa) and 28 U.S.C. §1391(b), as many of the acts charged herein, including the dissemination of materially false and misleading information, occurred in substantial part in this Judicial District as Triangle is headquartered in this District.

14. In connection with acts, conduct and other wrongs alleged in this Complaint, Defendants, directly or indirectly, used the means and instrumentalities of interstate commerce including, but not limited to, the United States mails, interstate telephone communications and the facilities of a national securities exchange.

PARTIES

15. Plaintiff LifeWise is a financing and investment company, which is incorporated in Utah and headquartered in Salt Lake City. LifeWise purchased Triangle common stock during the Class Period at artificially inflated prices as set forth in the certification on file with the Court. See ECF No. 35.3.

16. Defendant Triangle is a business development company, headquartered in the State of North Carolina with principal executive offices located at 3700 Glenwood Avenue, Suite 530, Raleigh, NC 27612. Triangles common stock trades on the New York Stock Exchange under the ticker symbol TCAP.

5

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 5 of 56

17. Defendant E. Ashton Poole (Poole) is the Companys President, Chief Executive Officer (CEO) and the Chairman of the Board of Directors (the Board). Poole assumed the role of CEO in February 2016, prior to which he was the Chief Operating Officer (COO) of Triangle.

18. Defendant Steven C. Lilly (Lilly) is the Chief Financial Officer (CFO), Secretary and a director of Triangle. He is also a co-founder of the Company.

19. Defendant Tucker is a director and co-founder of Triangle. He was the Chairman of the Board until May 2017 and CEO until February 2016.

20. The defendants referenced above in 17-19 are collectively referred to herein as the Individual Defendants. The Individual Defendants made, or caused to be made, false and misleading statements that artificially inflated the price of Triangle securities during the Class Period.

21. As a result of their positions within the Company, the Individual Defendants possessed the power and authority to control the contents of Triangles quarterly reports; press releases; and presentations to securities analysts, money and portfolio managers, and institutional investors i.e. the market. The Individual Defendants were provided with copies of the Companys reports and press releases alleged herein to be misleading prior to or shortly after their issuance and had the ability, authority and opportunity to prevent their issuance or cause them to be promptly corrected. Given their positions within the Company and their access to material non-public information, the Individual Defendants knew that the adverse facts specified herein were not properly disclosed to and were being concealed from the investing public. The Individuals Defendants are liable for the false and misleading statements pleaded herein.

6

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 6 of 56

SUBSTANTIVE ALLEGATIONS

Mezzanine Financing and the Lower Middle Market

22. At the beginning of the Class Period, Triangle was heavily involved with mezzanine financing, which is a hybrid of debt and equity financing that provides the lender with the ability to convert to an ownership or equity interest in the borrowing company in the case of default, after venture capital companies and other senior lenders are paid.

23. Historically, to attract mezzanine financing, a company would typically have to demonstrate a track record in the industry with an established reputation and product, a history of profitability and a viable expansion plan for the business including through potential expansions, mergers or acquisitions or an initial public offering. According to Investopedia, mezzanine financing typically carries an interest rate ranging from 12% to 20%, and usually replaces part of the capital that equity investors would otherwise provide to a company. For example, if a private equity firm is purchasing a $200 million business and has obtained financing of $150 million from senior lenders, there is $50 million unaccounted for. If the private equity company secures mezzanine financing for $20 million and puts in $30 million of its own funds into the buyout, the purchasing company has leveraged its return while contributing less of its own capital.1

24. Borrowers use mezzanine debt because the interest is tax-deductible and because it is more manageable than other debt structures. For instance, if a borrower cannot make a scheduled interest payment, some or all of the interest may be deferred. This option is typically unavailable for other types of debt. However, when securing mezzanine financing, business owners sacrifice control and upside potential due to loss of equity.

| 1 | See https://www.investopedia.com/terms/m/mezzaninefinancing.asp (Last visited: April 10, 2018). |

7

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 7 of 56

25. In its 2014 Form 10-K filed with the SEC filed on March 2, 2015, Triangle provided an overview of its business, including its mezzanine financing. Triangle represented that it invested primarily in subordinated notes, which are junior to secured debt. As explained therein, Triangles subordinated debt was generally secured by a second priority security interest in the assets of the borrower and generally included an equity component, such as warrant to purchase common stock in the portfolio company. Further, Triangle explained that certain loan investments may have a form of interest that is not paid currently but is accrued and added to the loan balance and paid at the end of the term, referred to as payment-in-kind, or PIK, interest. PIK is contractually deferred interest added to the principal that generally becomes due at the end of the loan term. Through use of PIK interest provisions, a lender can recognize PIK interest income even though such income may have never been actually paid and, thus, obscure potential issues on its balance sheet until the end of the loan. When a borrower cannot pay normal interest terms, PIK provisions can be used in refinanced debt to nominally increase loan income while concurrently rendering that income more speculative as payment is deferred until the end of the loan term.

26. By approximately 2014, the mezzanine financing market began to experience some erosion due, in part, to the emergence of unitranche lenders. Unitranche lending is a strategy of combining senior and subordinated debt into one package with a blended rate. The emergence of unitranche financing put additional pressure on mezzanine financing because unlike mezzanine, lenders could present unitranche deals to borrowers at a single, blended interest rate while eliminating the inter-creditor agreements that cause difficulties in bringing deals to close. Further, offering more certainty for the borrower and less costly than mezzanine financing, unitranche yields have fallen between cheaper senior loans and junior mezzanine debt in the 9% to 11% range.2

| 2 | Clouse, Carol J., Navigating the Middle Market: Monroe Capital Gets the Unitranche Bump, http://www.abfjournal.com/articles/navigating-the-middle-market-monroe-capital-gets-the-unitranche-bump/ (Published: October 2014), (Last visited: April 10, 2018). |

8

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 8 of 56

27. Mezzanine financing was also faced with further pressure from private equity shops moving into the smaller markets, such as the lower middle market where Triangle primarily focused. Indeed, Joe Burkhart of Saratoga Investment Corp. aptly explained that, during 2014 and 2015, [t]he pressure PE sponsors have to deploy their capital in a low volume market was causing them to write larger equity checks which closes the gap between the senior debt and the equity where traditional mezzanine usually exists.3

