EX-99.1

Published on October 4, 2023

Barings BDC Investor Day OCTOBER 4–6, 2023

2 Disclaimers & Cautionary Notes Regarding Forward-Looking Statements Cautionary Notice: Certain statements contained in this presentation are "forward-looking" statements. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management's current estimates, projections, expectations or beliefs, and which are subject to risks and uncertainties that may cause actual results or events to differ materially. Forward-looking statements include, but are not limited to, Barings BDC, Inc.’s (“Barings BDC” or the “Company”) the Company's distribution levels and frequency of distributions, the Company's share repurchase activity, the ability of Barings LLC to manage the Company and identify investment opportunities, and some of the factors that could cause actual results or events to differ materially from those identified in forward-looking statements are enumerated in the filings the Company makes with the Securities and Exchange Commission (the "SEC"). These statements are subject to change at any time based upon economic, market or other conditions, including with respect to Barings BDC’s and its portfolio companies’ results of operations and financial condition, and may not be relied upon as investment advice or an indication of Barings BDC’s investment intent. Important factors that could cause actual results to differ materially from plans, estimates or expectations included in this presentation include, among others, those risk factors detailed in Barings BDC's annual report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on February 23, 2023, in Barings BDC’s subsequently filed quarterly reports on Form 10-Q, and as may be included from time to time in Barings BDC's other filings with the SEC, including current reports on Form 8-K. In addition, there is no assurance that Barings BDC or any of its affiliates will purchase additional shares of Barings BDC at any specific discount levels or in any specific amounts or that the market price of Barings BDC’s shares, either absolutely or relative to net asset value, will increase as a result of any share repurchases, or that any repurchase plan will enhance stockholder value over the long term. The Company undertakes no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise, unless required to do so by law. This presentation contains statistics and other data that has been obtained from or compiled from information made available by third-party service providers. We have not independently verified such statistics or data. These materials and any presentation of which they form a part are neither an offer to sell, or a solicitation of an offer to purchase, an interest in the Company. The information presented in this presentation is as of June 30, 2023 unless indicated otherwise. Other Important Information Any forecasts in this document are based upon Barings’ opinion of the market at the date of preparation and are subject to change without notice, dependent upon many factors. Any prediction, projection or forecast is not necessarily indicative of the future or likely performance. Investment involves risk. The value of any investments and any income generated may increase or decrease and are not guaranteed. Past performance is no indication of current or future performance. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any investment results, portfolio compositions and/or examples set forth in this document are provided for illustrative purposes only and are not indicative of any future investment results, future portfolio composition or investments. The composition, size of, and risks associated with an investment may differ substantially from any examples set forth in this document. No representation is made that an investment will be profitable or will not incur losses. Where appropriate, changes in the currency exchange rates may affect the value of investments. Prospective investors should read the relevant offering documents for the details and specific risk factors of any investment vehicle discussed in this document. 23-3117485

Barings Overview

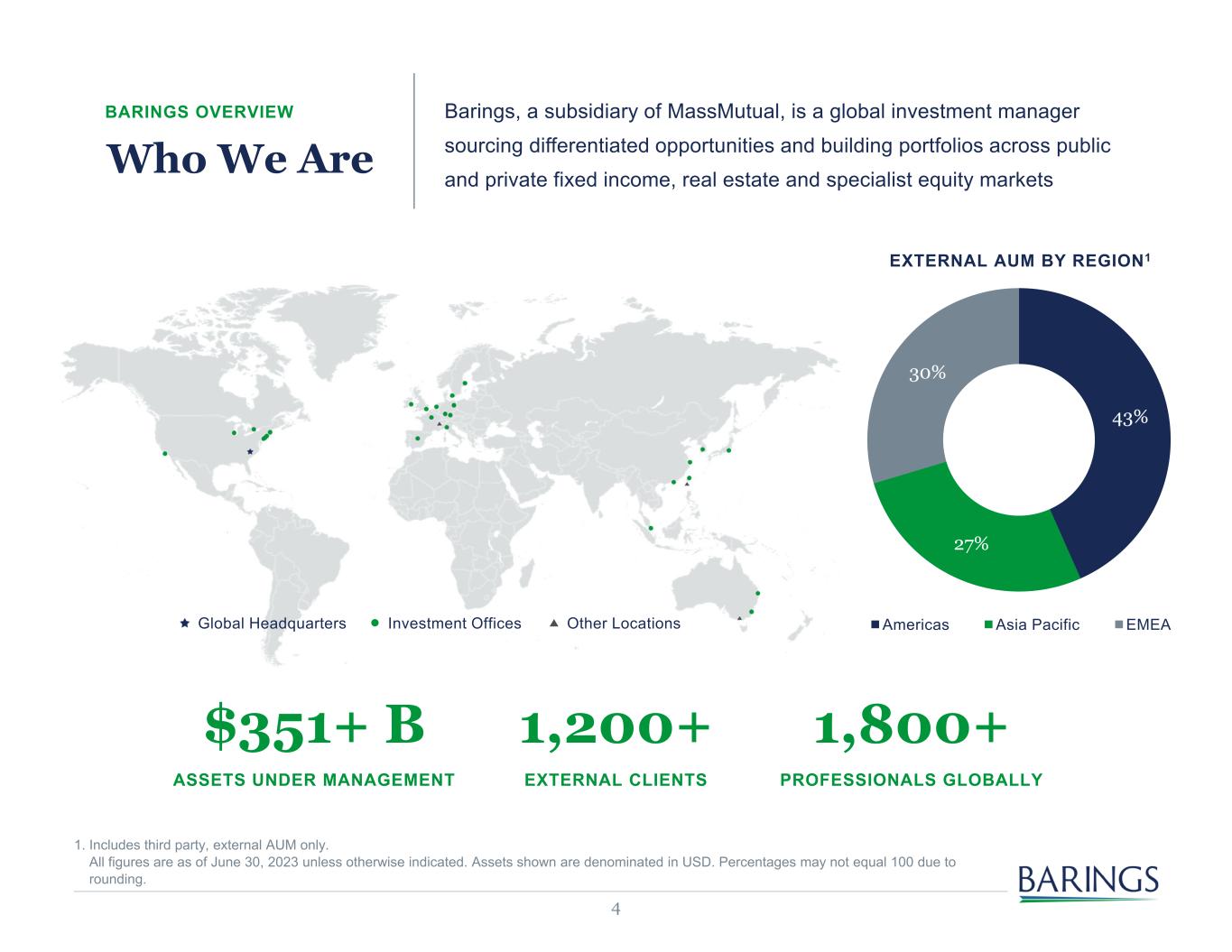

4 EXTERNAL AUM BY REGION1 43% 27% 30% Americas Asia Pacific EMEAInvestment Offices Global Headquarters Other Locations 1. Includes third party, external AUM only. All figures are as of June 30, 2023 unless otherwise indicated. Assets shown are denominated in USD. Percentages may not equal 100 due to rounding. Who We Are Barings, a subsidiary of MassMutual, is a global investment manager sourcing differentiated opportunities and building portfolios across public and private fixed income, real estate and specialist equity markets BARINGS OVERVIEW $351+ B ASSETS UNDER MANAGEMENT 1,200+ EXTERNAL CLIENTS 1,800+ PROFESSIONALS GLOBALLY

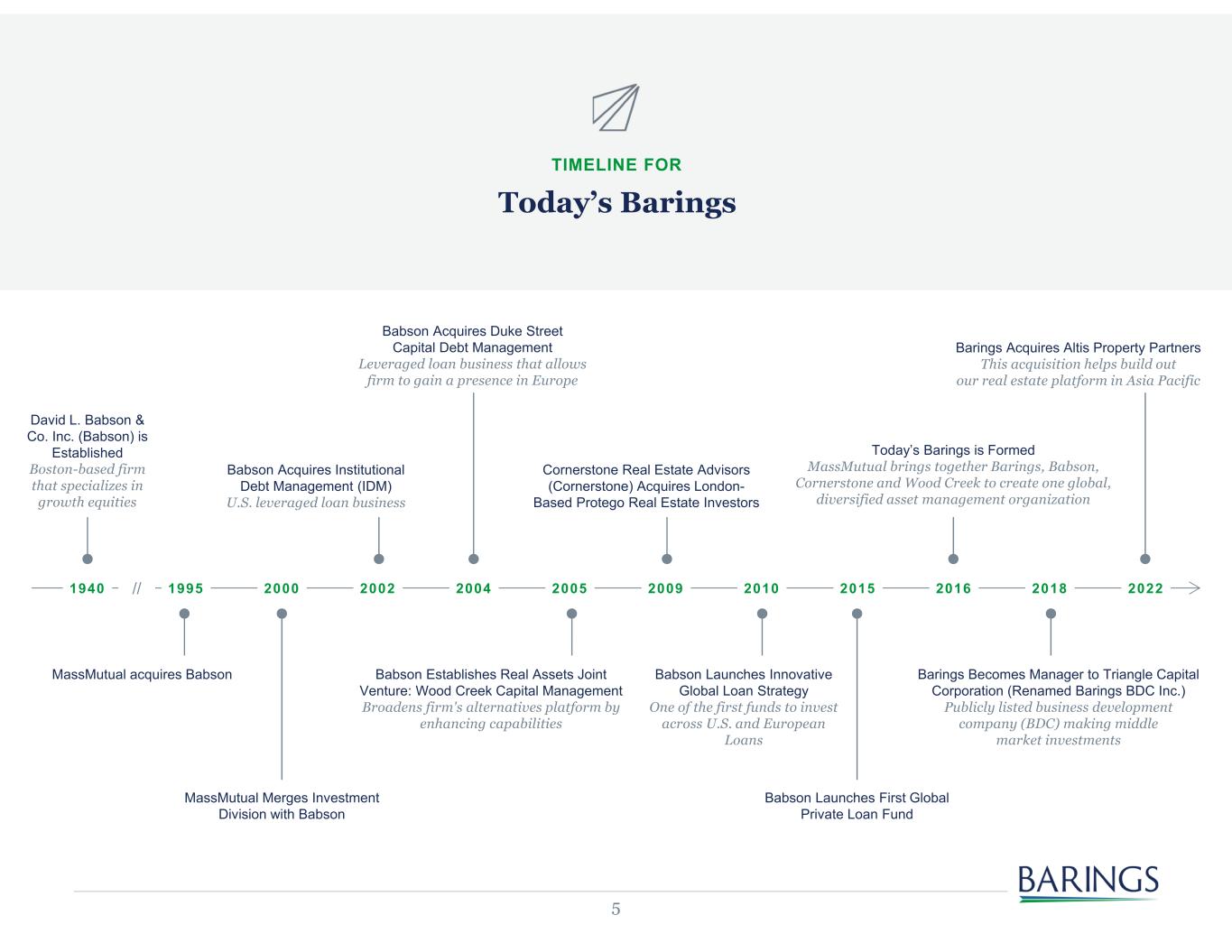

5 Today’s Barings TIMELINE FOR 1940 1995 2005 20092000 2002 2004 David L. Babson & Co. Inc. (Babson) is Established Boston-based firm that specializes in growth equities MassMutual acquires Babson Babson Launches Innovative Global Loan Strategy One of the first funds to invest across U.S. and European Loans 2010 20222015 2016 2018// MassMutual Merges Investment Division with Babson Babson Acquires Institutional Debt Management (IDM) U.S. leveraged loan business Babson Acquires Duke Street Capital Debt Management Leveraged loan business that allows firm to gain a presence in Europe Babson Establishes Real Assets Joint Venture: Wood Creek Capital Management Broadens firm's alternatives platform by enhancing capabilities Cornerstone Real Estate Advisors (Cornerstone) Acquires London- Based Protego Real Estate Investors Today’s Barings is Formed MassMutual brings together Barings, Babson, Cornerstone and Wood Creek to create one global, diversified asset management organization Barings Becomes Manager to Triangle Capital Corporation (Renamed Barings BDC Inc.) Publicly listed business development company (BDC) making middle market investments Barings Acquires Altis Property Partners This acquisition helps build out our real estate platform in Asia Pacific Babson Launches First Global Private Loan Fund

