425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on August 11, 2020

Filed by Barings BDC, Inc. pursuant to Rule 425 under the Securities Act of 1933 and deemed filed under Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: MVC Capital, Inc. Commission File No. 814-00201 Barings BDC, Inc. Strategic Acquisition of MVC Capital, Inc. August 10, 2020

Disclaimers and Cautionary Note Regarding Forward-Looking Statements Cautionary Notice: Certain statements contained in this presentation are "forward-looking" statements. Such forward-looking statements may include statements preceded by, followed by or that otherwise include the words “may,” “might,” “will,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” “plan” or similar words. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management's current estimates, projections, expectations or beliefs, and which are subject to risks and uncertainties that may cause actual results or events to differ materially. Forward-looking statements include, but are not limited to, the ability of Barings LLC to manage Barings BDC, Inc. (“Barings BDC”) and identify investment opportunities, and some of these factors are enumerated in the filings Barings BDC makes with the Securities and Exchange Commission (the "SEC"). These statements are subject to change at any time based upon economic, market or other conditions, including with respect to the impact of the COVID-19 pandemic and its effects on Barings BDC’s and its portfolio companies’ results of operations and financial condition, and may not be relied upon as investment advice or an indication of Barings BDC’s investment intent. Important factors that could cause actual results to differ materially from plans, estimates or expectations included in this presentation include, among others, those risk factors detailed in Barings BDC's annual report on Form 10-K for the fiscal year ended December 31, 2019, filed with the SEC on February 27, 2020, in Barings BDC’s subsequently filed quarterly reports on Form 10-Q, and as may be included from time to time in Barings BDC's other filings with the SEC, including current reports on Form 8-K and other documents filed with the SEC. In addition, there is no assurance that Barings BDC or any of its affiliates will purchase additional shares of Barings BDC at any specific discount levels or in any specific amounts. There is no assurance that the market price of Barings BDC’s shares, either absolutely or relative to net asset value, will increase as a result of any share repurchases, or that any repurchase plan will enhance stockholder value over the long term. The Company undertakes no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. This investor presentation also contain “forward-looking statements” regarding the proposed acquisition of MVC Capital, Inc. (“MVC Capital”) by Barings BDC pursuant to a definitive merger agreement and related transactions thereunder (collectively, the “Transaction”), including statements regarding the completion of the proposed Transaction. Certain factors could cause actual results and conditions to differ materially from those projected, including the uncertainties associated with (i) the timing or likelihood of the Transaction closing, (ii) the expected synergies and savings associated with the Transaction, (iii) the expected elimination of certain expenses and costs due to the Transaction, (iv) the percentage of MVC Capital’s stockholders voting in favor of the Transaction, (v) the percentage of Barings BDC’s stockholders voting in favor of the relevant Proposals (as defined below), (vi) the possibility that competing offers or acquisition proposals for MVC Capital will be made; (vii) the possibility that any or all of the various conditions to the consummation of the Transaction may not be satisfied or waived; (viii) risks related to diverting the attention of Barings BDC's management or MVC Capital's management from ongoing business operations, (ix) the risk that stockholder litigation in connection with the Transaction may result in significant costs of defense and liability, (x) the future operating results of the combined company or Barings BDC’s, MVC Capital’s or the combined company’s portfolio companies, (xi) regulatory approvals and other factors, (xii) changes in regional or national economic conditions, including but not limited to the impact of the COVID-19 pandemic, and their impact on the industries in which Barings BDC and MVC Capital invest, (xiii) changes to the form and amounts of MVC Capital’s tax obligations, (xiv) changes in the Euro-to-U.S. dollar exchange rate, (xv) fluctuations in the market price of Barings BDC’s common stock, (xvi) the Transaction’s effect on the relationships of Barings BDC or MVC Capital with their respective investors, portfolio companies, lenders and service providers, whether or not the Transaction is completed, (xvii) the reduction in Barings BDC’s stockholders’ and MVC Capital’s stockholders’ percentage ownership and voting power in the combined company, (xviii) the challenges and costs presented by the integration of Barings BDC and MVC Capital, (xix) the uncertainty of third-party approvals, (xx) the significant Transaction costs, (xxi) the restrictions on Barings BDC’s and MVC Capital’s conduct of business set forth in the definitive merger agreement and (xxii) other changes in the conditions of the industries in which Barings BDC and MVC Capital invest and other factors enumerated in Barings BDC’s and MVC Capital’s filings with the SEC. You should not place undue reliance on such forward-looking statements, which are based upon Barings BDC management’s views and assumptions regarding future events and operating performance, and speak only as of the date of this communication. Barings BDC undertakes no duty to update any forward-looking statement made herein. 2

Disclaimers and Cautionary Note Regarding Forward-Looking Statements Additional Information and Where to Find It This communication relates to a proposed business combination involving Barings BDC and MVC Capital, along with related proposals for which stockholder approval will be sought (collectively, the "Proposals"). In connection with the proposed Transaction, Barings BDC and MVC Capital plan to file with the SEC and mail to their respective stockholders a joint proxy statement on Schedule 14A (the "Proxy Statement"), and Barings BDC plans to file with the SEC a registration statement on Form N-14 (the "Registration Statement") that will include the Proxy Statement and a prospectus of Barings BDC. The Proxy Statement and the Registration Statement will each contain important information about Barings BDC, MVC Capital, the proposed Transaction and related matters. STOCKHOLDERS OF EACH OF BARINGS BDC AND MVC CAPITAL ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT AND THE REGISTRATION STATEMENT WHEN THEY BECOME AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS THERETO, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BARINGS BDC, MVC CAPITAL, THE TRANSACTION AND THE PROPOSALS. Investors and security holders will be able to obtain the documents filed with the SEC free of charge at the SEC’s web site at http://www.sec.gov or, for documents filed by Barings BDC, from the Barings BDC website at http://www.baringsbdc.com. Participants in the Solicitation Barings BDC and MVC Capital and their respective directors, executive officers and certain other members of management and employees of Barings LLC, The Tokarz Group Advisers LLC and their respective affiliates, may be deemed to be participants in the solicitation of proxies from the stockholders of Barings BDC and MVC Capital in connection with the Proposals. Information about the directors and executive officers of Barings BDC is set forth in its proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on March 10, 2020. Information about the directors and executive officers of MVC Capital is set forth in its proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on June 10, 2020. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of Barings BDC’s and MVC Capital’s stockholders in connection with the Proposals will be contained in the Proxy Statement and other relevant materials to be filed with the SEC when such documents become available. Investors should read the Proxy Statement and Registration Statement carefully and in their entirety when they become available before making any voting or investment decisions. These documents may be obtained free of charge from the sources indicated above. 3

Disclaimers and Cautionary Note Regarding Forward-Looking Statements No Offer or Solicitation This investor presentation is not, and under no circumstances is it to be construed as, a prospectus or an advertisement, and the communication of this investor presentation is not, and under no circumstances is it to be construed as, an offer to sell or a solicitation of an offer to purchase any securities in Barings BDC, MVC Capital or in any fund or other investment vehicle. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933. Other Important Information Any forecasts in this document are based upon Barings’ opinion of the market at the date of preparation and are subject to change without notice, dependent upon many factors. Any prediction, projection or forecast, including any pro forma projection or forecast for the combined company following the closing of the Transaction, is not necessarily indicative of the future or likely performance. Investment involves risk. The value of any investments and any income generated may go down as well as up and is not guaranteed. Past performance is no indication of current or future performance. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any investment results, portfolio compositions and/or examples set forth in this document are provided for illustrative purposes only and are not indicative of any future investment results, future portfolio composition or investments. The composition, size of, and risks associated with an investment may differ substantially from any examples set forth in this document. No representation is made that an investment will be profitable or will not incur losses. Where appropriate, changes in the currency exchange rates may affect the value of investments. Prospective investors should read the relevant offering documents for the details and specific risk factors of any investment vehicle discussed in this document. 4

Agenda ERIC LLOYD BARINGS OVERVIEW (Lloyd) Who is Barings? What does Barings BDC look like today? IAN FOWLER BARINGS BDC’S STRATEGIC ACQUISTION OF MVC CAPITAL (Lloyd/Fowler/Bock) What are the strategic benefits of the transaction? How is the acquisition structured? What will the company look like after close? JONATHAN BOCK 5

