DEFR14A: Definitive revised proxy soliciting materials

Published on March 20, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

(Amendment No. 1)

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ |

Preliminary Proxy Statement |

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

Definitive Proxy Statement |

¨ |

Definitive Additional Materials |

¨ |

Soliciting Material Pursuant to Section 240.14a-12 |

(Name of Registrant as Specified in its Charter) | ||||

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required. |

|||

¨ |

Fee paid previously with preliminary materials. |

|||

¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

Explanatory Note

This Amendment No. 1 (this “Amendment”) to the Definitive Proxy Statement and related Proxy Card that was filed

by Barings BDC, Inc. (the “Company”) with the Securities and Exchange Commission on March 19, 2024

(collectively, the “Original Filing”) amends and restates in its entirety the Original Filing (which was not previously

mailed to the Company’s stockholders) to remove the inadvertent inclusion of references to the Company’s 2023

annual meeting of stockholders. The Company will print and mail to its stockholders this revised definitive proxy

statement in lieu of the Original Filing.

300 South Tryon Street, Suite 2500

Charlotte, North Carolina 28202

(704) 805-7200

March 19, 2024

Dear Stockholder:

You are cordially invited to the 2024 Annual Meeting of Stockholders of Barings BDC, Inc., to be held

virtually on Tuesday, May 7, 2024 at 8:30 a.m. (Eastern Time), at the following website:

www.virtualshareholdermeeting.com/BBDC2024.

The notice of Annual Meeting of Stockholders and proxy statement accompanying this letter provide an

outline of the business to be conducted at the meeting.

It is important that your shares be represented at the Annual Meeting. If you are unable to attend the meeting

virtually, I urge you to vote your shares by completing, dating and signing the enclosed proxy card and promptly

returning it in the envelope provided. If a broker or other nominee holds your shares in “street name,” your broker

has enclosed a voting instruction form, which you should use to vote those shares. The voting instruction form

indicates whether you have the option to vote those shares by telephone or by using the Internet. Your vote is

important.

Sincerely yours, |

Eric Lloyd |

Chief Executive Officer |

& Executive Chairman |

BARINGS BDC, INC.

300 South Tryon Street, Suite 2500

Charlotte, North Carolina 28202

(704) 805-7200

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On Tuesday, May 7, 2024

To the Stockholders of Barings BDC, Inc.:

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Barings BDC, Inc. (the “Company”)

will be held virtually on Tuesday, May 7, 2024 at 8:30 a.m. (Eastern Time) at the following website:

www.virtualshareholdermeeting.com/BBDC2024. The Annual Meeting will be held in a virtual meeting format

only. You will not be able to attend the Annual Meeting in person.

You are being asked to consider and vote upon the following proposals:

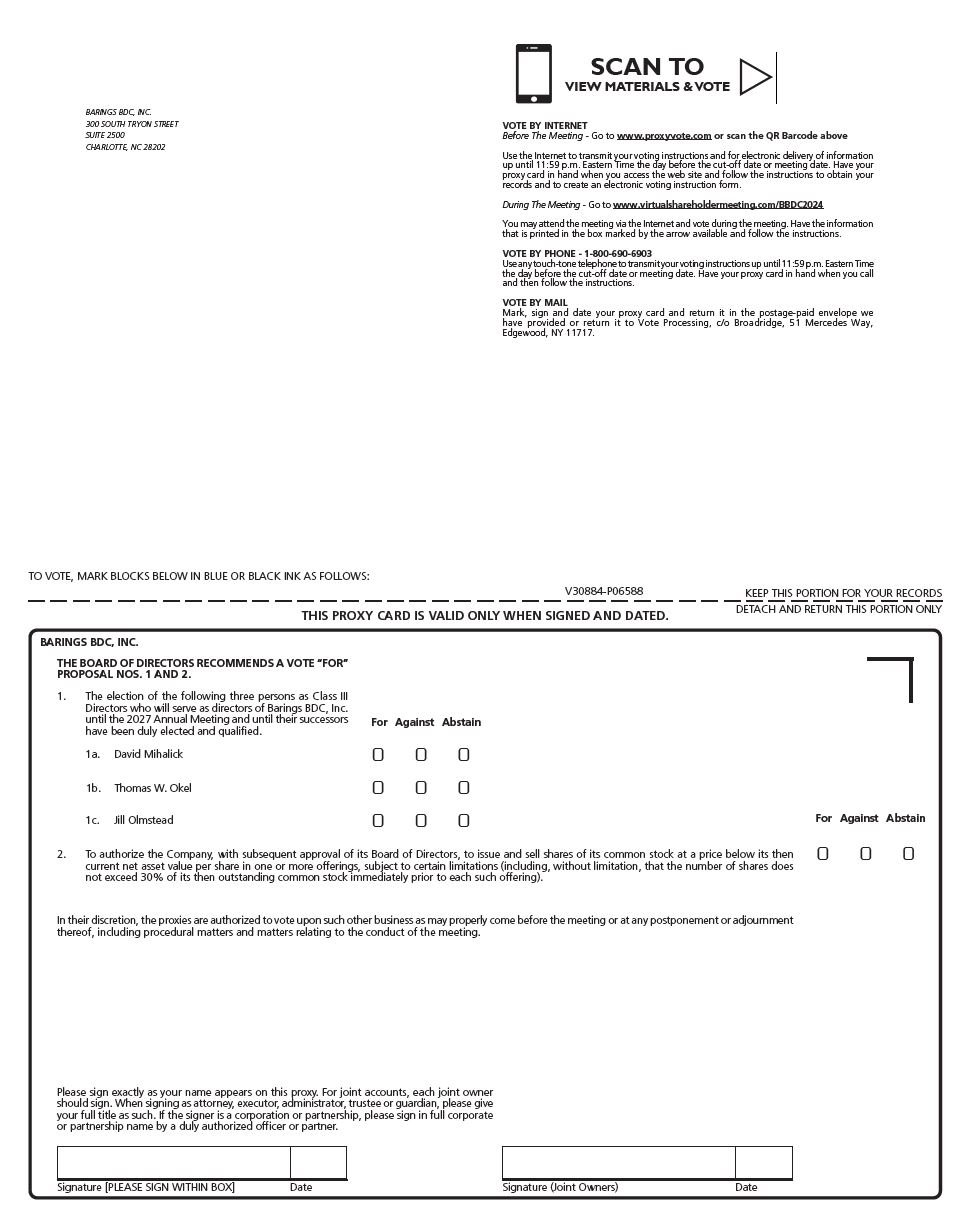

1. To elect three Class III directors to serve for a three-year term and until their successors have been

duly elected and qualify (Proposal No. 1);

2. To approve a proposal to authorize the Company, pursuant to subsequent approval of its Board of

Directors, to issue and sell shares of its common stock (during the 12 months following such authorization) at a price

below the Company’s then-current net asset value per share in one or more offerings, subject to certain limitations

set forth in the Proxy Statement accompanying this Notice (including, without limitation, that the number of shares

issued and sold pursuant to such authority does not exceed 30% of the Company’s then-outstanding common stock

immediately prior to each such offering) (Proposal No. 2); and

3. To transact such other business as may properly come before the meeting.

We have enclosed our annual report on Form 10-K for the year ended December 31, 2023, proxy statement

and a proxy card.

Our Board of Directors has fixed the close of business on March 8, 2024, as the record date for the

determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournment or

postponement thereof. We intend to mail these materials on or about March 19, 2024, to all stockholders of record

entitled to vote at the Annual Meeting.

Each Company stockholder is invited to attend the Annual Meeting virtually. You or your proxyholder will be

able to attend the Annual Meeting online, vote and submit questions by visiting

www.virtualshareholdermeeting.com/BBDC2024 and using a control number assigned by Broadridge Financial

Solutions, Inc. (“Broadridge”). Please see "How To Participate in the Annual Meeting" in the accompanying proxy

statement for more information.

