N-14 8C/A: Initial registration statement filed on Form N14 by closed-end investment company (business combinations)

Published on December 13, 2021

As filed with the Securities and Exchange Commission on December 13, 2021

Registration No. 333-260591

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. 1 ☒

Post-Effective Amendment No. ☐

(Check appropriate box or boxes)

Barings BDC, Inc.

(Exact Name of Registrant as Specified in Charter)

300 South Tryon Street, Suite 2500

Charlotte, NC 28202

(Address of Principal Executive Offices)

(704) 805-7200

(Area Code and Telephone Number)

Eric Lloyd

Chief Executive Officer

and Chairman of the Board

Barings BDC, Inc.

300 South Tryon Street, Suite 2500

Charlotte, NC 28202

(Name and Address of Agent for Service)

Copies to:

|

John T. Haggerty

Paul J. Delligatti

Thomas J. LaFond

Goodwin Procter LLP

100 Northern Avenue

Boston, MA 02118

Telephone: (617) 570-1000

Fax: (617) 523-1231

|

| |

David M. Leahy

William J. Curry

John L. Chilton

Sullivan & Worcester LLP

1666 K Street, NW

Washington, D.C. 20006-1264

Telephone: (202) 775-1200

Fax: (202) 775-6875

|

Approximate Date of Proposed Public Offering: As soon as practicable after this registration statement becomes effective and upon completion of the transactions described in the enclosed document.

Calculation of Registration Fee under the Securities Act of 1933

Title of Securities Being Registered |

| |

Amount Being

Registered(1)

|

| |

Proposed Maximum

Offering Price

per Share of

Common Stock

|

| |

Proposed Maximum

Aggregate Offering

Price(2)

|

| |

Amount of

Registration Fee(3)

|

Common Stock, par value $0.001 per share

|

| | 102,276,889.12 shares

|

| | N/A |

| | $555,363,507.92 |

| | $51,482.20(4)

|

(1) |

The number of shares to be registered represents the maximum number of shares of the registrant’s common stock estimated to be issuable in connection with the merger agreement described in the enclosed document. Pursuant to Rule 416, this registration statement also covers additional securities that may be issued as a result of stock splits, stock dividends or similar transactions. |

(2) |

Estimated solely for the purpose of calculating the registration fee and calculated pursuant to Rule 457(f)(2) under the Securities Act of 1933, as amended, the proposed maximum aggregate offering price is equal to: (i) 102,276,889.12, the estimated number of shares of common stock of Sierra Income Corporation to be exchanged for shares of the registrant’s common stock in accordance with the terms of the merger agreement, multiplied by (ii) $5.43, the book value per share of such shares to be exchanged as of the latest practicable date prior to the filing date. |

(3) |

Based on a rate of $92.70 per $1,000,000 of the proposed maximum aggregate offering price. |

(4) |

Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the U.S. Securities and Exchange Commission. Barings BDC may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This document is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where such offer or sale is not permitted.

PRELIMINARY—SUBJECT TO COMPLETION—DATED DECEMBER 13, 2021BARINGS BDC, INC.

300 South Tryon Street, Suite 2500

Charlotte, NC 28202

MERGER PROPOSED—YOUR VOTE IS VERY IMPORTANT

Dear Stockholder: |

| | [•], 2021 |

You are cordially invited to attend the Special Meeting of Stockholders (the “Barings BDC Special Meeting”) of Barings BDC, Inc., a Maryland corporation (“Barings BDC”), to be held virtually on [•], 2022, at [•] [a.m.][p.m.], Eastern Time, at the following website: www.virtualshareholdermeeing.com/BBDC2022SM.

The notice of special meeting and the joint proxy statement/prospectus accompanying this letter provide an outline of the business to be conducted at the Barings BDC Special Meeting. At the Barings BDC Special Meeting, you will be asked to consider and vote upon a proposal to:

(1) |

approve the issuance of shares of Barings BDC common stock, $0.001 par value per share (“Barings BDC Common Stock”), pursuant to the Agreement and Plan of Merger, dated as of September 21, 2021 (as may be amended from time to time, the “Merger Agreement”), by and among Barings BDC, Mercury Acquisition Sub, Inc., a Maryland corporation and a direct wholly-owned subsidiary of Barings BDC (“Acquisition Sub”), Sierra Income Corporation, a Maryland corporation (“Sierra”), and Barings LLC, a Delaware limited liability company and the external investment adviser to Barings BDC (“Barings”) (such proposal, the “Merger Stock Issuance Proposal”); |

(2) |

approve the issuance of shares of Barings BDC Common Stock pursuant to the Merger Agreement at a price below its then-current net asset value (“NAV”) per share, if applicable (such proposal, the “Barings BDC Below NAV Issuance Proposal”); and |

(3) |

approve the adjournment of the Barings BDC Special Meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are insufficient votes at the time of the Barings BDC Special Meeting to approve the Merger Stock Issuance Proposal or the Barings BDC Below NAV Issuance Proposal (such proposal, the “Barings BDC Adjournment Proposal” and, together with the Merger Stock Issuance Proposal and the Barings BDC Below NAV Issuance Proposal, the “Barings BDC Proposals”). |

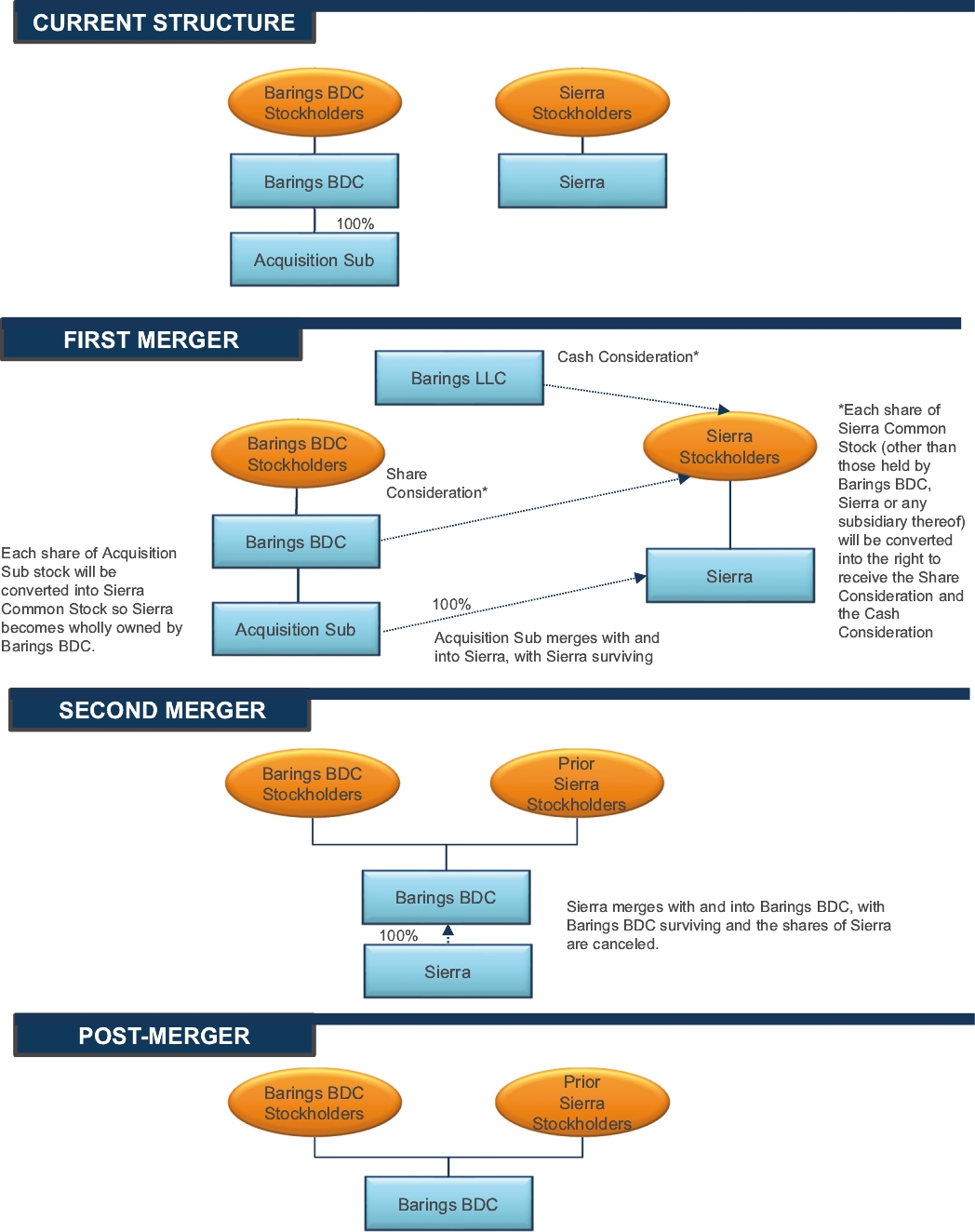

Barings BDC and Sierra are proposing a combination of both companies by a merger and related transactions pursuant to the Merger Agreement in which Acquisition Sub would merge with and into Sierra (the “First Merger”), with Sierra continuing as the surviving corporation and as a wholly-owned subsidiary of Barings BDC. Immediately after the effectiveness of the First Merger, Sierra, as the surviving corporation, will merge with and into Barings BDC (together with the First Merger, the “Merger”), with Barings BDC continuing as the surviving corporation.