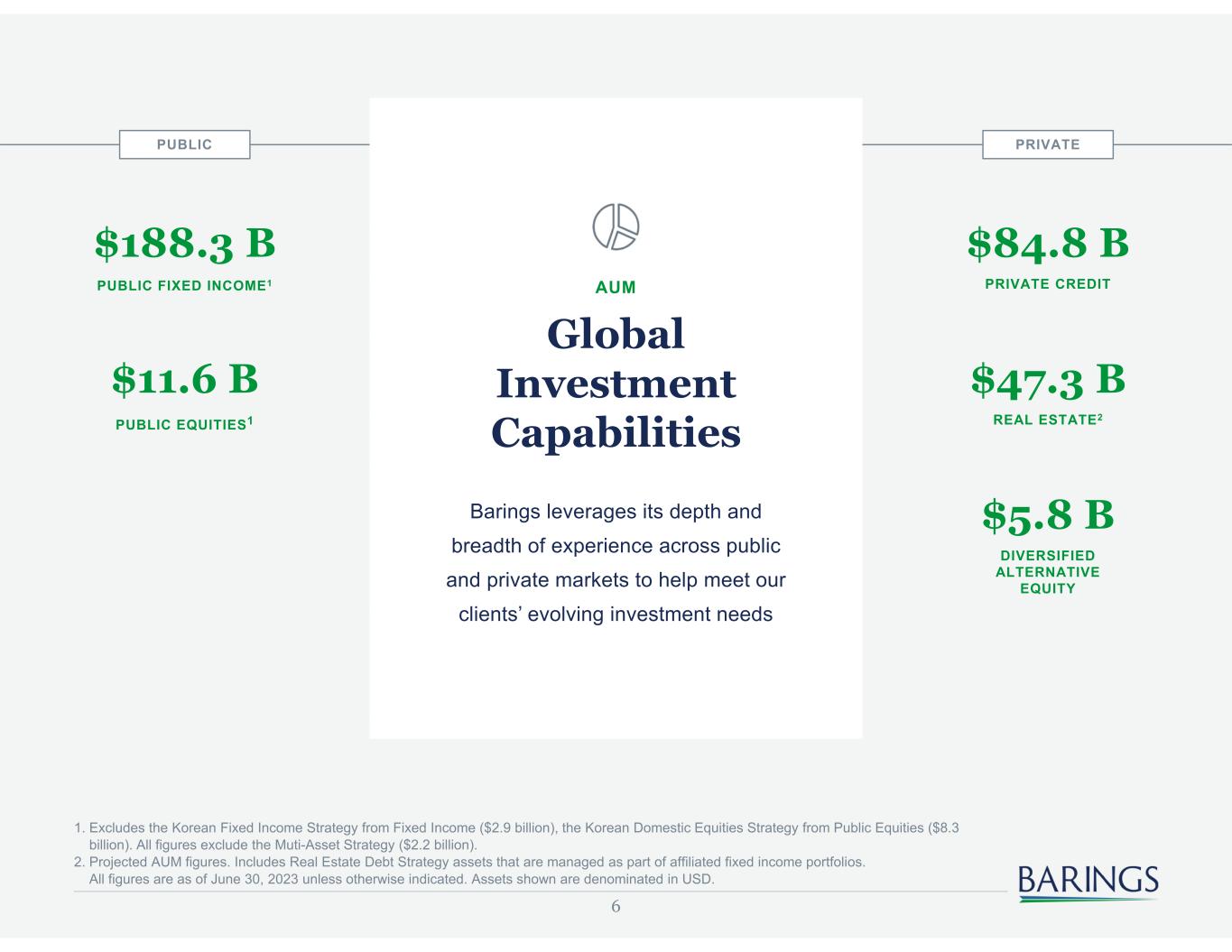

6 1. Excludes the Korean Fixed Income Strategy from Fixed Income ($2.9 billion), the Korean Domestic Equities Strategy from Public Equities ($8.3 billion). All figures exclude the Muti-Asset Strategy ($2.2 billion). 2. Projected AUM figures. Includes Real Estate Debt Strategy assets that are managed as part of affiliated fixed income portfolios. All figures are as of June 30, 2023 unless otherwise indicated. Assets shown are denominated in USD. $11.6 B PUBLIC EQUITIES1 $188.3 B PUBLIC FIXED INCOME1 PUBLIC $84.8 B PRIVATE CREDIT $47.3 B REAL ESTATE2 $5.8 B DIVERSIFIED ALTERNATIVE EQUITY PRIVATE Global Investment Capabilities Barings leverages its depth and breadth of experience across public and private markets to help meet our clients’ evolving investment needs AUM

7 Private Credit Real Estate1 Diversified Alternative Equity $84.8 B $47.3 B $5.8 B TRACK RECORD: 27+ YEARS TRACK RECORD: 55+ YEARS TRACK RECORD: 30+ YEARS We lend directly to corporates and infrastructure projects A Strategic & Panoramic View of Private Markets Active participation across the capital structure for a variety of assets informs our view We own, actively manage and lend to real estate across the risk spectrum, globally We build custom portfolios of co-investments, secondaries and primary funds 1. Projected AUM figures. Includes Real Estate Debt Strategy assets that are managed as part of affiliated fixed income portfolios. All figures are as of June 30, 2023 unless otherwise indicated. Assets shown are denominated in USD.

8 Our Ownership Structure is Differentiated & Offers a Number of Benefits Investor Solutions Warehouse transactions prior to our funds launching where appropriate Market Access Seeding key initiatives, enabling access to emerging opportunities Investment Philosophy We take a thoughtful and purposeful approach, aiming to evolve our capabilities and grow alongside our clients over the long term Alignment of Interest We believe in aligning both our business and our capital with the best interests of our clients and we make decisions with long-term outcomes in mind. As a private company with deep experience managing assets on behalf of our parent company, MassMutual, we measure relationships in decades, not quarters

Private Credit Landscape

10 What is Private Credit? Private credit is a fixed income investment directly originated by an asset manager. Transactions may consist of corporate credit, infrastructure debt, or private placements in a variety of securities Premiums to Public Markets Private credit transactions often provide enhanced yield relative to liquid credit markets, commonly referred to as an “illiquidity premium” Speed of Execution Transactions are often bilateral (issuer and lender) or small club facilities, obviating a syndication process to cobble a facility together Tailored Financings Financings are structured to achieve the objectives of both the issuer and the lender Confidentiality Given the smaller number of transaction participants, information is disseminated to fewer parties than in a syndicated execution Takeaway? Private credit is exactly that—issuance of credit that is maintained on a private basis. Investors must understand the details of a manager’s investment strategy to appreciate the risks and return

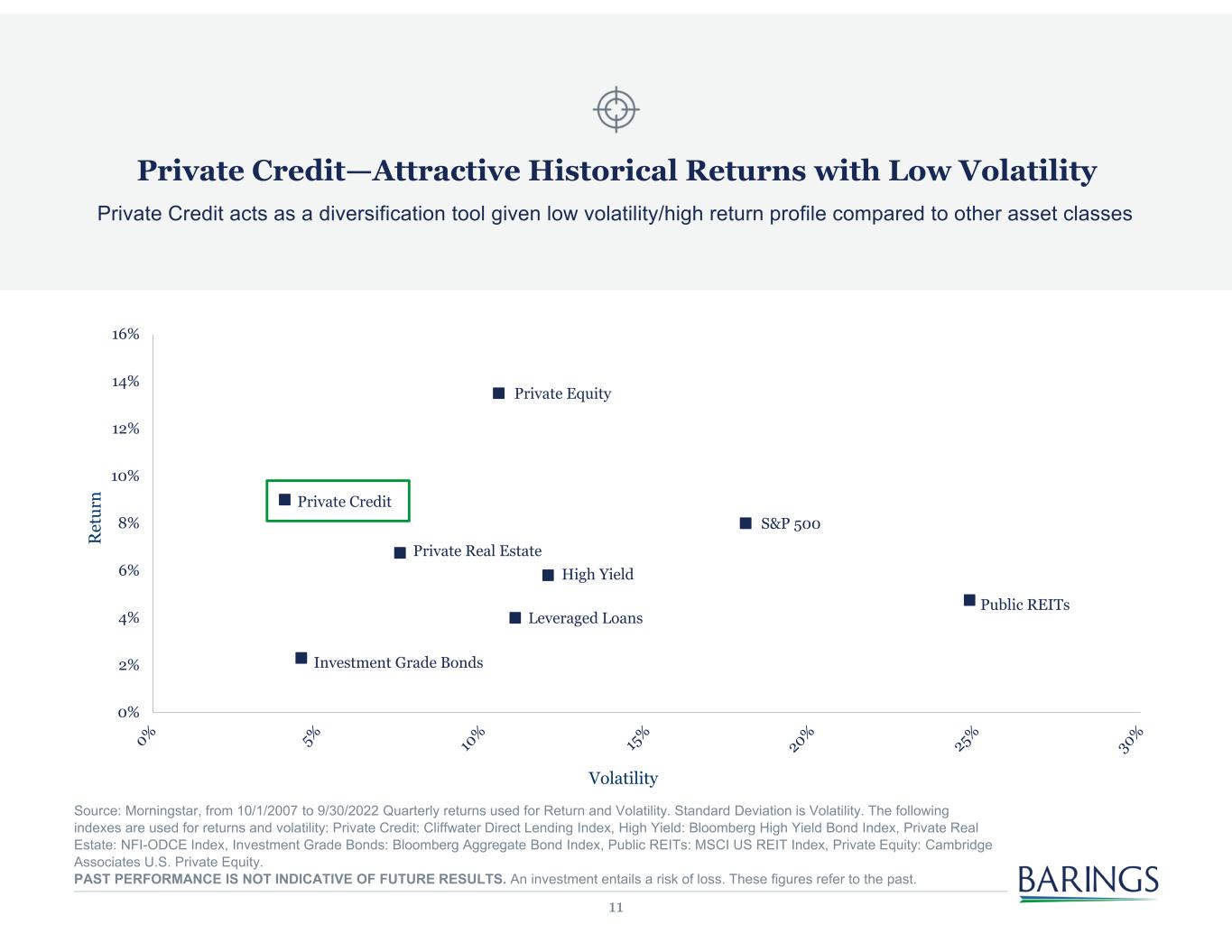

11 Private Credit—Attractive Historical Returns with Low Volatility Private Credit acts as a diversification tool given low volatility/high return profile compared to other asset classes Private Credit Private Equity Private Real Estate Investment Grade Bonds Leveraged Loans High Yield S&P 500 Public REITs 0% 2% 4% 6% 8% 10% 12% 14% 16% R et ur n Volatility Source: Morningstar, from 10/1/2007 to 9/30/2022 Quarterly returns used for Return and Volatility. Standard Deviation is Volatility. The following indexes are used for returns and volatility: Private Credit: Cliffwater Direct Lending Index, High Yield: Bloomberg High Yield Bond Index, Private Real Estate: NFI-ODCE Index, Investment Grade Bonds: Bloomberg Aggregate Bond Index, Public REITs: MSCI US REIT Index, Private Equity: Cambridge Associates U.S. Private Equity. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. An investment entails a risk of loss. These figures refer to the past.