Whether or not you expect to be present at the virtual Annual Meeting, please sign the enclosed proxy card

and return it promptly in the self-addressed envelope provided. Instructions are shown on the proxy card. If a broker

or other nominee holds your shares in “street name,” that is they are registered in the name of your broker, bank,

trustee or other nominee, you should have received a notice containing voting instructions from your nominee rather

than from us. You should follow the voting instructions in the notice to ensure that your vote is counted. The voting

instruction form indicates whether you have the option to vote those shares by telephone or by using the Internet.

Your vote is extremely important to the Company. In the event there are not sufficient votes for a quorum or

to approve or ratify any of the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be

adjourned in order to permit further solicitation of proxies by the Company.

OUR BOARD OF DIRECTORS INCLUDING EACH OF THE INDEPENDENT DIRECTORS,

UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" EACH OF THE PROPOSALS.

If you have additional questions and you are a Barings BDC, Inc., stockholder you may contact the

Company’s Investor Relations department at 1-888-401-1088, or by email at BDCinvestorrelations@barings.com.

You may also contact Broadridge, the Company's proxy solicitor, toll-free at 1-877-777-4652 for directions on how

to attend the Annual Meeting virtually and how to vote during the virtual meeting.

By order of the Board of Directors, |

Alexandra Pacini |

Secretary, Barings BDC, Inc. |

Charlotte, North Carolina

March 19, 2024

This is an important Annual Meeting. To ensure proper representation at the Annual Meeting, please

complete, sign, date and return the proxy card in the enclosed, self-addressed envelope, or vote your shares

electronically via the Internet or by telephone. Please see the enclosed proxy statement and the enclosed proxy

card for details about electronic voting. Even if you vote your shares prior to this Annual Meeting, you still

may attend the meeting and vote your shares electronically via the live webcast if you wish to change your

vote.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to

Be Held on Tuesday, May 7, 2024:

Our notice of the Annual Meeting, proxy statement, and annual report on Form 10-K for the year ended

December 31, 2023 are available on the internet at https://materials.proxyvote.com/06759L.

The following information applicable to the Annual Meeting may be found in the notice of the Annual Meeting,

proxy statement and accompanying proxy card:

▪The date, time and location of the meeting;

▪A list of the matters intended to be acted on and our Board of Directors' recommendations regarding those

matters;

▪Any control/identification numbers that you need to access your proxy card; and

▪Information on how to obtain directions to attend the Annual Meeting electronically via the live webcast.

BARINGS BDC, INC.

300 South Tryon Street, Suite 2500

Charlotte, North Carolina 28202

(704) 805-7200

PROXY STATEMENT

2024 Annual Meeting of Stockholders

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Barings

BDC, Inc. (the “Company,” “Barings BDC,” “we,” “us” or “our”) for use at our 2024 Annual Meeting of

Stockholders to be held virtually on Tuesday, May 7, 2024 at 8:30 a.m. (Eastern Time) at the following website:

www.virtualshareholdermeeting.com/BBDC2024, and at any postponement or adjournment thereof (the “Annual

Meeting”). The Notice of Annual Meeting, this proxy statement, the accompanying proxy card and our Annual

Report for the fiscal year ended December 31, 2023, which includes audited financial statements for the year ended

December 31, 2023, are first being released on or about March 19, 2024 to the Company's stockholders of record as

of the close of business on March 8, 2024.

We encourage you to access the Annual Meeting prior to the start time. The live webcast will begin promptly at 8:30

a.m. (Eastern Time) on Tuesday, May 7, 2024. We will have technicians ready to assist you with any technical

difficulties you may have accessing the live webcast. Technical support will be available on the meeting website

starting approximately 8:15 a.m. (Eastern Time) and will remain available until the Annual Meeting has finished.

The virtual meeting platform is fully supported across browsers and devices running the most updated version of

applicable software and plugins. Participants should ensure that they have a strong WiFi connection if they intend to

participate in the Annual Meeting. Participants should also give themselves plenty of time to log in and ensure that

they can hear audio prior to the start of the Annual Meeting. Please see “How to Participate in the Annual Meeting”

below for additional details.

We encourage you to vote your shares, either by voting electronically via the live webcast of the Annual Meeting or

by granting a proxy (i.e., authorizing someone to vote your shares). If you properly sign, date and mail the

accompanying proxy card or authorize your proxy by telephone or through the Internet, and the Company receives it

in time for voting at the Annual Meeting, the persons named as proxies will vote your shares in the manner that you

specify. If you give no instructions on the proxy card you execute, the shares covered by the proxy card will be

voted “FOR” the election of the nominees as directors and "FOR" the proposal to authorize the Company,

with the subsequent approval of its Board of Directors, to issue and sell shares of its common stock (during

the 12 months following such authorization) at a price below its then-current net asset value per share in one

or more offerings, subject to certain limitations set forth herein (including, without limitation, that the

number of shares issued and sold pursuant to such authority does not exceed 30% of the Company’s then-

outstanding common stock immediately prior to each such offering). If any other business is brought before

the Annual Meeting, your votes will be cast at the discretion of the proxy holders, subject to applicable SEC

rules.

Any stockholder “of record” (i.e., stockholders holding shares directly in their name) giving a valid proxy for the

Annual Meeting may revoke it before it is exercised by giving a later-dated properly executed proxy, by giving

notice of revocation to the Company's Secretary in writing before the Annual Meeting or by voting electronically via

the live webcast of the Annual Meeting. However, the mere presence of the stockholder at the Annual Meeting does

not revoke the proxy. Any stockholder of record attending the Annual Meeting virtually by live webcast may vote

electronically whether or not he or she has previously authorized his or her shares to be voted by proxy.

If your shares are registered in the name of a bank, brokerage firm or other nominee, you will receive instructions

from your bank, broker, or other nominee that you must follow in order to instruct how your shares are to be voted at

the Annual Meeting. If your shares are registered in the name of a bank, brokerage firm or other nominee, to revoke

any voting instructions prior to the time the vote is taken at the Annual Meeting, you must contact such broker, bank

or other institution or nominee to determine how to revoke your vote in accordance with its policies a sufficient time

1

in advance of the Annual Meeting. Unless revoked as stated above, the shares of common stock represented by valid

proxies will be voted on all matters to be acted upon at the Annual Meeting.

If you want to submit a question during the Annual Meeting, log into the live webcast at

www.virtualshareholdermeeting.com/BBDC2024, type your question into the “Ask a Question” field, and click

“Submit.”

Only questions submitted via the live webcast that are pertinent to Annual Meeting matters will be answered during

the Annual Meeting, subject to time constraints. Questions or comments that are not related to the proposals under

discussion, are about personal concerns not shared by stockholders generally, or use blatantly offensive language

may be ruled out of order. Additionally, the Company may not be able to answer multiple questions submitted by

the same stockholder. The Company intends to post and answer questions pertinent to the Annual Meeting matters

that cannot be answered during the Annual Meeting due to time constraints online at the Company’s website at

https://ir.barings.com/annual-shareholder-meeting-materials. The questions and answers will be available as soon as

practicable after the Annual Meeting and will remain available until one week after posting.

PURPOSE OF ANNUAL MEETING

At the Annual Meeting, you will be asked to consider and vote on the following proposals:

1.To elect three Class III directors to serve for a three-year term and until their successors have been duly

elected and qualify (Proposal No. 1);

2.To approve a proposal to authorize the Company, pursuant to subsequent approval of its Board of

Directors, to issue and sell shares of its common stock (during the 12 months following such authorization)

at a price below the Company’s then-current net asset value per share in one or more offerings, subject to

certain limitations set forth herein (including, without limitation, that the number of shares issued and sold

pursuant to such authority does not exceed 30% of the Company’s then-outstanding common stock

immediately prior to each such offering) (Proposal No. 2); and

3.To transact such other business as may properly come before the meeting, or any postponement or

adjournment thereof.

The Board of Directors is not aware of any matter to be presented for action at the Annual Meeting other than the

matters set forth herein. Should any other matter requiring a vote of stockholders arise, it is the intention of the

persons named in the proxy to vote in accordance with their discretion on such matters. Stockholders have no

dissenters' or appraisal rights in connection with any of the proposals described herein.

