EX-99.2

Published on April 4, 2018

Triangle Capital Corporation Barings LLC Strategic Transaction Investor Presentation April 4, 2018 Exhibit 99.2

Forward-Looking Statements and Disclaimers This presentation contains forward-looking statements, including statements regarding the proposed transactions. All statements, other than historical facts, including statements regarding the expected timing of the closing of the proposed transactions; the ability of the parties to complete the proposed transactions considering the various closing conditions; the expected benefits of the proposed transactions such as improved operations, enhanced revenues and cash flow, growth potential, market profile and financial strength; the competitive ability and position of Triangle Capital Corporation (“TCAP”) following completion of the proposed transactions; and any assumptions underlying any of the foregoing, are forward-looking statements. Additional factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the transactions may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transactions, may require conditions, limitations or restrictions in connection with such approvals or that the required approvals by the shareholders of TCAP may not be obtained; (2) the risk that the transactions contemplated by the asset purchase agreement and the stock purchase and transaction agreement may not be completed in the time frame expected by parties, or at all; (3) unexpected costs, charges or expenses resulting from the proposed transactions; (4) uncertainty of the expected financial performance of TCAP following completion of the proposed transactions; (5) failure to realize the anticipated benefits of the proposed transactions, including as a result of delay in completing the proposed transactions; (6) the ability of TCAP and/or Barings to implement its business strategy; (7) the occurrence of any event that could give rise to termination of the agreements; (8) the risk that shareholder litigation in connection with the proposed transactions may affect the timing or occurrence of the proposed transactions or result in significant costs of defense, indemnification and liability; (9) evolving legal, regulatory and tax regimes; (10) changes in general economic and/or industry specific conditions; and (11) other risk factors as detailed from time to time in TCAP’s reports filed with the Securities and Exchange Commission (“SEC”), including TCAP’s annual report on Form 10-K for the year ended December 31, 2017, periodic quarterly reports on Form 10-Q, periodic current reports on Form 8-K and other documents filed with the SEC. Any forward-looking statements speak only as of the date of this press release. TCAP does not undertake any obligation to update any forward-looking statements, whether as a result of new information or developments, future events or otherwise, except as required by law. The stated targeted returns included herein are based on a variety of factors and assumptions and involve significant elements of subjective judgment and analysis. The targeted returns are subject to uncertainties and are based upon assumptions which may prove to be invalid and may change without notice. TCAP believes the assumptions referred to above are reasonable under current circumstances; however, there can be no assurance that targeted returns will be achieved.

Forward-Looking Statements and Disclaimers Available Information and Where to Find It This communication relates to certain matters that are expected to be submitted as proposals for the consideration and approval of stockholders of Triangle Capital Corporation (the “Proposals”). In connection with the Proposals, Triangle Capital Corporation intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A (“Proxy Statement”). STOCKHOLDERS OF TRIANGLE CAPITAL CORPORATION ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING ANY PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSALS. Investors and stockholders will be able to obtain the documents filed by Triangle Capital Corporation with the SEC free of charge at the SEC’s website (http://www.sec.gov), at the Company’s website (http://www.tcap.com), or by writing to the Triangle Capital Corporation at 3700 Glenwood Avenue, Suite 530 Raleigh, NC 27612, (919) 747-8615. Participants in the Solicitations Each of Triangle Capital Corporation and Barings LLC and their respective directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Triangle Capital Corporation in connection with the Proposals. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of Triangle Capital Corporation’s stockholders in connection with the Proposals will be contained in the Proxy Statement when such document becomes available. This document may be obtained free of charge from the sources indicated above. The summary descriptions and other information included herein are intended only for informational purposes and convenient reference. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations No representation or warranty, express or implied, is made as to the accuracy or completeness of the information contained herein, and nothing shall be relied upon as a promise or representation as to the future performance of Triangle Capital Corporation. Unless otherwise stated, all Barings data presented herein is as of December 31, 2017. This presentation contains forward-looking statements based on estimates, projections, beliefs and assumptions of Barings' management at the time of such statements and are not guarantees of future performance.