28. With dual pressure on mezzanine financing, particularly in the lower middle market, previously readily available quality opportunities for mezzanine financing began to dry up. As Defendant Poole acknowledged in the November 2, 2017 earnings call at the close of the Class Period: [d]uring the period from early 2013 through the end of 2015, as large amounts of capital poured into the direct lending space, investment structures and pricing in the lower middle market and broader middle market changed rapidly. Defendant Poole further admitted in November 2017 that: Our investment professionals were aware of these changes and recommended to our former CEO to begin moving away from mezzanine structures and into lower-yielding but more secure second lien unitranche and senior structures. Their reasoning was simple. Companies in our target market were gaining access to additional forms of capital on terms more favorable than what they could have achieved in the past. And as a result, the traditional risk-reward equation from mezzanine debt did not appear as attractive as it previously had. Defendant Poole would further characterize the shift in the lower middle market as massive.

| 3 | See Fink, Billy; Two Trends Shaping the Future of Mezzanine, https://www.axial.net/forum/two-major-threats-mezzanine-financing/ (Published: February 18, 2014) (Last Visited: April 10, 2018). |

9

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 9 of 56

29. However, as is explained below, during the Class Period, Triangle continued to chase high-end yields with lesser quality opportunities, rather than adapt to a massive market change. Triangle and Defendants executed this strategy despite the advice of its own internal investment professionals. Throughout the Class Period, Defendants misled the market regarding the strengths of the Companys underwriting and risk assessment controls and quality of its 2014 and 2015 investments. Then, as the Company realized the issues with the 2014 and 2015 vintage, Defendants concealed the material issues from the market, preserving Triangles stock price at an artificially high level.

30. Triangles 2014 investment vintage included investments and/or loans to the following companies: Café Enterprises Inc. (Subordinated Note 12% cash, 2% PIK, 10,000 shares of Series C Preferred Stock); DialogDirect, Inc. (Subordinated Note 12% cash, 3% PIK); DPII Holdings, LLC (Senior Note 12% Cash, 4% PIK, Class A Member Interest 17,308 units); Frank Entertainment Group, LLC (Senior Note 10% Cash, 5.8% PIK, Class A Redeemable Preferred Units (10.5% Cash), Class B Redeemable Preferred Units (189,744 Units), Class A Common Units and Warrants); and GST AutoLeather Inc. (Subordinated Note 11% Cash, 2% PIK). At the close of the Class Period, these investments would be placed on non-accrual.

31. The Companys 2015 vintage included loans and/or investments in the following businesses: Community Intervention Services, Inc. (Subordinated Note 10% Cash, 3% PIK); FrontStream Holdings, LLC (Subordinated Note 13% Cash, Series C-2 Preferred Shares (500 shares)); Media Storm, LLC (Subordinated Note 10% Cash, Membership Unites (1,216,204 units)); and Womens Marketing, Inc. (Subordinated Note 11% Cash, 1.5% PIK, Class A Common Units (16,300 units)). At the close of the Class Period, these investments would be placed on non-accrual.

10

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 10 of 56

MATERIALLY FALSE AND MISLEADING STATEMENTS ISSUED DURING THE CLASS PERIOD

Triangle Invests Heavily in Mezzanine Financing Over its Investment Advisors Advice

32. On May 7, 2014, the first day of the Class Period, Triangle issued a press release announcing its financial results for the quarter ended March 31, 2014. According to the release, the fair value of the Companys investment portfolio was $690 million, with $438.6 million in total net assets. Triangle also represented that it had made $77.5 million in new investments during the quarter. On the same day, the Company filed its Form 10-Q with the SEC detailing the Companys financial results.

33. In the release, Defendant Tucker, then-CEO, was quoted as stating: The first quarter represented the beginning of the more active year we are expecting 2014 to be, with new portfolio investments totaling more than $77 million . Our activity during the quarter supports our optimism for the year, as we believe the lower middle market is poised to provide attractive investment opportunities during the balance of 2014. (emphasis added).

34. On the following day, May 8, 2014, the Company held an earnings call with analysts and investors to discuss the financial results. During the call, Defendants stressed the purportedly quality of the Companys investments during the quarter, while quelling any potential concerns in speaking about the robustness of Triangles underwriting and risk assessment policies and procedures. For example, Defendant Poole, then-COO, stated that Triangle was focusing on quality over quantity in terms of [its] investment pace per quarter. Further, Defendant Poole emphasized the Companys selectivity in stating that Triangle was being discriminate in how [it is] reviewing opportunities and choosing to invest and passing

11

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 11 of 56

on B deals so it could focus on the A deals. He also explained [f]rom a more macro standpoint as we analyzed the lower middle market, we see certain trends that we believe are interesting in which we think will prove to be positive for our business. Mr. Poole continued, in pertinent part:

So I think we are thinking about it as a great way to continue to prudently invest the liquidity that we have - had over the last year and the firepower that weve reserved for more fruitful investing environment, which we believe is clearly unfolding or has unfolded as weve seen in Q1 and hopefully well continue to do so in Q2, Q3, and Q4.

(emphasis added.).

35. Defendant Lilly also spoke on the conference call and described the Companys investment philosophy as follows: [T]he primary keys to a successful long-term track record in the BDC industry are to maintain ones credit focus, remain conservative and consistently apply an underwriting formula that produces solid results. (emphasis added.)

36. Defendants statements made on May 7 and May 8, 2014 were false and misleading because Defendants were not emphasizing quality over quantity in Triangles approach, prudently investing Triangles liquidity, or passing on the B deals while focusing on the A deals. Similarly, statements concerning the underwriting process and risk assessment controls were materially false and misleading. As subsequently revealed, Defendants were chasing higher yields through mezzanine financing rather than prioritizing investment quality and its volume and lack of selectivity were later revealed to have been contributors to the credit issues with the Companys 2014 and 2015 investments. Further, the market was materially misled regarding the quality of Triangles underwriting and risk control practices because Defendant Tucker had sole authority to veto or approve an investment opportunity and the processes were significantly lacking appropriate checks and balances by Defendants own belated admission.

12

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 12 of 56

37. Defendants statement that the market was a fruitful investing environment rife with attractive investment opportunities for Triangle was materially false and misleading because Defendants would subsequently disclose that they knew there was a massive shift in the lower middle market away from mezzanine financing, along with increased competition from unitranche lenders and private equity firms, which would limit the availability of high-quality investment options for Triangle. In fact, at some point between early 2013 and the beginning of 2016, Triangles investment advisors instructed senior management to move away from mezzanine financing because of the lack of quality opportunities, but were disregarded by the Companys management.