Barings Overview

Who We Are Barings is a $346+ BILLION global financial services firm dedicated to meeting the evolving investment and capital needs of our clients and customers. Through ACTIVE ASSET MANAGEMENT and DIRECT ORIGINATION, we provide innovative solutions and access to differentiated opportunities across public and private capital markets. A subsidiary of MASSMUTUAL, we have the financial stability and flexibility to take a long-term approach. GLOBAL HEADQUARTERS INVESTMENT OFFICES OTHER LOCATIONS 1,900+ business and investment professionals globally Barings’ GLOBAL FOOTPRINT gives us a broader perspective, access to a diverse set of opportunities and the ability to truly partner with our clients to invest across global markets. All figures are as of June 30, 2020 unless otherwise indicated. Assets shown are denominated in USD. 7

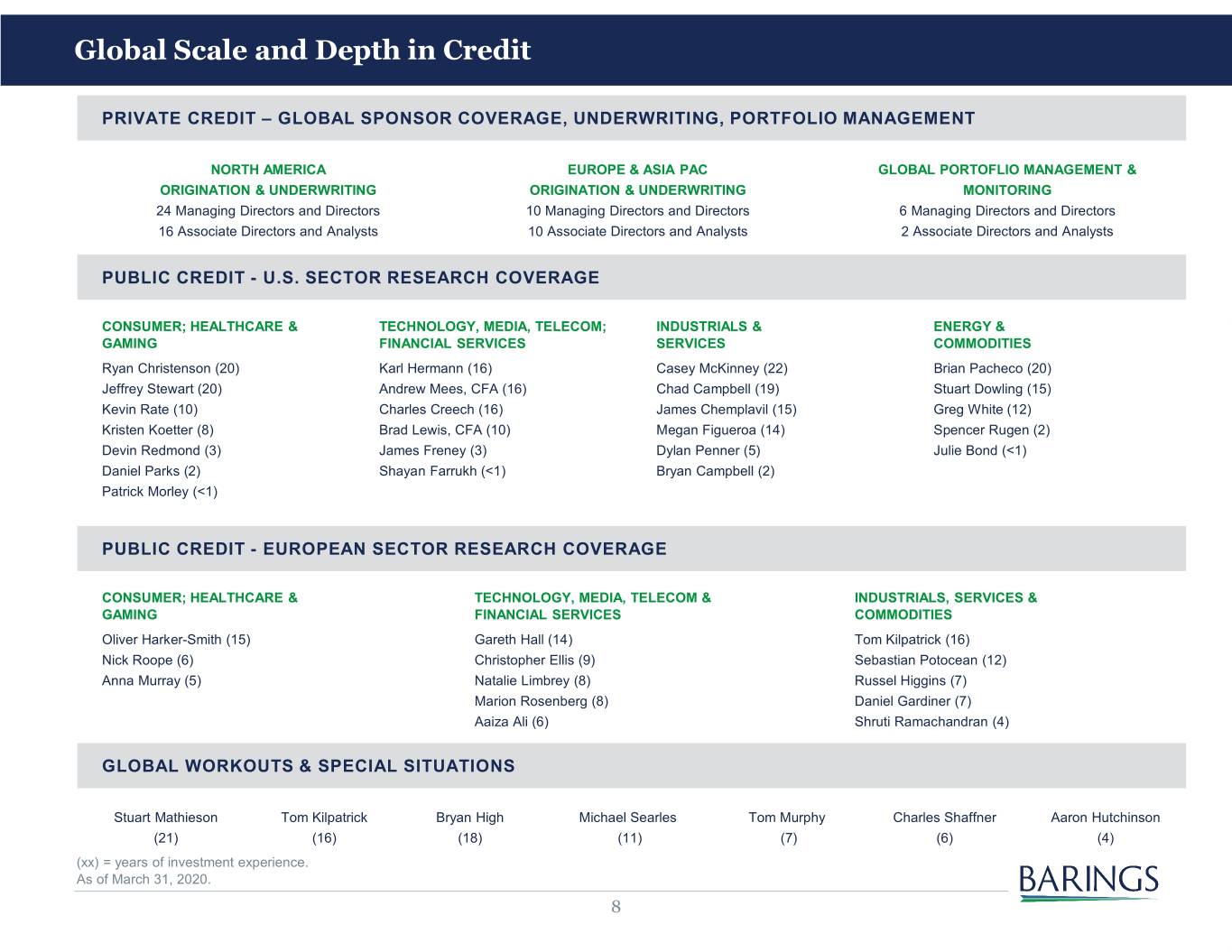

Global Scale and Depth in Credit PRIVATE CREDIT – GLOBAL SPONSOR COVERAGE, UNDERWRITING, PORTFOLIO MANAGEMENT NORTH AMERICA EUROPE & ASIA PAC GLOBAL PORTOFLIO MANAGEMENT & ORIGINATION & UNDERWRITING ORIGINATION & UNDERWRITING MONITORING 24 Managing Directors and Directors 10 Managing Directors and Directors 6 Managing Directors and Directors 16 Associate Directors and Analysts 10 Associate Directors and Analysts 2 Associate Directors and Analysts PUBLIC CREDIT - U.S. SECTOR RESEARCH COVERAGE CONSUMER; HEALTHCARE & TECHNOLOGY, MEDIA, TELECOM; INDUSTRIALS & ENERGY & GAMING FINANCIAL SERVICES SERVICES COMMODITIES Ryan Christenson (20) Karl Hermann (16) Casey McKinney (22) Brian Pacheco (20) Jeffrey Stewart (20) Andrew Mees, CFA (16) Chad Campbell (19) Stuart Dowling (15) Kevin Rate (10) Charles Creech (16) James Chemplavil (15) Greg White (12) Kristen Koetter (8) Brad Lewis, CFA (10) Megan Figueroa (14) Spencer Rugen (2) Devin Redmond (3) James Freney (3) Dylan Penner (5) Julie Bond (<1) Daniel Parks (2) Shayan Farrukh (<1) Bryan Campbell (2) Patrick Morley (<1) PUBLIC CREDIT - EUROPEAN SECTOR RESEARCH COVERAGE CONSUMER; HEALTHCARE & TECHNOLOGY, MEDIA, TELECOM & INDUSTRIALS, SERVICES & GAMING FINANCIAL SERVICES COMMODITIES Oliver Harker-Smith (15) Gareth Hall (14) Tom Kilpatrick (16) Nick Roope (6) Christopher Ellis (9) Sebastian Potocean (12) Anna Murray (5) Natalie Limbrey (8) Russel Higgins (7) Marion Rosenberg (8) Daniel Gardiner (7) Aaiza Ali (6) Shruti Ramachandran (4) GLOBAL WORKOUTS & SPECIAL SITUATIONS Stuart Mathieson Tom Kilpatrick Bryan High Michael Searles Tom Murphy Charles Shaffner Aaron Hutchinson (21) (16) (18) (11) (7) (6) (4) (xx) = years of investment experience. As of March 31, 2020. 8