Subject to the terms and conditions of the Merger Agreement, at the effective time of the First Merger, each share of Sierra common stock, $0.001 par value per share (“Sierra Common Stock”), issued and outstanding immediately prior to the effective time of the First Merger (excluding Canceled Shares (as defined below)) will be converted into the right to receive (i) $0.9783641 per share in cash, without interest, from Barings (such amount of cash, the “Cash Consideration”), and (ii) 0.44973 (the “Exchange Ratio”) of a validly issued, fully paid and non-assessable share of Barings BDC Common Stock, plus any cash in lieu of fractional shares (the “Share Consideration” and, together with the Cash Consideration, the “Merger Consideration”). For purposes of the Merger Agreement, “Canceled Shares” means all shares of Sierra Common Stock issued and outstanding immediately prior to the effective time of the First Merger that are held by a subsidiary of Sierra or held, directly or indirectly, by Barings BDC or Acquisition Sub.

The market value of the Merger Consideration will fluctuate with changes in the market price of Barings BDC Common Stock. Barings BDC urges you to obtain current market quotations of Barings BDC Common Stock. Barings BDC Common Stock trades on the New York Stock Exchange (the “NYSE”) under the ticker symbol “BBDC.” The following table shows the closing sale prices of Barings BDC Common Stock, as reported on the NYSE on September 20, 2021, the last trading day before the execution of the Merger Agreement, and on [•], 2021, the last trading day before printing this document.

| | |

Barings BDC

Common Stock

|

|

Closing Sales Price at September 20, 2021

|

| | $10.63 |

Closing Sales Price at [•], 2021

|

| | $[•] |

Your vote is extremely important. At the Barings BDC Special Meeting, you will be asked to vote on the Merger Stock Issuance Proposal and the Barings BDC Below NAV Issuance Proposal and, if necessary or appropriate, the Barings BDC Adjournment Proposal. The approval of the Merger Stock Issuance Proposal and the Barings BDC Adjournment Proposal each requires the affirmative vote of the holders of at least a majority of votes cast by holders of shares of Barings BDC Common Stock present at the Barings BDC Special Meeting, virtually or represented by proxy, and entitled to vote thereat. The approval the Barings BDC Below NAV Issuance Proposal requires the affirmative vote of each of the following: (1) a majority of the outstanding voting securities (as used in the Investment Company Act of 1940, as amended (the “Investment Company Act”)) of Barings BDC Common Stock; and (2) a majority of the outstanding voting securities of Barings BDC Common Stock that are not held by affiliated persons of Barings BDC. For purposes of this proposal, the Investment Company Act defines a “majority of the outstanding voting securities” as the vote of the lesser of: (1) 67% or more of the voting securities of Barings BDC present at the Barings BDC Special Meeting, if the holders of more than 50% of the outstanding voting securities of Barings BDC are present virtually or represented by proxy; or (2) more than 50% of the outstanding voting securities of Barings BDC.

Abstentions and broker non-votes (if any) will (1) not be included in determining the number of votes cast and, as a result, will have no effect on the voting outcome of the Merger Stock Issuance Proposal or the Barings BDC Adjournment Proposal and (2) will have the same effect as votes “against” the Barings BDC Below NAV Issuance Proposal.

Barings, as party to the Merger Agreement, agreed to vote all shares of Barings BDC Common Stock over which it has voting power (other than in its fiduciary capacity) in favor of the Barings BDC Proposals.

After careful consideration, the Barings BDC Board unanimously approved the Merger Agreement and the transactions contemplated thereby, including the Merger, the Merger Stock Issuance Proposal and the Barings BDC Below NAV Issuance, and unanimously recommends that Barings BDC stockholders vote “FOR” the Merger Stock Issuance Proposal, “FOR” the Barings BDC Below NAV Issuance Proposal and, if necessary or appropriate, “FOR” the Barings BDC Adjournment Proposal.

It is important that your shares be represented at the Barings BDC Special Meeting. You have the right to receive notice of, and to vote at, the Barings BDC Special Meeting if you were a stockholder of record of Barings BDC Common Stock at the close of business on [•], 2021 (the “Barings BDC Record Date”). Each Barings BDC stockholder is invited to attend the Barings BDC Special Meeting virtually. You or your proxyholder will be able to attend the Barings BDC Special Meeting online, vote and submit questions by visiting www.virtualshareholdermeeing.com/BBDC2022SM and using a control number assigned by Broadridge Financial Solutions Inc. To receive access to the virtual Barings BDC Special Meeting, you will need to follow the instructions provided in the Notice of Special Meeting of Stockholders and the joint proxy statement/prospectus that follow. Barings BDC encourages you to vote via the Internet as it saves Barings BDC significant time and processing costs. If you are the beneficial owner of your shares, you will need to follow the instructions provided by your broker, bank, trustee or nominee regarding how to instruct your broker, bank, trustee or nominee to vote your shares at the Barings BDC Special Meeting. Voting by proxy does not deprive you of your right to participate in the virtual Barings BDC Special Meeting.

The joint proxy statement/prospectus accompanying this letter describes the Barings BDC Special Meeting, the Merger and the documents related to the Merger (including the Merger Agreement) that Barings BDC stockholders should review before voting on the Merger Stock Issuance Proposal, the Barings BDC Below NAV Issuance Proposal and, if necessary or appropriate, the Barings BDC Adjournment Proposal and should be retained for future reference. Please carefully read this entire document, including “Risk Factors” beginning on page [•] and as otherwise incorporated by reference herein, for a discussion of the risks relating to the Merger, Barings BDC and Sierra. Barings BDC files annual, quarterly and current reports, proxy statements and other information about itself with the SEC. Barings BDC maintains a website at www.baringsbdc.com and makes all of its annual, quarterly and current reports, proxy statements and other publicly filed information available on or through its website. Information contained on Barings BDC’s website is not incorporated by reference into the joint proxy statement/prospectus accompanying this letter, and you should not consider information contained on Barings BDC’s website to be part of the joint proxy statement/prospectus accompanying this letter. You may also obtain such information, free of charge, and make stockholder inquiries by calling Barings BDC at (888) 401-1088, by sending an email to Barings BDC at BDCinvestorrelations@barings.com or by writing to Barings BDC at 300 South Tryon Street, Suite 2500, Charlotte, North Carolina 28202, Attention: Investor Relations. The SEC also maintains a website at www.sec.gov that contains such information.

Sincerely yours,

Eric Lloyd

Chairman of the Board and Chief Executive Officer of Barings BDC, Inc.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the shares of Barings BDC Common Stock to be issued under the joint proxy statement/prospectus accompanying this letter or determined if the joint proxy statement/prospectus accompanying this letter is truthful or complete. Any representation to the contrary is a criminal offense.

Important Notice Regarding the Availability of Proxy Materials for the Barings BDC Special Meeting to Be Held on [•], 2022

The date of the accompanying joint proxy statement/prospectus is [•], 2021 and it is first being mailed or otherwise delivered to Barings BDC stockholders and Sierra stockholders on or about [•], 2021.

|

Barings BDC, Inc.

300 South Tryon Street, Suite 2500

Charlotte, North Carolina 28202

(704) 805-7200

|

| |

Sierra Income Corporation

100 Park Avenue, 16th Floor

New York, New York 10017

(212) 759-0777

|

BARINGS BDC, INC.