Adjournment and Additional Solicitation

If there appear to be insufficient votes to obtain a quorum at the Annual Meeting, the chairman of the meeting or the

stockholders who are represented in person (electronically via the live webcast) or by proxy may vote to adjourn the

Annual Meeting to permit further solicitation of proxies. If adjournment is submitted to the stockholders for

approval, the designated Company proxy holders will vote proxies held by each of them for such adjournment to

permit the further solicitation of proxies. Approval of any proposal to adjourn the Annual Meeting submitted to the

stockholders for approval requires the affirmative vote of a majority of the votes cast on the proposal.

A stockholder vote may be taken on any of the proposals in this Proxy Statement prior to any such adjournment if

there are sufficient votes for approval of such proposal.

You may vote at the Annual Meeting only if you were a holder of record of the Company's common stock at the

close of business on March 8, 2024 or if you hold a valid proxy from a stockholder of record as of such record date.

As of March 8, 2024, there were 106,067,070 shares of the Company's common stock outstanding. Each share of

common stock is entitled to one vote on each matter submitted to a vote at the Annual Meeting. Stockholders do not

2

QUORUM REQUIRED

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual

Meeting, electronically via live webcast or by proxy, of the holders of shares of common stock of the Company

entitled to cast a majority of the votes entitled to be cast as of the record date of March 8, 2024 will constitute a

quorum for the purposes of the Annual Meeting. If there are not sufficient votes for a quorum or to approve or ratify

any of the foregoing proposals at the time of the Annual Meeting, the chairman of the meeting may adjourn the

Annual Meeting in order to permit further solicitation of proxies by the Company.

Abstentions and broker non-votes, if any, will be treated as shares present for the purpose of determining a quorum

for the Annual Meeting. A “broker non-vote” with respect to a matter occurs when a broker, bank or other institution

or nominee holding shares on behalf of a beneficial owner returns a proxy but has not provided voting instructions

because it has not received voting instructions from the beneficial owner on a particular proposal and does not have,

or chooses not to exercise, discretionary authority to vote the shares on such proposals. If a stockholder does not

vote electronically via the live webcast or does not submit voting instructions to its broker, bank or other nominee,

the broker, bank or other nominee will only be permitted to vote the stockholder’s shares on “routine” proposals.

There are no “routine” proposals at the Annual Meeting. Therefore, the Company does not expect to receive any

broker non-votes at the Annual Meeting.

VOTES REQUIRED

Proposal No. 1

You may vote “For” or “Against” or abstain from voting on Proposal No. 1 (to elect three Class III directors to serve

for a term of three years, and until their successors are duly elected and qualify). For nominees for director listed in

Proposal No. 1 to be elected, each director nominee requires a majority of the votes cast for his or her election,

which means that each director nominee must receive more votes cast “FOR” than “AGAINST” that director

nominee. For purposes of the vote on this proposal, abstentions and broker non-votes, if any, will not be counted as

votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose

of determining the presence of a quorum. If an incumbent director nominee does not receive the required number of

votes for re-election, then under Maryland law, he or she will continue to serve as a director of the Company until

his or her successor is duly elected and qualifies, subject to the Company's corporate governance guidelines

discussed further below.

Proposal No. 2

You may vote “For” or “Against” or abstain from voting on Proposal No. 2 (to authorize the Company, with the

subsequent approval of its Board of Directors, to issue and sell shares of its common stock (during the 12 months

following such authorization) at a price below its then-current net asset value per share in one or more offerings,

subject to certain limitations set forth herein (including, without limitation, that the number of shares issued and sold

pursuant to such authority does not exceed 30% of the Company’s then-outstanding common stock immediately

prior to each such offering)). To be approved, Proposal No. 2 must receive “FOR” votes from each of the following:

(1) a majority of the outstanding shares of the Company’s common stock; and (2) a majority of the outstanding

shares of the Company’s common stock that are not held by affiliated persons of the Company. For purposes of

Proposal No. 2, the Investment Company Act of 1940, as amended (the “1940 Act”), defines a “majority of the

outstanding shares” as the vote of the lesser of: (1) 67% or more of the voting securities of the Company present at

the Annual Meeting, if the holders of more than 50% of the outstanding voting securities of the Company are present

virtually or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Company. For

purposes of the vote on Proposal No. 2, abstentions and broker non-votes, if any, will have the effect of votes cast

against the proposal.

HOW TO PARTICIPATE IN THE ANNUAL MEETING

The Annual Meeting will be conducted virtually, on Tuesday, May 7, 2024 at 8:30 a.m. (Eastern Time) via live

webcast.

3

Stockholders of record can participate in the Annual Meeting virtually by logging in to

www.virtualshareholdermeeting.com/BBDC2024 and following the instructions provided. We recommend that you

log in at least ten minutes before the Annual Meeting to ensure you are logged in when the meeting starts. Only

registered stockholders as of March 8, 2024, the record date for the Annual Meeting, may submit questions and vote

at the Annual Meeting. You may still virtually participate in the Annual Meeting if you vote by proxy in advance of

the Annual Meeting.

Upon written request from a stockholder of record as of the record date, the Company's legal counsel, Dechert LLP,

will stream the webcast live at its offices located at 1900 K Street NW, Washington, DC 20006. Please note that no

members of the Company's management or the Board will be in attendance at this location. If you wish to attend the

Annual Meeting via webcast at the Washington, DC offices of Dechert LLP, please submit a written request to

Barings BDC, Inc., Attention: Corporate Secretary, 300 South Tryon Street, Suite 2500, Charlotte, NC 28202, to be

received no later than April 30, 2024. Your written request must include your name as stockholder of record and the

number of shares of the Company’s common stock you hold.

Please note that if you hold your shares through a bank, broker or other nominee (i.e., in street name), you may be

able to authorize your proxy by telephone or the Internet, as well as by mail. You should follow the instructions you

receive from your bank, broker or other nominee to vote these shares. Also, if you hold your shares in street name,

you must obtain a proxy executed in your favor from your bank, broker or nominee to be able to participate in and

vote via the Annual Meeting webcast.

The Company and Dechert LLP are sensitive to the health and travel concerns of the Company's

stockholders and recommendations from public health officials. As a result, the location, means, or other

details of attending the webcast of the Annual Meeting at Dechert LLP's Washington, DC offices may change.

In the event of such a change, and if a stockholder of record has requested to attend the meeting via webcast

at Dechert LLP's Washington, DC offices, the Company will issue a press release announcing the change and

file the announcement on the SEC's EDGAR system, along with other steps, but may not deliver additional

soliciting materials to stockholders or otherwise amend the proxy materials. The Company plans to announce

these changes, if any, at https://ir.barings.com/, and encourages you to check the “Investor Relations” and

“Latest News” sections of this website prior to the Annual Meeting if you plan to attend the webcast at the

Washington, DC offices of Dechert LLP.

INFORMATION REGARDING THIS SOLICITATION

The Company will bear the cost of solicitation of proxies in the form accompanying this statement. Proxies will be

solicited by mail or by requesting brokers and other custodians, nominees and fiduciaries to forward proxy soliciting

material to the beneficial owners of shares of common stock held of record by such brokers, custodians, nominees

and fiduciaries, each of whom the Company will reimburse for its expenses in so doing. In addition to the use of

mail, directors, officers and regular employees of Barings LLC, the Company’s external investment adviser

(“Barings” or the “Adviser”), without special compensation therefor, may solicit proxies personally or by telephone,

electronic mail, facsimile or other electronic means from stockholders. The address of Barings LLC is 300 South

Tryon Street, Suite 2500, Charlotte, NC 28202.

The Company has engaged the services of Broadridge Financial Solutions, Inc. ("Broadridge") for the purpose of

assisting in the solicitation of proxies at an anticipated cost of approximately $54,000 plus reimbursement of certain

expenses and fees for additional services requested. We may also reimburse brokerage firms, banks and other agents

for the cost of forwarding proxy materials to beneficial owners and obtaining your voting instructions. Please note

that Broadridge may solicit stockholder proxies by telephone on behalf of the Company. They will not attempt to

influence how you vote your shares, but only ask that you take the time to authorize your proxy. You may also be

asked if you would like to authorize your proxy over the telephone and to have your voting instructions transmitted

to the Company’s proxy tabulation firm.