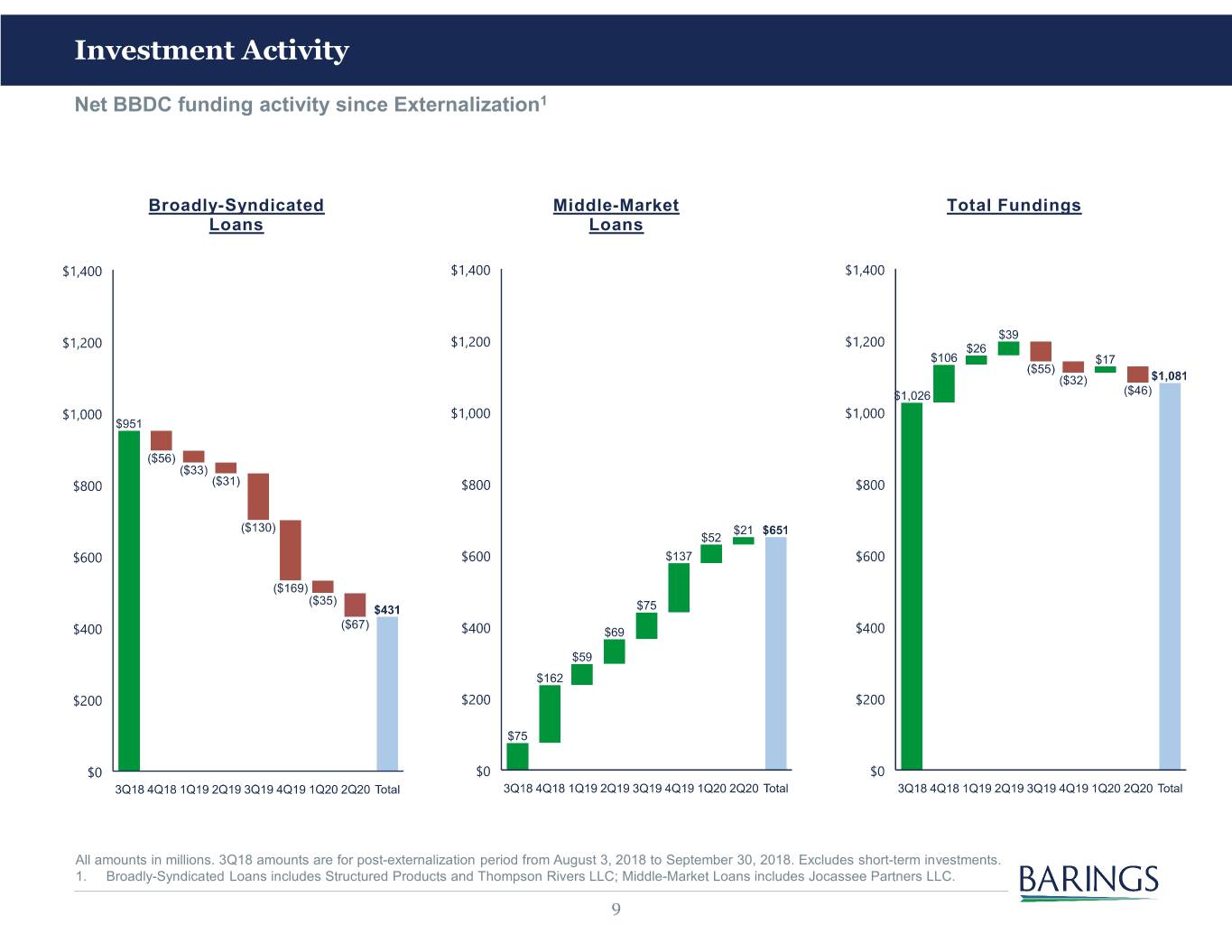

Investment Activity Net BBDC funding activity since Externalization1 Broadly-Syndicated Middle-Market Total Fundings Loans Loans All amounts in millions. 3Q18 amounts are for post-externalization period from August 3, 2018 to September 30, 2018. Excludes short-term investments. 1. Broadly-Syndicated Loans includes Structured Products and Thompson Rivers LLC; Middle-Market Loans includes Jocassee Partners LLC. 9

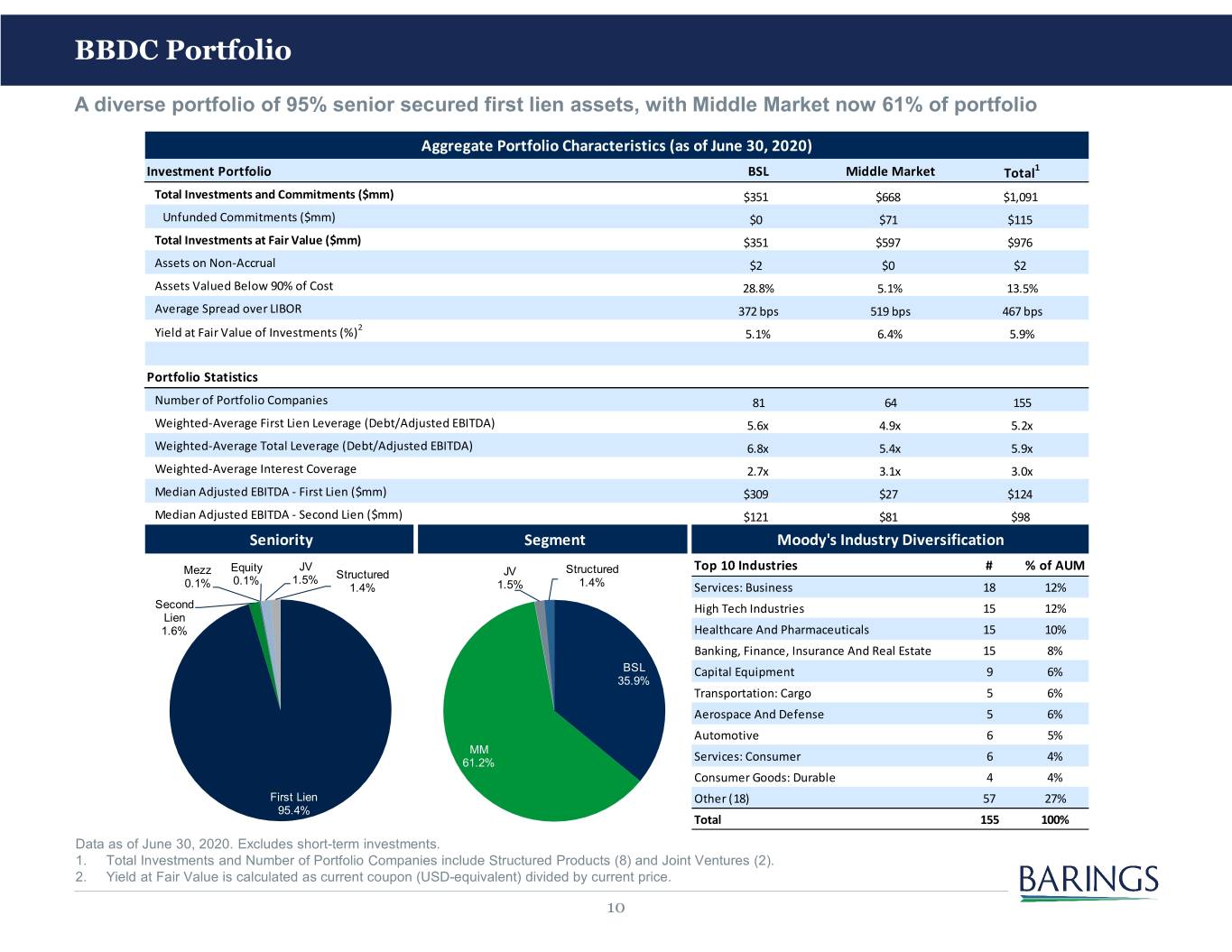

BBDC Portfolio A diverse portfolio of 95% senior secured first lien assets, with Middle Market now 61% of portfolio Aggregate Portfolio Characteristics (as of June 30, 2020) Investment Portfolio BSL Middle Market Total1 Total Investments and Commitments ($mm) $351 $668 $1,091 Unfunded Commitments ($mm) $0 $71 $115 Total Investments at Fair Value ($mm) $351 $597 $976 Assets on Non-Accrual $2 $0 $2 Assets Valued Below 90% of Cost 28.8% 5.1% 13.5% Average Spread over LIBOR 372 bps 519 bps 467 bps 2 Yield at Fair Value of Investments (%) 5.1% 6.4% 5.9% Portfolio Statistics Number of Portfolio Companies 81 64 155 Weighted-Average First Lien Leverage (Debt/Adjusted EBITDA) 5.6x 4.9x 5.2x Weighted-Average Total Leverage (Debt/Adjusted EBITDA) 6.8x 5.4x 5.9x Weighted-Average Interest Coverage 2.7x 3.1x 3.0x Median Adjusted EBITDA - First Lien ($mm) $309 $27 $124 Median Adjusted EBITDA - Second Lien ($mm) $121 $81 $98 Seniority Segment Moody's Industry Diversification Equity JV Top 10 Industries # % of AUM Mezz Structured JV Structured 0.1% 1.5% 0.1% 1.4% 1.5% 1.4% Services: Business 18 12% Second High Tech Industries 15 12% Lien 1.6% Healthcare And Pharmaceuticals 15 10% Banking, Finance, Insurance And Real Estate 15 8% BSL Capital Equipment 9 6% 35.9% Transportation: Cargo 5 6% Aerospace And Defense 5 6% Automotive 6 5% MM 61.2% Services: Consumer 6 4% Consumer Goods: Durable 4 4% First Lien Other (18) 57 27% 95.4% Total 155 100% Data as of June 30, 2020. Excludes short-term investments. 1. Total Investments and Number of Portfolio Companies include Structured Products (8) and Joint Ventures (2). 2. Yield at Fair Value is calculated as current coupon (USD-equivalent) divided by current price. 10