Overview On November 1, 2017, TCAP announced its Board of Directors was initiating a review of certain strategic alternatives The strategic review was based on the rapidly changing dynamics within the private credit asset class in general and the BDC industry specifically The primary goals of TCAP’s decision to review strategic alternatives were to: Maximize shareholder value Partner with an organization having the scale, scope and resources to help TCAP accelerate its transition to a senior-focused provider of capital to the lower and middle-markets The results of the Board’s strategic process are outlined on the following pages

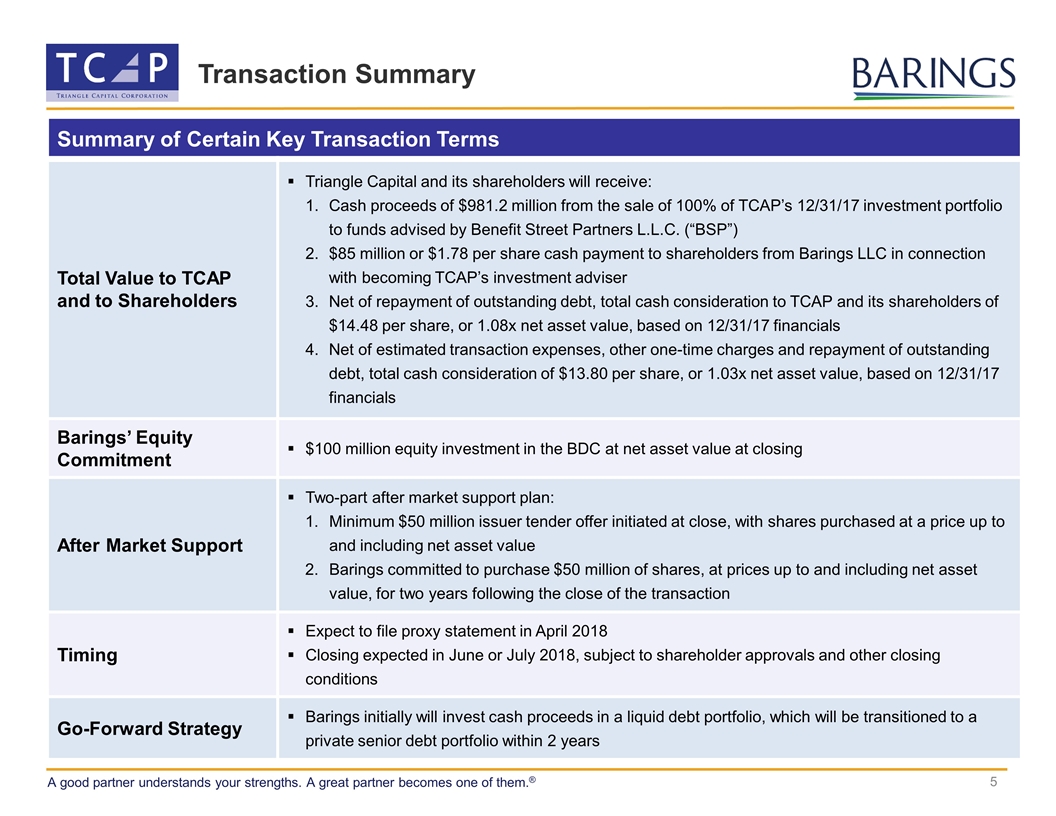

Transaction Summary Summary of Certain Key Transaction Terms Total Value to TCAP and to Shareholders Triangle Capital and its shareholders will receive: Cash proceeds of $981.2 million from the sale of 100% of TCAP’s 12/31/17 investment portfolio to funds advised by Benefit Street Partners L.L.C. (“BSP”) $85 million or $1.78 per share cash payment to shareholders from Barings LLC in connection with becoming TCAP’s investment adviser Net of repayment of outstanding debt, total cash consideration to TCAP and its shareholders of $14.48 per share, or 1.08x net asset value, based on 12/31/17 financials Net of estimated transaction expenses, other one-time charges and repayment of outstanding debt, total cash consideration of $13.80 per share, or 1.03x net asset value, based on 12/31/17 financials Barings’ Equity Commitment $100 million equity investment in the BDC at net asset value at closing After Market Support Two-part after market support plan: Minimum $50 million issuer tender offer initiated at close, with shares purchased at a price up to and including net asset value Barings committed to purchase $50 million of shares, at prices up to and including net asset value, for two years following the close of the transaction Timing Expect to file proxy statement in April 2018 Closing expected in June or July 2018, subject to shareholder approvals and other closing conditions Go-Forward Strategy Barings initially will invest cash proceeds in a liquid debt portfolio, which will be transitioned to a private senior debt portfolio within 2 years