Barings BDC Investment Strategy

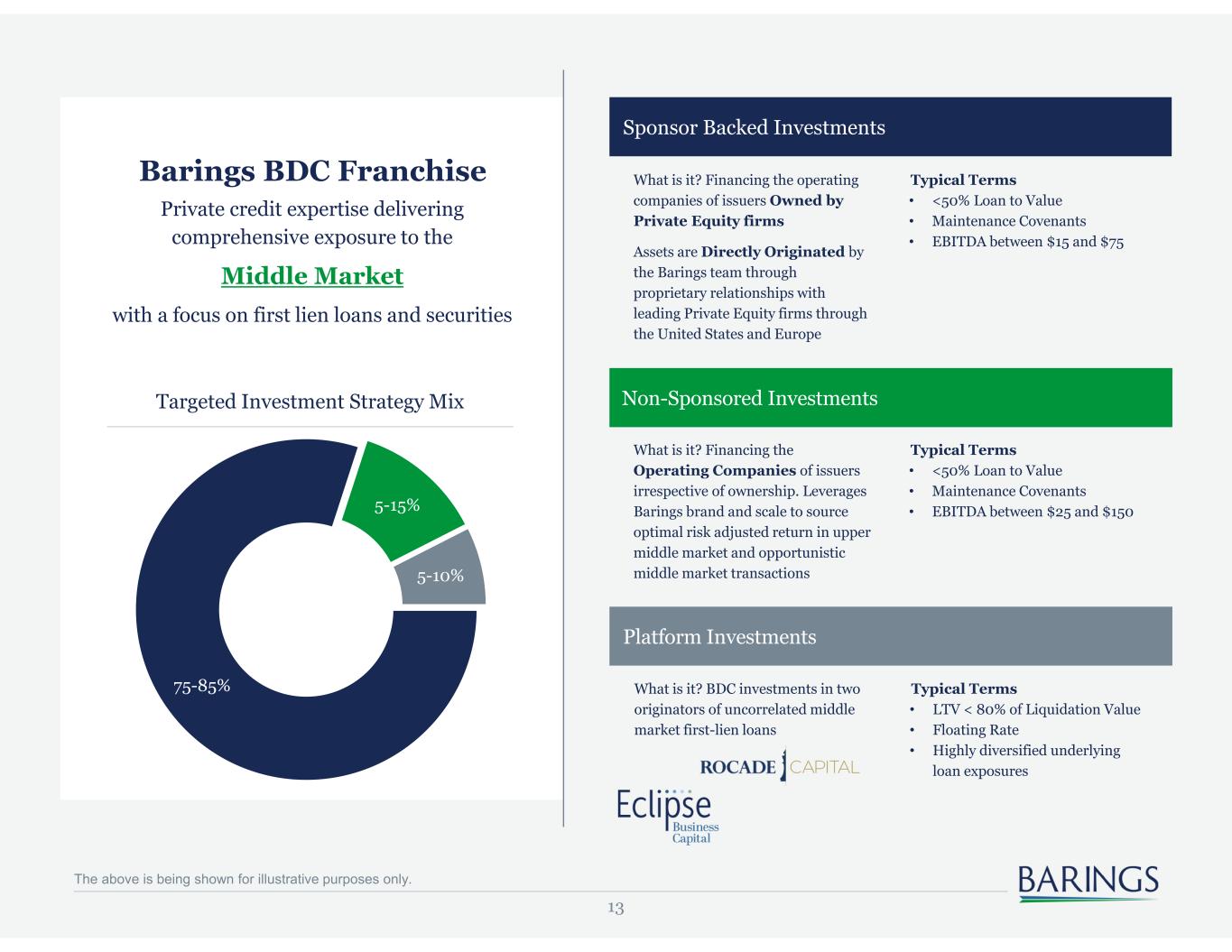

13 What is it? Financing the operating companies of issuers Owned by Private Equity firms Assets are Directly Originated by the Barings team through proprietary relationships with leading Private Equity firms through the United States and Europe What is it? Financing the Operating Companies of issuers irrespective of ownership. Leverages Barings brand and scale to source optimal risk adjusted return in upper middle market and opportunistic middle market transactions Targeted Investment Strategy Mix Sponsor Backed Investments Non-Sponsored Investments Platform Investments What is it? BDC investments in two originators of uncorrelated middle market first-lien loans Barings BDC Franchise Private credit expertise delivering comprehensive exposure to the Middle Market with a focus on first lien loans and securities Typical Terms • <50% Loan to Value • Maintenance Covenants • EBITDA between $15 and $75 Typical Terms • <50% Loan to Value • Maintenance Covenants • EBITDA between $25 and $150 Typical Terms • LTV < 80% of Liquidation Value • Floating Rate • Highly diversified underlying loan exposures The above is being shown for illustrative purposes only. 75-85% 5-15% 5-10%

14 Barings offers clients unique access to private capital markets Barings’ Strengths in Direct Lending $50.0B+ COMMITMENTS UNDER MANAGEMENT1 125 INVESTMENT PROFESSIONALS 26 DEDICATED ORIGINATIONS PROFESSIONALS 280+ INSTITUTIONAL INVESTORS Global Team Insight Collaboration across private market teams provides insight into unique opportunities around the globe Robust Origination Dedicated, in-house professionals based in local offices offering full range of capital solutions Aligned Interests Significant capital invested from our parent, MassMutual, aligns our business with the best interests of our clients 1. Commitments reflect commitments to Global Private Finance and Capital Solutions as of the most recent valuation period. All figures are as of June 30, 2023 unless otherwise indicated. Assets shown are denominated in USD.

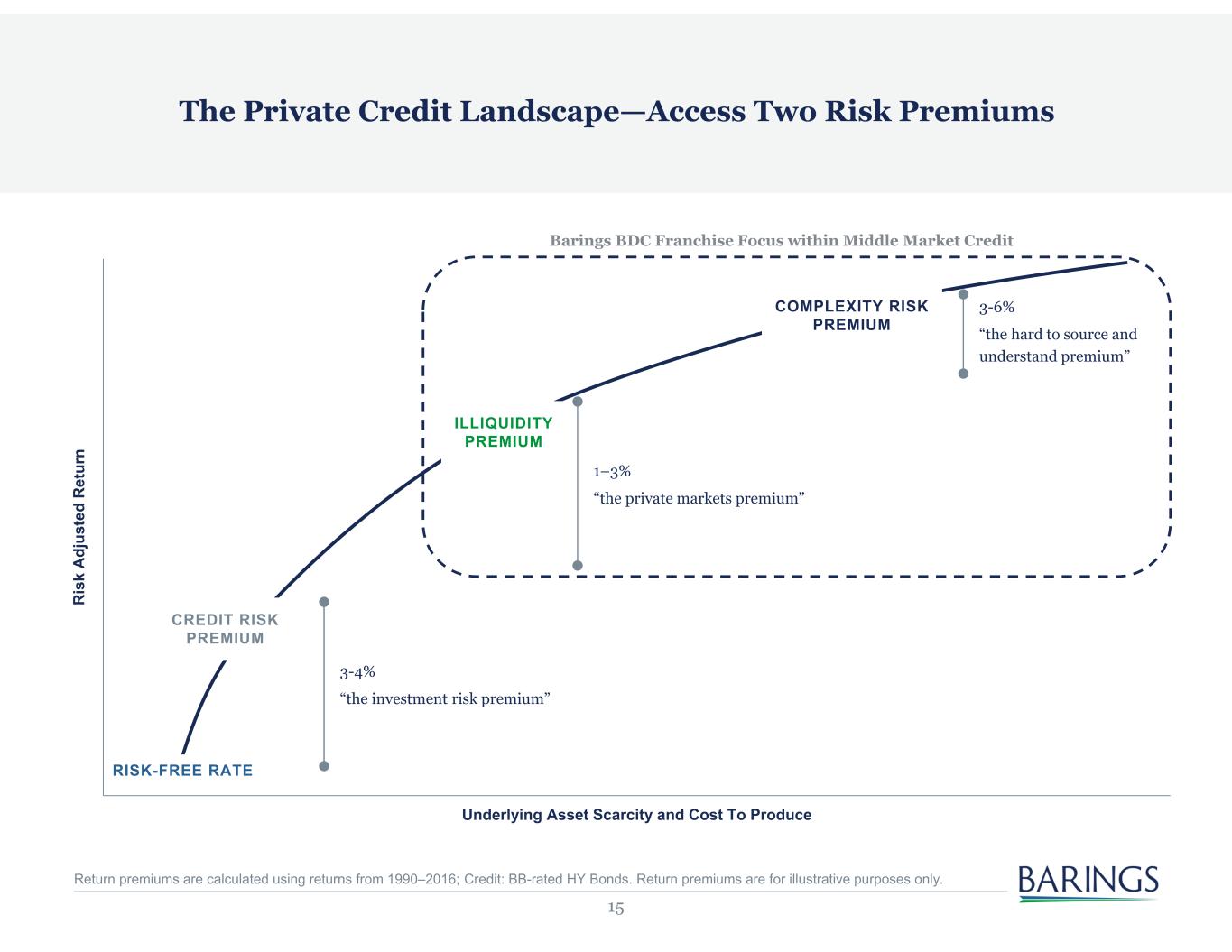

15 CREDIT RISK PREMIUM ILLIQUIDITY PREMIUM COMPLEXITY RISK PREMIUM RISK-FREE RATE 3-4% “the investment risk premium” R is k A dj us te d R et ur n Underlying Asset Scarcity and Cost To Produce Barings BDC Franchise Focus within Middle Market Credit The Private Credit Landscape—Access Two Risk Premiums 1–3% “the private markets premium” 3-6% “the hard to source and understand premium” Return premiums are calculated using returns from 1990–2016; Credit: BB-rated HY Bonds. Return premiums are for illustrative purposes only.