300 South Tryon Street, Suite 2500

Charlotte, NC 28202

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [•], 2022

NOTICE OF VIRTUAL 2022 SPECIAL MEETING OF STOCKHOLDERS

Online Meeting Only—No Physical Meeting Location

www.virtualshareholdermeeing.com/BBDC2022SM

[•], 2022, at [•] [a.m.][p.m.], Eastern Time

Notice is hereby given to the holders of shares of common stock of Barings BDC, Inc., a Maryland corporation (“Barings BDC”), that:

A Special Meeting of Stockholders of Barings BDC will be held virtually, solely by the means of remote communication, on [•], 2022, at [•] [a.m.][p.m.], Eastern Time, at the following website: www.virtualshareholdermeeing.com/BBDC2022SM, for the following purposes:

(1) |

to consider and vote upon a proposal to approve the issuance of shares of Barings BDC common stock, $0.001 par value per share (“Barings BDC Common Stock”), pursuant to the Agreement and Plan of Merger, dated as of September 21, 2021 (as may be amended from time to time, the “Merger Agreement”), by and among Barings BDC, Mercury Acquisition Sub, Inc., a Maryland corporation and a direct wholly-owned subsidiary of Barings BDC (“Acquisition Sub”), Sierra Income Corporation, a Maryland corporation (“Sierra”), and Barings LLC, a Delaware limited liability company and the external investment adviser to Barings BDC (“Barings”) (such proposal, the “Merger Stock Issuance Proposal”); |

(2) |

to consider and vote upon a proposal to approve the issuance of shares of Barings BDC Common Stock pursuant to the Merger Agreement at a price below its then-current net asset value (“NAV”) per share, if applicable (such proposal, the “Barings BDC Below NAV Issuance Proposal”); and |

(3) |

to consider and vote upon a proposal to approve the adjournment of the Barings BDC Special Meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are insufficient votes at the time of the Barings BDC Special Meeting to approve the Merger Stock Issuance Proposal or the Barings BDC Below NAV Issuance Proposal (such proposal, the “Barings BDC Adjournment Proposal” and, together with the Merger Stock Issuance Proposal and the Barings BDC Below NAV Issuance Proposal, the “Barings BDC Proposals”). |

Barings BDC and Sierra are proposing a combination of both companies by a merger and related transactions pursuant to the Merger Agreement in which Acquisition Sub would merge with and into Sierra (the “First Merger”), with Sierra continuing as the surviving corporation and as a wholly-owned subsidiary of Barings BDC. Immediately after the effectiveness of the First Merger, Sierra, as the surviving corporation, will merge with and into Barings BDC (together with the First Merger, the “Merger”), with Barings BDC continuing as the surviving corporation.

THE BOARD OF DIRECTORS OF BARINGS BDC (THE “BARINGS BDC BOARD”) UNANIMOUSLY APPROVED THE MERGER AGREEMENT AND THE TRANSACTIONS CONTEMPLATED THEREBY, INCLUDING THE MERGER, MERGER STOCK ISSUANCE PROPOSAL AND BARINGS BDC BELOW NAV ISSUANCE PROPOSAL, AND UNANIMOUSLY RECOMMENDS THAT BARINGS BDC STOCKHOLDERS VOTE “FOR” THE MERGER STOCK ISSUANCE PROPOSAL, “FOR” THE BARINGS BDC BELOW NAV ISSUANCE PROPOSAL AND, IF NECESSARY OR APPROPRIATE, “FOR” THE BARINGS BDC ADJOURNMENT PROPOSAL.

You have the right to receive notice of, and to vote at, the Barings BDC Special Meeting if you were a stockholder of record of Barings BDC Common Stock at the close of business on [•], 2021 (the “Barings BDC Record Date”). A list of these stockholders will be open for examination by any Barings BDC stockholder for any purpose germane to the Barings BDC Special Meeting for a period of 10 days prior to the Barings BDC

Special Meeting at Barings BDC’s principal executive office at 300 South Tryon Street, Suite 2500, Charlotte, North Carolina 28202, and electronically during the Barings BDC Special Meeting at www.virtualshareholdermeeing.com/BBDC2022SM. Barings BDC is furnishing a joint proxy statement/prospectus and proxy card to Barings BDC stockholders on the Internet, rather than mailing printed copies of those materials to Barings BDC stockholders.

Each Barings BDC stockholder is invited to attend the Barings BDC Special Meeting virtually. You or your proxyholder will be able to attend the Barings BDC Special Meeting online, vote and submit questions by visiting www.virtualshareholdermeeing.com/BBDC2022SM and using a control number assigned by Broadridge Financial Solutions Inc.

If you are a beneficial owner of shares that are held in “street name,” that is they are registered in the name of your broker, bank, trustee or other nominee, you should have received a notice containing voting instructions from your nominee rather than from us. You should follow the voting instructions in the notice to ensure that your vote is counted. Many brokers and banks participate in a program that offers a means to grant proxies to vote shares via the Internet or by telephone. If your shares are held in an account with a broker or bank participating in this program, you may grant a proxy to vote those shares via the Internet or telephonically by using the website or telephone number shown on the instruction form provided to you by your nominee.

In order to vote at the Barings BDC Special Meeting, you must either be a stockholder of record of Barings BDC Common Stock as of the Barings BDC Record Date, or you must be a beneficial holder as of the Barings BDC Record Date and obtain a legal proxy from your broker, bank, trustee, or other nominee. Barings BDC stockholders of record will have the opportunity to vote electronically at the Barings BDC Special Meeting after they have checked into the Barings BDC Special Meeting as described above and in the joint proxy statement/prospectus. If you are a beneficial holder, you must request a legal proxy from your nominee in sufficient time so that it can be obtained, completed and submitted by you to Barings BDC no later than 11:59 p.m., Eastern Time, on [•], 2022.

The meeting webcast will begin promptly at [•] [a.m.][p.m.], Eastern Time, on [•], 2022. We encourage you to access the meeting prior to the start time. Because the Barings BDC Special Meeting will be a completely virtual meeting, there will be no physical location for Barings BDC stockholders to attend.

Whether or not you plan to participate in the Barings BDC Special Meeting, Barings BDC encourages you to vote your shares either virtually or by proxy.

Your vote is extremely important to Barings BDC. In the event there are insufficient votes for a quorum or to approve the Merger Stock Issuance Proposal or the Barings BDC Below NAV Issuance Proposal at the time of the Barings BDC Special Meeting, the Barings BDC Special Meeting may be adjourned in order to permit further solicitation of proxies by Barings BDC.

The Merger and the Merger Agreement are each described in more detail in the joint proxy statement/prospectus accompanying this letter, which you should read carefully and in its entirety before authorizing a proxy to vote. A copy of the Merger Agreement is attached as Annex A to the joint proxy statement/prospectus accompanying this letter.

| | | By Order of the Board of Directors, |

|

| | | ||

| | | Ashlee Steinnerd |

|

| | | Secretary of Barings BDC, Inc. |

Charlotte, North Carolina

[•], 2021

To ensure proper representation at the Barings BDC Special Meeting, please follow the instructions on the accompanying proxy card to authorize a proxy to vote your shares via the Internet or telephone, or by requesting, signing, dating and returning a proxy card. Even if you vote your shares prior to the Barings BDC Special Meeting, you still may participate in the virtual Barings BDC Special Meeting.

SIERRA INCOME CORPORATION

100 Park Avenue, 16th Floor

New York, NY 10017

MERGER PROPOSED—YOUR VOTE IS VERY IMPORTANT

[•], 2021

Dear Stockholder:

You are cordially invited to attend the Special Meeting of Stockholders (the “Sierra Special Meeting”) of Sierra Income Corporation, a Maryland corporation (“Sierra”), to be held virtually on [•], 2022, at [•] [a.m.][p.m.], Eastern Time, at the following website: https://viewproxy.com/sicSM/2022.

The notice of special meeting and the joint proxy statement/prospectus accompanying this letter provide an outline of the business to be conducted at the Sierra Special Meeting. At the Sierra Special Meeting, you will be asked to consider and vote upon a proposal to:

(1) |

approve the merger of Mercury Acquisition Sub, Inc. (“Acquisition Sub”), a Maryland corporation and a direct wholly-owned subsidiary of Barings BDC, Inc. (“Barings BDC”), a Maryland corporation, with and into Sierra (the “First Merger”), with Sierra continuing as the surviving corporation and as a wholly-owned subsidiary of Barings BDC, pursuant to the Agreement and Plan of Merger, dated as of September 21, 2021 (as may be amended from time to time, the “Merger Agreement”), by and among Barings BDC, Acquisition Sub, Sierra and Barings LLC, a Delaware limited liability company and the external investment adviser to Barings BDC (“Barings”) (such proposal, the “Merger Proposal”); and |

(2) |

approve the adjournment of the Sierra Special Meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are insufficient votes at the time of the Sierra Special Meeting to approve the Merger Proposal (such proposal, the “Sierra Adjournment Proposal” and, together with the Merger Proposal, the “Sierra Proposals”). |

Sierra and Barings BDC are proposing a combination of both companies by a merger and related transactions, including the First Merger, pursuant to the Merger Agreement. Immediately after the effectiveness of the First Merger, Sierra, as the surviving corporation, will merge with and into Barings BDC (together with the First Merger, the “Merger”), with Barings BDC continuing as the surviving corporation.

Subject to the terms and conditions of the Merger Agreement, at the effective time of the First Merger, each share of Sierra common stock, $0.001 par value per share (“Sierra Common Stock”), issued and outstanding immediately prior to the effective time of the First Merger (excluding Canceled Shares (as defined below)) will be converted into the right to receive (i) $0.9783641 per share in cash, without interest, from Barings (such amount of cash, the “Cash Consideration”), and (ii) 0.44973 (the “Exchange Ratio”) of a validly issued, fully paid and non-assessable share of Barings BDC common stock, $0.001 par value per share (“Barings BDC Common Stock”), plus any cash in lieu of fractional shares (the “Share Consideration” and, together with the Cash Consideration, the “Merger Consideration”). For purposes of the Merger Agreement, “Canceled Shares” means all shares of Sierra Common Stock issued and outstanding immediately prior to the effective time of the First Merger that are held by a subsidiary of Sierra or held, directly or indirectly, by Barings BDC or Acquisition Sub.