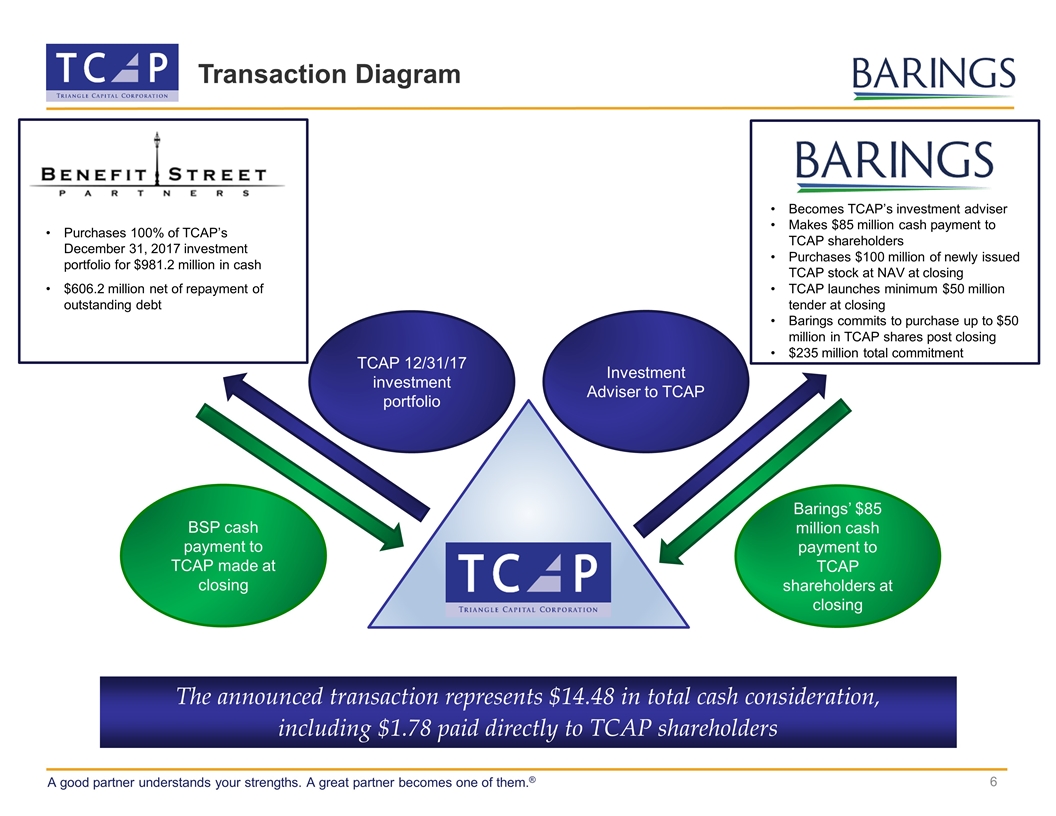

Transaction Diagram The announced transaction represents $14.48 in total cash consideration, including $1.78 paid directly to TCAP shareholders TCAP 12/31/17 investment portfolio Investment Adviser to TCAP BSP cash payment to TCAP made at closing Barings’ $85 million cash payment to TCAP shareholders at closing Becomes TCAP’s investment adviser Makes $85 million cash payment to TCAP shareholders Purchases $100 million of newly issued TCAP stock at NAV at closing TCAP launches minimum $50 million tender at closing Barings commits to purchase up to $50 million in TCAP shares post closing $235 million total commitment Purchases 100% of TCAP’s December 31, 2017 investment portfolio for $981.2 million in cash $606.2 million net of repayment of outstanding debt