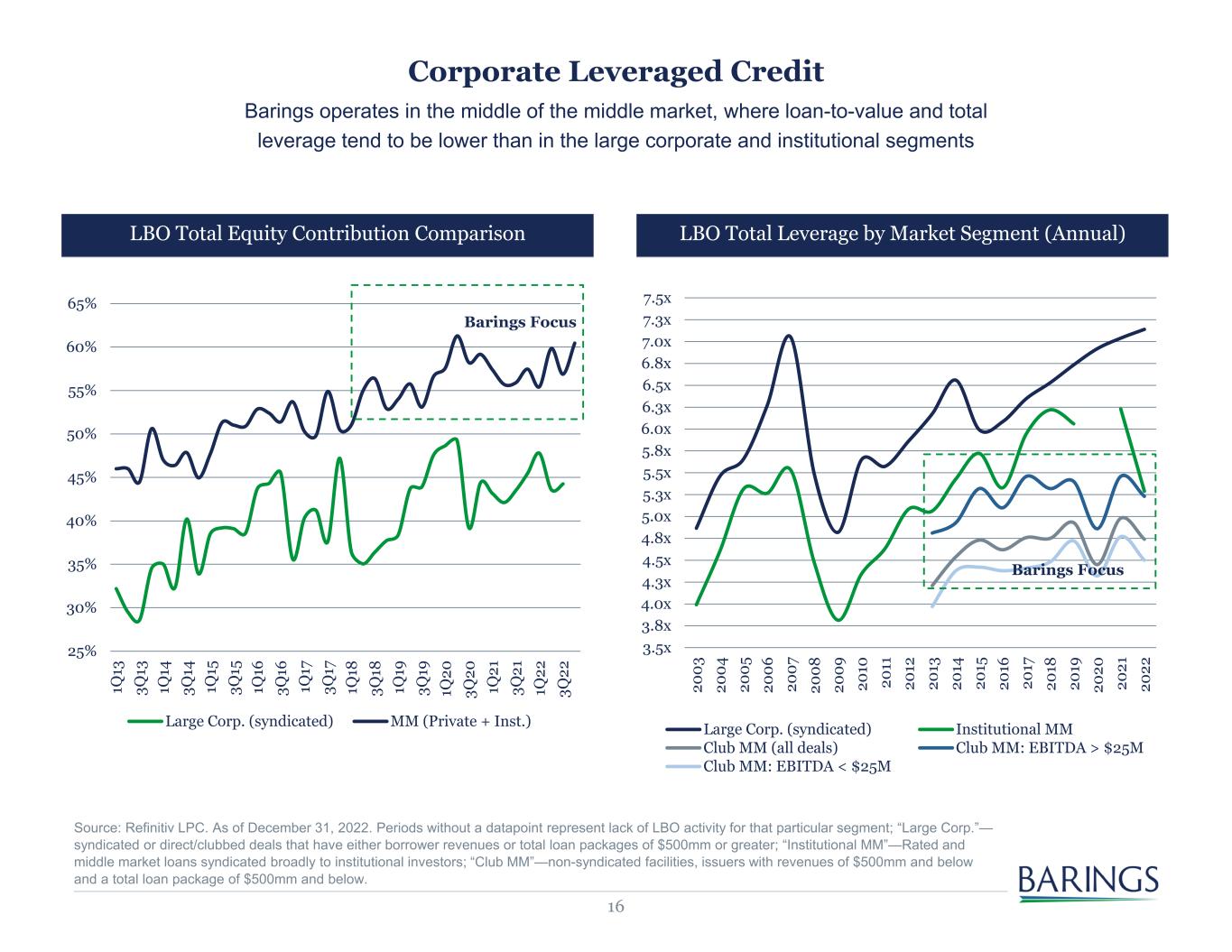

16 Source: Refinitiv LPC. As of December 31, 2022. Periods without a datapoint represent lack of LBO activity for that particular segment; “Large Corp.”— syndicated or direct/clubbed deals that have either borrower revenues or total loan packages of $500mm or greater; “Institutional MM”—Rated and middle market loans syndicated broadly to institutional investors; “Club MM”—non-syndicated facilities, issuers with revenues of $500mm and below and a total loan package of $500mm and below. Corporate Leveraged Credit Barings operates in the middle of the middle market, where loan-to-value and total leverage tend to be lower than in the large corporate and institutional segments LBO Total Equity Contribution Comparison LBO Total Leverage by Market Segment (Annual) 25% 30% 35% 40% 45% 50% 55% 60% 65% 1Q 13 3Q 13 1Q 14 3Q 14 1Q 15 3Q 15 1Q 16 3Q 16 1Q 17 3Q 17 1Q 18 3Q 18 1Q 19 3Q 19 1Q 20 3Q 20 1Q 21 3Q 21 1Q 22 3Q 22 Large Corp. (syndicated) MM (Private + Inst.) 3.5x 3.8x 4.0x 4.3x 4.5x 4.8x 5.0x 5.3x 5.5x 5.8x 6.0x 6.3x 6.5x 6.8x 7.0x 7.3x 7.5x 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 Large Corp. (syndicated) Institutional MM Club MM (all deals) Club MM: EBITDA > $25M Club MM: EBITDA < $25M Barings Focus Barings Focus

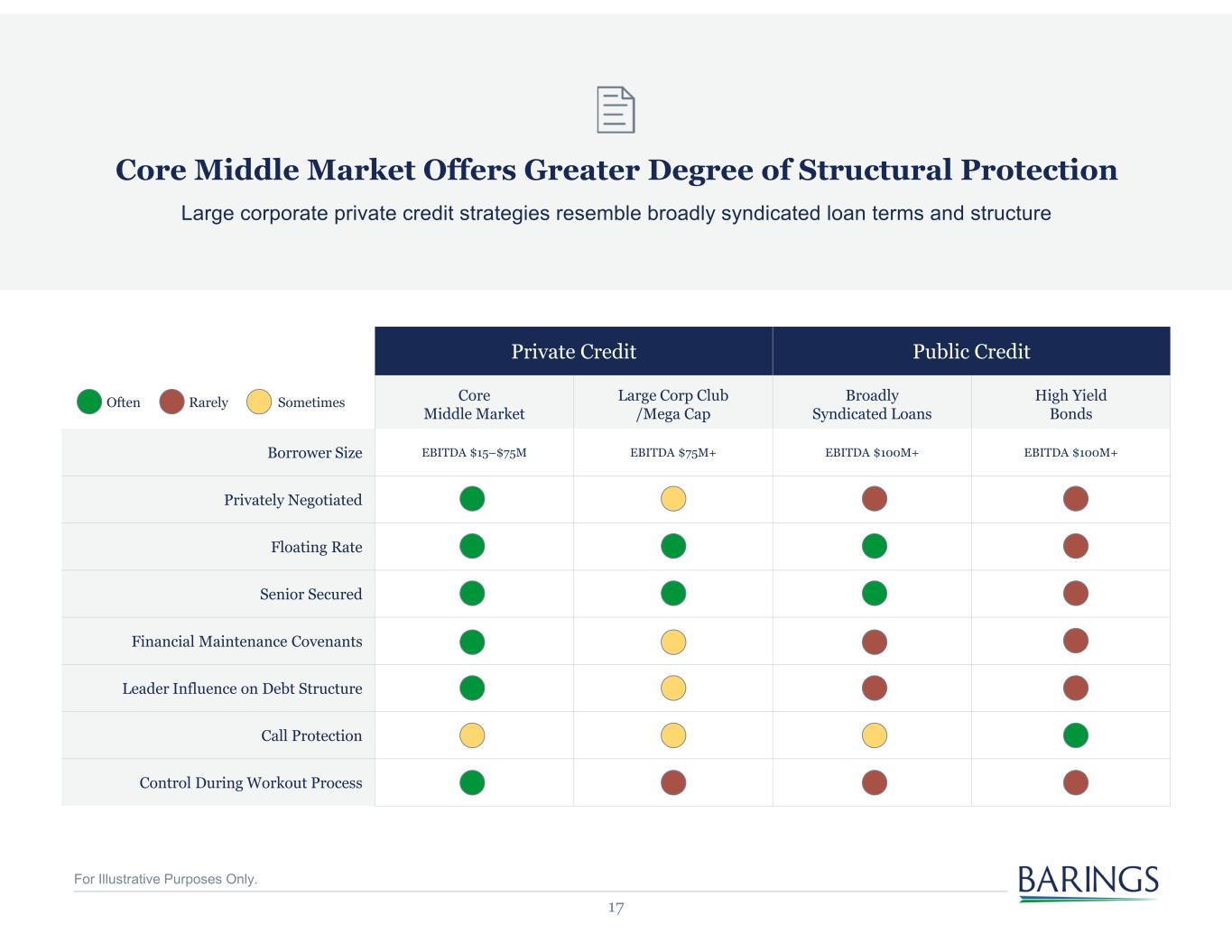

17 Large corporate private credit strategies resemble broadly syndicated loan terms and structure Core Middle Market Offers Greater Degree of Structural Protection Private Credit Public Credit Core Middle Market Large Corp Club /Mega Cap Broadly Syndicated Loans High Yield Bonds Borrower Size EBITDA $15–$75M EBITDA $75M+ EBITDA $100M+ EBITDA $100M+ Privately Negotiated Floating Rate Senior Secured Financial Maintenance Covenants Leader Influence on Debt Structure Call Protection Control During Workout Process Often Rarely Sometimes For Illustrative Purposes Only.