The market value of the Merger Consideration will fluctuate with changes in the market price of Barings BDC Common Stock. Sierra urges you to obtain current market quotations of Barings BDC Common Stock. Barings BDC Common Stock trades on the New York Stock Exchange (the “NYSE”) under the ticker symbol “BBDC.” The following table shows the closing sale prices of Barings BDC Common Stock, as reported on the NYSE on September 20, 2021, the last trading day before the execution of the Merger Agreement, and on [•], 2021, the last trading day before printing this document.

| | |

Barings BDC

Common

Stock

|

|

Closing Sales Price at September 20, 2021

|

| | $10.63 |

Closing Sales Price at [•], 2021

|

| | $[•] |

Your vote is extremely important. At the Sierra Special Meeting, you will be asked to vote on the Merger Proposal and, if necessary or appropriate, the Sierra Adjournment Proposal. The approval of the Merger Proposal requires the affirmative vote of holders of Sierra Common Stock constituting a majority of all the votes entitled to be cast on the matter at the Sierra Special Meeting. The approval of the Sierra Adjournment Proposal requires the affirmative vote of the holders of at least a majority of the votes cast by holders of Sierra Common Stock present at the Sierra Special Meeting, virtually or represented by proxy.

Because the vote on the Merger Proposal is based on the total number of shares entitled to be cast on the matter (i.e., shares outstanding), abstentions and broker non-votes (which occur when a beneficial owner does not instruct its broker, bank, trustee or nominee holding its shares of Sierra Common Stock how to vote such shares on its behalf) will not count as affirmative votes cast and therefore will have the same effect as votes “against” the Merger Proposal. Abstentions and broker non-votes (if any) will not be included in determining the number of votes cast and, as a result, will have no effect on the voting outcome of the Sierra Adjournment Proposal. In addition, please note that the chairman of the Sierra Special Meeting will have the authority to adjourn the Sierra Special Meeting from time-to-time for any reason without notice and without the vote or approval of the Sierra stockholders.

After careful consideration, the Board of Directors of Sierra (the “Sierra Board”), including each of its independent directors, and upon recommendation from the Special Committee of the Sierra Board (the “Sierra Special Committee”), unanimously approved the First Merger, and unanimously recommends that Sierra stockholders vote “FOR” the Merger Proposal and, if necessary or appropriate, “FOR” the Sierra Adjournment Proposal.

It is important that your shares be represented at the Sierra Special Meeting. You have the right to receive notice of, and to vote at the Sierra Special Meeting if you were a stockholder of record of Sierra Common Stock at the close of business on [•], 2021 (the “Sierra Record Date”). Each Sierra stockholder is invited to attend the Sierra Special Meeting virtually. You or your proxy holder will be able to attend the Sierra Special Meeting online, vote and submit questions by visiting https://viewproxy.com/sicSM/2022 and using a control number assigned by Alliance Advisors, LLC. To reserve access to the virtual Sierra Special Meeting, you will need to follow the instructions provided in the Notice of Special Meeting of Stockholders and the joint proxy statement/prospectus that follow. Please follow the instructions on the accompanying proxy card and authorize a proxy via the Internet, by telephone or by mail to vote your shares. Sierra encourages you to vote via the Internet as it saves Sierra significant time and processing costs. If you are the beneficial owner of your shares, you will need to follow the instructions provided by your broker, bank, trustee or nominee regarding how to instruct your broker, bank, trustee or nominee to vote your shares at the Sierra Special Meeting. Voting by proxy does not deprive you of your right to participate in the virtual Sierra Special Meeting.

The joint proxy statement/prospectus accompanying this letter describes the Sierra Special Meeting, the First Merger, and the documents related to the First Merger (including the Merger Agreement) that Sierra stockholders should review before voting on the Merger Proposal and the Sierra Adjournment Proposal and should be retained for future reference. Please carefully read this entire document, including “Risk Factors” beginning on page [•] and as otherwise incorporated by reference herein, for a discussion of the risks relating to the Merger, Sierra and Barings BDC. Sierra files annual, quarterly and current reports, proxy statements and other information about itself with the U.S. Securities and Exchange Commission (the “SEC”). Sierra maintains a website at www.sierraincomecorp.com and makes all of its annual, quarterly and current reports, proxy statements and other publicly filed information available on or through its website. Information contained on Sierra’s website is not incorporated by reference into the joint proxy statement/prospectus accompanying this letter, and you should not consider information contained on Sierra’s website to be part of the joint proxy statement/prospectus accompanying this letter. You may also obtain such information, free of charge, and make stockholder inquiries by calling Sierra at (212) 759-0777 or by writing to Sierra Income Corporation at 100 Park Avenue, 16th Floor, New York, New York 10017. The SEC also maintains a website at www.sec.gov that contains such information.

Sincerely yours,

Dean Crowe

Chief Executive Officer and President of Sierra Income Corporation

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the shares of Barings BDC Common Stock to be issued under the joint proxy statement/prospectus accompanying this letter or determined if the joint proxy statement/prospectus accompanying this letter is truthful or complete. Any representation to the contrary is a criminal offense.

Important Notice Regarding the Availability of Proxy Materials for the Sierra Special Meeting to Be Held on [•], 2022

The date of the accompanying joint proxy statement/prospectus is [•], 2021 and it is first being mailed or otherwise delivered to Barings BDC stockholders and Sierra stockholders on or about [•], 2021.

|

Sierra Income Corporation

100 Park Avenue, 16th Floor

New York, New York 10017

(212) 759-0777

|

| |

Barings BDC, Inc.

300 South Tryon Street, Suite 2500

Charlotte, North Carolina 28202

(704) 805-7200

|

SIERRA INCOME CORPORATION

100 Park Avenue, 16th Floor

New York, NY 10017

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [•], 2022

NOTICE OF VIRTUAL 2022 SPECIAL MEETING OF STOCKHOLDERS

Online Meeting Only—No Physical Meeting Location

https://viewproxy.com/sicSM/2022

[•], 2022, at [•] [a.m.][p.m.], Eastern Time

Notice is hereby given to the holders of shares of common stock of Sierra Income Corporation, a Maryland corporation (“Sierra”), that:

A Special Meeting of Stockholders of Sierra (“Sierra Special Meeting”) will be held virtually, solely by the means of remote communication, on [•], 2022, at [•] [a.m.][p.m.], Eastern Time, at the following website: https://viewproxy.com/sicSM/2022, for the following purposes:

(1) |

to consider and vote upon a proposal to approve the merger of Mercury Acquisition Sub, Inc. (“Acquisition Sub”), a Maryland corporation and a direct wholly-owned subsidiary of Barings BDC, Inc. (“Barings BDC”), a Maryland corporation, with and into Sierra (the “First Merger”), with Sierra continuing as the surviving corporation and as a wholly-owned subsidiary of Barings BDC, pursuant to the Agreement and Plan of Merger, dated as of September 21, 2021 (as may be amended from time to time, the “Merger Agreement”), by and among Barings BDC, Acquisition Sub, Sierra and Barings LLC, a Delaware limited liability company and the external investment adviser to Barings BDC (“Barings”) (such proposal, the “Merger Proposal”); and |

(2) |

to consider and vote upon a proposal to approve the adjournment of the Sierra Special Meeting, if necessary or appropriate, to solicit additional proxies, in the event there are insufficient votes at the time of the Sierra Special Meeting to approve the Merger Proposal (such proposal, the “Sierra Adjournment Proposal” and, together with the Merger Proposal, the “Sierra Proposals”). |

Sierra and Barings BDC are proposing a combination of both companies by a merger and related transactions, including the First Merger, pursuant to the Merger Agreement. Immediately after the effectiveness of the First Merger, Sierra, as the surviving corporation, will merge with and into Barings BDC (together with the First Merger, the “Merger”), with Barings BDC continuing as the surviving corporation.

THE BOARD OF DIRECTORS OF SIERRA (THE “SIERRA BOARD”), INCLUDING EACH OF ITS INDEPENDENT DIRECTORS AND THE SPECIAL COMMITTEE OF THE SIERRA BOARD (THE “SIERRA SPECIAL COMMITTEE”), HAS UNANIMOUSLY APPROVED THE MERGER AGREEMENT AND THE TRANSACTIONS CONTEMPLATED THEREBY, AND THE SIERRA BOARD, INCLUDING EACH OF ITS INDEPENDENT DIRECTORS, AND UPON RECOMMENDATION FROM THE SIERRA SPECIAL COMMITTEE, UNANIMOUSLY RECOMMENDS THAT SIERRA STOCKHOLDERS VOTE “FOR” THE MERGER PROPOSAL AND “FOR” THE SIERRA ADJOURNMENT PROPOSAL.