38. On August 6, 2014, Triangle issued a press release to announce its financial results for the quarter ended June 30, 2014. In the release, the Company represented that the fair value of its investment portfolio was $736.3 million, with $445.8 million in total net assets. In addition, Triangle reported $87.3 million in new investments during the quarter. In the release, Defendant Tucker was quoted as stating: The second quarter of 2014 was robust on all fronts. We made $87.3 million of investments . Again, it is an exciting time for Triangle and it gives me great pleasure to be able to share such good news with our investors. On that same day, Triangle filed its Form 10-Q with the SEC. Therein, the Company detailed its financial results.

13

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 13 of 56

39. On the following day, August 7, 2014, Triangle held an earnings call with analysts and investors to discuss its financial results. During the call, Defendants emphasized the quality of the Companys quarterly investments and reiterated the robustness of its underwriting and risk assessment policies and procedures. For example, on the call, Defendant Lilly stated:

During 2014, as the market has naturally shifted back to a healthy amount of M&A activity, we have found that our patience has been rewarded and we have taken advantage of what we perceive to be high-quality investment opportunities at attractive price points. As a result, as we enter the second half of the year, we are becoming increasingly convinced that 2014 could end up being one of TCAPs most active years in terms of new investments.

(emphasis added.).

40. With respect to the statements made on August 7, 2014, Defendants materially misled the market because the Company was not rife with high-quality investment opportunities at attractive price points. Instead, as Defendants subsequently revealed, there was a massive shift in the lower-middle market, where highest quality opportunities were foregoing mezzanine financing and seeking unitranche financing on more attractive terms. Defendants also did not disclose the shortcomings in the Companys internal controls for underwriting and risk assessment, including that Defendant Tucker had sole veto authority or that there were inadequate checks and balances in the review and approval process. Moreover, at some point between early 2013 and the beginning of 2016, the Individual Defendants ignored the advice of Triangles investment professionals to move away from mezzanine financing based on the market conditions.

41. On November 5, 2014, Triangle issued a press release announcing its financial results for the quarter ended September 30, 2014. In the release, Triangle represented that the fair value of its investment portfolio was $841.6 million at quarter end, with $547.4 million in total net assets. Additionally, Triangle reported $180.8 million in new investments during the quarter. According to the release, Defendant Tucker was quoted as stating: The third quarter of 2014 was extremely active for Triangle. We originated a record $181 million of new investments . . . On the same day, the Company filed its Form 10-Q with the SEC detailing the Companys financial results.

14

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 14 of 56

42. On the following day, November 6, 2014, Triangle hosted an earnings call with analysts and investors to discuss the financial results. During the call, Defendants boasted about the purported quality of the Companys quarterly investments and re-emphasized the robustness of Triangles underwriting and risk assessment policies and procedures. For example, Defendant Tucker stated the following: [W]e are pleased that the origination portion of our business is operating so well. Our investment pipeline has been robust all year and [we] remain very pleased with the quality of the new investments weve made. Defendant Poole provided additional color on the purported quality of Triangles new investments, stating in pertinent part, as follows:

I think obviously the question is always what is the quality of that flow and which investments do we feel are the right ones to pursue on behalf of our shareholders. And I can assure you that we spend quite a bit of time on that question.

And so when we think about pipeline and when you guys think about pipeline, I think it really has to be measured in two ways, one is just externally how much or what is the amount of flow of opportunities coming in the door and then the subset of that flow that we choose to pursue. And on both accounts that I can safely say that our pipeline is healthy.

(emphasis added.).

43. The statements made on November 6, 2014, were false and misleading because its origination business was not operating so well. Instead, Defendants continued to pursue unduly risky higher yields via mezzanine financing while the higher quality and healthier opportunities were shifting to unitranche financing. Further, Defendants did not acknowledge the flaws in its origination business including in underwriting and risk assessment, which were subject to sole approval or veto by Defendant Tucker. In failing to acknowledge the decline of its underwriting and risk assessment practices, Defendants misled the market regarding the state of Triangles investment portfolio and its business.

15

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 15 of 56

44. In a March 2, 2015, press release, Triangle announced its financial results for the fourth quarter and full year ended December 31, 2014. Triangle represented that the fair value of its investment portfolio was $887.2 million at year-end, with $530.8 million in total net assets. Additionally, the Company had only 5.8% and 3.0% in non-accrual assets as a percentage of the Companys total portfolio at cost and at fair value, respectively. Triangle also made $129 million in new investments during the fourth quarter.

45. In the press release, Defendant Tucker was quoted as stating: The fourth quarter represented a strong end to the year for Triangle Capital. We remained active in the investing market [and] we generated a record amount of investment income . . . . As we move into 2015 we are pleased with the quality of our investment portfolio, the strength of our balance sheet, and the opportunities we see across the lower middle market.

16

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 16 of 56

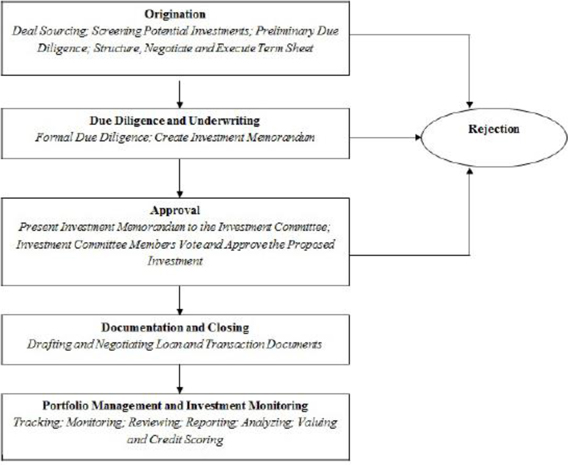

46. On that same day, Triangle filed its Form 10-K with the SEC. Therein, the Defendants represented their belief that the financing market for lower middle market companies was underserved, providing [the Company] with greater investment opportunities. Further, Defendants also emphasized that senior management implemented rigorous underwriting policies that are followed in each transaction. Therein, the Company also included the following flow chart, which outlined its Investment Process:

47. With specific respect to underwriting and approval, Defendants represented that: [t]he underwriting team for the proposed investment presents the Investment Memorandum to our investment committee for consideration and approval. After reviewing the Investment Memorandum, members of the investment committee may request additional due diligence or modify the proposed financing structure or terms of the proposed investment. Before we proceed with any investment, the investment committee must approve the proposed investment by the affirmative vote from a majority of the investment committee members.