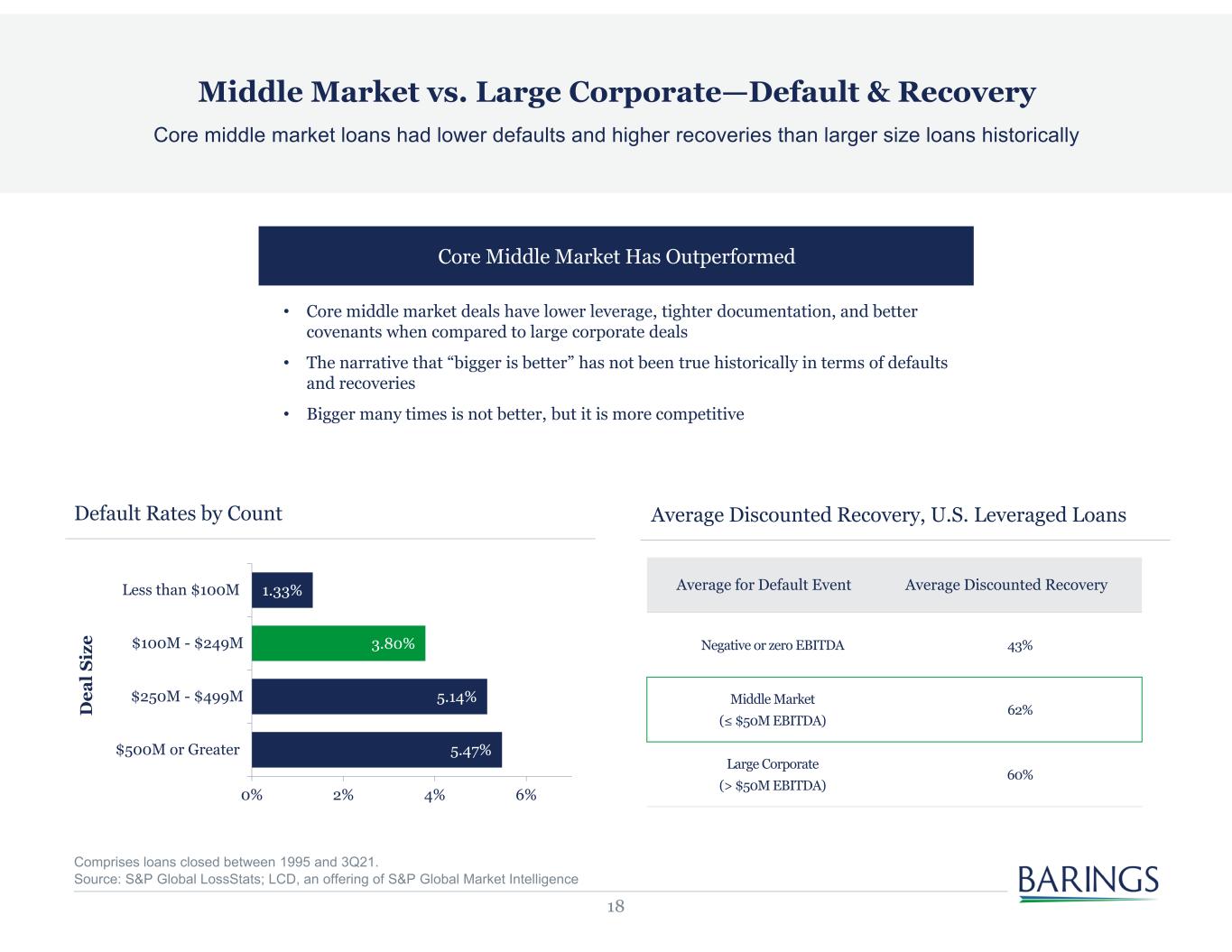

18 • Core middle market deals have lower leverage, tighter documentation, and better covenants when compared to large corporate deals • The narrative that “bigger is better” has not been true historically in terms of defaults and recoveries • Bigger many times is not better, but it is more competitive Core Middle Market Has Outperformed 1.33% 3.80% 5.14% 5.47% 0% 2% 4% 6% Less than $100M $100M - $249M $250M - $499M $500M or Greater D ea l S iz e Default Rates by Count Average Discounted Recovery, U.S. Leveraged Loans Average for Default Event Average Discounted Recovery Negative or zero EBITDA 43% Middle Market (≤ $50M EBITDA) 62% Large Corporate (> $50M EBITDA) 60% Core middle market loans had lower defaults and higher recoveries than larger size loans historically Middle Market vs. Large Corporate—Default & Recovery Comprises loans closed between 1995 and 3Q21. Source: S&P Global LossStats; LCD, an offering of S&P Global Market Intelligence

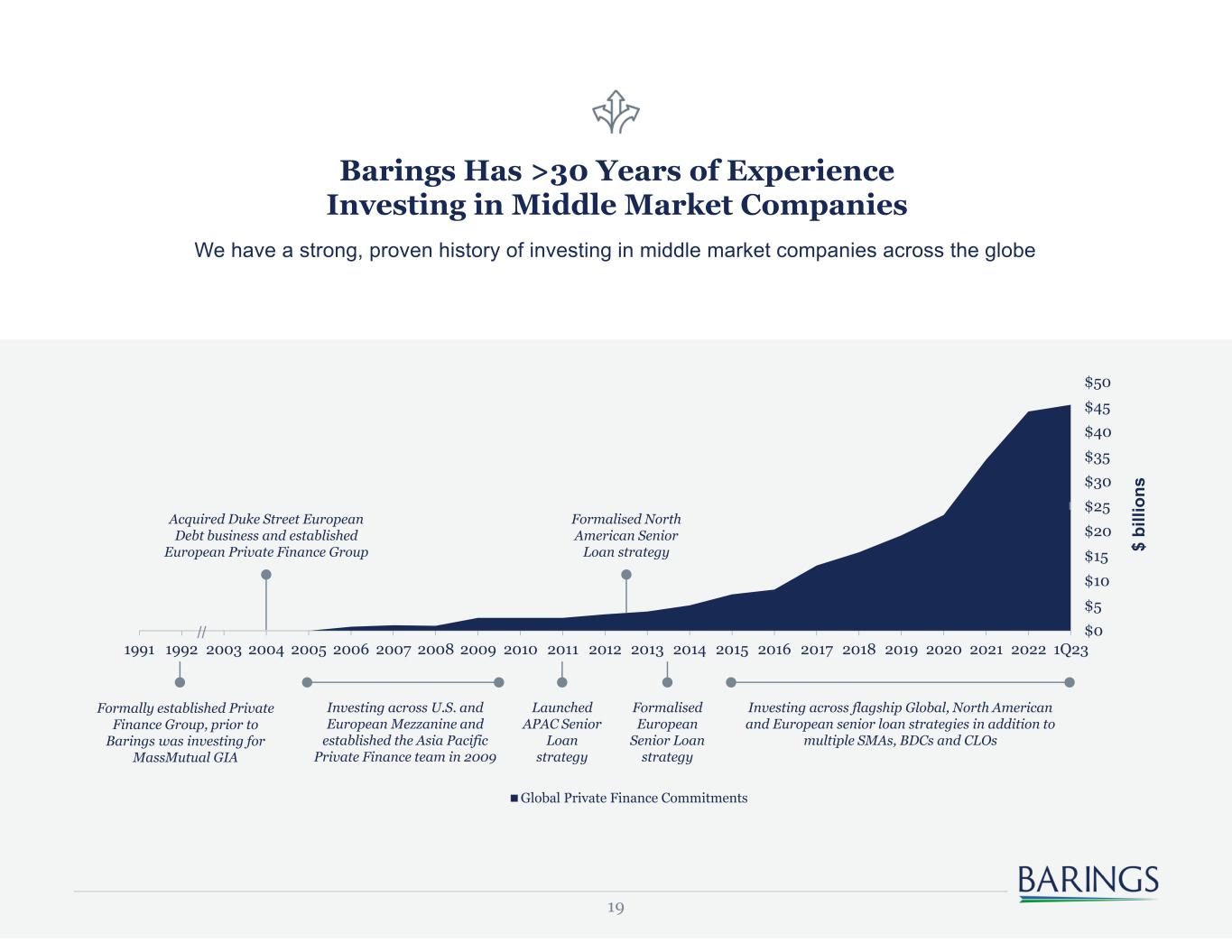

19 Barings Has >30 Years of Experience Investing in Middle Market Companies We have a strong, proven history of investing in middle market companies across the globe $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 1991 1992 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 1Q23 $ bi lli on s Global Private Finance Commitments Formally established Private Finance Group, prior to Barings was investing for MassMutual GIA Acquired Duke Street European Debt business and established European Private Finance Group Formalised North American Senior Loan strategy Formalised European Senior Loan strategy Investing across flagship Global, North American and European senior loan strategies in addition to multiple SMAs, BDCs and CLOs Investing across U.S. and European Mezzanine and established the Asia Pacific Private Finance team in 2009 Launched APAC Senior Loan strategy //

20 2022 League Table (Deals Closed) US Direct Lending League Table Deployment 1 Ares 2 Churchill 3 Antares Capital 4 Audax Private Debt 5 Twin Brook Capital Partners 6 Golub Capital 7 BARINGS 8 Monroe Capital 9 BMO Financial Group 10 PNC 11 Morgan Stanley Private Credit 12 Owl Rock 13 Varagon Capital Partners 14 Truist Financial 15 North Haven Private Income Fund BDC 16 Crescent Capital 17 Citizens Bank 18 Midcap Financial 19 Apollo Debt Solutions BDC 20 Blackstone Private Credit Fund BDC 21 Capital One 22 Fifth Third Bank 23 KeyBank 24 HPS Corporate Lending Fund BDC 25 NXT Capital Barings is a market leading franchise within the world of Sponsor backed credit Source: Pitchbook — 2022 Annual US PE Middle Market Lending League Tables (number of deals)