You have the right to receive notice of, and to vote at, the Sierra Special Meeting if you were a stockholder of record of Sierra common stock at the close of business on [•], 2021 (the “Sierra Record Date”). A list of these stockholders will be open for examination by any Sierra stockholder for any purpose germane to the Sierra Special Meeting for a period of 10 days prior to the Sierra Special Meeting at Sierra’s principal executive office at 100 Park Avenue, 16th Floor, New York, New York 10017, and will be available electronically during the Sierra Special Meeting. Sierra is furnishing a joint proxy statement/prospectus and proxy card to Sierra stockholders on the Internet, rather than mailing printed copies of those materials to Sierra stockholders.

Each Sierra stockholder is invited to attend the Sierra Special Meeting virtually. You or your proxyholder will be able to attend the Sierra Special Meeting online, vote and submit questions by visiting https://viewproxy.com/sicSM/2022 and using a control number assigned by Alliance Advisors, LLC.

If you are a beneficial owner of shares that are held in “street name,” that is they are registered in the name of your broker, bank, trustee or other nominee, you should have received a notice containing voting instructions from your nominee rather than from us. You should follow the voting instructions in the notice to ensure that your vote is counted. Many brokers and banks participate in a program that offers a means to grant proxies to vote shares via the Internet or by telephone. If your shares are held in an account with a broker or bank participating in this program, you may grant a proxy to vote those shares via the Internet or telephonically by using the website or telephone number shown on the instruction form provided to you by your nominee.

In order to vote at the Sierra Special Meeting, you must either be a stockholder of record of Sierra common stock as of the Sierra Record Date, or you must be a beneficial holder as of the Sierra Record Date and obtain a legal proxy from your broker, bank, trustee, or other nominee. Sierra stockholders of record will have the opportunity to vote electronically at the Sierra Special Meeting after they have checked into the Sierra Special Meeting as described above and in the joint proxy statement/prospectus. If you are a beneficial holder, you must request a legal proxy from your nominee in sufficient time so that it can be obtained, completed and submitted by you to Sierra no later than 11:59 p.m., Eastern Time, on [•], 2022.

The meeting webcast will begin promptly at [•] [a.m.][p.m.], Eastern Time, on [•], 2022. We encourage you to access the virtual Sierra Special Meeting prior to the start time. Because the Sierra Special Meeting will be a completely virtual meeting, there will be no physical location for Sierra stockholders to attend.

Whether or not you plan to participate in the Sierra Special Meeting, Sierra encourages you to vote your shares by following the instructions on the proxy card.

Your vote is extremely important to Sierra. In the event there are insufficient votes for a quorum or to approve the Merger Proposal at the time of the Sierra Special Meeting, the Sierra Special Meeting may be adjourned in order to permit further solicitation of proxies by Sierra.

The Merger and the Merger Agreement are each described in more detail in the joint proxy statement/prospectus accompanying this notice, which you should read carefully and in its entirety before authorizing a proxy to vote. A copy of the Merger Agreement is attached as Annex A to the joint proxy statement/prospectus accompanying this notice.

| | | By Order of the Board of Directors, |

|

| | | ||

| | | Stephen R. Byers |

|

| | | Independent Chairman of Sierra |

New York, New York

[•], 2021

To ensure proper representation at the Sierra Special Meeting, please follow the instructions on the accompanying proxy card to authorize a proxy to vote your shares via the Internet or telephone, or by requesting, signing, dating and returning a proxy card. Even if you vote your shares prior to the Sierra Special Meeting, you still may participate in the virtual Sierra Special Meeting.

i

This document, which forms part of a registration statement on Form N-14 filed with the U.S. Securities and Exchange Commission (the “SEC”) by Barings BDC (as defined below) (File No. 333-260591), constitutes a prospectus of Barings BDC, Inc., a Maryland corporation (“Barings BDC”), under Section 5 of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the shares of Barings BDC common stock, $0.001 par value per share (“Barings BDC Common Stock”), to be issued to the holders of shares of common stock, par value $0.001 per share (“Sierra Common Stock”), of Sierra Income Corporation, a Maryland corporation (“Sierra”), pursuant to the Agreement and Plan of Merger, dated as of September 21, 2021 (as may be amended from time to time, the “Merger Agreement”), by and among Barings BDC, Mercury Acquisition Sub, Inc., a Maryland corporation and a direct wholly-owned subsidiary of Barings BDC (“Acquisition Sub”), Sierra and Barings LLC, a Delaware limited liability company and investment adviser to Barings BDC (“Barings”). Pursuant to the Merger Agreement, Acquisition Sub will merge with and into Sierra (the “First Merger”), with Sierra continuing as the surviving corporation and as a wholly-owned subsidiary of Barings BDC. Immediately after the effectiveness of the First Merger (the “Effective Time”), Sierra, as the surviving corporation, will merge with and into Barings BDC (together with the First Merger, the “Merger”), with Barings BDC continuing as the surviving corporation.

Effective January 1, 2021, the SEC adopted certain new disclosure rules applicable to transactions such as the Merger under SEC release No. 33-10786, Amendments to Financial Disclosures about Acquired and Disposed Businesses (the “Final Rule”), which among other things, added a new rule Regulation S-X Rule 6-11 that eliminates the requirement to provide pro forma financial information for fund acquisitions if certain supplemental financial information is disclosed, as described under Regulation S-X Rule 6-11(d) (“Regulation S-X Rule 6-11(d)”). Furthermore, the Final Rule amended Form N-14 to make the disclosure requirements consistent with Regulation S-X Rule 6-11(d). Under the Final Rule, Barings BDC has determined that it has met the supplemental disclosure requirements consistent with Regulation S-X Rule 6-11(d) as it has (1) included a pro forma fee table, showing (a) the pre-transaction fee structures of Barings BDC and Sierra and (b) the post-transaction fee structure of the combined company, (2) determined that the Merger would not result in a material change in Sierra’s investment portfolio due to investment restrictions and (3) determined that there are no material differences in accounting policies between Barings BDC and Sierra.

This document also constitutes a joint proxy statement of Barings BDC and Sierra under Section 14(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). It also constitutes a notice of meeting with respect to: (1) the Special Meeting of Stockholders of Barings BDC (the “Barings BDC Special Meeting”), at which holders of shares of Barings BDC Common Stock will be asked to vote upon the Merger Stock Issuance Proposal (as defined below), the Barings BDC Below NAV Issuance Proposal (as defined below) and, if necessary or appropriate, the Barings BDC Adjournment Proposal (as defined below); and (2) the Special Meeting of Stockholders of Sierra (the “Sierra Special Meeting”), at which Sierra stockholders will be asked to vote upon the Merger Proposal (as defined below) and, if necessary or appropriate, the Sierra Adjournment Proposal (as defined below).

You should rely only on the information contained in this joint proxy statement/prospectus, including in determining how to vote the shares of Barings BDC Common Stock or Sierra Common Stock, as applicable. No one has been authorized to provide you with information that is different from that contained in this joint proxy statement/prospectus. This joint proxy statement/prospectus is dated [•], 2021. You should not assume that the information contained in this joint proxy statement/prospectus is accurate as of any date other than that date. Neither any mailing of this joint proxy statement/prospectus to Barings BDC stockholders or Sierra stockholders nor the issuance of Barings BDC Common Stock in connection with the First Merger will create any implication to the contrary.

This joint proxy statement/prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction to or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction.

Except where the context otherwise indicates, information contained in this joint proxy statement/prospectus regarding Barings BDC has been provided by Barings BDC and information contained in this joint proxy statement/prospectus regarding Sierra has been provided by Sierra.

iii

The questions and answers below highlight only selected information from this joint proxy statement/prospectus. They do not contain all of the information that may be important to you. You should carefully read this entire document to fully understand the Merger Agreement and the transactions contemplated thereby (including the Merger) and the voting procedures for the Barings BDC Special Meeting and the Sierra Special Meeting (collectively, the “Special Meetings”).

Questions and Answers about the Special Meetings

Q: |

Why am I receiving these materials? |

A: |

Barings BDC is furnishing these materials to Barings BDC stockholders in connection with the solicitation of proxies by the board of directors of Barings BDC (the “Barings BDC Board”) for use at the Barings BDC Special Meeting to be held virtually at [•] [a.m.][p.m.], Eastern Time, on [•], 2022 at the following website: www.virtualshareholdermeeing.com/BBDC2022SM, and any adjournments or postponements thereof.

|

Sierra is furnishing these materials to Sierra stockholders in connection with the solicitation of proxies by the board of directors of Sierra (the “Sierra Board”) for use at the Sierra Special Meeting to be held virtually at [•] [a.m.][p.m.], Eastern Time, on [•], 2022 at the following website: https://viewproxy.com/sicSM/2022, and any adjournments or postponements thereof.

This joint proxy statement/prospectus and the accompanying materials are being made available on or about [•], 2021 to stockholders of record of Barings BDC and Sierra as described below and are available at www.proxyvote.com for stockholders of record of Barings BDC and at https://viewproxy.com/sicSM/2022 for stockholders of record of Sierra.