Stockholders may authorize proxies and provide their voting instructions through the Internet, by telephone, or by

mail by following the instructions on the proxy card. These options require stockholders to input the Control

Number, which is provided on the proxy card. If you authorize a proxy using the Internet, after visiting

www.proxyvote.com and inputting your Control Number, you will be prompted to provide your voting instructions.

4

Stockholders will have an opportunity to review their voting instructions and make any necessary changes before

submitting their voting instructions and terminating their Internet link. Stockholders who authorize a proxy via the

Internet, in addition to confirming their voting instructions prior to submission, will, upon request, receive an e-mail

confirming their instructions.

If a stockholder wishes to participate in the Annual Meeting but does not wish to authorize his, her or its proxy by

telephone or Internet, the stockholder may authorize a proxy by mail by completing and executing the

accompanying proxy card and returning it in the postage-paid envelope or attend the Annual Meeting via live

webcast.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL

MEETING VIRTUALLY, PLEASE PROMPTLY VOTE YOUR SHARES EITHER BY MAIL, BY

TELEPHONE, OR VIA THE INTERNET.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board of Directors is currently comprised of nine Directors divided into three (3) classes, with terms expiring in

2024, 2025 and 2026. The term of office of Class III Directors ends on the date of the Annual Meeting (or on the

date their respective successors are elected and qualify, if later).

The three Class III Directors of the Company—David Mihalick, Thomas W. Okel and Jill Olmstead—have been

nominated by the Board of Directors (upon the recommendation of the Nominating and Corporate Governance

Committee) for election for a three-year term expiring in 2027. No person being nominated as a Class III Director is

being proposed for election pursuant to any agreement or understanding between such person, on the one hand, and

the Company or any other person or entity, on the other hand. Each Class III Director has agreed to serve as a

director if elected and has consented to be named as a nominee.

Pursuant to the Company's Seventh Amended and Restated Bylaws (the “Bylaws”), a nominee for director is elected

to the Board of Directors if the number of votes cast for such nominee’s election exceed the number of votes cast

against such nominee’s election. Pursuant to the Company's corporate governance guidelines, incumbent directors

must agree to tender their resignation if they fail to receive the required number of votes for re-election, and in such

event the Board of Directors will act within 90 days following certification of the stockholder vote to determine

whether to accept the director’s resignation. These procedures are described in more detail in the Company's

corporate governance guidelines, which are available under “Governance Documents” on the Investor Relations

section of the Company's website at https://ir.barings.com/governancedocs. The Board of Directors may consider

any factors it deems relevant in deciding whether to accept a director’s resignation. If a director’s resignation offer is

not accepted by the Board of Directors, the Company expects that such director would continue to serve until his or

her successor is duly elected and qualifies, or until the director’s earlier death, resignation, or removal. Any such

director will be eligible for nomination for election as a director at future Annual Meetings.

The Board of Directors recommends that you vote “FOR” the election of the nominees named in this proxy

statement.

In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such

proxy for the election of all the nominees named below. If any of the nominees should decline or be unable to

serve as a director, it is intended that the proxy will be voted for the election of such person or persons who

are nominated as replacements. The Board of Directors has no reason to believe that any of the persons

named below will be unable or unwilling to serve.

Information about the Nominees for Director and Other Directors

The following chart summarizes the professional experience and additional considerations that contributed to the

Nominating and Corporate Governance Committee’s and the Board of Directors’ conclusion that each nominee for

Director and other Director should serve on the Board of Directors. The term “Fund Complex” included in the

5

director biographies included in this proxy statement includes the Company, Barings Capital Investment Corporation

(“BCIC”) (a non-listed business development company), Barings Private Credit Corporation (“BPCC”) (a

perpetually offered non-listed business development company), Barings Global Short Duration High Yield Fund (a

closed-end fund), Barings Corporate Investors (a closed-end fund), and Barings Participation Investors (a closed-end

fund). The director information in the following chart is organized by class and, within each class, by “Interested

Directors” and “Non-Interested Directors.” “Interested Directors” are “interested persons,” as defined in Section

2(a)(19) of the 1940 Act, of the Company.

6

NOMINEES FOR CLASS III DIRECTORS

Name, Address and Age(1)

|

Position(s)

Held with

Company

|

Term and

Length of Time

Served

|

Principal Occupations

During Past 5 Years

|

Number

of

Portfolios

Overseen

in Fund

Complex

(2)

|

Other Directorships of Public or

Registered Investment Companies

Held by Director or Nominee for

Director During Past 5 Years

|

Interested Director |

|||||

David Mihalick(3) (51)

|

Director |

Class III

Director;

Term expires

2024;

Director

since

November

2020

|

Head of Private Assets

(since 2021), Head of

U.S. Public Fixed

Income and Member of

Global Investment

Grade Allocation

Committee

(2019-2021), Head of

U.S. High Yield and

Member of Global

High Yield Allocation

Committee

(2017-2021), Barings

LLC (global asset

manager).

|

5 |

Director (since March 2021),

BCIC; Trustee (since 2020),

Barings Global Short

Duration High Yield Fund

(closed-end investment

company advised by

Barings); Trustee (since

2022), Barings Corporate

Investors (a closed-end fund

advised by Barings); Trustee

(since 2022), Barings

Participation Investors (a

closed-end fund advised by

Barings); Trustee

(2020-2021), Barings Funds

Trust (open-end investment

company advised by Barings

until 2021.

|

7

Non-Interested

Directors

|

|||||

Thomas W. Okel (61) |

Director |

Class III

Director;

Term expires

2024;

Director

since August

2018

|

Executive Director

(2011 - 2019),

Catawba Lands

Conservancy.

|

4 |

Director (since 2021), BPCC;

Director (since 2020), BCIC;

Trustee (since 2012), Barings

Global Short Duration High

Yield Fund (closed-end

investment company advised

by Barings); Trustee (since

2015), Horizon Funds

(mutual fund complex);

Trustee (2013-2021), Barings

Funds Trust (open-end

investment company advised

by Barings until 2021);

Trustee (2022-2024), Barings

Private Equity Opportunities

and Commitments Fund (a

non-diversified, closed-end

management investment

company advised by Barings

until February 2024).

|

Jill Olmstead (60) |

Director |

Class III

Director;

Term expires

2024;

Director

since August

2018

|

Chief Human

Resources Officer,

(since 2018),

LendingTree, Inc.;

Founding Partner

(2010-2018), Spivey

& Olmstead, LLC

(talent and leadership

consulting firm).

|

4 |

Director (since 2021), BPCC;

Trustee (since Aug. 2021),

Barings Global Short

Duration High Yield Fund

(closed-end investment

company advised by

Barings); Director (since

2020), BCIC; Trustee

(2022-2024), Barings Private

Equity Opportunities and

Commitments Fund (a non-

diversified, closed-end

management investment

company advised by Barings

until February 2024).

|

(1)The business address of each nominee for director is 300 South Tryon Street, Suite 2500, Charlotte, NC 28202. The age

of each individual is as of the date of the Annual Meeting.

(2)Including the Company.

(3)Interested Director due to affiliations with Barings LLC.

8

CLASS I DIRECTORS: TERM EXPIRING 2025

Name, Address and Age(1)

|

Position(s)

Held with

Company

|

Term and

Length of Time

Served

|

Principal Occupations

During Past 5 Years

|

Number

of

Portfolios

Overseen

in Fund

Complex

(2)

|

Other Directorships of Public or

Registered Investment Companies

Held by Director or Nominee for

Director During Past 5 Years

|

Interested Director |

|||||

Eric Lloyd(3) (55)

|

Chief

Executive

Officer

and

Executive

Chairman

of the

Board of

Directors

|

Class I

Director;

Term

Expires

2025;

Director

since August

2018

|

President (since 2021),

Global Head of Private

Assets (2020-2021),

Deputy Head of Global

Markets & Head of

Private Fixed Income

(2019-2020), Head of

Global Private Finance

(2013-2019), Barings

LLC (global asset

manager).

|

3 |

Director (since 2020),

Chairman (since 2021),

BCIC; Director (Chairman)

(since 2021), BPCC.

|

Non-Interested

Directors

|

|||||

Mark F. Mulhern (64) |

Director |

Class I

Director;

Term

Expires

2025;

Director

since

October

2016

(Triangle

Capital)

|

Executive Vice

President and Chief

Financial Officer (2014

- 2022), Highwood

Properties, Inc.