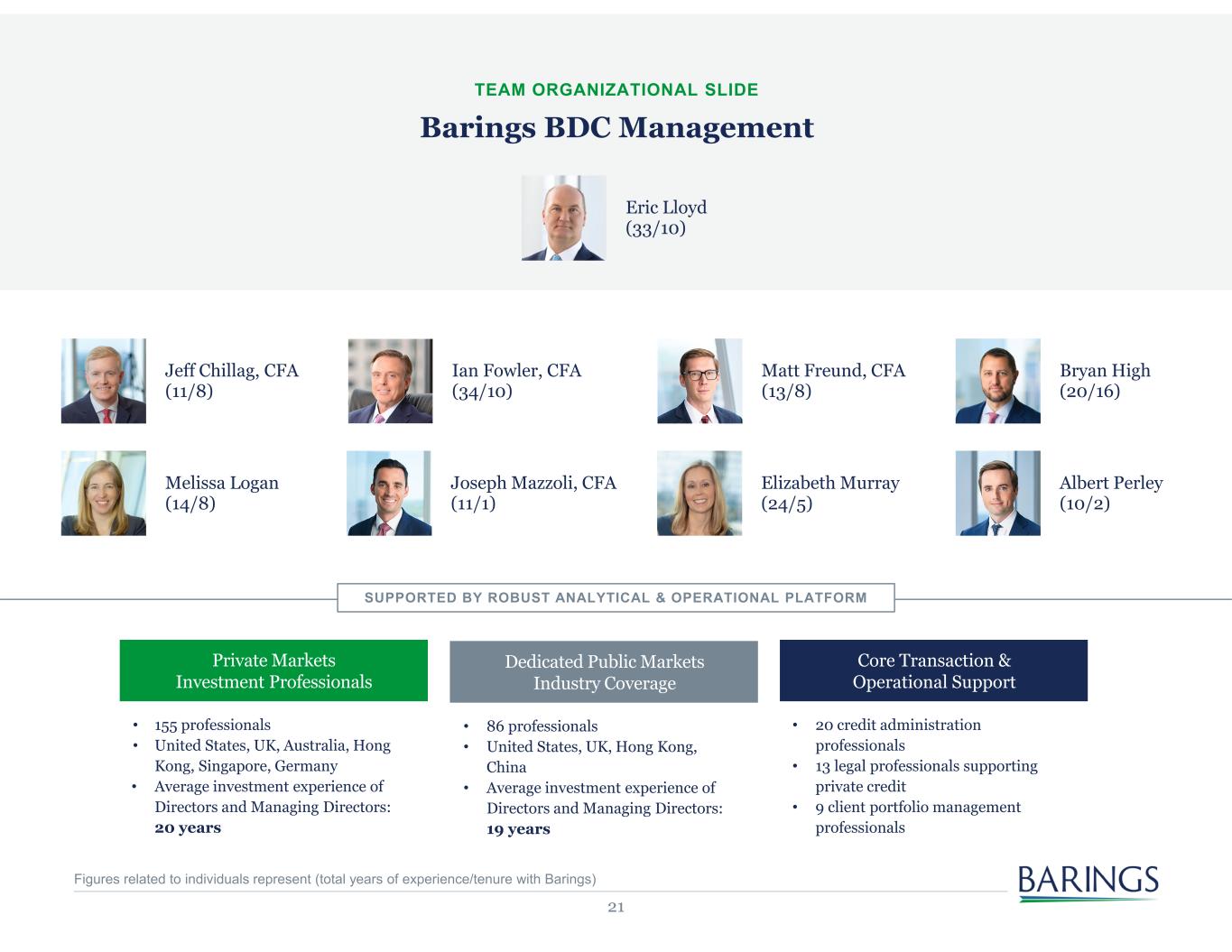

21 Barings BDC Management TEAM ORGANIZATIONAL SLIDE Bryan High (20/16) Matt Freund, CFA (13/8) Ian Fowler, CFA (34/10) Elizabeth Murray (24/5) Jeff Chillag, CFA (11/8) Albert Perley (10/2) Joseph Mazzoli, CFA (11/1) Melissa Logan (14/8) • 155 professionals • United States, UK, Australia, Hong Kong, Singapore, Germany • Average investment experience of Directors and Managing Directors: 20 years Core Transaction & Operational Support Private Markets Investment Professionals Dedicated Public Markets Industry Coverage • 86 professionals • United States, UK, Hong Kong, China • Average investment experience of Directors and Managing Directors: 19 years • 20 credit administration professionals • 13 legal professionals supporting private credit • 9 client portfolio management professionals SUPPORTED BY ROBUST ANALYTICAL & OPERATIONAL PLATFORM Eric Lloyd (33/10) Figures related to individuals represent (total years of experience/tenure with Barings)

Barings BDC Investment Process

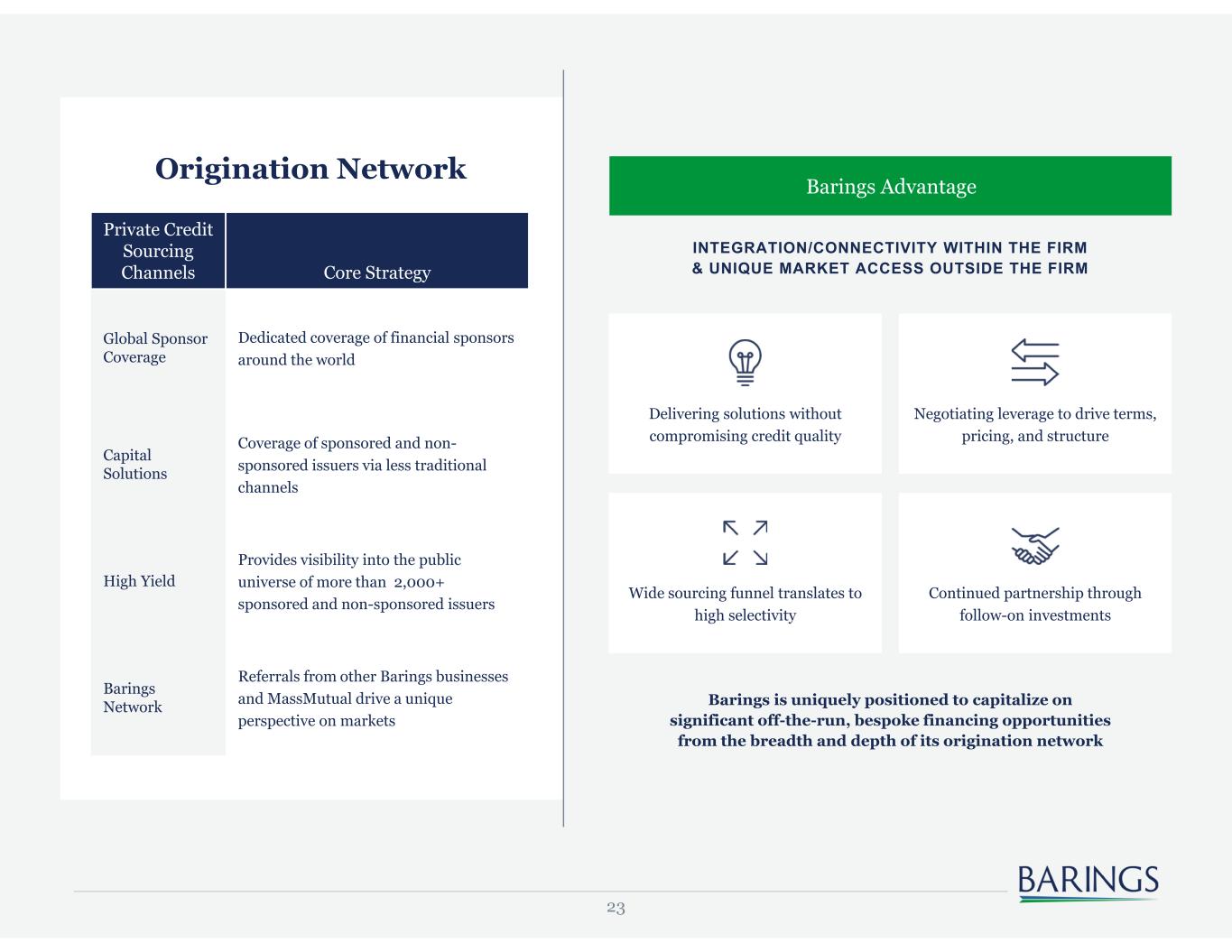

23 Private Credit Sourcing Channels Core Strategy Global Sponsor Coverage Dedicated coverage of financial sponsors around the world Capital Solutions Coverage of sponsored and non- sponsored issuers via less traditional channels High Yield Provides visibility into the public universe of more than 2,000+ sponsored and non-sponsored issuers Barings Network Referrals from other Barings businesses and MassMutual drive a unique perspective on markets INTEGRATION/CONNECTIVITY WITHIN THE FIRM & UNIQUE MARKET ACCESS OUTSIDE THE FIRM Barings Advantage Delivering solutions without compromising credit quality Negotiating leverage to drive terms, pricing, and structure Wide sourcing funnel translates to high selectivity Continued partnership through follow-on investments Barings is uniquely positioned to capitalize on significant off-the-run, bespoke financing opportunities from the breadth and depth of its origination network Origination Network

24 Significant Market Connectivity Drives Deal Flow Targeted Investment Strategy Mix Direct Sponsor Relationships Intermediaries Platform Investments 75-85% 5-15% 5-10%

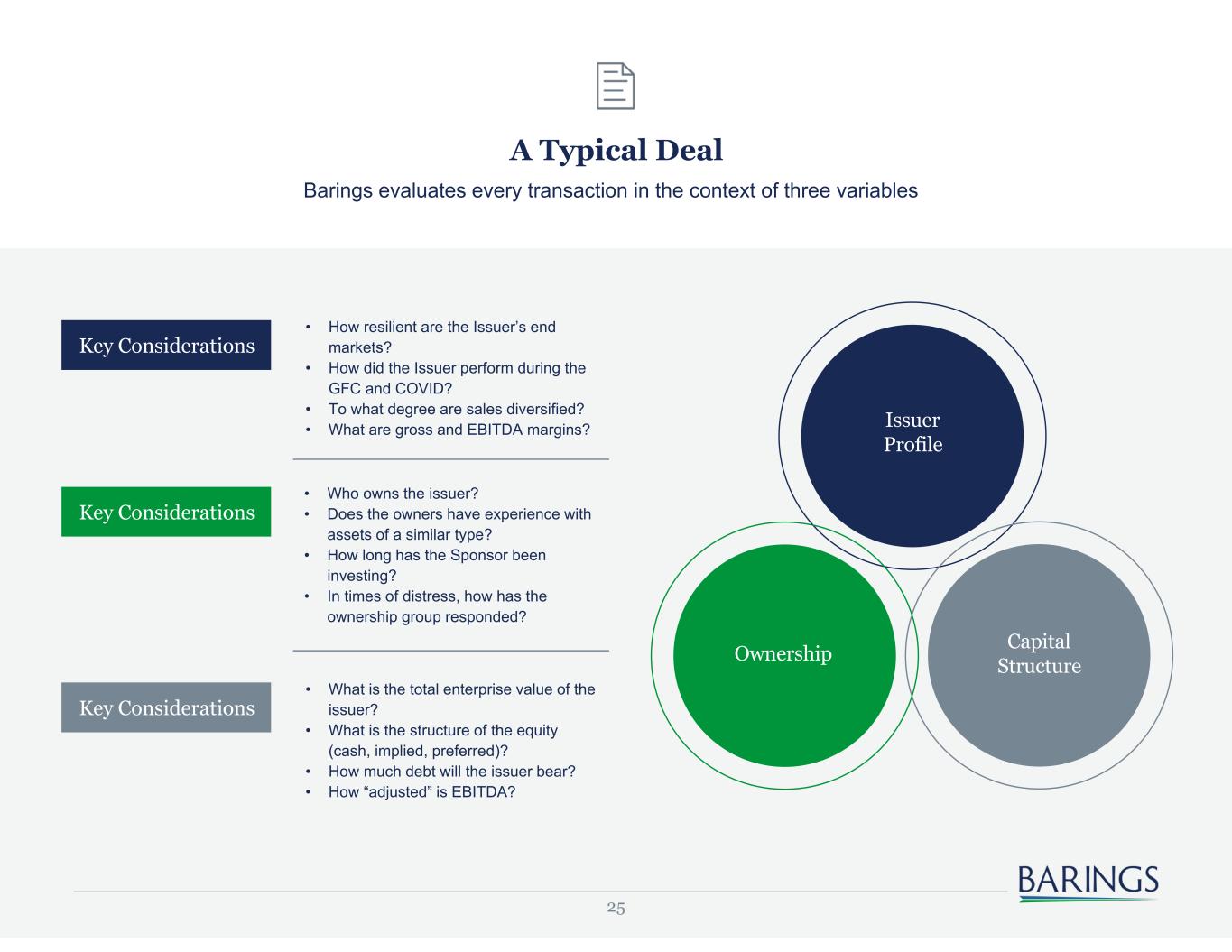

25 Issuer Profile Capital StructureOwnership Key Considerations Key Considerations Key Considerations • What is the total enterprise value of the issuer? • What is the structure of the equity (cash, implied, preferred)? • How much debt will the issuer bear? • How “adjusted” is EBITDA? • How resilient are the Issuer’s end markets? • How did the Issuer perform during the GFC and COVID? • To what degree are sales diversified? • What are gross and EBITDA margins? • Who owns the issuer? • Does the owners have experience with assets of a similar type? • How long has the Sponsor been investing? • In times of distress, how has the ownership group responded? Barings evaluates every transaction in the context of three variables A Typical Deal

26 Opportunity Sourcing & Conversion Barings leverages its broad and wide-reaching network across private equity sponsors and advisors to originate opportunities Internal Origination Channels Barings’ Network Affiliate Network Sourcing Capabilities External Origination Channels Restructuring Advisory & Legal Community Banks & Intermediaries Direct Relationships GLOBAL PRIVATE FINANCE: 175+ PE SPONSOR RELATIONSHIPS GLOBAL HIGH YIELD: 1,800+ CORPORATE ISSUERS COVERED GLOBAL STRUCTURED CREDIT: 3,300+ CLO TRANSACTIONS SOURCED OPPORTUNITIES FROM 115+ UNIQUE RELATIONSHIPS CLOSED DOZENS OF FINANCINGS WITH 20+ UNIQUE EXTERNAL PARTNERS IN THE PAST 12 MONTHS LTM Barings Deal Origination Process1 Deals Closed and Funded *includes 55+ proprietary add-on transactions 1,650 Deals Introduced and Reviewed 220 Deals Passed Briefing Stage 165 Deals Passed Screening Stage 145 Deals Receiving Final IC Approval 117 <4% conversion rate on new platform* opportunities 1. LTM as of June 30, 2023 based on closed date.