Barings BDC’s Strategic Acquisition of MVC Capital 11

Transaction Summary • On August 10th, Barings BDC, Inc. (“BBDC”) announced its intention to acquire MVC Capital Inc. (“MVC”) for a total value consideration of $177.5 million.1 Additionally, Barings LLC will provide $23 million of credit support through a credit support agreement (“CSA”) to investors in the combined entity on the legacy MVC portfolio over the next 10 years • We believe this combination provides strategic and financial benefits to the combined company, including the following anticipated benefits: 1) Increased scale, as the combined company is expected to have more than $1.2 billion of investments on a pro forma basis; 2) Earnings accretion, as we estimate NOI per share to be $0.18 - $0.20 in the first full quarter post-closing compared to $0.14 during 2Q20; 3) Investment “option” value through an expanded equity base, increased leverage and investment capacity, and improved access to unsecured debt capital markets; 4) Manager and shareholder alignment through an upfront cash payment to MVC stockholders in connection with the Transaction and the use of a manager CSA and share repurchases; 5) Efficiencies and portfolio diversification through cost synergies and an increase in portfolio obligors; and 6) Expected accretion to long-term NAV as assets are realized and repositioned into directly-originated investments • In connection with the Transaction, Barings LLC will seek to amend its current investment management agreement with Barings BDC to, among other things, (i) lower the base management fee to 1.25%, down from 1.375%, (ii) make certain conforming and definitional changes relating to the Transaction, and (iii) reset the incentive fee cap commencement date to coincide with the first quarterly period ending after the closing of the Transaction. These proposed changes to the investment management agreement are subject to Barings BDC board and stockholder approvals. However, such approvals are not closing conditions required to consummate the Transaction 1. Includes a $7 million cash payment by Barings LLC and $170.5 million of BBDC stock issued based on BBDC’s 6/30/20 NAV of $10.23 per share. Total value of the consideration to be received by MVC stockholders at closing is subject to adjustment as set forth in the definitive merger agreement and may be different than the estimated total consideration described in this presentation depending on a number of factors, including the payment of tax dividends by MVC, undistributed investment company taxable income and undistributed net capital gains of MVC and changes of the Euro-to-U.S. dollar exchange rate relating to certain of MVC’s investments between April 30, 2020 and the closing date. 12

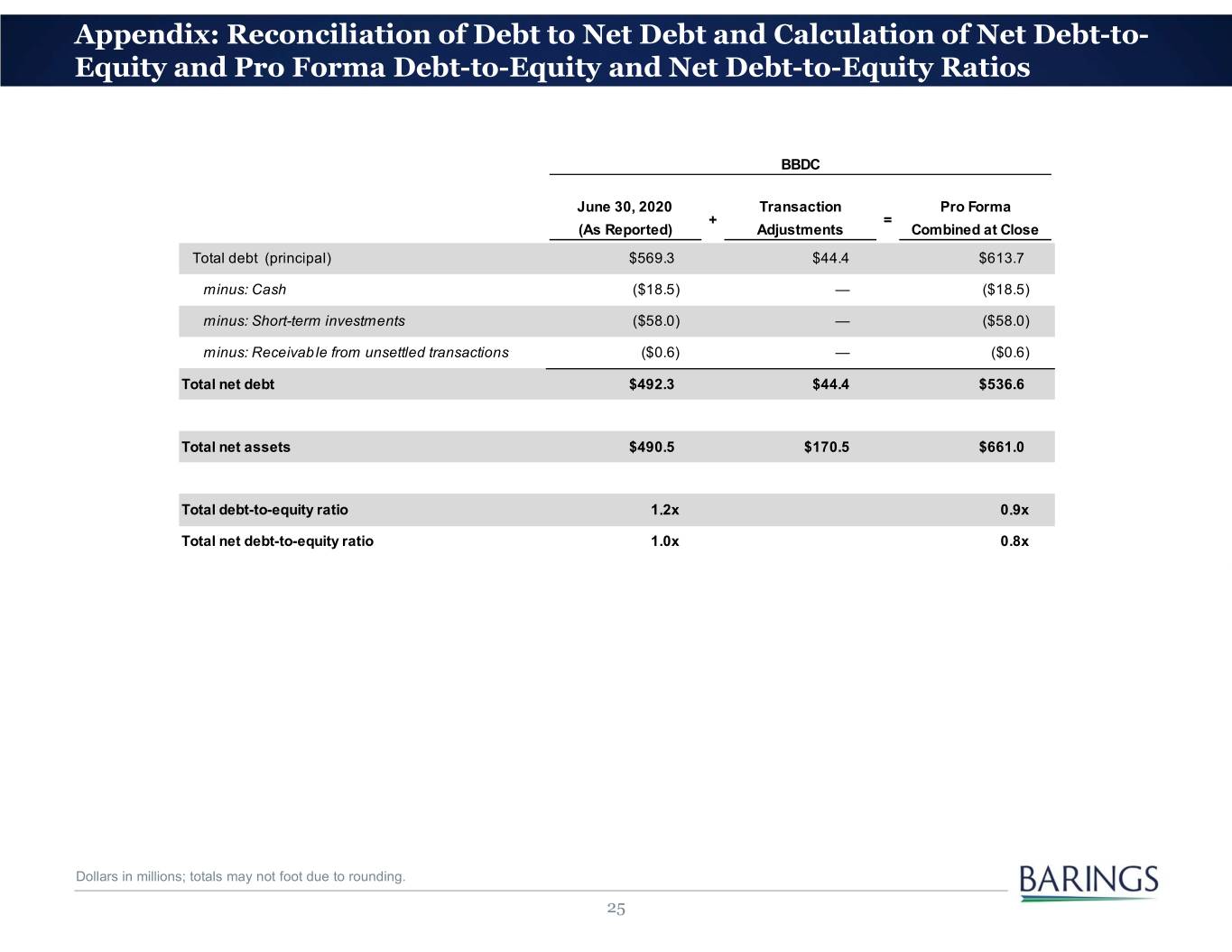

Transaction Details Summary of Certain Transaction Terms MVC shareholders will receive a book value consideration of $177.5 million, or $10.01 per share,1 of total consideration,2 consisting of: • Cash of $7.0 million, or $0.39492 per share, directly from Barings LLC Total • BBDC common stock of $170.5 million at a fixed exchange ratio of 0.94024 BBDC shares for every MVC share Consideration i. Approximately 16.7 million BBDC shares are expected to be issued representing $170.5 million based on BBDC’s net asset value of $10.23 per share as of June 30, 2020 ii. At closing, legacy BBDC and MVC shareholders will own 74.2% and 25.8% of the combined company, respectively • $23 million of credit support offered by Barings LLC in the form of a CSA to limit potential net cumulative Credit Support realized and unrealized losses on the acquired MVC portfolio over the next 10 years Pro Forma • Pro forma debt/equity at closing expected to be approximately 0.9x Balance Sheet • Pro forma net debt/equity at closing expected to be approximately 0.8x3 Financing • No new sources of financing required at close • Anticipated closing by the end of 2020 subject to shareholder approvals, regulatory approvals, and other Timing customary closing conditions • BBDC will provide up to $15.0 million in secondary-market support via accretive share repurchases over a Share 12-month period in the event the combined company's shares trade below a specific level of NAV per share Repurchases following the completion of the first quarterly period ended after the closing, subject to covenant and regulatory constraints 1. Based on 17.7 million fully-diluted shares of MVC Capital and Barings BDC’s June 30, 2020 NAV of $10.23 per share. 2. Total value of the consideration to be received by MVC stockholders at closing is subject to adjustment as set forth in the definitive merger agreement and may be different than the estimated total consideration described in this presentation depending on a number of factors, including the payment of tax dividends by MVC, undistributed investment company taxable income and undistributed net capital gains of MVC and changes of the Euro-to-U.S. dollar exchange rate relating to certain of MVC’s investments between April 30, 2020 and the closing date. 3. Refer to slide 25 for reconciliation of Debt-to-Equity Ratio to Net Debt-to-Equity Ratio. 13

Other Important Highlights Other Important Highlights • In connection with the Transaction, Barings LLC will seek to amend its current investment management Changes to agreement with Barings BDC to, among other things, (i) lower the base management fee to 1.25%, down Investment from 1.375%, (ii) make certain conforming and definitional changes relating to the Transaction, and (iii) reset the incentive fee cap commencement date to coincide with the first quarterly period ending after the closing Management of the Transaction. These proposed changes to the investment management agreement are subject to Agreement Barings BDC board and stockholder approvals. However, such approvals are not closing conditions required to consummate the Transaction 1 Investment • On August 5th, Barings BDC received an investment-grade rating (Baa3, stable) from Moody’s, and also announced a $100 million, 5-year unsecured private placement debt commitment from MassMutual with a Grade Rating 4.66% coupon for the first $50 million drawn 1. A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. 14