Transaction Benefits Sale of 12/31/17 Investment Portfolio to Funds Advised by BSP 100% cash transaction Monetizes the value of the portfolio Accelerates TCAP’s transition to a senior-focused provider of capital to the lower and middle-markets Barings as External Manager Access to a premier global investment manager with $300+ billion of assets under management and 650+ investment professionals Stable and consistent run-rate dividend yield based on lower risk/volatility senior secured private debt strategy Attractive management and incentive fee structure Significant alignment of interest between Barings manager and shareholders given Barings significant pro forma ownership of TCAP

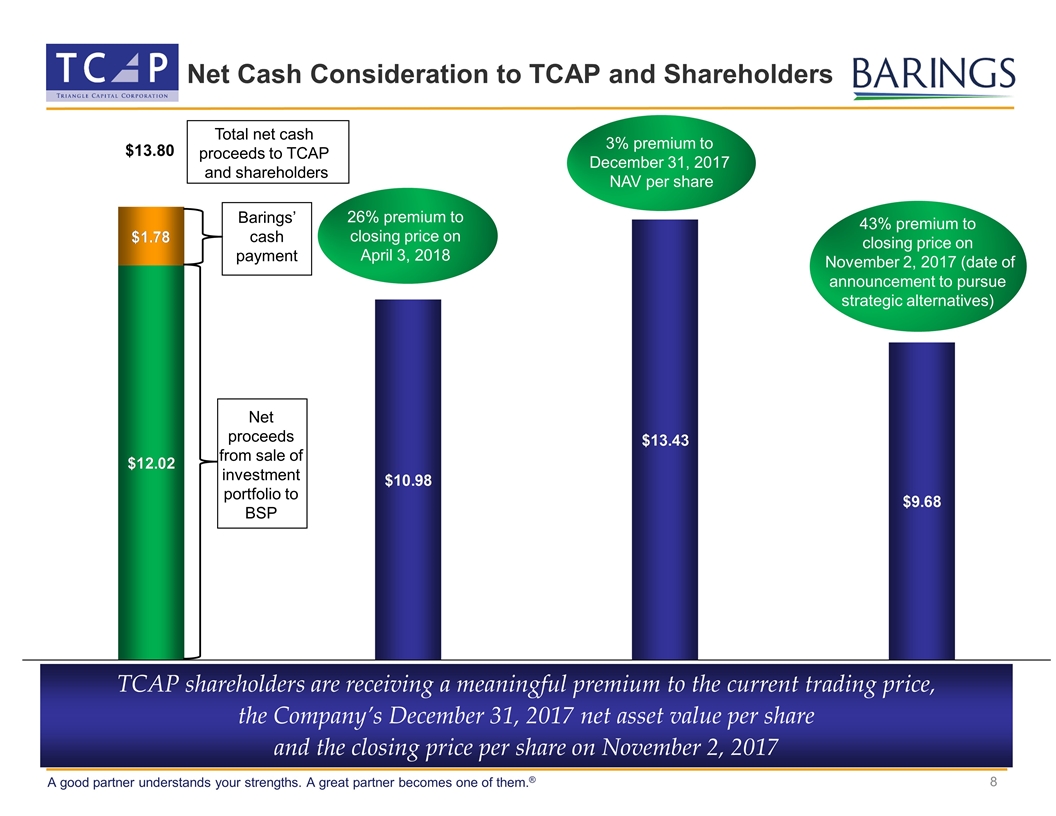

Net Cash Consideration to TCAP and Shareholders TCAP shareholders are receiving a meaningful premium to the current trading price, the Company’s December 31, 2017 net asset value per share and the closing price per share on November 2, 2017 $13.80 Barings’ cash payment 3% premium to December 31, 2017 NAV per share 43% premium to closing price on November 2, 2017 (date of announcement to pursue strategic alternatives) 26% premium to closing price on April 3, 2018 Total net cash proceeds to TCAP and shareholders Net proceeds from sale of investment portfolio to BSP