48. Additionally, on March 2, 2015, Triangle hosted an earnings call with analysts and investors to discuss its financial results. On that call, Defendants exalted the quality of the Companys investments and reiterated the robustness of Triangles underwriting and risk assessment policies and procedures. For example, Defendant Tucker stated: As we begin 2015,

17

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 17 of 56

we are reminded that the most successful BDCs are those that continually exercise corporate discipline in areas such as investment prudence and those that resisted certain temptations, such as growing their investment portfolios in an rational [SIC irrational implied by context] way.

49. In support, Defendant Poole emphasized that Triangle was selective in its investments and focused on quality over quantity in securing sound investments, stating in pertinent part, as follows:

In the lower-middle market, we are finding that financial sponsors are entering 2015 with a very optimistic view. For the first time in a number of years, there are significant inventory available in terms of both first time sellers of private companies, coupled with a healthy backlog of sponsor to sponsor trades, which in recent years have become a meaningful component of the market.

Balancing against this robust level of inventory is our internal view that not every company meets our underwriting standards. And so while our deal teams are very busy analyzing a healthy number of opportunities. You can expect that we will continue to remain focused on quality versus quantity in terms of new investment activity.

50. The statements made on March 2, 2015 were both false and misleading because they did not accurately reflect that the opportunities [management was] seeing across the lower level market were less desirable. Further, Defendants were not exercising corporate discipline in areas such as investment prudence, despite their impressive looking flow chart, nor were they resisting certain temptations, such as growing their investment portfolios in an [ir]rational way. In fact, Defendants were investing in subpar opportunities because the most attractive investment opportunities in the lower middle market were shifting towards unitranche financing beginning in early 2013. Defendants knew that their focus had not remained on quality versus quantity in terms of new investment activity, as they were chasing higher yields in volume, rather than investment quality on Triangles behalf. Defendants also materially misled the market regarding

18

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 18 of 56

the underwriting process and approval because Defendants would later reveal that the process was inferior and that at the time, Triangle substantially lacked the necessary checks and balances for a fulsome underwriting process and then-CEO Defendant Tucker possessed sole authority to approve or reject an investment opportunity.

51. In a May 6, 2015, press release, Triangle announced its financial results for the quarter ended March 31, 2015. The Company represented that fair value of the Companys investment portfolio was $877.4 million at the end of the quarter, with $519.6 million in total net assets. Further, the press release stated that Triangle had only 6.1% and 2.7% in non-accrual assets as a percentage of the Companys total portfolio at cost and at fair value, respectively. Triangle also represented that it had made $98.2 million in new investments during the quarter. In the press release, Defendant Tucker was quoted as stating: We are pleased that we were able to follow a strong fourth quarter of 2014 with another strong quarter to begin 2015 . . . . We remain confident in both the overall quality of our investment portfolio and the investment opportunities in the lower middle market for the remainder of 2015. On the same day, the Company filed its financial results on Form 10-Q with the SEC.

52. The next day, Triangle hosted an earnings call with analysts and investors to discuss the financial results. During the call, Defendants stressed the purported quality of the Companys quarterly investments along with the strength of Triangles underwriting and risk assessment policies and procedures. For example, Defendant Poole explained during the call that he and management feel very good about Triangles new investments during the quarter. In a similar vein, Defendant Lilly stated: [Q]uality over quantity . . . . thats what we try to focus on and always have and I think that will be the most biggest guide post as we move forward.

19

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 19 of 56

53. The statements made on May 6 and 7, 2015, were false and misleading because the Defendants were not emphasizing quality over quantity while making investments at this time. Instead, Defendants were focused first and foremost on obtaining high yields in volume regardless of whether they were sacrificing quality. Defendants were materially misleading the market about the quality and strength of Triangles underwriting and risk protocols as it continued to seek out higher-risk investments on mezzanine financing terms.

54. In an August 5, 2015, press release, Triangle reported its financial results for the quarter ended June 30, 2015. The Company stated that the fair value of the Companys investment portfolio was $884.9 million at quarter end, with total net assets of $514.8 million. Additionally, Triangle represented that non-accrual assets were merely 3.1% and 1.6% as a percentage of the Companys total portfolio at cost and at fair value, respectively. Triangle also stated that it had made $65.1 million in new investments during the quarter. In the release, Defendant Tucker was quoted as stating: The second quarter was another active quarter for Triangle . . . . Our expanded balance sheet enables Triangle to focus on new portfolio opportunities during the remainder of 2015. On the same day, the Company filed its Form 10-Q with the SEC, which stated the Companys financial results for the quarter.

55. On the next day, Triangle hosted an earnings call with analysts and investors to discuss the financial results. During the call, Defendants touted the purported quality of Triangles quarterly investments and reasserted the robustness of the Companys underwriting and risk assessment policies and procedures. For example, Defendant Tucker stated, We believe a steady unwavering focus on appropriate risk adjusted returns is the best method of producing above average, long term results. Defendant Lilly echoed that I think thematically what you continue to hear from us is were not trying to grow the portfolio purely for growth. Say, were trying to find the best risk adjusted returns we can.

20

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 20 of 56

56. The statements made on August 6, 2015, were materially false and misleading because Defendants were not trying to find the best risk adjusted returns. In fact, Defendants were pursuing higher risk returns by chasing higher yields because, as Defendants would subsequently disclose, the more attractive investment opportunities in the market had shifted to unitranche financing starting in early 2013. Further, the quality of Triangles risk assessment and underwriting practices was materially misrepresented to the market as the system lacked the necessary checks and balances and left Defendant Tucker with sole and absolute veto authority.

57. In a November 4, 2015 press release, Triangle announced its financial results for the quarter ended September 30, 2015. Therein, the Company reported that the fair value of its investment portfolio was $968.1 million with $515.7 million in total assets. Additionally, Triangle represented that it had only 2.0% and 0.7% in non-accrual assets as a percentage of the Companys total portfolio at cost and at fair value, respectively. The Company also stated that it made $189.2 million in new investments during the quarter.

58. Defendant Tucker was quoted in the release as stating: The third quarter was an extremely active quarter for Triangle. The recent volatility in the broader credit markets has accrued to our benefit as we were able to originate a record level of new investments in high quality companies during the quarter. Needless to say, we are pleased that we exercised patience during the first half of the year and maintained sufficient liquidity to take advantage of what we perceive to be an opportune time in the investing market. On the same day, the Company filed its Form 10-Q with the SEC, which stated the Companys financial results for the quarter.