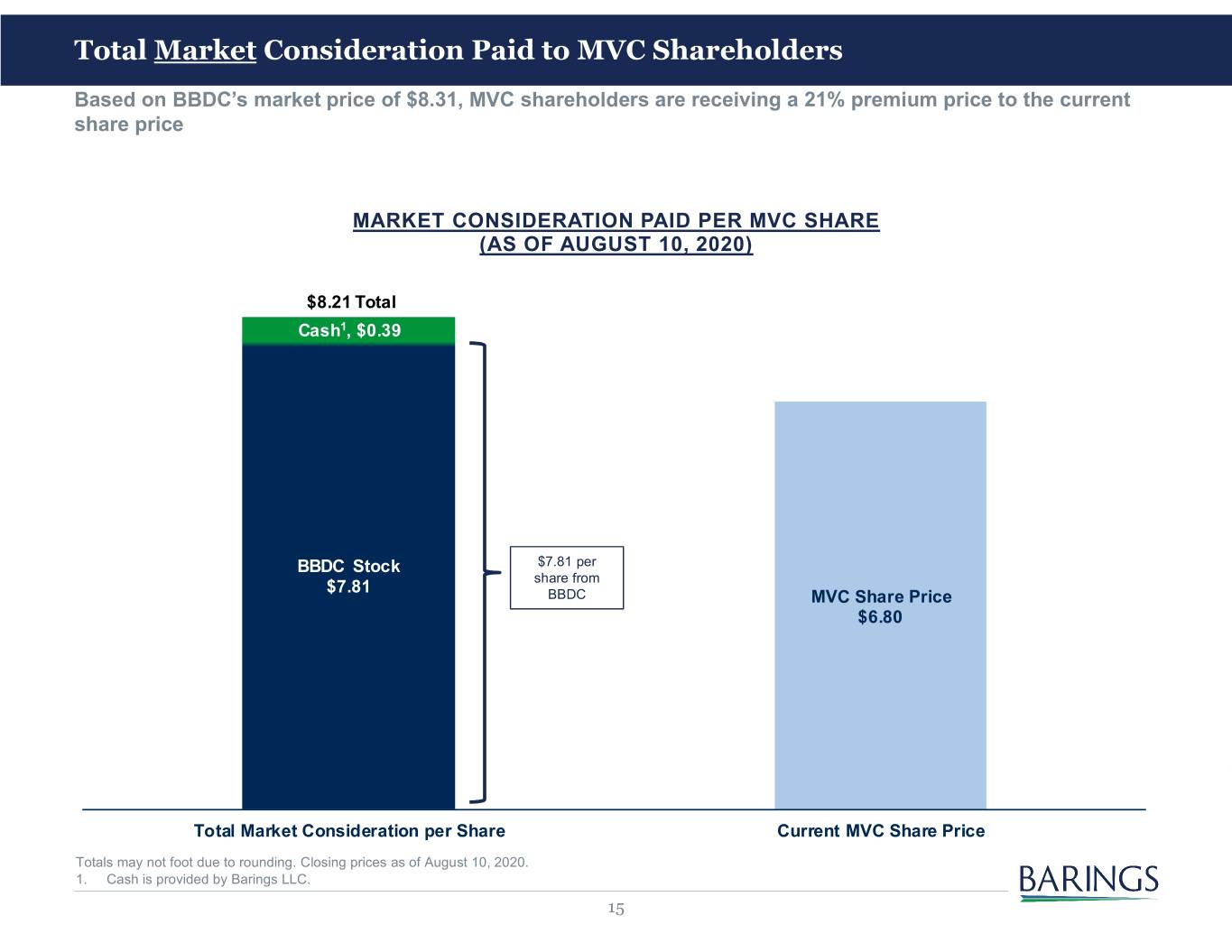

Total Market Consideration Paid to MVC Shareholders Based on BBDC’s market price of $8.31, MVC shareholders are receiving a 21% premium price to the current share price MARKET CONSIDERATION PAID PER MVC SHARE (AS OF AUGUST 10, 2020) $8.21 Total Cash1, $0.39 BBDC Stock $7.81 per share from $7.81 BBDC MVC Share Price $6.80 Total Market Consideration per Share Current MVC Share Price Totals may not foot due to rounding. Closing prices as of August 10, 2020. 1. Cash is provided by Barings LLC. 15

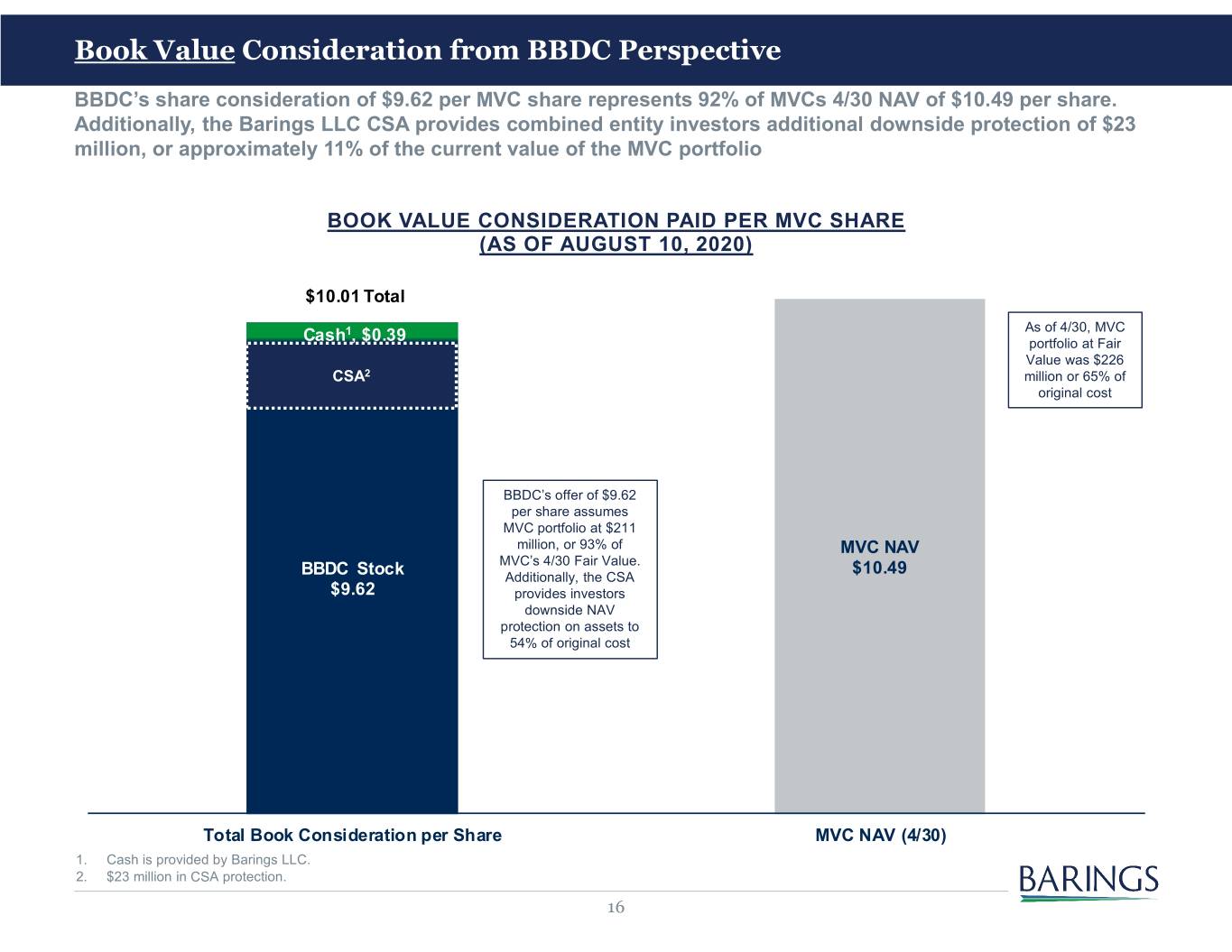

Book Value Consideration from BBDC Perspective BBDC’s share consideration of $9.62 per MVC share represents 92% of MVCs 4/30 NAV of $10.49 per share. Additionally, the Barings LLC CSA provides combined entity investors additional downside protection of $23 million, or approximately 11% of the current value of the MVC portfolio BOOK VALUE CONSIDERATION PAID PER MVC SHARE (AS OF AUGUST 10, 2020) $10.01 Total 1 As of 4/30, MVC Cash , $0.39 portfolio at Fair Value was $226 CSA2 million or 65% of original cost BBDC’s offer of $9.62 per share assumes MVC portfolio at $211 million, or 93% of MVC NAV MVC’s 4/30 Fair Value. $10.49 BBDC Stock Additionally, the CSA $9.62 provides investors downside NAV protection on assets to 54% of original cost Total Book Consideration per Share MVC NAV (4/30) 1. Cash is provided by Barings LLC. 2. $23 million in CSA protection. 16