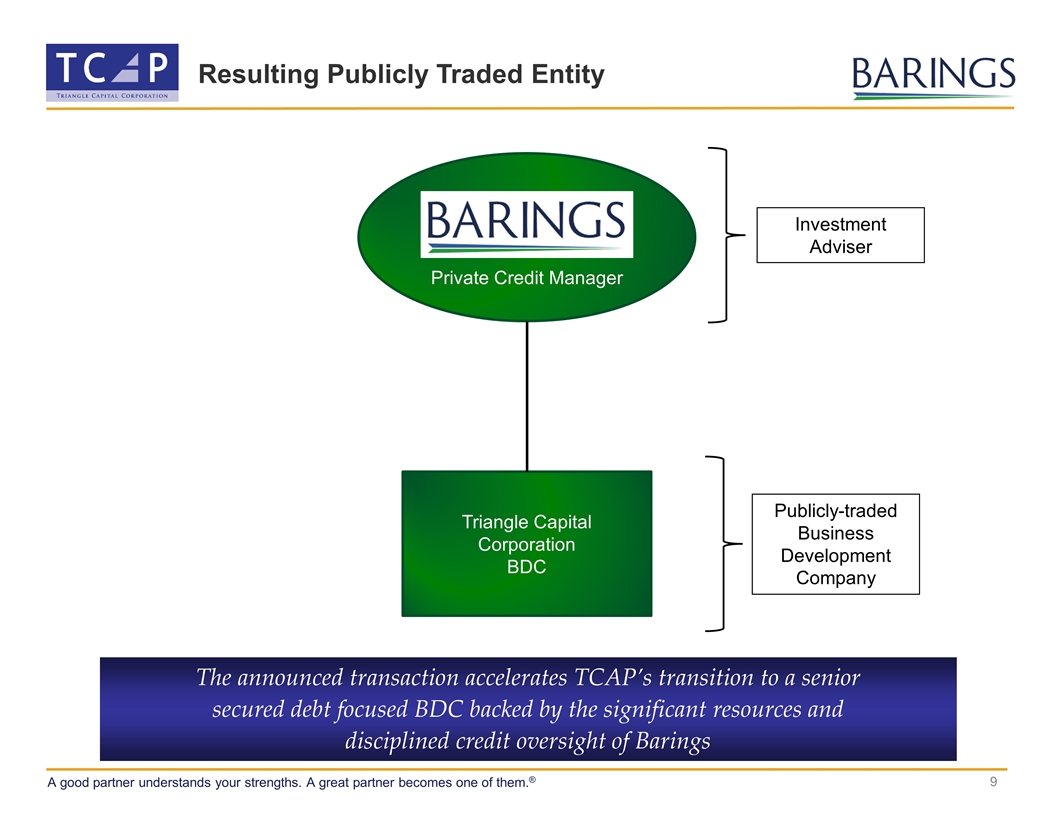

Resulting Publicly Traded Entity The announced transaction accelerates TCAP’s transition to a senior secured debt focused BDC backed by the significant resources and disciplined credit oversight of Barings Private Credit Manager Triangle Capital Corporation BDC Investment Adviser Publicly-traded Business Development Company