21

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 21 of 56

59. On the next day, November 5, 2015, Triangle hosted an earnings call with analysts and investors to discuss its financial results. During the call, Defendants spoke about the purported quality of the Companys quarterly investments and reiterated the robustness of Triangles underwriting and risk assessment policies and procedures. For example, Defendant Tucker stated: As we move to the end of 2015, and beg[i]n to look forward to 2016, I believe Triangle has successfully navigated this rough [p]atch with the same measure of discipline and focus that our team employed to navigate the successful days in quarters before. Defendant Lilly also spoke on the call about the Companys selectivity in choosing investments that promised the best risk-adjusted returns pursuant to a robust underwriting process, stating in pertinent part, as follows:

In terms of how we felt, how we feel about the current originations, the [de facto] answer is, we feel very good about them, we wouldnt have made the investments to begin with, we look at a lot of opportunities s youve heard Ashton say on these calls before, its not unusual for us to have $2 billion of total flow in a single quarter it will filter in in terms of the total consideration.

So, there is a lot of filter and it goes on, we tend to close somewhere between 3% and 5% of what we look at. We are very much in line with that this quarter and I think, feel really good about those.

(emphasis added.)

60. Defendant Poole also represented that Triangle had expanded its investments into attractive opportunities by focusing on credit discipline, stating in pertinent part as follows:

[W]e are pleased to have been cautious during the first half of the year and that we held onto our liquidity, to be able to put us in a position to achieve in what we believe is a very opportunistic time in the market. . . .

By focusing on our key sponsor relationships, we believe we can better target long-term returns for shareholders by operating within our credit discipline and maintaining our focus.

(emphasis added.)

22

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 22 of 56

61. The statements made on November 4 and 5, 2015, were materially misleading because Triangle was not being cautious or exercising discipline with its investments. To the contrary, and as was subsequently revealed, Defendants were chasing higher yields at this time through mezzanine financing, rather than emphasizing the quality of the investment.

In Announcing the TCAP 2.0 Transition, The Defendants Conceal the Harm to Triangles Portfolio

62. On February 3, 2016, Triangle announced that Defendant Poole would take over as the new CEO of the Company, while Defendant Tucker would continue to serve as the Chairman of the Board. In connection with this announcement, Defendant Tucker stated As I look at the business, I think we are arguably the leading investor (of its type) in the lower middle market. Defendant Poole echoed that Triangle was in no need of a revolution.

63. After the changing of the guard at CEO, Triangle implemented a new operational plan, which it claimed would promote open communication, cross-functional alignment and increased accountability TCAP 2.0. However, at this time, Defendants did not give any indication or disclose that Triangles prior controls were inadequate or that its 2014 and 2015 vintage was in danger of non-accrual or could potentially harm the Company.

64. In terms of the process for originations, under TCAP 2.0, the Company would have an investment committee that required approval from the Chief Operating, Chief Accounting and Chief Compliance Officers while, under the prior regime, sole approval and rejection power resided with then-CEO Defendant Tucker. This new regime belied Defendants prior statements regarding its risk assessment, underwriting policies and investment committee approval process.

23

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 23 of 56

65. With respect to TCAP 2.0, as is revealed in subsequent disclosures, Triangle began to shift its focus away from riskier, higher-yield investments and placed further emphasis on unitranche financing. However, Defendant did not reveal the true extent of the issues with its investment portfolio that arose from its 2014 and 2015 vintage until the close of the Class Period.

66. In a February 24, 2016, press release, Triangle announced its financial results for the fourth quarter and year ended December 31, 2015. Therein, Triangle represented that the Companys investment portfolios fair value was $977.3 million at year end, with $508.4 million in total net assets. Additionally, Triangle announced that its nonaccrual assets were just 2.0% and 0.7% of the Companys total portfolio at cost and at fair value, respectively. Further, Triangle represented that it had made $101.5 million in new investments during the fourth quarter.

67. Defendant Poole was quoted in the release as stating: We are pleased to report a strong finish to 2015 . . . . As we move into 2016, we believe our investing platform is well positioned to continue capitalizing on the attractive opportunities the lower middle market providers.

68. On that same day, Triangle filed its Form 10-K with the SEC concerning the Companys fourth quarter and full year financial results. Therein, Defendants described the Companys Portfolio Management and Investment Monitoring, including identification of several methods of evaluating and monitoring the performance of our portfolio companies. These methods included the following:

| | Monthly and quarterly reviews of actual financial performance versus the corresponding period of the prior year and financial projections; |

| | Monthly and quarterly monitoring of all financial and other covenants; |

| | Reviews of senior lender loan compliance certificates, where applicable; |

24

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 24 of 56

| | Quarterly reviews of operating results and general business performance, including the preparation of a portfolio monitoring report which is distributed to members of our investment committee; |

| | Periodic face-to-face meetings with management teams and financial sponsors of portfolio companies; |

| | Attendance at portfolio company board meetings through board seats or observation rights; and |

| | Application of our investment rating system to each investment. |

In the event that our investment committee determines that an investment is underperforming, or circumstances suggest that the risk associated with a particular investment has significantly increased, we undertake to monitor more closely the affected portfolio company. The level of monitoring of an investment is determined by a number of factors, including, but not limited to, trends in the financial performance of the portfolio company, the investment structure and the type of collateral securing our investment, if any.

69. Further, Defendants also described the Companys Investment Rating System. According to the Form 10-K, the Company monitor[s] a wide variety of key credit statistics that provide information regarding our portfolio companies to help us assess credit quality and portfolio performance. Additionally, Defendants represented that Triangle generally require[s] our portfolio companies to have annual financial audits in addition to monthly and quarterly unaudited financial statements and those financial statements are used to calculate and evaluate certain financing ratios.

70. On the next day, February 26, 2016, Triangle held an earnings call with analysts and investors to discuss its financial results. During the call, Defendants emphasized the purported quality of the Companys investments, along with the robustness of Triangles underwriting and risk assessment policies and procedures. For instance, Defendant Poole explained that: 2015 for Triangle was marked by several notable items. First, we excelled [i]n originating high-quality new investments in the lower-middle market. As 2015 representing our second most active investing year on record with over $450 million in total capital deployed.

25

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 25 of 56

71. The statements made on February 26, 2016 were materially false and misleading because the Company did not excel at originating high-quality new investments in the lower middle market. As the Defendants ultimately revealed, the higher quality investments had shifted to unitranche financing, while Triangle was still focused on mezzanine financing and chasing higher yields at the expense of quality. Further, in the beginning of 2016, at the very latest, Defendants were made aware by their investment advisors that Triangle should de-emphasize mezzanine financing because those investments were adding undue risk to the Companys portfolio. Despite having this knowledge, Defendants continued to insist and misrepresent to the market that the Company had been investing in high-quality opportunities during 2015, even after Defendant Poole took over as CEO and Defendant Tucker was removed. In fact, Defendant Poole would later change his opinion and admit that decisions made in 2014 and 2015 ultimately came back to bite Triangle.