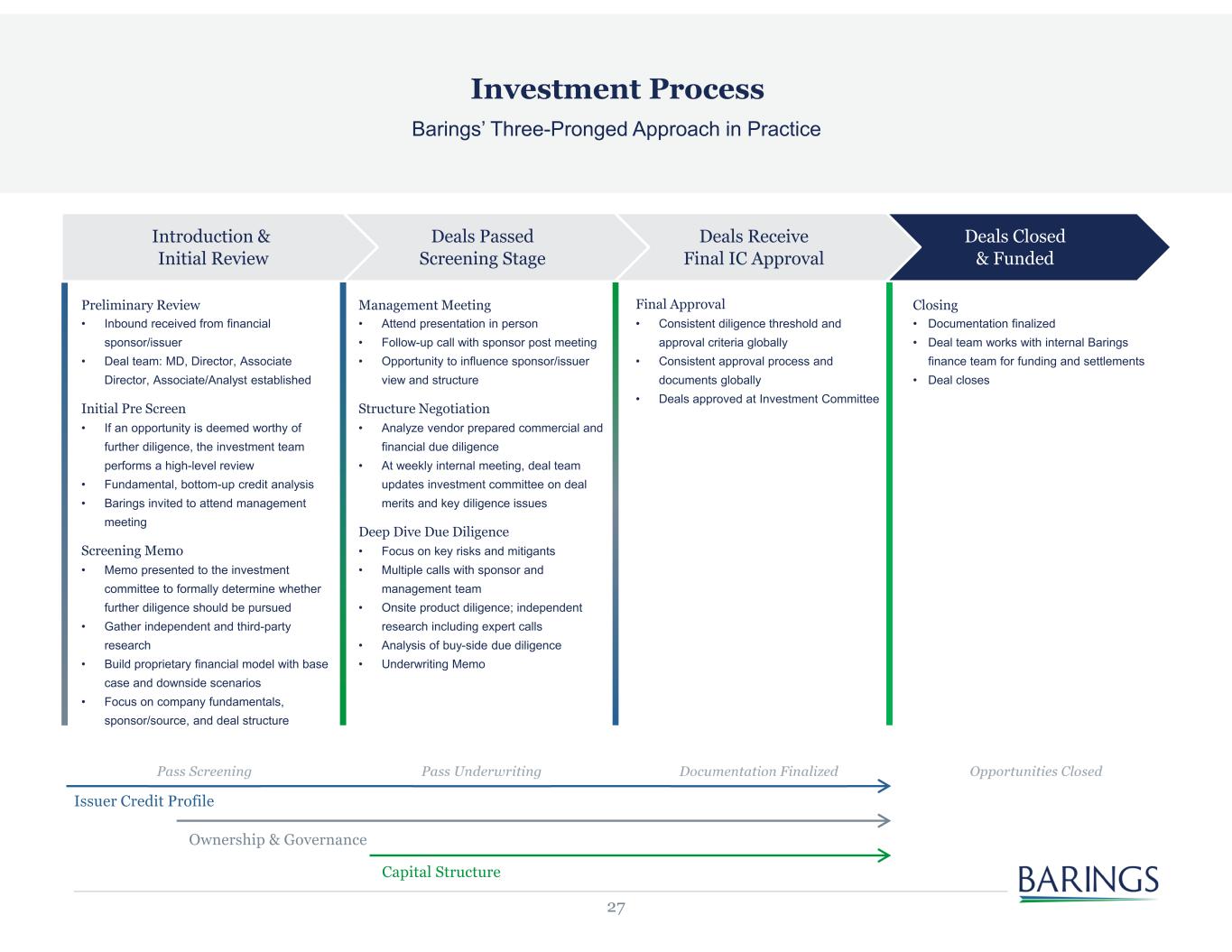

27 Deals Closed & Funded Deals Receive Final IC Approval Deals Passed Screening Stage Investment Process Barings’ Three-Pronged Approach in Practice Issuer Credit Profile Ownership & Governance Capital Structure Introduction & Initial Review Preliminary Review • Inbound received from financial sponsor/issuer • Deal team: MD, Director, Associate Director, Associate/Analyst established Initial Pre Screen • If an opportunity is deemed worthy of further diligence, the investment team performs a high-level review • Fundamental, bottom-up credit analysis • Barings invited to attend management meeting Screening Memo • Memo presented to the investment committee to formally determine whether further diligence should be pursued • Gather independent and third-party research • Build proprietary financial model with base case and downside scenarios • Focus on company fundamentals, sponsor/source, and deal structure Management Meeting • Attend presentation in person • Follow-up call with sponsor post meeting • Opportunity to influence sponsor/issuer view and structure Structure Negotiation • Analyze vendor prepared commercial and financial due diligence • At weekly internal meeting, deal team updates investment committee on deal merits and key diligence issues Deep Dive Due Diligence • Focus on key risks and mitigants • Multiple calls with sponsor and management team • Onsite product diligence; independent research including expert calls • Analysis of buy-side due diligence • Underwriting Memo Final Approval • Consistent diligence threshold and approval criteria globally • Consistent approval process and documents globally • Deals approved at Investment Committee Closing • Documentation finalized • Deal team works with internal Barings finance team for funding and settlements • Deal closes

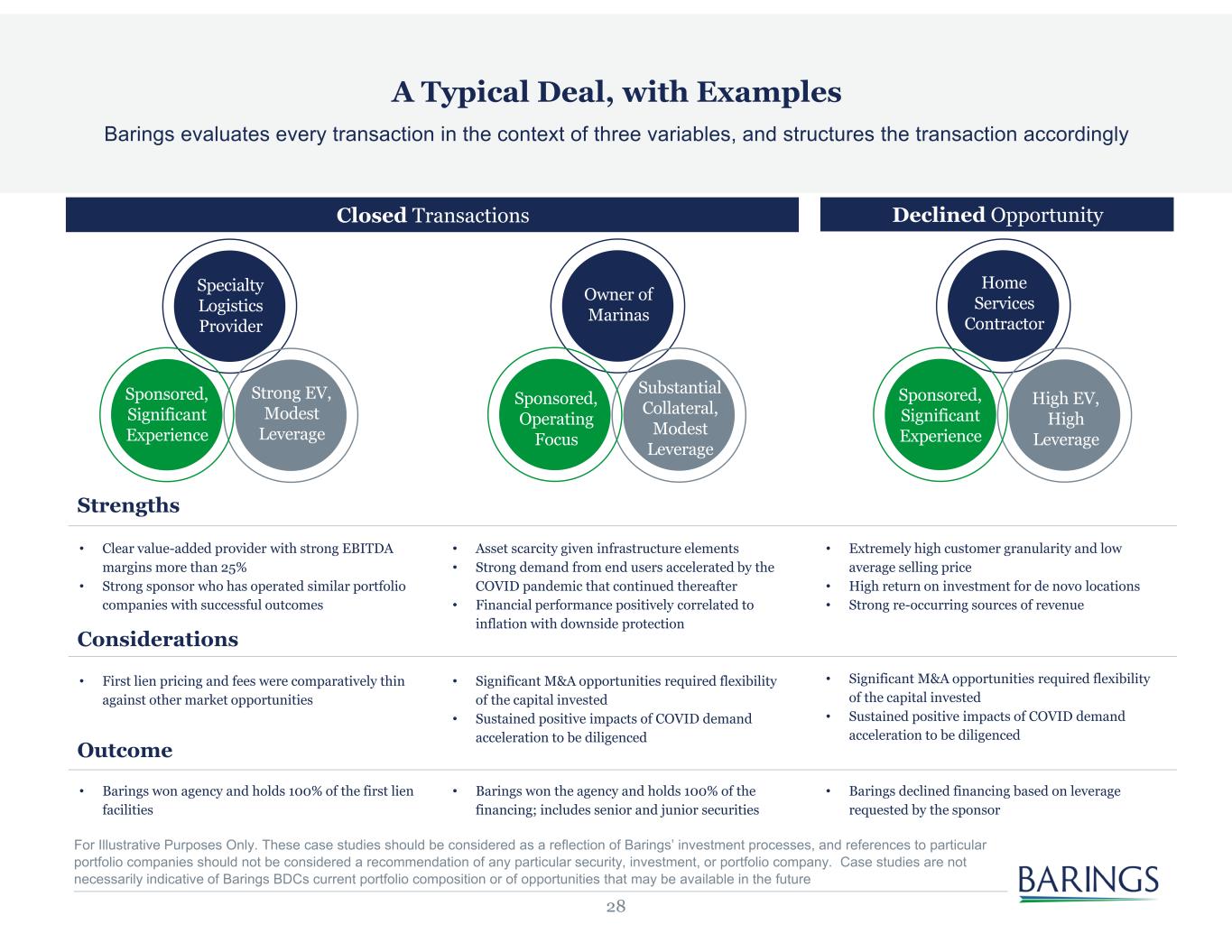

28 A Typical Deal, with Examples Specialty Logistics Provider Strong EV, Modest Leverage Sponsored, Significant Experience Owner of Marinas Substantial Collateral, Modest Leverage Sponsored, Operating Focus Home Services Contractor High EV, High Leverage Sponsored, Significant Experience • Clear value-added provider with strong EBITDA margins more than 25% • Strong sponsor who has operated similar portfolio companies with successful outcomes • Asset scarcity given infrastructure elements • Strong demand from end users accelerated by the COVID pandemic that continued thereafter • Financial performance positively correlated to inflation with downside protection • Extremely high customer granularity and low average selling price • High return on investment for de novo locations • Strong re-occurring sources of revenue Strengths Considerations • First lien pricing and fees were comparatively thin against other market opportunities • Significant M&A opportunities required flexibility of the capital invested • Sustained positive impacts of COVID demand acceleration to be diligenced Outcome • Barings won agency and holds 100% of the first lien facilities • Barings won the agency and holds 100% of the financing; includes senior and junior securities • Barings declined financing based on leverage requested by the sponsor Barings evaluates every transaction in the context of three variables, and structures the transaction accordingly Closed Transactions Declined Opportunity • Significant M&A opportunities required flexibility of the capital invested • Sustained positive impacts of COVID demand acceleration to be diligenced For Illustrative Purposes Only. These case studies should be considered as a reflection of Barings’ investment processes, and references to particular portfolio companies should not be considered a recommendation of any particular security, investment, or portfolio company. Case studies are not necessarily indicative of Barings BDCs current portfolio composition or of opportunities that may be available in the future