(publicly traded real

estate investment trust).

|

4 |

Director (since 2021), BPCC;

Trustee (since 2021), Barings

Global Short Duration High

Yield Fund (closed-end

investment company advised

by Barings); Director (since

2020), Intercontinental

Exchange (NYSE: ICE);

Director (since 2020), ICE

Mortgage Technology;

Director (since 2020), BCIC;

Director (since 2015),

McKim and Creed

(engineering service firm);

Director and Audit

Committee member

(2012-2014), Highwood

Properties (real estate

investment trust); Director

(2015-2017), Azure MLP

(midstream oil and gas);

Trustee (2022-2024), Barings

Private Equity Opportunities

and Commitments Fund (a

non-diversified, closed-end

management investment

company advised by Barings

until February 2024).

|

9

Robert Knapp (58)

|

Director |

Class I

Director;

Term

Expires

2025;

Director

since

December

2020

|

Chief Investment

Officer (since 2007),

Ironsides Partners LLC

(investment

management firm).

|

1 |

Director (since 2007), Africa

Opportunity Fund Ltd.;

Director (since 2010), Pacific

Alliance Asia Opportunity

Fund and Pacific Alliance

Group Asset Management

Ltd.; Director (since 2010),

Sea Education Association;

Director (since 2015),

Lamington Road DAC

(successor to Emergent

Capital Inc.); Director (since

2018), Okeanis Eco Tankers

Corp.; Director (2017-2023),

Children's School of Science;

Director (2016-2022), Mass

Eye & Ear; Director

(2003-2020), MVC Capital;

Director (2012-2019), Castle

Private Equity; Director

(2017-2018), MPC Container

Ships.

|

(1)The business address of each director is 300 South Tryon Street, Suite 2500, Charlotte, NC 28202. The age of each

individual is as of the date of the Annual Meeting.

(2) Including the Company.

(3)Interested Director due to affiliations with Barings LLC.

10

CLASS II DIRECTORS: TERM EXPIRING 2026

Name, Address and Age(1)

|

Position(s)

Held with

Company

|

Term and

Length of Time

Served

|

Principal Occupations

During Past 5 Years

|

Number

of

Portfolios

Overseen

in Fund

Complex

(2)

|

Other Directorships of

Public or Registered

Investment Companies

Held by Director or

Nominee for Director

During Past 5 Years

|

Non-Interested

Directors

|

|||||

Steve Byers (70)

|

Director |

Class II

Director;

Term expires

2026;

Director since

February

2022

|

Independent Consultant

(since 2014).

|

1 |

Director (since 2011),

Chairman (since 2016)

Deutsche Bank DBX

ETF Trust; Trustee

(since 2016), The

Arbitrage Funds Trust;

Director (2012-2022),

Chairman

(2012-2022), Sierra

Income Corporation.

|

Valerie Lancaster-

Beal (69)

|

Director |

Class II

Director;

Term expires

2026;

Director since

February

2022

|

President and Chief

Executive Officer (since

2014), VLB Associates, LLC

(management consulting firm

providing financial and

operational advisory

services); Chief Financial

Officer (2015-2021),

Odyssey Media (marketing

and communications

company).

|

1 |

Director (2012-2022),

Sierra Income

Corporation; Director

(since 2012), KIPP

NYC; Trustee

(2000-2014), City

University of New

York; Board Member

(2006 - 2010),

Georgetown

University Board of

Regents.

|

John A. Switzer (67) |

Director |

Class II

Director;

Term expires

2026;

Director since

August 2018

|

Director, Weisiger Group

(formerly Carolina Tractor

and Equipment Company

(CTE)) (since 2017).

|

2 |

Director (since March

2021), BCIC; Director

and Audit Committee

member (since 2019),

HomeTrust

Bancshares, Inc.

|

(1)The business address of each director is 300 South Tryon Street, Suite 2500, Charlotte, NC 28202. The age of each

individual is as of the date of the Annual Meeting.

(2)Including the Company.

11

Qualifications of Director Nominees and Other Directors.

The following provides an overview of the considerations that led the Nominating and Corporate Governance

Committee and the Board of Directors to recommend and approve the election or appointment of the individuals

serving as a Director or nominee for Director. Each of the Directors has demonstrated superior credentials and

recognition in his or her respective field and the relevant expertise and experience upon which to be able to offer

advice and guidance to the Company’s management. In recommending the election or appointment of the Board

members or nominees, the Nominating and Corporate Governance Committee generally considers certain factors

including the current composition of the Board of Directors, overall business expertise, gender, cultural and racial

diversity, whether the composition of the Board of Directors contains a majority of independent directors as

determined under the NYSE listing standards and the 1940 Act, the candidate’s character and integrity, whether the

candidate possesses an inquiring mind, vision and the ability to work well with others, conflicts of interest

interfering with the proper performance of the responsibilities of a director, a candidate’s overall business

experience, what type of diversity he or she brings to the Board of Directors, whether the candidate has sufficient

time to devote to the affairs of the Company, including consistent attendance at Board of Directors and committee

meetings and advance review of materials and whether each candidate can be trusted to act in the best interests of

the Company and its stockholders.

Nominees for Class III Directors; Term expiring at the 2024 Annual Stockholder Meeting

•Mr. Mihalick — Mr. Mihalick brings over 16 years of experience in the financial services industry. He is

Barings LLC's Head of Private Assets, managing the firm's global private markets businesses, including

direct middle-market lending, private placements, infrastructure debt, private structured finance, diversified

alternative equity and real estate. He is also a member of Barings LLC's Senior Leadership Team. Prior to

his current role, Mr. Mihalick served as Head of U.S. Public Fixed Income and Head of U.S. High Yield,

where he was responsible for the U.S. High Yield and Investment Grade Investment Groups. Prior to

joining Barings LLC in 2008, he was a Vice President with Wachovia Securities Leveraged Finance Group.

At Wachovia (now Wells Fargo) he was responsible for sell-side origination of leveraged loans and high

yield bonds to support both corporate and private equity issuers. Prior to entering the financial services

industry, he served as an officer in the United States Air Force and worked in the telecommunications

industry for 7 years. Mr. Mihalick serves as a trustee or director of Barings Capital Investment Corporation,

a business development company advised by Barings, Barings Global Short Duration High Yield Fund, a

closed-end investment company advised by Barings, Barings Corporate Investors and Barings Participation

Investors, both closed-end funds advised by Barings. Mr. Mihalick holds a B.S. from the United States Air

Force Academy, an M.S. from the University of Washington and an M.B.A. from Wake Forest University.

•Mr. Okel — Mr. Okel brings over 20 years of experience in the underwriting, structuring, distribution and

trading of debt used for corporate acquisitions, leveraged buyouts, recapitalizations and refinancings. He

previously served as Executive Director of Catawba Lands Conservancy, a non-profit land trust. Prior to

joining Catawba Lands Conservancy, he served as Global Head of Syndicated Capital Markets at Bank of

America Merrill Lynch, where he managed capital markets, sales, trading and research for the United

States, Europe, Asia and Latin America from 1989 to 2010. He currently serves as trustee or director of

several public companies and non-profit organizations, including Barings Private Credit Corporation and

Barings Capital Investment Corporation (both business development companies advised by Barings);

Barings Global Short Duration High Yield Fund, a closed-end investment company advised by Barings;

Barings Private Equity Opportunities and Commitments Fund, a non-diversified, closed-end management

investment company advised by Barings; and is Chairman of the Board of Directors of Horizon Funds, a

mutual fund complex. Mr. Okel holds a Bachelor of Arts in Economics from Davidson College and a

Masters of Management, Finance, Accounting and Marketing from Kellogg School of Management,

Northwestern University.