72. In a May 4, 2016, press release, Triangle announced its financial results for the quarter ended March 31, 2016. Therein, the Company stated that the fair value of its investment portfolio was $940 million at quarter end, with $504.3 million in total net assets. Additionally, Triangle represented that non-accrual assets were 3.6% and 0.9% as a percentage of its total portfolio at cost and at fair value, respectively. The Company also revealed that it was cutting its dividend to $0.45 from $0.54 in the first quarter and $0.59 in 2015. According to the release, Triangle made just $11.8 million in new investments during the quarter, which was the lowest of

the Class Period to this point by far. On that same day, Triangle filed its Form 10-Q with the SEC. Therein, Defendants reported on the Companys financial results.

26

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 26 of 56

73. On the next day, Triangle hosted an earnings call with analysts and investors. During the call, Defendants addressed both the adjustment in the dividend and the lack of new investments during the quarter. On the call, Defendant Poole stated that yield compressions impacted our market pricing and the weighted average yield of our investment portfolio, but did not acknowledge that struggles of the 2014 and 2015 vintage of investments. Further, Defendant Poole would state:

The market right now and has been, literally, for the last six, nine months kind of bifurcated between what we would call A deals and then B and C deals. And the higher spreads, that youre talking about that are being realized in todays market arent happening with the A deals, the A companies. They are happening with the B and C companies. And those are companies that exhibit different characteristics, such as cyclicality, lower free cash flow conversion, they may be carve outs, they may be having management changes, they may be having ERP implementation, they may have a whole host of risk profiles that are different than what you see in the A deals.

(emphasis added.)

74. Although Defendants attempted to pin the dividend adjustment on market pricing and resultant declining spread income earned on debt investments, Defendants did not disclose at this time that many of the investments made by the Company in 2014 and 2015 were the B and C deals because of its continued emphasis on mezzanine financing. In fact, Defendant Poole had previously represented to the market that its 2014 and 2015 vintage were A deals. These material misrepresentations and omissions led the market and investors to believe that Triangles portfolio and its 2014 and 2015 vintage were still high quality, when they were anything but.

27

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 27 of 56

75. These material misrepresentations and omissions served as support to the Companys July 2016 equity offering. The offering provided net proceeds of approximately $120 million. Further, Defendants explained that this equity offering was specifically done to provide capital to infuse further investments. This would not be Triangles last effort to raise capital before it revealed the true issues with the 2014 and 2015 vintage.

76. On July 29, 2016, Triangle announced that it closed an underwritten public offering of 6,250,000 shares of common stock. The net proceeds were approximately $119.6 million. According to the press release announcing the closing, the Company intended to use the net proceeds of the public offering to make additional investments in lower middle market companies in accordance with its investment objective and strategies, and for working capital and general corporate purposes.

77. In an August 3, 2016, press release, Triangle announced its financial results for the quarter ended June 30, 2016. Therein, Triangle announced that the fair value of its investment portfolio was $930.8 million at quarter end with $498.3 million in total net assets. Additionally, Triangle announced that its non-accrual assets were 5.6% and 2.2% of the Companys total portfolio at cost and at fair value, respectively. The Company also represented that it had made $63.6 million in new investments during the quarter. On the same day, the Company filed its quarter financial results on Form 10-Q with the SEC. Defendants Poole and Lilly certified that these statements were accurate, not misleading and free from fraud.

78. On the next day, August 4, 2016, the Company hosted an earnings conference call with analysts and investors. During the conference call, Defendant Poole represented that the pipeline that we have is healthy. It represents a good mix of mezzanine and unitranche opportunities.

28

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 28 of 56

79. The statement made on August 4, 2016, was materially misleading and did not accurately reflect the quality of Triangles investment portfolio. At the time, Triangles portfolio was not healthy, as the 2014 and 2015 vintage constituted a material percentage of the Companys portfolio and those investments were lower quality because the markets upper crust was moving towards alternative financing forms like unitranche starting in early 2013. At this time, while Defendants may have been adjusting their strategy to incorporate more conservative, senior financing, Defendants failed to disclose to the market that the failure to adjust earlier, as recommended by the Companys investment professionals, was adversely affecting and would further adversely affect the Company.

80. On October 18, 2016, Triangle announced that Brent P.W. Burgess was resigning from his positions as the Companys Chief Investment Officer (CIO) and a member of the Board. In a period of ten months, Triangle had removed its CEO and CIO during the years 2014 and 2015 and enacted philosophical changes to its investing practices; however, despite these changes, Defendants remained steadfast about the quality of the Companys portfolio and its underwriting practices from 2014 and 2015.

81. In a November 2, 2016, press release, Triangle announced its financial results for the quarter ended September 30, 2016. The Company reported that the fair value of its investment portfolio was $947.7 million at quarter end with $619.4 million in total net assets. Additionally, Triangle stated that non-accrual assets were 3.9% and 2.1% of the Companys total portfolio at cost and at fair value, respectively. The Company also stated that it had made $88.4 million in new investment during the quarter. On the same date, Triangle filed its quarterly financial results on Form 10-Q with the SEC.

82. On the next day, November 3, 2016, the Company hosted an earnings conference call with analysts and investors. During the call, Defendant Poole stated that as we begin to experience the full quarter effects of the recent investments we have made. We expect our quarterly NII per share to increase to a level at or above $0.45 per share. Further, Defendant Lilly added that we had a very healthy investment pipeline in the second half of the year, which resulted in our desire to raise growth equity capital to fund into that pipeline.

29

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 29 of 56

83. On the call, Robert Dodd, analyst from Raymond James, questioned whether the Companys current structure may have been able to avoid issues from the old regime. In response Defendant Poole stated:

Id have to be honest and say that I think the answer to your question is, yes, that if you go back the former structure we had in place might have had elements, not in every case, but in some cases might have influenced decisions that ultimately came back to bite us.

So one thing, I would say, that we have done, Robert, is we went back and weve certainly looked at all of the problem situations that weve had in the past. And I think its fair to say that in every case, that we have had investments goes South, for the reasons they went South all of those risk were appropriately identified in our investment memo.