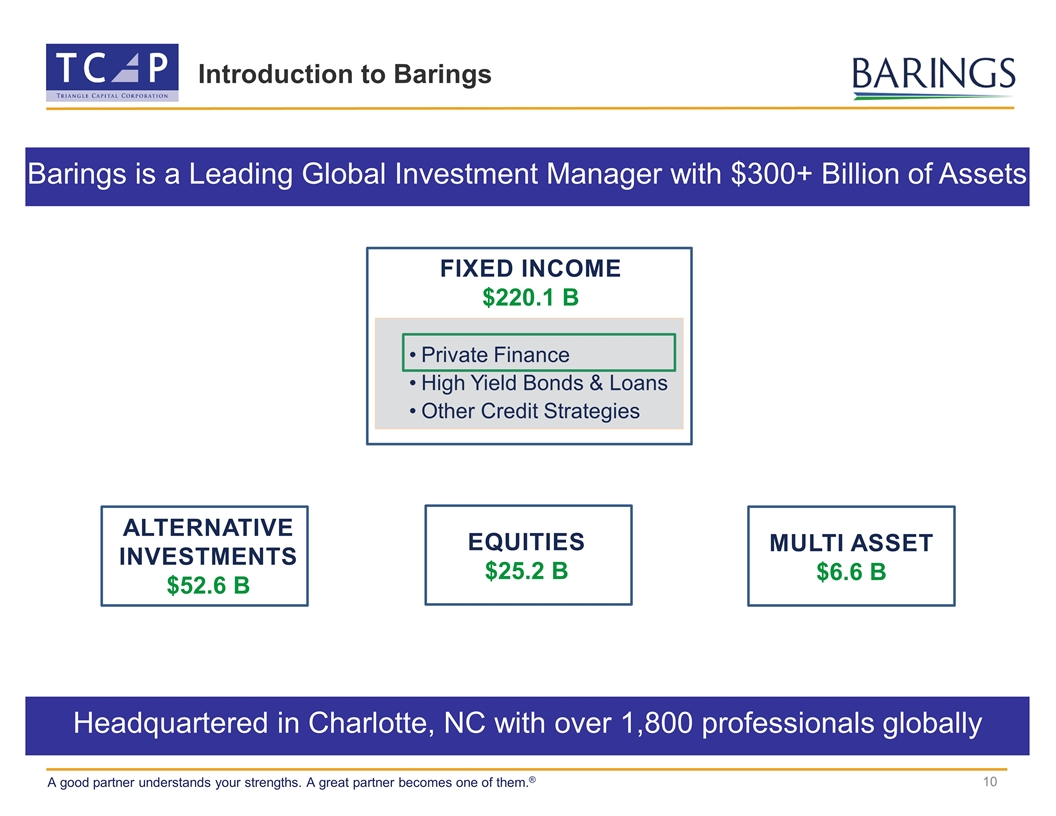

Introduction to Barings Barings is a Leading Global Investment Manager with $300+ Billion of Assets Private Finance High Yield Bonds & Loans Other Credit Strategies Equities $25.2 B Multi asset $6.6 B Fixed Income $220.1 B Headquartered in Charlotte, NC with over 1,800 professionals globally Alternative Investments $52.6 B

Barings’ Expertise 1,000+ institutional investors plus investors in publicly traded closed-end funds Significant experience managing private and public funds (NYSE: BGH since 2012, NYSE: MCI since 1970, NYSE: MPV since 1988) Robust infrastructure with strong finance and accounting, audit, investor relations Private finance team supported by industry research analysts, legal, risk and compliance, and operational support Trusted and Experienced Global Investment Manager