Q: |

What items will be considered and voted on at the Barings BDC Special Meeting? |

A: |

At the Barings BDC Special Meeting, Barings BDC stockholders will be asked to approve: (1) the issuance of shares of Barings BDC Common Stock pursuant to the Merger Agreement (such proposal, the “Merger Stock Issuance Proposal”), (2) the issuance of shares of Barings BDC Common Stock pursuant to the Merger Agreement at a price below its then-current net asset value (“NAV”) per share, if applicable (such proposal, the “Barings BDC Below NAV Issuance Proposal”) and (3) if necessary or appropriate, to solicit additional proxies, in the event that there are insufficient votes at the time of the Barings BDC Special Meeting to approve the Merger Stock Issuance Proposal or the Barings BDC Below NAV Issuance Proposal (such proposal, the “Barings BDC Adjournment Proposal” and, together with the Merger Stock Issuance Proposal and the Barings BDC Below NAV Issuance Proposal, the “Barings BDC Proposals”). No other matters will be acted upon at the Barings BDC Special Meeting without further notice.

|

Q: |

What items will be considered and voted on at the Sierra Special Meeting? |

A: |

At the Sierra Special Meeting, Sierra stockholders will be asked to: (1) approve the First Merger on the terms and conditions set forth in the Merger Agreement (such proposal, the “Merger Proposal”) and (2) approve the adjournment of the Sierra Special Meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are insufficient votes at the time of the Sierra Special Meeting to approve the Merger Proposal (such proposal, the “Sierra Adjournment Proposal” and, together with the Merger Proposal, the “Sierra Proposals”). No other matters will be acted upon at the Sierra Special Meeting without further notice.

|

Q: |

How does the Barings BDC Board recommend voting on the Barings BDC Proposals at the Barings BDC Special Meeting? |

A: |

The Barings BDC Board believes that the transactions contemplated by the Merger Agreement are in the best interests of the Barings BDC stockholders and unanimously approved the Merger Agreement and the transactions contemplated thereby. Therefore, the Barings BDC Board unanimously recommends that Barings BDC stockholders vote “FOR” the Merger Stock Issuance Proposal, “FOR” the Barings Below NAV Issuance Proposal and, if necessary or appropriate, “FOR” the Barings BDC Adjournment Proposal.

|

1

Certain material factors considered by the Barings BDC Board, including the directors that are not “interested persons,” as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “Investment Company Act”), of Barings BDC or Barings (the “Barings BDC Independent Directors”), that favored the conclusion of the Barings BDC Board that the Merger is in the best interests of Barings BDC and Barings BDC stockholders included, among others:

• |

the combined company’s increased scale and liquidity; |

• |

the expected accretion to Barings BDC stockholders; |

• |

the alignment of Barings and Barings BDC stockholders as a result of Barings agreeing to (1) fund the cash portion of the purchase price of $0.9783641 per share, or approximately $100.0 million, (2) amend the Existing Barings BDC Advisory Agreement (as defined below) to increase the incentive fee hurdle rate from 8.0% to 8.25% (annualized) and (3) provide up to $100.0 million of credit support pursuant to a credit support agreement (the “Credit Support Agreement”) designed to limit downside to Barings BDC stockholders from net cumulative realized and unrealized losses on the acquired Sierra portfolio relative to purchase price while also allowing Barings BDC stockholders to benefit from long-term Sierra portfolio appreciation; and |

• |

the combined company’s economies of scale. |

The Barings BDC Board considered that while the Merger could cause dilution to Barings BDC stockholders’ voting interests and the NAV per share of the combined company’s common stock, the potential benefits of the Merger (including each of the foregoing) outweighed this cost.

For more information regarding the Barings BDC Board’s considerations in determining that the Merger is in the best interests of Barings BDC and Barings BDC stockholders, see “The Merger—Reasons for the Merger—Barings BDC.”

Q: |

How does the Sierra Board recommend voting on the Sierra Proposals at the Sierra Special Meeting? |

A: |

The Sierra Board, acting on the recommendation of a special committee of the Sierra Board (the “Sierra Special Committee”), consisting of Stephen R. Byers, Valerie Lancaster-Beal, Oliver T. Kane and Matthew E. Forstenhausler, believes the Merger Agreement and the transactions contemplated thereby are in the best interests of Sierra stockholders, and unanimously approved the First Merger on the terms and conditions set forth in the Merger Agreement, and therefore unanimously recommends that Sierra stockholders vote “FOR” the Merger Proposal and, if necessary or appropriate, “FOR” the Sierra Adjournment Proposal.

|

Certain material factors considered by the Sierra Board, including Sierra directors who are not “interested persons” as defined by the Investment Company Act (the “Sierra Independent Directors”) and who comprise the Sierra Special Committee, that favored the conclusion of the Sierra Board that the First Merger is in the best interests of Sierra and Sierra stockholders included, among others:

• |

the consideration to be received by Sierra stockholders represents a premium to Sierra’s NAV as of June 30, 2021; |

• |

the First Merger will provide the Sierra stockholders with the opportunity for immediate liquidity upon the close of the Merger; |

• |

the Sierra stockholders will have the option of selling the shares of Barings BDC they receive in the First Merger or remaining stockholders of Barings BDC; and |

• |

the Merger is expected to qualify as a tax-free transaction for federal income tax purposes and the other factors described under “The Merger—Reasons for the Merger—Sierra.” |

Q: |

If I am a Barings BDC stockholder, what is the “Record Date” and what does it mean? |

A: |

The record date for the Barings BDC Special Meeting is [•] (the “Barings BDC Record Date”). The Barings BDC Record Date was established by the Barings BDC Board, and only holders of record of shares of Barings BDC Common Stock at the close of business on the Barings BDC Record Date are entitled to receive notice of the Barings BDC Special Meeting and vote at the Barings BDC Special Meeting. As of the Barings BDC Record Date, there were [•] shares of Barings BDC Common Stock outstanding.

|

2

Q: |

If I am a Sierra stockholder, what is the “Record Date” and what does it mean? |

A: |

The record date for the Sierra Special Meeting is [•] (the “Sierra Record Date”). The Sierra Record Date was established by the Sierra Board, and only holders of record of shares of Sierra Common Stock at the close of business on the Sierra Record Date are entitled to receive notice of, and vote at, the Sierra Special Meeting. As of the Sierra Record Date, there were [•] shares of Sierra Common Stock outstanding.

|

Q: |

If I am a Barings BDC stockholder, how many votes do I have? |

A: |

Each share of Barings BDC Common Stock held by a holder of record as of the Barings BDC Record Date has one vote on each matter to be considered at the Barings BDC Special Meeting.

|

Q: |

If I am a Sierra stockholder, how many votes do I have? |

A: |

Each share of Sierra Common Stock held by a holder of record as of the Sierra Record Date has one vote on each matter to be considered at the Sierra Special Meeting.

|

Q: |

If I am a Barings BDC stockholder, how do I vote? |

A: |

The Barings BDC Special Meeting will be hosted live via Internet audio webcast. Any Barings BDC stockholder can attend the Barings BDC Special Meeting live at www.virtualshareholdermeeing.com/BBDC2022SM. A Barings BDC stockholder should follow the instructions on the accompanying proxy card and authorize a proxy via the Internet or telephone to vote in accordance with the instructions provided below. Authorizing a proxy by telephone or through the Internet requires you to input the control number located on your proxy card. After inputting the control number, you will be prompted to direct your proxy to vote on each proposal. You will have an opportunity to review your directions and make any necessary changes before submitting your directions and terminating the telephone call or Internet link. If you are the beneficial owner of your shares, you will need to follow the instructions provided by your broker, bank, trustee or nominee regarding how to instruct your broker, bank, trustee or nominee to vote your shares at the Barings BDC Special Meeting.

|

• |

By Internet: www.proxyvote.com |

• |

By telephone: (800) 690-6903 to reach a toll-free, automated touchtone voting line, or (877) 777-4652 Monday through Friday 9:00 a.m. until 10:00 p.m. Eastern Time to reach a toll-free, live operator line. |

• |

By mail: You may vote by proxy, after you request the hard copy materials, by following the directions and indicating your instructions on the enclosed proxy card, dating and signing the proxy card, and promptly returning the proxy card in the envelope provided, which requires no postage if mailed in the United States. Please allow sufficient time for your proxy card to be received on or prior to 11:59 p.m., Eastern Time, on [•], 2022. |

Important notice regarding the availability of proxy materials for the Barings BDC Special Meeting. Barings BDC’s joint proxy statement/prospectus and the proxy card are available at www.proxyvote.com.