So wasnt as though we didnt highlight potential risks that may have ultimately materialize, but the way that maybe there were fewer checks and balances in the investment process at that time and we have a larger investment committee at that time and it probably contributed to even if you had a voice that may have been contrarian not being able to carry the day. And so what Ive tried to do is implement a more fulsome upfront, check and balance process that will hopefully on the margin continue to tighten up that underwriting process and improve the investment results, which overall frankly from a corporate perspective have been pretty good.

(emphasis added.)

84. For the first time, Defendant Poole acknowledged during this call that the Companys underwriting practices in prior years were lax despite prior representations regarding the strength and robust nature of the Companys risk protocols and underwriting practices. However, Defendants, including Defendant Poole, did not fully disclose the nature of the issues underlying the 2014 and 2015 vintage. In fact, Defendants continued to insist that Triangles pipeline was very healthy, misleading the market as to the issues festering beneath the surface at the Company and with its portfolio.

30

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 30 of 56

85. In a February 22, 2017, press release, Triangle announced its financial results for the fourth quarter and full year ended December 31, 2016. The Company represented that the fair value of its investment portfolio was $1.04 billion at year end with $611.2 million in total net assets. Additionally, the Company disclosed its non-accrual assets were 3.5% and 1.5% of the total portfolio at cost and at fair value. Triangle also stated that it made $155.6 million in new investments during the fourth quarter.

86. On the same day, Triangle filed its quarterly and full-years result on Form 10-K with the SEC. Therein, Defendants extensively discussed the Companys Portfolio Management and Investment Monitoring including identification of several methods of evaluating and monitoring the performance of our portfolio companies. These methods included the following:

| | Monthly and quarterly reviews of actual financial performance versus the corresponding period of the prior year and financial projections; |

| | Monthly and quarterly monitoring of all financial and other covenants; |

| | Reviews of senior lender loan compliance certificates, where applicable; |

| | Quarterly reviews of operating results and general business performance, including the preparation of a portfolio monitoring report which is distributed to members of our investment committee; |

| | Periodic face-to-face meetings with management teams and financial sponsors of portfolio companies; |

| | Attendance at portfolio company board meetings through board seats or observation rights; and |

| | Application of our investment rating system to each investment. |

31

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 31 of 56

In the event that our investment committee determines that an investment is underperforming, or circumstances suggest that the risk associated with a particular investment has significantly increased, we undertake to monitor more closely the affected portfolio company. The level of monitoring of an investment is determined by a number of factors, including, but not limited to, trends in the financial performance of the portfolio company, the investment structure and the type of collateral securing our investment, if any.

87. Further, Defendants also discussed the Companys Investment Rating System. According to the Form 10-K, the Company monitor[s] a wide variety of key credit statistics that provide information regarding our portfolio companies to help us assess credit quality and portfolio performance. Additionally, Defendants represented that Triangle generally require[s] our portfolio companies to have annual financial audits in addition to monthly and quarterly unaudited financial statements and those financial statements are used to calculate and evaluate certain financing ratios.

88. The above statements regarding the level of portfolio monitoring and management indicate that the Company was actively monitoring the 2014 and 2015 vintage and were aware that the potential harmful effect that those investments could have on the Company and its investors. However, Defendants, despite this monitoring, failed to disclose the full extent and depth of the underlying issues with those investments until the end of the Class Period after financing was secured.

89. On the next day, February 23, 2017, Triangle hosted an earnings conference call with analysts and investors. During the call, Defendant Poole stated at the calls outset that Triangle was moving in a positive direction and implied that Triangle had weathered the storm that had gripped the entire BDC industry in 2015. However, these statements were materially false and misleading because Triangle was still suffering with its 2014 and 2015 vintage and was only weathering the storm because its mezzanine financing permitted Triangle to recognize revenue from deferred PIK interest income despite not receiving such payments. This revenue recognition method ultimately obscured the issues within the 2014 and 2015 vintage from surfacing earlier.

32

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 32 of 56

90. Once again, Defendant Poole outlined how improved the Companys underwriting controls were under the new regime compared to the former, which was in place in 2014 and 2015. Specifically, Defendant Poole stated the following: In terms of the new structure we put in place and process we put in place, I created multiple points of what I would call veto authority for transactions, whether in the original inception mode, in contemplation mode, all the way through documentation modes and ultimately through final approval modes. So at each point of the process, unlike before, certain individuals within the organization have full veto rights on a transaction, and therefore we have much better ability to provide checks and balances as transactions are vetted through the system. (emphasis added.). Defendant Poole made these statements despite Defendants repeated, prior misrepresentations regarding the quality of the Companys underwriting protocol and risk assessment procedures.

91. On February 28, 2017, Triangle raised approximately $132 million in equity growth capital, and a fully underwritten offering of 7 million shares. Then, on May 1, 2017, Triangle announced that it had amended its senior credit facility, whereby it increased the facility by $135 million or 45% from $300 million to $435 million. The final maturity date was extended to April 30, 2022. According to the Company, the enlarged senior credit facility provided the Company with a more streamlined ability to borrow, to support its normal operational and investing activities. In conjunction with the offering and credit facility, the Company, by and through certain Defendants, amassed $272 million for Triangle.

33

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 33 of 56

92. In a May 3, 2017 press release, Triangle announced its financial results for the quarter ended March 31, 2017. Therein, the Company reported that the fair value of its investment portfolio was $1.13 billion at quarter end with $792.2 million in total net assets. Additionally, Triangle stated that non-accrual assets were 4.2% and 2.2% of the Companys total portfolio at cost and at fair value, respectively. Triangle also revealed that it made $161.5 million in new investments during the quarter. On the same date, Triangle filed its quarterly financial results on Form 10-Q with the SEC.

93. The next day, May 4, 2017, the Company held an earnings conference call with investors and analysts. During the call, Defendant Lilly stated as follows with respect to the Companys portfolio: And we talked about this as you may recall at our Investor Day last year and the weighted average yield in our portfolio went from north of 15%, 15.1% down to 12.3% as of a year ago this time. And so, it moved by call it 300 basis points, but much of that move occurred in 2013 and 2014. And if you look at that period of time and look at fair value within our book today, I think you would reasonably conclude that there was a period where Triangle was pacing yield more than it should have.

94. Defendant Lilly went even further into detail on the Companys older investments, I dont think we said we were mispricing risks. I think the expression that we used was there were times where we were chasing yield as a company. And so, I want to be sure that we are precise on that. It does not mean that every transaction was like that during that time period. Those were active years I think for many platforms in the debt financing arena certainly not unique to Triangle. But I think if you are to look at clear things or marked and we I think had a very successful history of marking things appropriately in our investment role. And we would certainly expect, given that we havent changed that part of our process that that would continue to be accurate. So, think as you look at, every credit is unique, every investment is unique. So its dangerous to draw conclusions one way or the other about an entire v[i]ntage or an entire book.