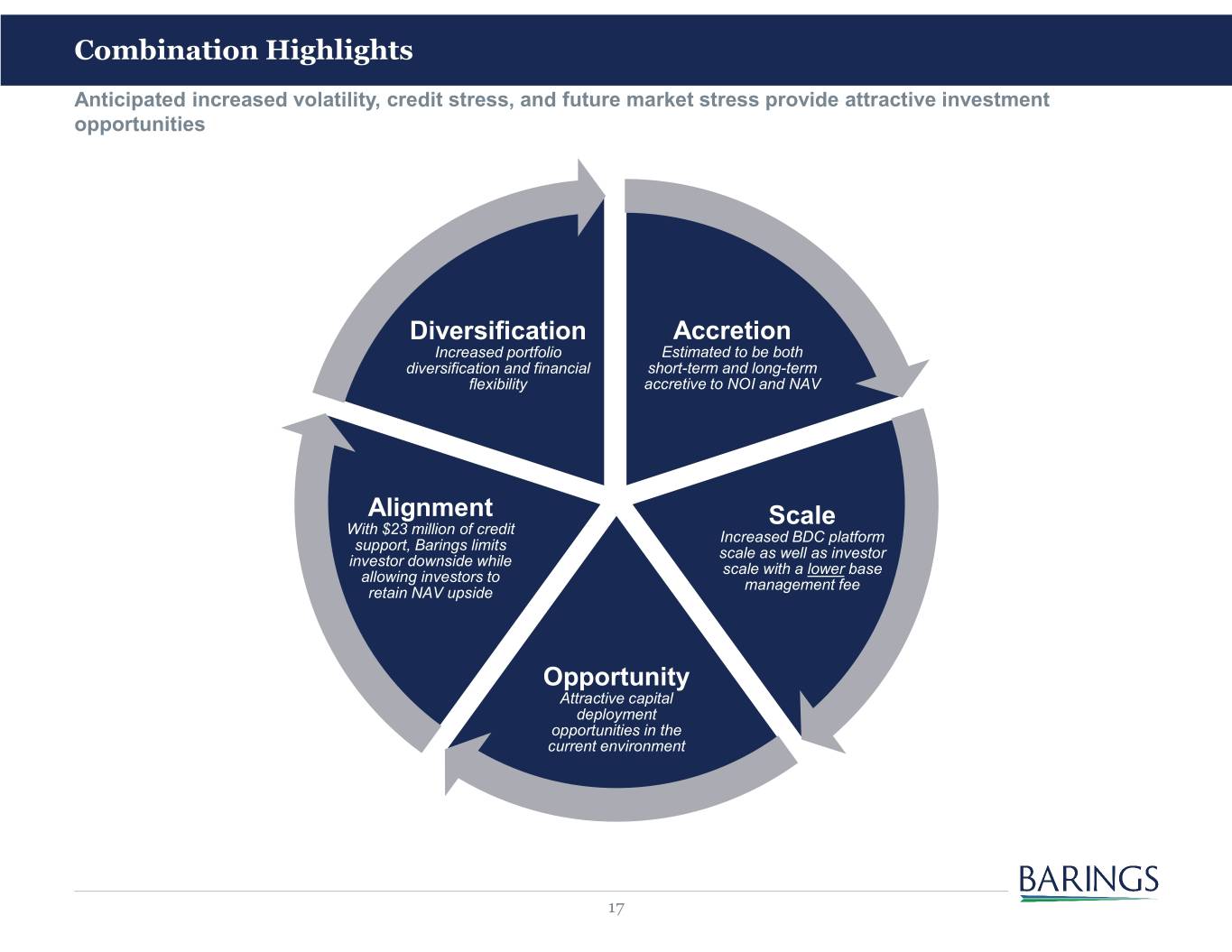

Combination Highlights Anticipated increased volatility, credit stress, and future market stress provide attractive investment opportunities Diversification Accretion Increased portfolio Estimated to be both diversification and financial short-term and long-term flexibility accretive to NOI and NAV Alignment Scale With $23 million of credit Increased BDC platform support, Barings limits scale as well as investor investor downside while scale with a lower base allowing investors to management fee retain NAV upside Opportunity Attractive capital deployment opportunities in the current environment 17

Scale Benefits To BDC Platform BBDC + MVC BDC PLATFORM BENEFITS Diversifi- Accretion cation Align- ment Scale Oppor- Ability to originate larger commitments and hold sizes tunity Improved BBDC access to capital markets Increased combined cost synergies Increased share liquidity / institutional relevance Estimated ROE improvement 18

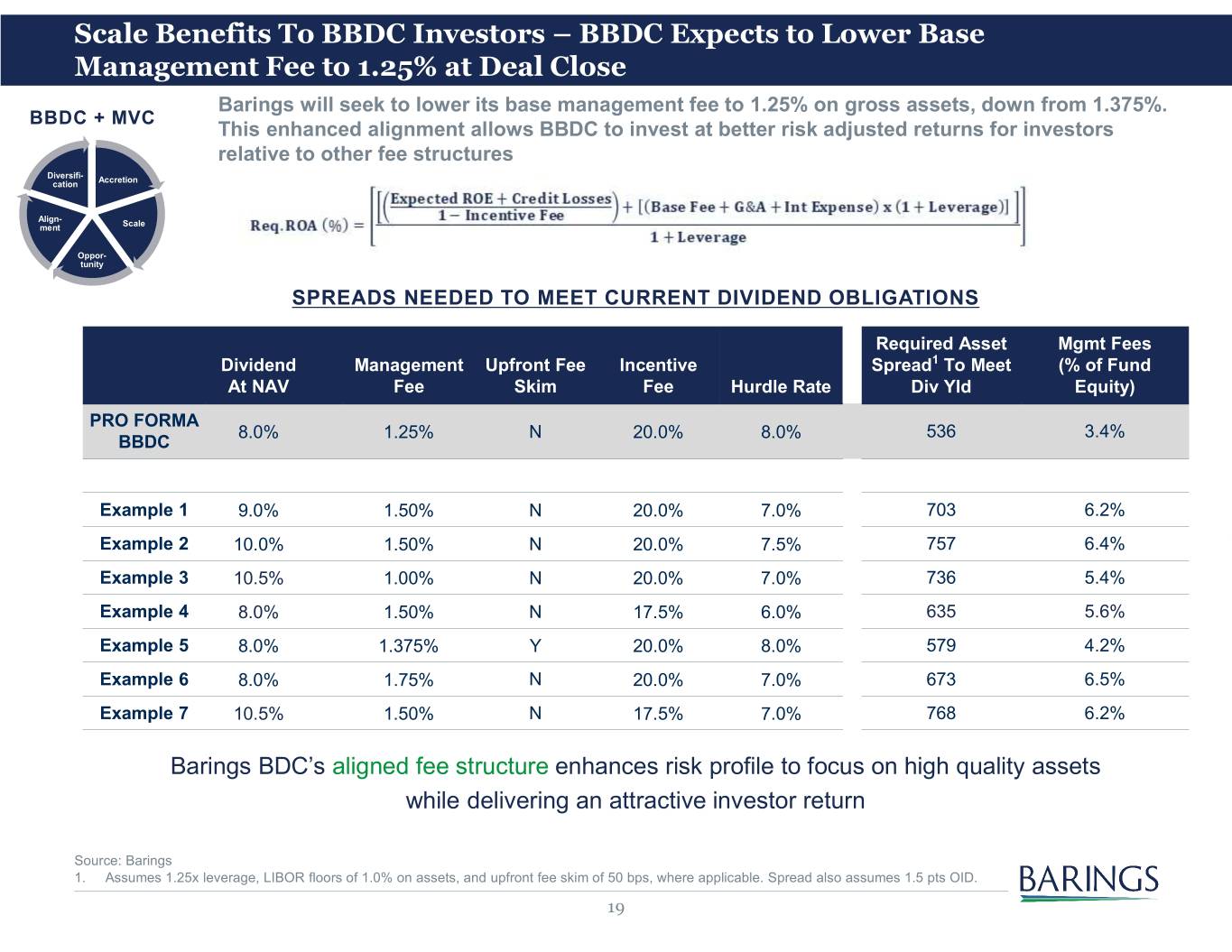

Scale Benefits To BBDC Investors – BBDC Expects to Lower Base Management Fee to 1.25% at Deal Close Barings will seek to lower its base management fee to 1.25% on gross assets, down from 1.375%. BBDC + MVC This enhanced alignment allows BBDC to invest at better risk adjusted returns for investors relative to other fee structures Diversifi- Accretion cation Align- ment Scale Oppor- tunity SPREADS NEEDED TO MEET CURRENT DIVIDEND OBLIGATIONS Required Asset Mgmt Fees Dividend Management Upfront Fee Incentive Spread1 To Meet (% of Fund At NAV Fee Skim Fee Hurdle Rate Div Yld Equity) PRO FORMA 8.0% 1.25% N 20.0% 8.0% 536 3.4% BBDC Example 1 9.0% 1.50% N 20.0% 7.0% 703 6.2% Example 2 10.0% 1.50% N 20.0% 7.5% 757 6.4% Example 3 10.5% 1.00% N 20.0% 7.0% 736 5.4% Example 4 8.0% 1.50% N 17.5% 6.0% 635 5.6% Example 5 8.0% 1.375% Y 20.0% 8.0% 579 4.2% Example 6 8.0% 1.75% N 20.0% 7.0% 673 6.5% Example 7 10.5% 1.50% N 17.5% 7.0% 768 6.2% Barings BDC’s aligned fee structure enhances risk profile to focus on high quality assets while delivering an attractive investor return Source: Barings 1. Assumes 1.25x leverage, LIBOR floors of 1.0% on assets, and upfront fee skim of 50 bps, where applicable. Spread also assumes 1.5 pts OID. 19