Q: |

If I am a Sierra stockholder, how do I vote? |

A: |

The Sierra Special Meeting will be hosted live via Internet audio webcast. Any Sierra stockholder can attend the Sierra Special Meeting live at https://viewproxy.com/sicSM/2022. A Sierra stockholder should follow the instructions on the accompanying proxy card and authorize a proxy via the Internet or telephone to vote in accordance with the instructions provided below. Authorizing a proxy by telephone or through the Internet requires you to input the control number located on your proxy card. After inputting the control number, you will be prompted to direct your proxy to vote on each proposal. You will have an opportunity to review your directions and make any necessary changes before submitting your directions and terminating the telephone call or Internet link. If you are the beneficial owner of your shares, you will need to follow the instructions provided by your broker, bank, trustee or nominee regarding how to instruct your broker, bank, trustee or nominee to vote your shares at the Sierra Special Meeting.

|

• |

By Internet: https://viewproxy.com/sicSM/2022 |

• |

By telephone: (844) 885-0180 Monday through Friday between 9 a.m. and 10 p.m. Eastern Time and Saturday and Sunday between 10 a.m. and 6 p.m. Eastern Time. |

3

• |

By mail: You may vote by proxy, after you request the hard copy materials, by following the directions and indicating your instructions on the enclosed proxy card, dating and signing the proxy card, and promptly returning the proxy card in the envelope provided, which requires no postage if mailed in the United States. Please allow sufficient time for your proxy card to be received on or prior to 11:59 p.m., Eastern Time, on [•], 2022. |

Important notice regarding the availability of proxy materials for the Sierra Special Meeting. Sierra’s joint proxy statement/prospectus and the proxy card are available at https://viewproxy.com/sicSM/2022.

Q: |

What if a Barings BDC stockholder does not specify a choice for a matter when authorizing a proxy? |

A: |

All properly executed proxies representing shares of Barings BDC Common Stock at the Barings BDC Special Meeting will be voted in accordance with the directions given. If the enclosed proxy card is signed and returned without any directions given, the shares of Barings BDC Common Stock will be voted “FOR” the Barings BDC Proposals.

|

Q: |

What if a Sierra stockholder does not specify a choice for a matter when authorizing a proxy? |

A: |

All properly executed proxies representing shares of Sierra Common Stock at the Sierra Special Meeting will be voted in accordance with the directions given. If the enclosed proxy card is signed and returned without any directions given, the shares of Sierra Common Stock will be voted “FOR” the Sierra Proposals.

|

Q: |

If I am a Barings BDC stockholder, how can I change my vote or revoke a proxy? |

A: |

You may revoke your proxy and change your vote by giving notice at any time before your proxy is exercised. A revocation may be effected by submitting new voting instructions via the Internet voting site, by telephone, by obtaining and properly completing another proxy card that is dated later than the original proxy card and returning it, by mail, in time to be received before the Barings BDC Special Meeting, by attending the Barings BDC Special Meeting and voting virtually or by a notice, provided in writing and signed by you, delivered to Barings BDC’s Secretary on any business day before the date of the Barings BDC Special Meeting.

|

Q: |

If I am a Sierra stockholder, how can I change my vote or revoke a proxy? |

A: |

You may change your vote or revoke a proxy by giving notice at any time before your proxy is exercised. A revocation may be effected by submitting new voting instructions via the Internet voting site, by telephone, by obtaining and properly completing another proxy card that is dated later than the original proxy card and returning it, by mail, in time to be received before the Sierra Special Meeting, by attending the Sierra Special Meeting and voting virtually or by a notice, provided in writing and signed by you, delivered to Sierra’s Secretary on any business day before the date of the Sierra Special Meeting.

|

Q: |

If my shares of Barings BDC Common Stock or Sierra Common Stock, as applicable, are held in a broker-controlled account or in “street name,” will my broker vote my shares for me? |

A: |

No. You should follow the instructions provided by your broker on your voting instruction form. It is important to note that your broker will vote your shares only if you provide instructions on how you would like your shares to be voted at the applicable Special Meeting.

|

Q: |

What constitutes a “quorum” for the Barings BDC Special Meeting? |

A: |

The presence at the Barings BDC Special Meeting, virtually or represented by proxy, of the holders of a majority of the shares of Barings BDC Common Stock, issued and outstanding and entitled to vote at the Barings BDC Special Meeting, will constitute a quorum. Shares held by a broker, bank, trustee or nominee for which the broker, bank, trustee or nominee has not received voting instructions from the record holder as to how to vote such shares and does not have discretionary authority to vote the shares on non-routine proposals (which are considered “broker non-votes” with respect to such proposals) will not be treated as shares present for quorum purposes.

|

4

Q: |

What constitutes a “quorum” for the Sierra Special Meeting? |

A: |

The presence at the Sierra Special Meeting, virtually or represented by proxy, of the holders of one-third of the shares of Sierra Common Stock entitled to be cast at the Sierra Special Meeting will constitute a quorum.

|

Q: |

What vote is required to approve each of the proposals being considered at the Barings BDC Special Meeting? |

A: |

The Merger Stock Issuance Proposal requires the affirmative vote of the holders of at least a majority of the votes cast by holders of shares of Barings BDC Common Stock present at the Barings BDC Special Meeting, virtually or represented by proxy, entitled to vote thereat. Abstentions and broker non-votes (if any) will not be counted as votes cast and will have no effect on the result of the vote of the Merger Stock Issuance Proposal.

|

The Barings BDC Below NAV Issuance Proposal requires the affirmative vote of each of the following: (1) a majority of the outstanding voting securities of Barings BDC Common Stock; and (2) a majority of the outstanding voting securities of Barings BDC Common Stock that are not held by affiliated persons of Barings BDC. For purposes of this proposal, the Investment Company Act defines a “majority of the outstanding voting securities” as the vote of the lesser of: (1) 67% or more of the voting securities of Barings BDC present at the Barings BDC Special Meeting, if the holders of more than 50% of the outstanding voting securities of Barings BDC are present virtually or represented by proxy; or (2) more than 50% of the outstanding voting securities of Barings BDC. Abstentions and broker non-votes (if any) will have the effect of a vote “against” the Barings BDC Below NAV Issuance Proposal.

The Barings BDC Adjournment Proposal requires the affirmative vote of the holders of at least a majority of votes cast by holders of shares of Barings BDC Common Stock present at the Barings BDC Special Meeting, virtually or represented by proxy, and entitled to vote thereat is required to approve the Barings BDC Adjournment Proposal. Abstentions and broker non-votes (if any) will not be counted as votes cast and will have no effect on the result of the vote of the Barings BDC Adjournment Proposal.

Q: |

What vote is required to approve each of the proposals being considered at the Sierra Special Meeting? |

A: |

The affirmative vote of the holders of Sierra Common Stock constituting a majority of all the votes entitled to be cast on the matter at the Sierra Special Meeting is required to approve the Merger Proposal. The affirmative vote of the holders of at least a majority of the votes cast by holders of the shares of Sierra Common Stock present at the Sierra Special Meeting, virtually or represented by proxy, is required to approve the Sierra Adjournment Proposal.

|

Abstentions and broker non-votes (which occur when a beneficial owner does not instruct its broker, bank, trustee or nominee holding its shares of Sierra Common Stock how to vote such shares on its behalf), if any, will not be included in determining the number of votes cast and, as a result, will have no effect on the voting outcome of the Sierra Adjournment Proposal but will have the same effect as a vote “against” the Merger Proposal.

Q: |

How does the bankruptcy of Medley LLC affect the Merger Agreement and/or the Merger? |

A: |

The bankruptcy of Medley LLC is not expected to affect the Merger Agreement or the Merger. On March 7, 2021, Medley commenced a voluntary case (the “Medley LLC Bankruptcy Case”) under chapter 11 of title 11 of the United States Code in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). Medley LLC is the sole member of Sierra’s investment adviser, SIC Advisors LLC (“SIC Advisors”), and Sierra’s administrator, Medley Capital LLC (“Medley Capital”). Medley LLC, Medley Capital and the Official Committee of Unsecured Creditors appointed in the Medley LLC Bankruptcy Case reached agreement on the terms of a chapter 11 plan, which was filed with the Bankruptcy Court on August 13, 2021, and ultimately confirmed by the Bankruptcy Court on October 14, 2021 (as supplemented and modified, the Modified Third Amended Combined Disclosure Statement Chapter 11 Plan of Medley LLC, the “Final Plan”). The Final Plan became effective on October 18, 2021.

|

The Final Plan provides for a limited restructuring in chapter 11 to enable Medley LLC to maximize the value of its remaining contracts (the “Remaining Contracts”) over a short run-off period, until the

5

Remaining Contracts are terminated, subject to an end date of March 31, 2022 (the “Run-Off End Date”). The Remaining Contracts include the Sierra Investment Advisory Agreement (as defined below under “—Questions and Answers about the Merger—Will stockholders of Barings BDC following the Merger pay a higher base management fee than stockholders of Barings BDC and Sierra prior to the Merger?”) and the Sierra Administration Agreement (as defined in “Certain Relationships and Related Party Transactions—Sierra Administration Agreement”). The Final Plan contemplates that SIC Advisors will continue to honor its obligations under the Sierra Investment Advisory Agreement until the termination thereof. Accordingly, Sierra’s arrangements with SIC Advisors and Medley Capital are expected to remain in place until the closing of the First Merger. If, notwithstanding that, SIC Advisors is no longer performing its duties and obligations under the Sierra Investment Advisory Agreement, the Merger Agreement permits Sierra to replace SIC Advisors as Sierra’s investment adviser. See “Description of the Merger Agreement—Additional Covenants—Sierra Investment Advisory Agreement”).