34

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 34 of 56

95. In these statements from May 3 and 4, 2017, Defendants once again tacitly acknowledged that their prior representations regarding the Companys underwriting, risk-assessment and selectivity were false and misleading. However, the statements from May 3 and 4, 2017, were also materially false and misleading because once again, Defendants did not acknowledge the true extent of the issues with respect to the 2014 and 2015 vintage or how those issues would dampen the Companys financial outlook and prospects as these investments matured.

96. On June 22, 2017, the Company hosted its 8th Annual Analyst and Investor Meeting. During this meeting, the Company made a presentation, which made representations about the prior management regime including the following: (i) For many years TCAP was small enough to operate with a partnership mentality; (ii) Investment committee met and looked to CEO for approval or rejection; (iii) Fewer difficult questions coupled with a lack of individual ownership and accountability; and (iv) No TCAP standard on documentation items. Further, in contrast, Defendants made the following representations about the then-present state of Triangle including: (i) cross-functional veto rights; (ii) Investment committee meets and looks to COO, CAO and CCO for approval or rejection; (iii) More rigorous questions coupled with increased individual ownership and accountability; (iv) Decisions are based solely on protecting the firm; and (v) Our operational changes have improved our investment results and created a culture of increased accountability.

35

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 35 of 56

97. The statements in the June 22, 2017, analyst and investor meeting underscore the materially misleading nature of the Companys statements regarding its underwriting and risk assessment protocols during the 2014 and 2015. Although Triangle and Defendants were representing that the Company had extensive controls in place to ensure that Company was achieving the best shareholder risk-return investments, in fact, the portfolio was built on the sole discretion and veto power of Defendant Tucker and Triangle had a poor in-house standard for documentation items. As a result, with its 2014 and 2015 investment practices, Defendants fostered a culture that was short on accountability and strong on risk despite representations to the contrary.

The Truth Begins to Emerge

98. In an August 2, 2017, press release, Triangle announced its financial results for the quarter ended June 30, 2017. The Company represented that the its investment portfolios fair value was $1.17 billion at quarter end, with $707.9 million in total net assets. Triangle also revealed significant deterioration in the credit quality of the Companys portfolio. Triangle represented that the Company had moved one investment into full-non-accrual status from PIK non-accrual and the amount of full non-accrual assets in the Companys portfolio increased to 5.4% and 2.5% of the Companys total portfolio at cost and at fair value, respectively. Further, Triangle also disclosed that it had moved two investments to PIK non-accrual status, increasing the amount of PIK non-accruals as a percentage of the Companys total portfolio. As a result, the Company revealed only $0.41 in net investment income per share, which was below the Companys $0.45 per share dividend, and $26.2 million in net unrealized depreciation in its investment portfolio.

36

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 36 of 56

99. As a result of this news, the price of Triangle stock declined nearly 15%, or $2.56 per share, from $17.19 per share on August 2, 2017, to close at $14.63 per share by August 4, 2017 on abnormally high trading volume.

100. However, the price of Triangle securities remained artificially inflated at this time because Defendants continued to conceal the true risks to Triangles business and prospects as a result of the impaired credit quality of its portfolio, defective underwriting practices and the facts and circumstances surrounding Triangles 2014 and 2015 investments.

101. For example during the August 3, 2017, earning conference call with analysts and investors, Defendant Lilly attempted to quell the markets concern by stating that it was likely that only two of the five portfolio companies that carried below 80% of cost on Triangles portfolio would go on non-accrual in the next two to four quarters, and only one that carried above 80% of cost might it might go in non-accrual during that same timeframe.

102. Similarly, in response to Keefe, Bruyette & Woods analyst Ryan Lynchs question about how Triangle would minimize loss or maximize recoveries from its legacy investments, Defendant Poole stated that the Company had recently improved its credit monitoring capabilities and reassured investors that Triangle had enhanced its abilities to identify trouble areas in its portfolio, stating in pertinent part:

As far as the portfolio management side of the equation, I think you all know that Jeff Dombcik is our Chief Credit Officer and he is Head of our Portfolio Management process. We brought on an additional resource to support Jeff in that effort. I will say that Jeff has done a terrific job of going back through and examining all of our prior tools and screens, and processes for getting ahead and forecasting trouble spots in the portfolio by industry and by company.

37

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 37 of 56

We now have a much, much greater visibility and predictability going forward of where we see potential issues. Jeff has also applied, what I think is just incredible focus and attention on the problem situations that we do have and has brought great leadership in trying to work through the situations and work either constructively with sponsors in terms of getting to solutions that benefit our shareholders or in cases where we need to exercise more influence directly on our own accord to generate the best outcome for TCAP and its shareholders.

So collectively, the two sides of the coin are much improved in my view and resulting in better performance for the company and our shareholders.

103. Defendants statements made on August 2 and 3, 2017, were materially false and misleading because Defendants failed to reveal the full extent of the issues with the Companys 2014 and 2015 vintage and attempted to wrongfully assuage the markets concerns by downplaying the likelihood of further non-accruals and stating that Triangles staff was working through the situations and work either constructively with sponsors in terms of getting to solutions that benefit our shareholders or in cases where we need to exercise more influence directly on our own accord to generate the best outcome for TCAP and its shareholders.

104. Further, Defendants statements at this time also highlight the deficiencies in Triangles previous disclosure with respect to the quality of its 2014 and 2015 vintage and the Companys underwriting and risk assessment procedures at that time, which Triangles investors relied upon.

105. For instance, Defendant Lilly stated the following: [a]nd frankly, a couple of years ago, in kind of 14 and 15, there was a motive, if you will, to internally to try to maintain what at that time was the highest base per share dividend in the sector. And thats not a long-term strategy, that has proven for investors as one of comfortably over earning for a long, sustained period of time and achieving that lower volatility.

106. Thus, Defendants repeated statements in 2014 and 2015 regarding Triangles emphasis on quality and selectivity were materially false and misleading because Defendants were chasing higher yields in an effort to maintain a high per share dividend, rather than

38

Case 5:18-cv-00015-FL Document 54 Filed 04/10/18 Page 38 of 56

carefully and cautiously weighing the risk-reward profile of an investment. Further, Defendants statements concerning the robust nature of their underwriting and risk assessment protocols were inaccurate because Defendant Tucker had the sole authority to push through or veto an investment opportunity.

The Truth is Fully Revealed