Alignment – Anticipated to be an Industry First: Credit Support Agreement BBDC + MVC • As a part of the transaction, Barings LLC will provide a CSA up to $23 million to limit Diversifi- Accretion cation investor downside from net cumulative realized and unrealized marks on the acquired Align- ment Scale MVC Capital portfolio relative to the purchase price while also allowing the investors to Oppor- tunity benefit from long-term MVC portfolio appreciation • The CSA will have a 10-year term, be independently fair valued quarterly, and will be recorded as an asset on BBDC’s balance sheet. To the extent there are negative marks on the MVC portfolio (the reference portfolio) relative to BBDC’s purchase price of those assets, the CSA will have a positive value on BBDC’s balance sheet • At the end of 10 years, Barings LLC will make a cash payment to BBDC to the extent losses were experienced relative to the purchase price, up to the value of the CSA • MVC’s portfolio at cost totaled $346 million and fair value as of April 30, 2020 totaled $226 million, representing 65% of original cost. The Barings CSA will provide investors downside protection on the acquired MVC assets to approximately $188 million of fair value, or 54% of MVC’s original cost 20

Opportunity to Capitalize on the Current Market BBDC + MVC Increased option value at a point when market volatility is high Diversifi- Accretion cation • Pro forma for the transaction, net debt/equity is approximately 0.8x, which is below Align- 1 ment Scale BBDC’s 6/30 net debt/equity profile of 1.0x Oppor- tunity • Anticipated increasing liquidity (and capital deployment optionality) in the face of heightened market volatility allows for improved risk-adjusted returns over market Liquidity cycles for both defensive and offensive purposes “Option” Value • Defensively, increased liquidity and optionality seeks to limit high investor costs associated with permanently dilutive rights offerings and/or high-cost unsecured issuance • Offensively, increased liquidity provides a prudent investment manager choice to deploy capital at a point when risk-adjusted returns are most attractive • Increased credit stress in global non-investment grade credit markets allow capital deployment opportunities in special situations at wide spread profiles • Market conditions and elevated volatility lead to enhanced pricing, conservative Improved leverage profiles and improved terms on par direct loans Market Opportunity • Higher price volatility allows for investment opportunities on liquid assets at wide discount margins • Expect middle-market firms to have an increased need for “gap” capital to bridge through market stress 1. Refer to slide 25 for reconciliation of Debt-to-Equity Ratio to Net Debt-to-Equity Ratio. 21

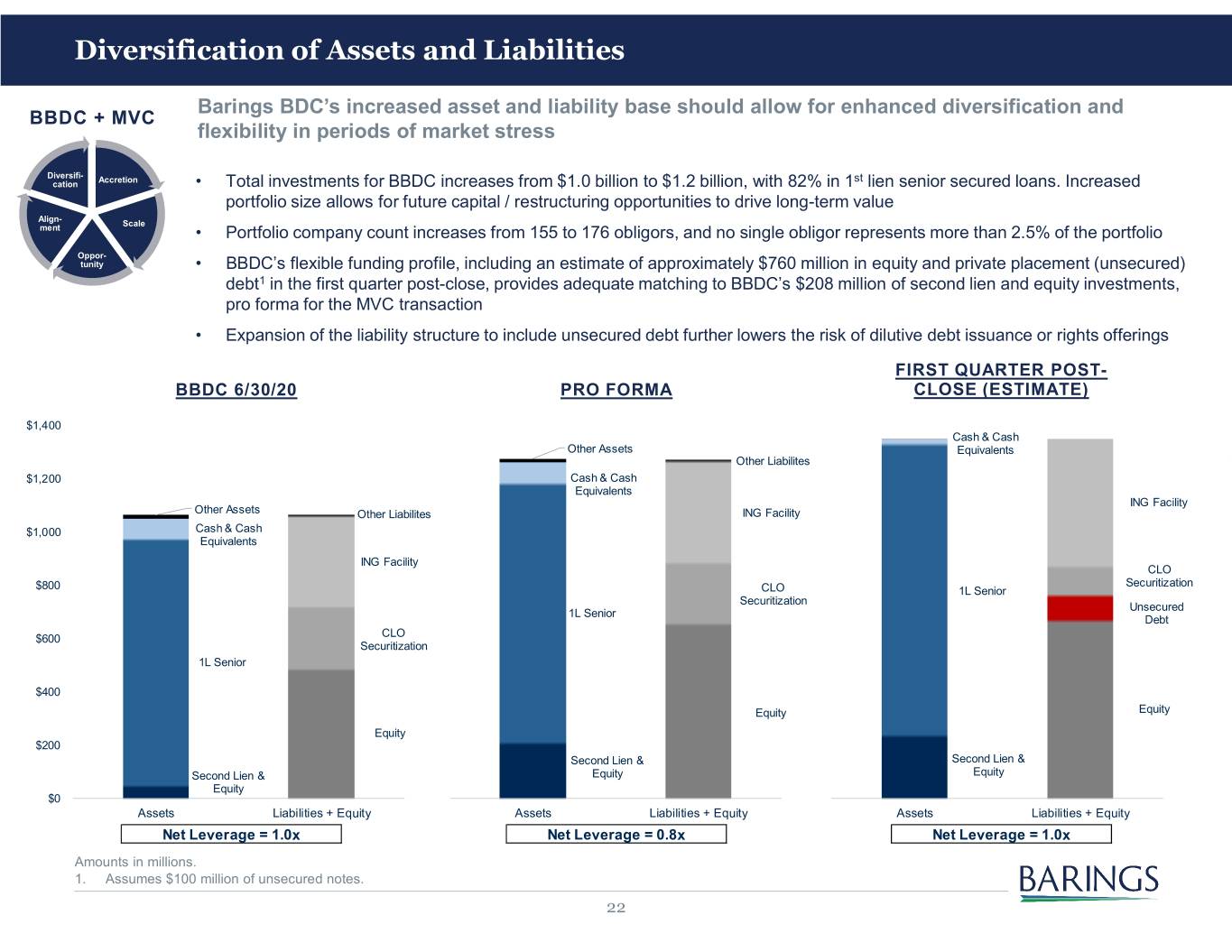

Diversification of Assets and Liabilities Barings BDC’s increased asset and liability base should allow for enhanced diversification and BBDC + MVC flexibility in periods of market stress Diversifi- Accretion st cation • Total investments for BBDC increases from $1.0 billion to $1.2 billion, with 82% in 1 lien senior secured loans. Increased portfolio size allows for future capital / restructuring opportunities to drive long-term value Align- Scale ment • Portfolio company count increases from 155 to 176 obligors, and no single obligor represents more than 2.5% of the portfolio Oppor- tunity • BBDC’s flexible funding profile, including an estimate of approximately $760 million in equity and private placement (unsecured) debt1 in the first quarter post-close, provides adequate matching to BBDC’s $208 million of second lien and equity investments, pro forma for the MVC transaction • Expansion of the liability structure to include unsecured debt further lowers the risk of dilutive debt issuance or rights offerings FIRST QUARTER POST- BBDC 6/30/20 PRO FORMA CLOSE (ESTIMATE) $1,400 Cash & Cash Other Assets Equivalents Other Liabilites $1,200 Cash & Cash Equivalents ING Facility Other Assets Other Liabilites ING Facility $1,000 Cash & Cash Equivalents ING Facility CLO Securitization $800 CLO 1L Senior Securitization Unsecured 1L Senior Debt CLO $600 Securitization 1L Senior $400 Equity Equity Equity $200 Second Lien & Second Lien & Second Lien & Equity Equity Equity $0 Assets Liabilities + Equity Assets Liabilities + Equity Assets Liabilities + Equity Net Leverage = 1.0x Net Leverage = 0.8x Net Leverage = 1.0x Amounts in millions. 1. Assumes $100 million of unsecured notes. 22