•Ms. Olmstead — Ms. Olmstead brings over 21 years of senior leadership experience in Human Resources

in the financial services industry to her role as the Chair of the Board's Compensation Committee. She is

currently the Chief Human Resources Officer at LendingTree, Inc. and was a Founding Partner of Spivey &

Olmstead, LLC, a Talent and Leadership Consulting firm with expertise in the fields of executive

12

development and talent management founded in June 2010. She also currently serves on the boards of

Barings Private Credit Corporation and Barings Capital Investment Corporation (both business

development companies advised by Barings); Barings Global Short Duration High Yield Fund, a closed-

end investment company advised by Barings; and Barings Private Equity Opportunities and Commitments

Fund, a non-diversified, closed-end management investment company advised by Barings. The Board

benefits from her experience working with executive-level and senior management at various companies,

helping lead their efforts on talent strategies, including succession planning, building strong performance

cultures, and diversity and inclusion work. She has a strategic and pragmatic approach to talent

management with an eye toward bottom line results. In her capacity as Managing Director (2006 to 2009)

and Executive Vice President (2000 to 2006) at Wachovia Corporation (now Wells Fargo) she was both the

Head of Human Resources for the Corporate and Investment Bank and the Head of Human Resources for

the International Businesses. Prior to this, she formed and led the Leadership Practices Group at Wachovia

to create and implement a company-wide talent management process that identified, developed, tracked and

promoted high potential leaders throughout their careers. Ms. Olmstead received a Bachelor of Science at

Clemson University and a Masters in Organization Behavior and Development at Fielding University,

Santa Barbara, CA.

Directors Continuing in Office

Class I Directors; Term expiring at the 2025 Annual Stockholder Meeting

•Mr. Lloyd — Mr. Lloyd brings over 30 years of experience in investment management, investment

banking, leveraged finance and risk management to the Board. Mr. Lloyd is President of Barings LLC

where he leads a diverse set of organizations, spanning cross-asset investment, sales and marketing,

business and product development and research. Mr. Lloyd also works closely with all the investment

teams at Barings LLC. Prior to his current role, Mr. Lloyd served as Head of Private Assets. Mr. Lloyd has

worked in the industry since 1990. Prior to joining Barings in 2013, Mr. Lloyd served as Head of Market

and Institutional Risk for Wells Fargo, was on Wells Fargo’s Management Committee and was a member

of the Board of Directors of Wells Fargo Securities. Before the acquisition of Wachovia, Mr. Lloyd worked

in Wachovia’s Global Markets Investment Banking division and served on the division’s Operating

Committee where he held various leadership positions, including Head of Wachovia’s Global Leveraged

Finance Group. Mr. Lloyd serves as the Chairman of the Board of Directors to Barings Private Capital

Corporation and Barings Capital Investment Corporation, both business development companies advised by

Barings. Mr. Lloyd holds a B.S. in Finance from the University of Virginia's McIntire School of

Commerce.

•Mr. Mulhern — Mr. Mulhern brings significant public company experience, both as a senior executive and

as a board member. From September 2014 until his retirement on January 1, 2022, he served as Executive

Vice President and Chief Financial Officer of Highwoods Properties, Inc., a Raleigh, North Carolina based

publicly-traded real estate investment trust. Prior to joining Highwoods, Mr. Mulhern served as Executive

Vice President and Chief Financial Officer of Exco Resources, Inc. Prior to Exco, he served as Senior Vice

President and Chief Financial Officer of Progress Energy, Inc. from 2008 until its merger with Duke

Energy Corporation in 2012. He joined Progress Energy in 1996 as Vice President and Controller and

served in a number of leadership roles at Progress Energy, including Vice President of Strategic Planning,

Senior Vice President of Finance and President of Progress Ventures. He also spent eight years at Price

Waterhouse, now known as PwC. Mr. Mulhern previously served on the Highwoods Board of Directors

and Audit Committee from January 2012 through August 2014. He currently serves on the boards of

Barings Private Credit Corporation and Barings Capital Investment Corporation, both business

development companies advised by Barings); Barings Global Short Duration High Yield Fund, a closed-

end investment company advised by Barings; and Barings Private Equity Opportunities and Commitments

Fund, a non-diversified, closed-end management investment company advised by Barings. Additionally,

Mr. Mulhern serves on the board of the Intercontinental Exchange, a Fortune 500 company and provider of

marketplace infrastructure, data service and technology solutions to a broad range of customers. He also

serves on the board of Ellie Mae, Inc., the operating company of ICE Mortgage Technology, both of which

are subsidiaries of Intercontinental Exchange. Mr. Mulhern also currently serves on the board of McKim

13

and Creed, a North Carolina based professional engineering services firm. Mr. Mulhern is a Certified

Public Accountant and is a graduate of St. Bonaventure University.

•Mr. Knapp — Mr. Knapp brings over 25 years of experience in the financial services industry to the Board.

He is the Founder and Chief Investment Officer of Ironsides Partners LLC, a Boston-based investment

manager specializing in closed-end funds, holding companies, and asset value investing generally.

Ironsides and related entities serve as the manager and general partner to various funds and managed

accounts for institutional clients. Mr. Knapp is also a director of Okeanis Eco Tankers, the Pacific Alliance

Asia Opportunity Fund and its related entities and Pacific Alliance Group Asset Management Ltd., based in

Hong Kong, and Lamington Road DAC, the successor to Emergent Capital. He is a principal and director

of Africa Opportunity Partners Limited, a Cayman Islands company that serves as the investment manager

to Africa Opportunity Fund Limited. Additionally, Mr. Knapp serves as a member of the Board of

Managers of Veracity Worldwide LLC and is Chairman of Ironsides Medical, Inc. Mr. Knapp previously

served as the Lead Independent Director of MVC Capital, Inc. until completion of its merger with the

Company in December 2020 and was previously an independent, nonexecutive director of Castle Private

Equity AG and MPC Container Ships. He also acted as Managing Director for over ten years at Millennium

Partners in New York. In the non-profit sector, Mr. Knapp serves as a Trustee and Treasurer of the Sea

Education Association, both based in Woods Hold, Massachusetts.

Class II Directors; Term expiring at the 2026 Annual Stockholder Meeting

•Mr. Byers — Mr. Byers is a senior executive with over 30 years of leadership experience in finance,

operations and control, investment management and capital markets with leading national firms in asset

management, banking and brokerage. Mr. Byers serves as the Independent Chairman of the Board of

Directors of Deutsche Bank DBX ETF Trust and as a member of the audit and nominating committees.

Since 2016, Mr. Byers has also served as a board member of the Mutual Fund Directors Forum, an

independent, non-profit organization serving independent directors of U.S. funds registered with the

Securities and Exchange Commission under the 1940 Act. Mr. Byers served as an Independent Director

and Chairman of Sierra Income Corporation, a non-traded business development company (BDC)

sponsored by Medley LLC (NYSE:MCC), from 2012 to 2022. Sierra Income merged with Barings BDC,

Inc. in February, 2022, in connection with which Mr. Byers was appointed to the Board of Directors of

Barings BDC, Inc. From 2002 to 2012, Mr. Byers also served as Trustee for the College of William and

Mary Graduate School of Business. Since 2014, Mr. Byers has been engaged periodically as an

independent consultant to provide expert reports and opinions in financial and investment related matters.

From 2000 to 2006, Mr. Byers served as an investment executive with Dreyfus Corporation and served as

Vice Chairman, Executive Vice President, Chief Investment Officer, member of the Board of Directors and

Executive Committee, and fund officer of 90 investment companies, responsible for investment

performance of approximately $200 billion in assets under management. Prior to joining Dreyfus

Corporation, Mr. Byers served in executive positions at PaineWebber Group from 1986 to 1997, and served

in such capacities as chairman of the Investment Policy and Risk Oversight Committee, Capital Markets

Director of Risk and Credit Management, and was NASD registered as General Principal, Financial and

Operations Principal and Branch Principal. Prior to PaineWebber, Mr. Byers was an executive at Citibank/

Citicorp from 1979 to 1986. Mr. Byers received his M.B.A. in Finance from Roth Graduate School of

Business, Long Island University and his B.A. in Economics from Long Island University. In December

2014, Mr. Byers was recognized by the National Association of Corporate Directors as a Board Leadership

Fellow.