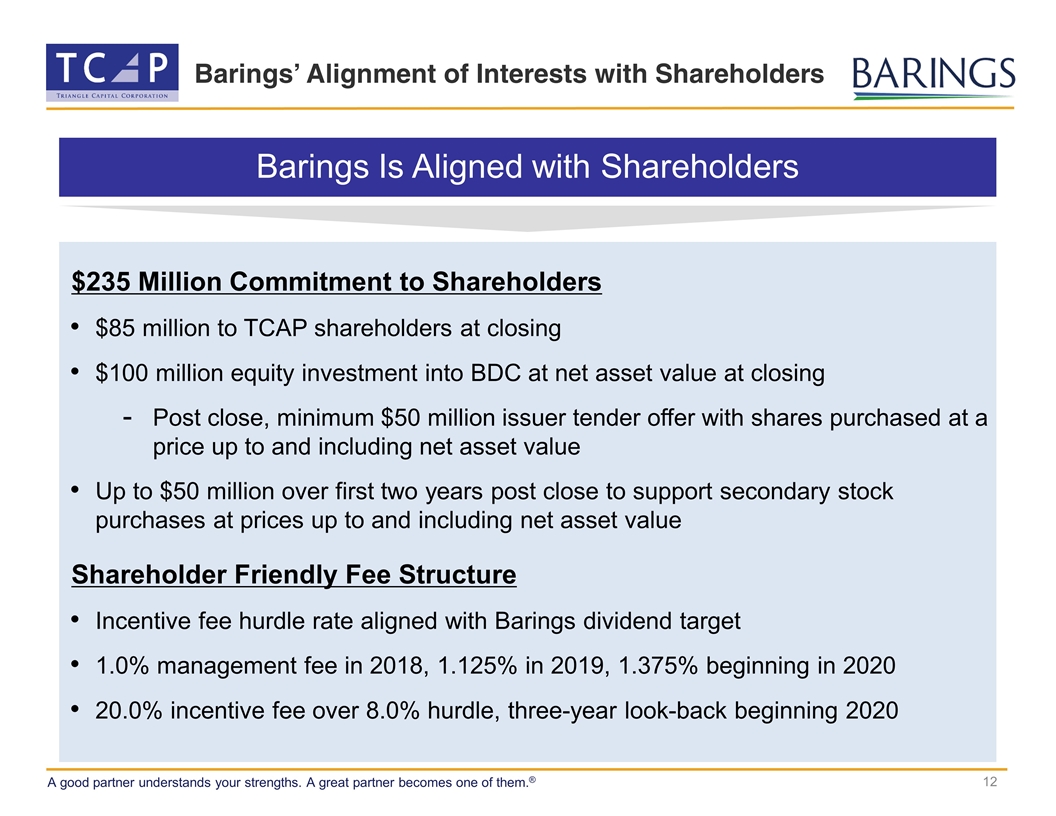

Barings’ Alignment of Interests with Shareholders $235 Million Commitment to Shareholders $85 million to TCAP shareholders at closing $100 million equity investment into BDC at net asset value at closing Post close, minimum $50 million issuer tender offer with shares purchased at a price up to and including net asset value Up to $50 million over first two years post close to support secondary stock purchases at prices up to and including net asset value Shareholder Friendly Fee Structure Incentive fee hurdle rate aligned with Barings dividend target 1.0% management fee in 2018, 1.125% in 2019, 1.375% beginning in 2020 20.0% incentive fee over 8.0% hurdle, three-year look-back beginning 2020 Barings Is Aligned with Shareholders

Barings’ Private Finance Competitive Advantages Aligned Interests Strong Unlevered Realized Returns1 Extensive Track Record Barings’ parent, MassMutual, invests capital alongside our investors Senior Secured: 8.1% gross IRR Mezzanine/Junior Capital: 14.9% gross IRR Over $13.5 billion invested since 1992 in 600+ companies across credit and economic cycles Robust Origination Closed over $2.5 billion of new loans in 2017 with 61 different sponsors. Barings has SEC exemptive relief allowing for co-investments across funds, including TCAP Experienced Team Over 50 professionals in U.S., with our Managing Directors averaging over 20 years of industry experience Disciplined Approach Rigorous credit analysis, portfolio monitoring, cross-discipline ESG committee, independent valuation committee, internal and external annual audits Capital Solutions Scale enables us to commit, lead, and hold large amounts of debt, which can benefit all of Barings investors 1. Represents unlevered gross return of realized investments made by Barings' Private Finance Group since inception through September 30, 2017. Inception of senior loan strategy in 2012 and mezzanine in 1992. Gross IRR shown as investments were made with Barings' proprietary balance sheet and allocated across various funds/accounts with differing fee structures, therefore uniform fees and expenses are not applicable. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

Barings’ Future Investment Strategy Go-Forward Strategy – Private Debt Senior secured debt focused strategy Target minimum 8.0%+ dividend yield Transition Period – Liquid Debt Cash invested in liquid loans, high yield bonds, and other liquid assets Systematically convert into private senior secured debt Lower management fee during transition from liquid portfolio to private senior secured debt portfolio Initially target 6.0%+ dividend yield, increasing to 8.0%+ as more invested in private debt1 Dividend Yield Target 8.0%+ Long Term 1. There is no guarantee the targeted dividend yield will be achieved. Dividend yield on book value

Barings’ Go-Forward Senior Secured Debt Strategy Senior secured debt focused strategy Target asset returns consistent with Barings historical returns1 Benefits of Senior Focused Strategy Attractive yields with lower volatility without reliance upon equity gains Floating rate loans afford potential yield upside in rising interest rate environment2 Moderate leverage and loan to value reduces volatility Covenants provide lender protections Ability for the BDC to borrow at attractive rates and terms Seeking Low Volatility 1. Based on Barings’ Private Finance Group historical investment experience in senior secured debt. 2. A decreasing interest rate environment may lower gross yields PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

Conclusion and Next Steps TCAP is targeting a proxy filing with the SEC in April The record date for the $85 million, or $1.78 per share, payment to shareholders will be the Closing Date Anticipated transaction closing in June or July 2018, following shareholder approval and satisfaction of other applicable closing conditions Upon closing, Barings plans to rename TCAP and to obtain a new ticker for the BDC