Q: |

What will happen if the Barings BDC Proposals being considered at the Barings BDC Special Meeting and/or the Sierra Proposals being considered at the Sierra Special Meeting are not approved by the required vote? |

A: |

The Merger Stock Issuance Proposal and the Barings BDC Below NAV Proposals with respect to Barings BDC, and the Merger Proposal with respect to Sierra, are conditions precedent to the closing of the Merger. If the Merger does not close because Barings BDC stockholders do not approve the Merger Stock Issuance Proposal or the Barings BDC Below NAV Proposal (the “Barings BDC Stockholder Approval”) and Sierra stockholders do not approve the Merger Proposal (the “Sierra Stockholder Approval”) or any of the other conditions to closing of the Merger are not satisfied or, if legally permissible, waived, Barings BDC and Sierra will continue to operate independently under the management of their respective investment advisers, and Barings BDC’s and Sierra’s respective directors and officers will continue to serve in such roles until their respective successors are duly elected and qualify or their resignation. Furthermore, neither Barings BDC nor Sierra will benefit from the expenses incurred in their pursuit of the Merger and, under certain circumstances, Sierra may be required to pay Barings BDC’s and Barings’ expenses incurred in connection with the Merger, subject to a cap of $2.0 million. See “Description of the Merger Agreement—Termination of the Merger Agreement” below for a more detailed discussion. The Sierra Board would also expect to consider alternatives, including the replacement of SIC Advisors as its investment adviser, another merger transaction or Sierra’s liquidation, based on, among other things, then-current market circumstances, the performance of the Sierra portfolio and the financial position of Sierra. Sierra also might seek a modification to the Final Plan that would extend the Run-Off End Date so that SIC Advisors may continue to serve as Sierra’s investment adviser beyond March 31, 2022.

|

Stockholder approval of the Barings BDC Adjournment Proposal and the Sierra Adjournment Proposal are not conditions to the closing of the Merger.

Q: |

How will the final voting results be announced? |

A: |

Preliminary voting results may be announced at each Special Meeting. Final voting results will be published by Barings BDC and Sierra in a current report on Form 8-K within four business days after the date of the Barings BDC Special Meeting and the Sierra Special Meeting, respectively.

|

Q: |

Are the proxy materials available electronically? |

A: |

Barings BDC and Sierra have made the registration statement (of which this joint proxy statement/prospectus forms a part), the applicable notice of special meeting of stockholders and the applicable proxy card available to stockholders of Barings BDC and Sierra on the Internet. Stockholders may (i) access and review the proxy materials of Barings BDC and Sierra, as applicable, (ii) authorize their proxies, as described in “The Barings BDC Special Meeting—Voting of Proxies” and “The Sierra Special Meeting—Voting of Proxies” and/or (iii) elect to receive future proxy materials by electronic delivery via the Internet address provided below.

|

The registration statement (of which this joint proxy statement/prospectus forms a part), notice of special meeting of stockholders and the proxy card are available at www.proxyvote.com for stockholders of record of Barings BDC and at https://viewproxy.com/sicSM/2022 for stockholders of record of Sierra.

6

Pursuant to the rules adopted by the SEC, Barings BDC and Sierra furnish proxy materials by email to those stockholders who have elected to receive their proxy materials electronically. While each of Barings BDC and Sierra encourages stockholders to take advantage of electronic delivery of proxy materials, which helps to reduce the environmental impact of stockholder meetings and the cost associated with the physical printing and mailing of materials, stockholders who have elected to receive proxy materials electronically by email, as well as beneficial owners of shares of Barings BDC Common Stock and Sierra Common Stock, as applicable, held by a broker or custodian, may request a printed set of proxy materials.

Q: |

Will my vote make a difference? |

A: |

Yes. Your vote is needed to ensure that the proposals can be acted upon. Your vote is very important. Your immediate response will help avoid potential delays and may save significant additional expenses associated with soliciting stockholder votes, and potentially adjourning the Special Meetings.

|

Q: |

Whom can I contact with any additional questions? |

A: |

If you are a Barings BDC stockholder, you can contact Barings BDC by calling Barings BDC collect at (888) 401-1088, by sending an e-mail to Barings BDC at BDCinvestorrelations@barings.com, or by writing to Barings BDC at 300 South Tryon Street, Suite 2500, Charlotte, North Carolina 28202, Attention: Investor Relations, or by visiting Barings BDC’s website at www.baringsbdc.com or you may contact Broadridge Inc., Barings BDC’s proxy solicitor, toll-free at 1-877-777-4652.

|

If you are a Sierra stockholder, you can contact Sierra by calling Sierra collect at (212) 759-0777, by sending an email to SierraIncome@allianceadvisors.com, or by writing to Sierra Income Corporation at 100 Park Avenue, 16th Floor, New York, New York 10017, or by visiting Sierra’s website at www.sierraincomecorp.com or you may contact Alliance Advisors, LLC, Sierra’s proxy solicitor, toll-free at (844) 885-0180 (Monday through Friday between 9 a.m. and 10 p.m. Eastern Time and Saturday and Sunday between 10 a.m. and 6 p.m. Eastern Time).

Q: |

Where can I find more information about Barings BDC and Sierra? |

A: |

You can find more information about Barings BDC and Sierra in the documents described under the section entitled “Where You Can Find More Information.”

|

Q: |

What do I need to do now? |

A: |

Barings BDC and Sierra urge you to carefully read this entire document, including its annexes. You should also review the documents referenced under “Where You Can Find More Information” and consult with your accounting, legal and tax advisors.

|

7

Questions and Answers about the Merger

Q: |

What will happen in the Merger? |

A: |

As of the Effective Time, the separate corporate existence of Acquisition Sub will cease. Sierra will be the surviving corporation of the First Merger and will continue its existence as a corporation under the laws of the State of Maryland until the Second Merger (as defined below). Immediately after the Effective Time, Sierra, as the surviving corporation in the First Merger, will merge with and into Barings BDC (the “Second Merger” and, together with the First Merger, the “Merger”), with Barings BDC as the surviving corporation in the Second Merger.

|

Q: |

What will Sierra stockholders receive in the Merger? |

A: |

Subject to the terms and conditions of the Merger Agreement, at the Effective Time, each share of Sierra Common Stock issued and outstanding immediately prior to the Effective Time (excluding Canceled Shares (as defined below)) will be converted into the right to receive (1) $0.9783641 per share in cash, without interest, from Barings (such amount of cash, the “Cash Consideration”) and (2) 0.44973 (as may be adjusted pursuant to the Merger Agreement) of a validly issued, fully paid and non-assessable share of Barings BDC Common Stock (and, if applicable, cash in lieu of fractional shares of Barings BDC Common Stock payable in accordance with the Merger Agreement) (the “Share Consideration” and, together with the Cash Consideration, the “Merger Consideration”). For purposes of the Merger Agreement, “Canceled Shares” means all treasury shares and all shares of Sierra Common Stock issued and outstanding immediately prior to the Effective Time that are owned by Barings BDC, Sierra or any subsidiary thereof.

|

Q: |

How will the Exchange Ratio be determined? |

A: |

The Exchange Ratio was fixed at the signing of the Merger Agreement at 0.44973. Because the Exchange Ratio is fixed, other than customary anti-dilution adjustments in the event of certain changes in the number of outstanding shares of Barings BDC Common Stock and Sierra Common Stock, the value of the consideration to be received by Sierra stockholders in the First Merger will depend on the market price of shares of Barings BDC Common Stock at the time of the First Merger.

|

Q: |

Who is responsible for paying the expenses relating to completing the Merger? |

A: |

In general, all fees and expenses incurred in connection with the Merger will be paid by the party incurring such fees and expenses, whether or not the Merger or any of the transactions contemplated in the Merger Agreement are consummated, provided that each of Barings BDC and Sierra agreed to be responsible for one-half of all filing fees incurred in connection with the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”). It is expected that Barings BDC will incur approximately $7.3 million, or $0.11 per share of Barings BDC Common Stock, and Sierra will incur approximately $9.1 million, of which approximately $3.8 million had been paid as of September 30, 2021, or $0.09 per share of Sierra Common Stock, of fees and expenses in connection with completing the Merger. While Barings BDC does not anticipate material portfolio repositioning following the Merger, these costs described above do not reflect commissions or other transaction fees that may be incurred by Barings BDC as a result of any such portfolio repositioning.

|