•Ms. Lancaster-Beal — Ms. Lancaster-Beal is a financial professional with extensive management and

board level experience in corporate governance, credit and financial analysis. Ms. Lancaster-Beal is the

President and Chief Executive Officer of VLB Associates, a management consulting firm she founded in

January 2014 that provides financial and operational advisory services to middle-market businesses,

investment firms and non-profit organizations. In this capacity, she previously served as the Chief

Financial Officer of Odyssey Media from 2015 to 2021, and as the Chief Administrative and Finance

Director of Data Capital Management from 2015 to 2017. Prior to this, she served as Managing Director at

M.R. Beal & Company, which she co-founded in April 1988, until 2014. Ms. Lancaster-Beal was a Senior

14

Vice President of Drexel Burnham Lambert from 1984 to 1988 and as Vice President of Citicorp

Investment Bank from 1978 to 1984. Ms. Lancaster-Beal served as an Independent Director and Chair of

the Nominating and Governance committee and the Audit committee of Sierra Income Corporation, a non-

traded business development company (BDC) sponsored by Medley LLC (NYSE:MCC), from 2012 to

2022. Sierra Income merged with Barings BDC, Inc. in February, 2022, in connection with which Ms.

Lancaster-Beal was appointed to the Board of Directors of Barings BDC, Inc. Ms. Lancaster-Beal currently

serves on the Board of Directors of KIPP NYC, a network of free, public charter schools. She also

previously served as a Trustee on the Board of the City University of New York from 2000 to 2014, where

she chaired the Faculty, Staff and Administration Committee and served on the Finance Committee.

Additionally, Ms. Lancaster-Beal served on the Board of Regents of Georgetown University from 2006 to

2010. Ms. Lancaster-Beal holds a B.A. in Economics from Georgetown University and an M.B.A. from the

Wharton School of Business of the University of Pennsylvania.

•Mr. Switzer — Mr. Switzer brings over 35 years of public accounting firm experience to the Board. Mr.

Switzer has served as a member of the Board of Directors of Barings Capital Investment Corporation (a

business development company advised by Barings) since March 2021, and since May 2017, has served as

a member of the Board of Directors of Weisiger Group (formerly Carolina Tractor and Equipment

Company (CTE)), a large, privately held Southeastern supplier of construction, forestry, paving, and

material handling equipment. Since September 2019, Mr. Switzer has also served as a member of the Board

of Directors of HomeTrust Bancshares, Inc., a publicly traded regional banking organization, where he also

serves on the Audit Committee. Previously, Mr. Switzer served as managing partner of KPMG's Charlotte

office (starting in 2009) until retirement in 2016, where he was also the market leader for KPMG’s

Carolinas, Florida, and San Juan offices. Prior to these positions, he served as managing partner of

KPMG’s Cleveland (1999 to 2007) and Kentucky (Louisville and Lexington) (1988 to 1998) offices. Mr.

Switzer currently serves on the boards of The Foundation for the Mint Museum and the National

Association of Corporate Directors, Carolinas Chapter. Mr. Switzer is a Certified Public Accountant and

holds a B.S. in Accounting from the University of Kentucky.

15

COMPENSATION DISCUSSION

The Company’s executive officers are employees of Barings and do not receive any direct compensation from the

Company. Barings serves as our external investment adviser and manages the Company’s investment portfolio

under the terms of a third amended and restated investment advisory agreement (the "Advisory Agreement"), in

connection with which the Company pays Barings a base management fee and an incentive fee, the details of which

are disclosed in the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2023, which is

being delivered to stockholders along with this proxy statement.

The Company’s day-to-day investment operations are managed by Barings and services necessary for its business,

including the origination and administration of its investment portfolio are provided by individuals who are

employees of Barings, as investment adviser and administrator, pursuant to the terms of the Advisory Agreement

and an administration agreement (the "Administration Agreement"). The Company reimburses Barings, in its

capacity as administrator, for the costs and expenses incurred by it in performing its obligations and providing

personnel and facilities under the Administration Agreement in an amount to be negotiated and mutually agreed to

by the Company and Barings quarterly in arrears. In no event will the agreed-upon quarterly expense amount exceed

the amount of expenses that would otherwise be reimbursable by the Company under the Administration Agreement

for the applicable quarterly period, and Barings will not be entitled to the recoupment of any amounts in excess of

the agreed-upon quarterly expense amount. The costs and expenses incurred by Barings on our behalf under the

Administration Agreement include, but are not limited to:

▪the allocable portion of Barings' rent for the Company’s Chief Financial Officer and Chief Compliance

Officer and their respective staffs, which is based upon the allocable portion of the usage thereof by such

personnel in connection with their performance of administrative services under the Administration

Agreement;

▪the allocable portion of the salaries, bonuses, benefits and expenses of the Company’s Chief Financial

Officer and Chief Compliance Officer and their respective staffs, which is based upon the allocable portion

of the time spent by such personnel in connection with performing administrative services for the Company

under the Administration Agreement;

▪the actual cost of goods and services used for the Company and obtained by Barings from entities not

affiliated with the Company, which is reasonably allocated to the Company on the basis of assets, revenues,

time records or other methods conforming with generally accepted accounting principles;

▪all fees, costs and expenses associated with the engagement of a sub-administrator, if any; and

▪costs associated with (a) the monitoring and preparation of regulatory reporting, including registration

statements and amendments thereto, prospectus supplements, and tax reporting, (b) the coordination and

oversight of service provider activities and the direct cost of such contractual matters related thereto and (c)

the preparation of all financial statements and the coordination and oversight of audits, regulatory inquiries,

certifications and sub-certifications.

16

DIRECTOR COMPENSATION

The Company's directors are divided into two groups — Interested Directors and Independent Directors. Interested

Directors are “interested persons” as defined in Section 2(a)(19) of the 1940 Act. During 2023, Interested Directors

did not receive any compensation from the Company for their service as members of the Board of Directors. The

compensation table below sets forth compensation that the Company's Independent Directors earned during the year

ended December 31, 2023.

Name |

Fees Earned

or Paid in

Cash

|

All Other

Compensation(1)

|

Total |

|||

Mark Mulhern ...........................................................

|

$130,000 |

$— |

$130,000 |

|||

John A. Switzer .........................................................

|

$120,000 |

$— |

$120,000 |

|||

Thomas W. Okel .......................................................

|

$130,000 |

$— |

$130,000 |

|||

Jill Olmstead .............................................................

|

$120,000 |

$— |

$120,000 |

|||

Robert Knapp ............................................................

|

$120,000 |

$— |

$120,000 |

|||

Steve Byers ...............................................................

|

$120,000 |

$— |

$120,000 |

|||

Valerie Lancaster-Beal ..............................................

|

$120,000 |

$— |

$120,000 |

(1)All other compensation includes reimbursement of out-of-pocket expenses

Director Fees

Each Independent Director of the Board of Directors is paid an annual board retainer of $120,000, payable by the

Company in quarterly installments, and the Board’s lead independent director and the chair of the Board’s Audit

Committee will each receive an additional $10,000 annual retainer in recognition of the increased responsibilities

associated with each such position.

In addition, the Company reimburses Independent Directors for any out-of-pocket expenses related to their service

as members of the Board of Directors. The Independent Directors of the Board of Directors do not receive any

stock-based compensation for their service as members of the Board of Directors. The Company's Interested

Directors do not receive any compensation from the Company for their service as members of the Board of

Directors.

17

CORPORATE GOVERNANCE

Director Independence

The Board of Directors has a majority of directors who are independent under the listing standards of the New York

Stock Exchange (“NYSE”). The NYSE Listed Company Rules provide that a director of a BDC shall be considered

to be independent if he or she is not an "interested person" of the Company, as defined in Section 2(a)(19) of the

1940 Act. Section 2(a)(19) of the 1940 Act defines an "interested person" to include, among other things, any person

who has, or within the last two years had, a material business or professional relationship with the Company.