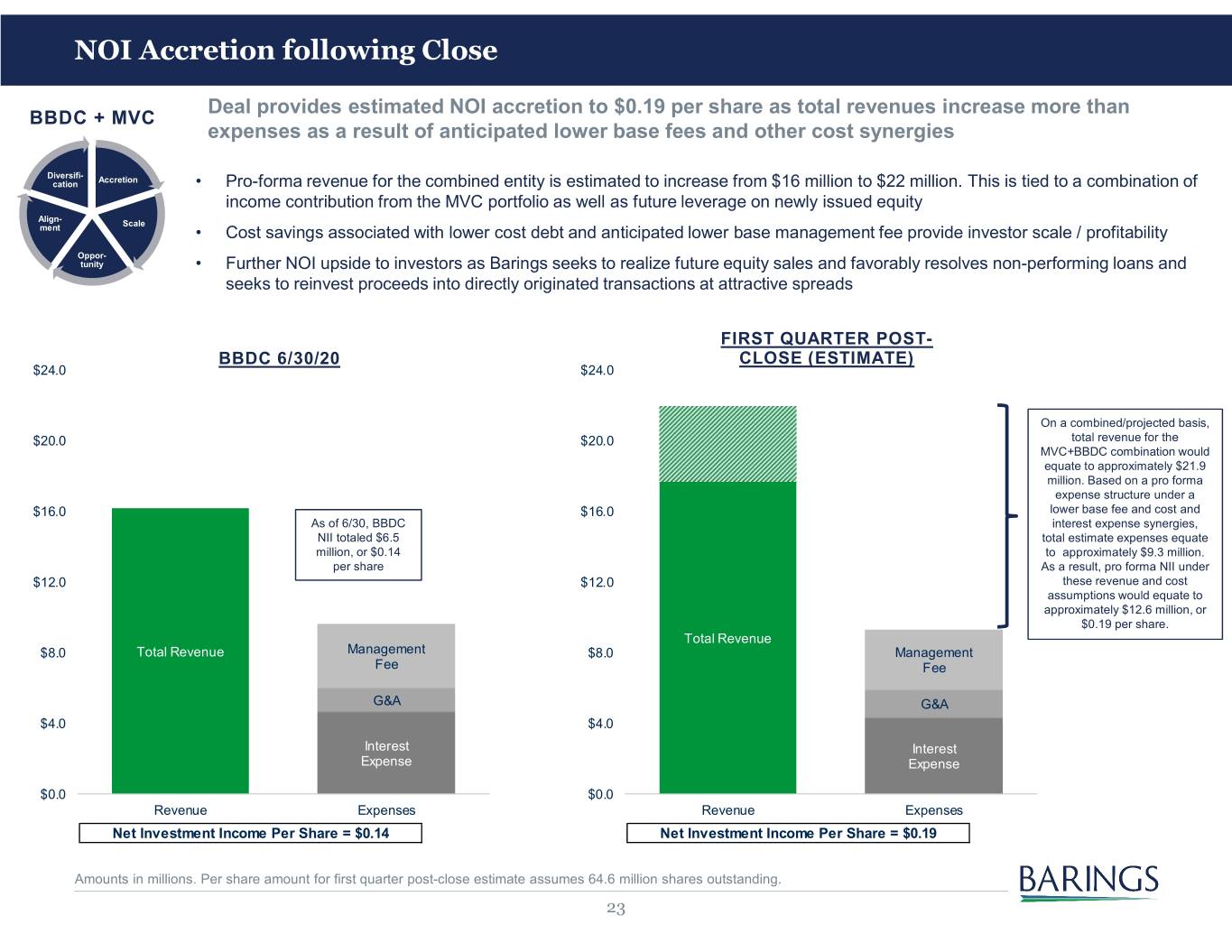

NOI Accretion following Close Deal provides estimated NOI accretion to $0.19 per share as total revenues increase more than BBDC + MVC expenses as a result of anticipated lower base fees and other cost synergies Diversifi- Accretion cation • Pro-forma revenue for the combined entity is estimated to increase from $16 million to $22 million. This is tied to a combination of income contribution from the MVC portfolio as well as future leverage on newly issued equity Align- Scale ment • Cost savings associated with lower cost debt and anticipated lower base management fee provide investor scale / profitability Oppor- tunity • Further NOI upside to investors as Barings seeks to realize future equity sales and favorably resolves non-performing loans and seeks to reinvest proceeds into directly originated transactions at attractive spreads FIRST QUARTER POST- BBDC 6/30/20 CLOSE (ESTIMATE) $24.0 $24.0 On a combined/projected basis, $20.0 $20.0 total revenue for the MVC+BBDC combination would equate to approximately $21.9 million. Based on a pro forma expense structure under a $16.0 $16.0 lower base fee and cost and As of 6/30, BBDC interest expense synergies, NII totaled $6.5 total estimate expenses equate million, or $0.14 to approximately $9.3 million. per share As a result, pro forma NII under $12.0 $12.0 these revenue and cost assumptions would equate to approximately $12.6 million, or $0.19 per share. Total Revenue $8.0 Total Revenue Management $8.0 Management Fee Fee G&A G&A $4.0 $4.0 Interest Interest Expense Expense $0.0 $0.0 Revenue Expenses Revenue Expenses Net Investment Income Per Share = $0.14 Net Investment Income Per Share = $0.19 Amounts in millions. Per share amount for first quarter post-close estimate assumes 64.6 million shares outstanding. 23

Appendix

Appendix: Reconciliation of Debt to Net Debt and Calculation of Net Debt-to- Equity and Pro Forma Debt-to-Equity and Net Debt-to-Equity Ratios BBDC June 30, 2020 Transaction Pro Forma + = (As Reported) Adjustments Combined at Close Total debt (principal) $569.3 $44.4 $613.7 minus: Cash ($18.5) — ($18.5) minus: Short-term investments ($58.0) — ($58.0) minus: Receivable from unsettled transactions ($0.6) — ($0.6) Total net debt $492.3 $44.4 $536.6 Total net assets $490.5 $170.5 $661.0 Total debt-to-equity ratio 1.2x 0.9x Total net debt-to-equity ratio 1.0x 0.8x Dollars in millions; totals may not foot due to rounding. 25

Appendix: Barings BDC Corporate Data Board of Directors Investment Committee Corporate Officers Research Coverage Corporate Headquarters MICHAEL FRENO ERIC LLOYD ERIC LLOYD BANK OF AMERICA 300 South Tryon Street Chairman of BBDC Board, Chief Executive Officer Chief Executive Officer MERRILL LYNCH Suite 2500 President of Barings, Head of Derek Hewett Charlotte, NC 28202 Investments at Barings IAN FOWLER IAN FOWLER (415) 676-3518 President President Investor Relations TOM FINKE COMPASS POINT Chairman and CEO of JONATHAN BOCK JONATHAN BOCK Casey Alexander (888) 401-1088 Barings Chief Financial Officer Chief Financial Officer (646) 448-3027 BDCInvestorRelations@barings.com ERIC LLOYD TOM MCDONNELL MICHAEL COWART JANNEY MONTGOMERY CEO of BBDC, Head of Vice President Chief Compliance Officer SCOTT Media Contact Global Private Investments at Mitchell Penn Barings JILL DINERMAN (410) 583-5976 Cheryl Krauss Chief Legal Officer (980) 417-5858 TOM OKEL JEFFERIES cheryl.krauss@barings.com Former Executive Director of ELIZABETH MURRAY Kyle Joseph Catawba Lands Conservancy, Principal Accounting Officer (415) 229-1525 Corporate Counsel a nonprofit land trust CHRIS CARY KBW, INC. Dechert LLP JILL OLMSTEAD Head of Stakeholder Ryan Lynch Chief Human Resources Relations and Assistant (314) 342-2918 Officer at LendingTree Treasurer Independent Accounting Firm NATIONAL SECURITIES MARK MULHERN JONATHAN LANDSBERG CORP KPMG LLP Senior Vice President and Assistant Director of Finance Bryce Rowe CFO at Highwoods Properties (212) 417-8243 Securities Listing TOM MCDONNELL JOHN SWITZER Vice President RAYMOND JAMES NYSE: BBDC Retired Managing Partner at Robert Dodd KPMG THOMAS MOSES (901) 579-4560 Treasurer Transfer Agent WELLS FARGO ALEXANDRA PACINI SECURITIES Computershare, Inc. Assistant Secretary Finian O’Shea (886) 228-7201 (704) 410-0067 www.computershare.com/investor ASHLEE STEINNERD Corporate Secretary Website www.baringsbdc.com 26