The Board of Directors has determined that Mses. Olmstead and Lancaster-Beal and Messrs. Mulhern, Okel,

Switzer, Knapp, and Byers are independent (or not “interested persons” of the Company). Based upon information

requested from each such director concerning his or her background, employment and affiliations, the Board of

Directors has affirmatively determined that none of the independent directors has a material business or professional

relationship with the Company, other than in his or her capacity as a member of the Board of Directors or any

committee thereof. None of the members of the Audit Committee, the Compensation Committee and the

Nominating and Corporate Governance Committee are "interested persons," as defined in Section 2(a)(19) of the

1940 Act, of the Company.

Meetings of the Board of Directors and Committees

In 2023, the Board of Directors held five meetings of the Board of Directors, as well as four Audit Committee

meetings, one Compensation Committee meeting, and one Nominating and Corporate Governance Committee

meeting. During 2023, none of the members of the Board of Directors attended less than 75% of the aggregate

number of meetings of the Board of Directors and of the respective committees on which they served.

Each of the Company's directors makes a diligent effort to attend all board and committee meetings, as well as each

Annual Meeting of Stockholders. We encourage, but do not require, our directors to attend annual meetings of

stockholders. All members of the then-constituted Board of Directors attended the Company's 2023 Annual Meeting

of Stockholders.

Audit Committee

The Company has a separately designated standing Audit Committee, as defined in Section 3(a)(58)(A) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee is responsible for

oversight matters, financial statement and disclosure oversight matters, matters relating to the hiring, retention and

oversight of the Company’s independent registered public accounting firm, reviewing the plans, scope and results of

the audit engagement with the Company’s independent registered public accounting firm, approving professional

services provided by the Company’s independent registered public accounting firm, reviewing the independence of

the Company’s independent registered public accounting firm, reviewing the integrity of the audits of the financial

statements and reviewing the adequacy of the Company’s internal accounting controls. The Audit Committee also

assists our Board of Directors in establishing and monitoring the application of the valuation policies used for

determining the fair value of the Company’s investments that are not publicly traded or for which current market

values are not readily available.

The Audit Committee Charter is publicly available under “Governance Documents” on the Investor Relations

section of the Company’s website at https://ir.barings.com/governance-docs. The contents of the Company’s website

are not intended to be incorporated by reference into this proxy statement or in any other report or document it files

with the SEC, and any references to the Company’s website are intended to be inactive textual references only.

The members of the Company’s Audit Committee are Messrs. Mulhern, Okel, Switzer, Knapp and Byers and Mses.

Olmstead and Lancaster-Beal. Messrs. Mulhern and Okel and Ms. Olmstead simultaneously serve on the audit

committees of more than three public companies, and the Board has determined that each of their simultaneous

service on the audit committees of other public companies does not impair their ability to effectively serve on the

Audit Committee. Mr. Mulhern serves as the chairman of the Audit Committee. The Board of Directors has

determined that Mr. Mulhern is an “audit committee financial expert” as defined under Item 407(d)(5) of Regulation

S-K of the Exchange Act and that all members of the Audit Committee are financially literate under NYSE listing

18

standards. The Board of Directors also has determined that each of Messrs. Mulhern, Okel, Switzer, Knapp, and

Byers and Mses. Olmstead and Lancaster-Beal meet the current independence requirements of Rule 10A-3 of the

Exchange Act and NYSE listing standards.

Compensation Committee

The Compensation Committee is responsible for determining, or recommending to the Board of Directors for

approval, the compensation of the Company’s independent directors; determining, or recommending to the Board of

Directors for determination, the compensation, if any, of the Company’s chief executive officer and all other

executive officers of the Company; and assisting the Board of Directors with matters related to compensation

generally.

In connection with reviewing, and recommending to the Board of Directors, the compensation of the independent

directors, the Compensation Committee evaluates the independent directors’ performance in light of goals and

objectives relevant to the independent directors and sets independent directors’ compensation based on such

evaluation and such other factors as the Compensation Committee deems appropriate and in the best interests of the

Company (including the cost to the Company of such compensation and a review of data of comparable business

development companies).

Currently none of the Company’s executive officers is compensated by the Company and, as a result, the

Compensation Committee does not produce and/or review a report on executive compensation practices. The

Compensation Committee also has the authority to engage compensation consultants, legal counsel or other advisors

(each, a “Consultant”) following consideration of certain factors related to such Consultants’ independence and has

the authority to form and delegate any of its responsibilities to a subcommittee of the Compensation Committee. The

Compensation Committee Charter is available under “Governance Documents” on the Investor Relations section of

our website at https://ir.barings.com/governance-docs.

The members of the Compensation Committee are Messrs. Mulhern, Okel, Switzer, Knapp and Byers, and Mses.

Olmstead and Lancaster-Beal, each of whom is not an "interested person" for purposes of Section 2(a)(19) of the

1940 Act and is independent under the applicable NYSE corporate governance listing standards. Ms. Olmstead

serves as the chair of the Compensation Committee. No members of the Compensation Committee during 2023 had

any relationship with the Company requiring disclosure under Item 404 of Regulation S-K under the Exchange Act.

Compensation Committee Interlocks and Insider Participation

No interlocking relationship, as defined by the rules adopted by the SEC, existed during the year ended

December 31, 2023 between any member of the Board of Directors or the Compensation Committee and an

executive officer of the Company.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for identifying, researching and

recommending for nomination directors for election by the Company's stockholders, recommending for appointment

nominees to fill vacancies on the Board of Directors or a committee of the Board of Directors, developing and

recommending to the Board of Directors a set of corporate governance principles and overseeing the evaluation of

the Board of Directors. The Nominating and Corporate Governance Committee’s policy is to consider nominees

properly recommended by the Company's stockholders in accordance with the Company's charter, Bylaws and

applicable law. For more information on how the Company's stockholders may recommend a nominee for a seat on

the Board of Directors, see "Stockholder Nominations and Proposals for the 2025 Annual Meeting" in this proxy

statement. The Nominating and Corporate Governance Committee also has the authority to retain, at the Company’s

expense, such consultants or advisors as the Committee may deem necessary or appropriate to carry out its duties.

The Committee has sole authority to retain or terminate any search firm or individual used to identify any director

candidate, including the sole authority to approve the search firm’s fees and retention terms.

The Nominating and Corporate Governance Committee Charter is publicly available under “Governance

Documents” on the Investor Relations section of the Company's website at https://ir.barings.com/governance-docs.

19

The members of the Nominating and Corporate Governance Committee are Messrs. Mulhern, Okel, Switzer, Knapp,

and Byers and Mses. Olmstead and Lancaster-Beal, each of whom is not an "interested person" for purposes of

Section 2(a)(19) of the 1940 Act and is independent under the NYSE corporate governance listing standards.

Mr. Okel serves as the chairman of the Nominating and Corporate Governance Committee. Each nominee for

election under Proposal No. 1 at the Annual Meeting was recommended by the members of the Nominating and

Corporate Governance Committee to the Board of Directors, which approved such nominees.

Communication with the Board of Directors

Barings BDC, Inc. stockholders and other interested parties may communicate with any member of our Board

(including the chairman), the chairman of any of our Board committees, or with our non-management directors as a

group by sending communications to Barings BDC, Inc., 300 South Tryon St., Suite 2500, Charlotte, North Carolina

28202, or via e-mail to BDCinvestorrelations@barings.com, or by calling the Barings BDC, Inc.’s investor relations

department at 1-888-401-1088. All such communications should indicate clearly the director or directors to whom

the communication is being sent so that each communication, other than unsolicited commercial solicitations, may

be forwarded directly to the appropriate director(s).

The Composition of the Board of Directors and Leadership Structure

The 1940 Act requires that at least a majority of the Company’s directors not be “interested persons” (as defined in

the 1940 Act) of the Company. Currently, seven of the Company’s nine directors have been determined to qualify as

independent directors (and to not be “interested persons”). However, Mr. Lloyd, our Chief Executive Officer and the

President of Barings LLC, and therefore an interested person of the Company, serves as Executive Chairman of the