29 Ongoing Portfolio Monitoring Portfolio managers and original investment team monitor at investment and portfolio level with goal of addressing any issues well in advance of potentially adverse events Culture of Risk Management Multiple, independent layers of review, both internally and externally • Hold regular watchlist reviews • Quarterly portfolio reviews internally to review risk sensitivities, near-term market outlook and relative value • Discuss any latent issues regularly with investment committee • Pricing committee utilizes independent third-party pricing vendors • Annual third party audit • Same team who underwrote deal monitors it in the portfolio • Receive monthly/quarterly financials from portfolio companies • Proprietary portfolio management system aggregates data to monitor trends • Engage sponsor and management early to address potential covenant breaks or other issues Investment Team Monitoring Committee and External Monitoring

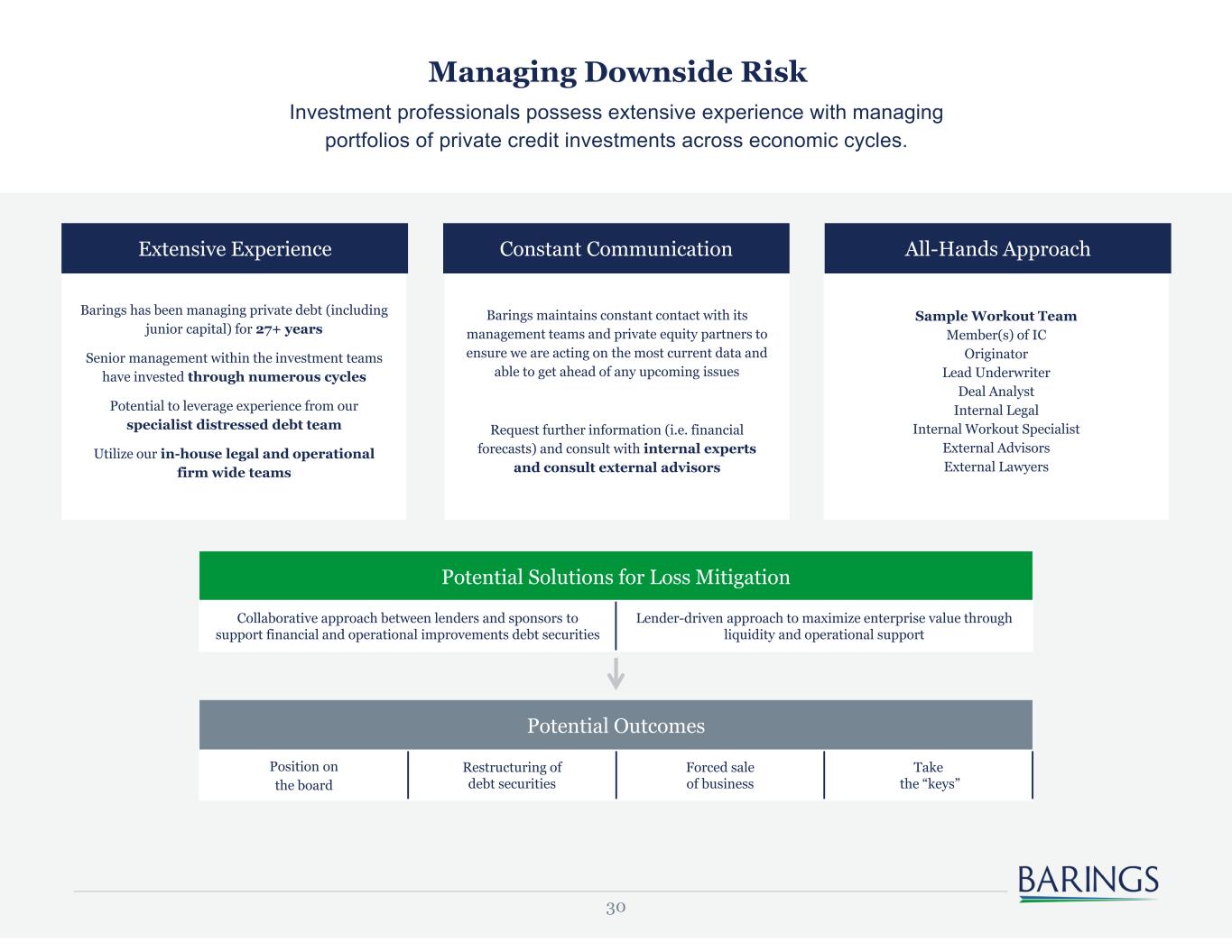

30 Managing Downside Risk Investment professionals possess extensive experience with managing portfolios of private credit investments across economic cycles. Extensive Experience Constant Communication All-Hands Approach Potential Solutions for Loss Mitigation Barings has been managing private debt (including junior capital) for 27+ years Senior management within the investment teams have invested through numerous cycles Potential to leverage experience from our specialist distressed debt team Utilize our in-house legal and operational firm wide teams Barings maintains constant contact with its management teams and private equity partners to ensure we are acting on the most current data and able to get ahead of any upcoming issues Request further information (i.e. financial forecasts) and consult with internal experts and consult external advisors Sample Workout Team Member(s) of IC Originator Lead Underwriter Deal Analyst Internal Legal Internal Workout Specialist External Advisors External Lawyers Potential Outcomes Collaborative approach between lenders and sponsors to support financial and operational improvements debt securities Lender-driven approach to maximize enterprise value through liquidity and operational support Position on the board Restructuring of debt securities Forced sale of business Take the “keys”

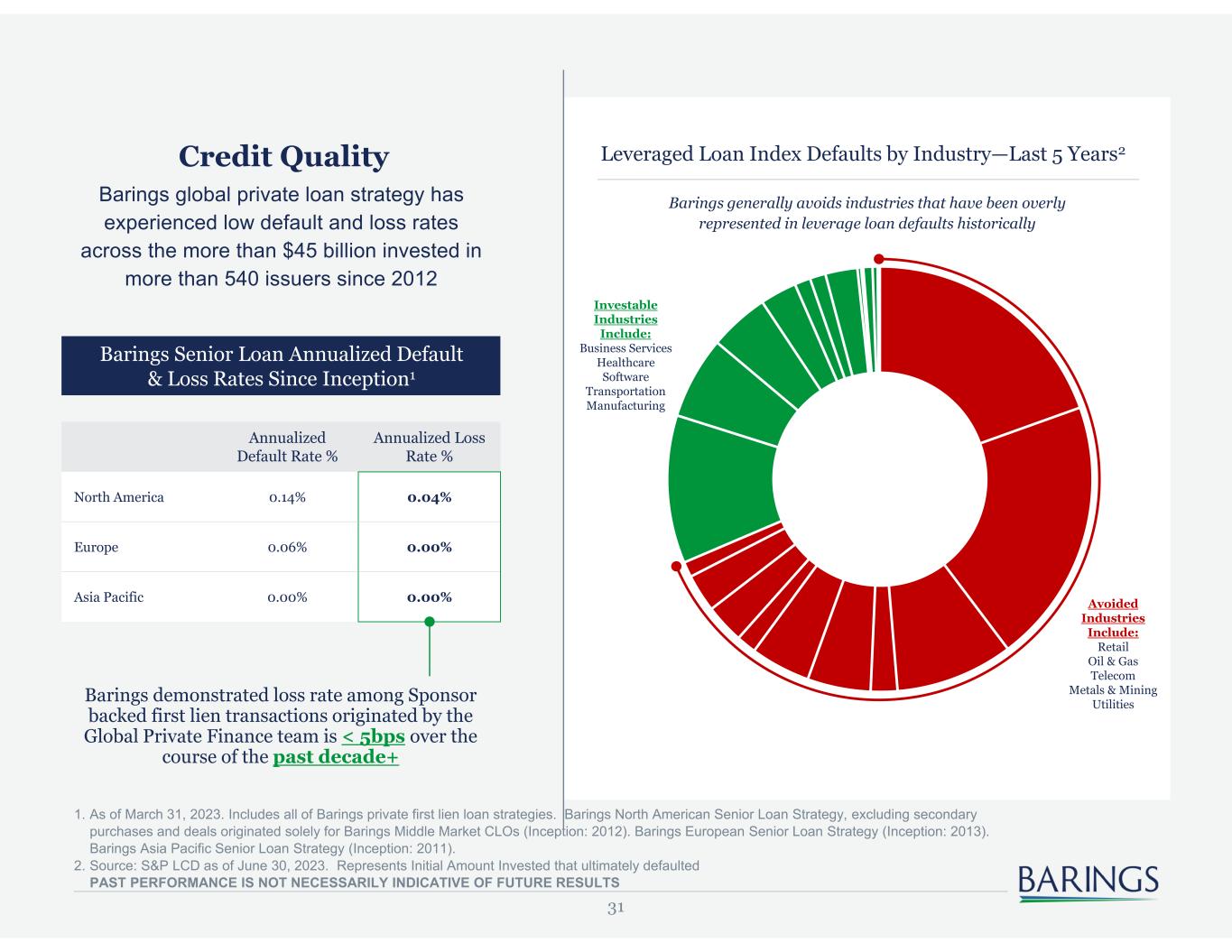

31 Leveraged Loan Index Defaults by Industry—Last 5 Years2Credit Quality Barings global private loan strategy has experienced low default and loss rates across the more than $45 billion invested in more than 540 issuers since 2012 Annualized Default Rate % Annualized Loss Rate % North America 0.14% 0.04% Europe 0.06% 0.00% Asia Pacific 0.00% 0.00% Barings demonstrated loss rate among Sponsor backed first lien transactions originated by the Global Private Finance team is < 5bps over the course of the past decade+ Barings Senior Loan Annualized Default & Loss Rates Since Inception1 Barings generally avoids industries that have been overly represented in leverage loan defaults historically Avoided Industries Include: Retail Oil & Gas Telecom Metals & Mining Utilities Investable Industries Include: Business Services Healthcare Software Transportation Manufacturing 1. As of March 31, 2023. Includes all of Barings private first lien loan strategies. Barings North American Senior Loan Strategy, excluding secondary purchases and deals originated solely for Barings Middle Market CLOs (Inception: 2012). Barings European Senior Loan Strategy (Inception: 2013). Barings Asia Pacific Senior Loan Strategy (Inception: 2011). 2. Source: S&P LCD as of June 30, 2023. Represents Initial Amount Invested that ultimately defaulted PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

BDC Platform

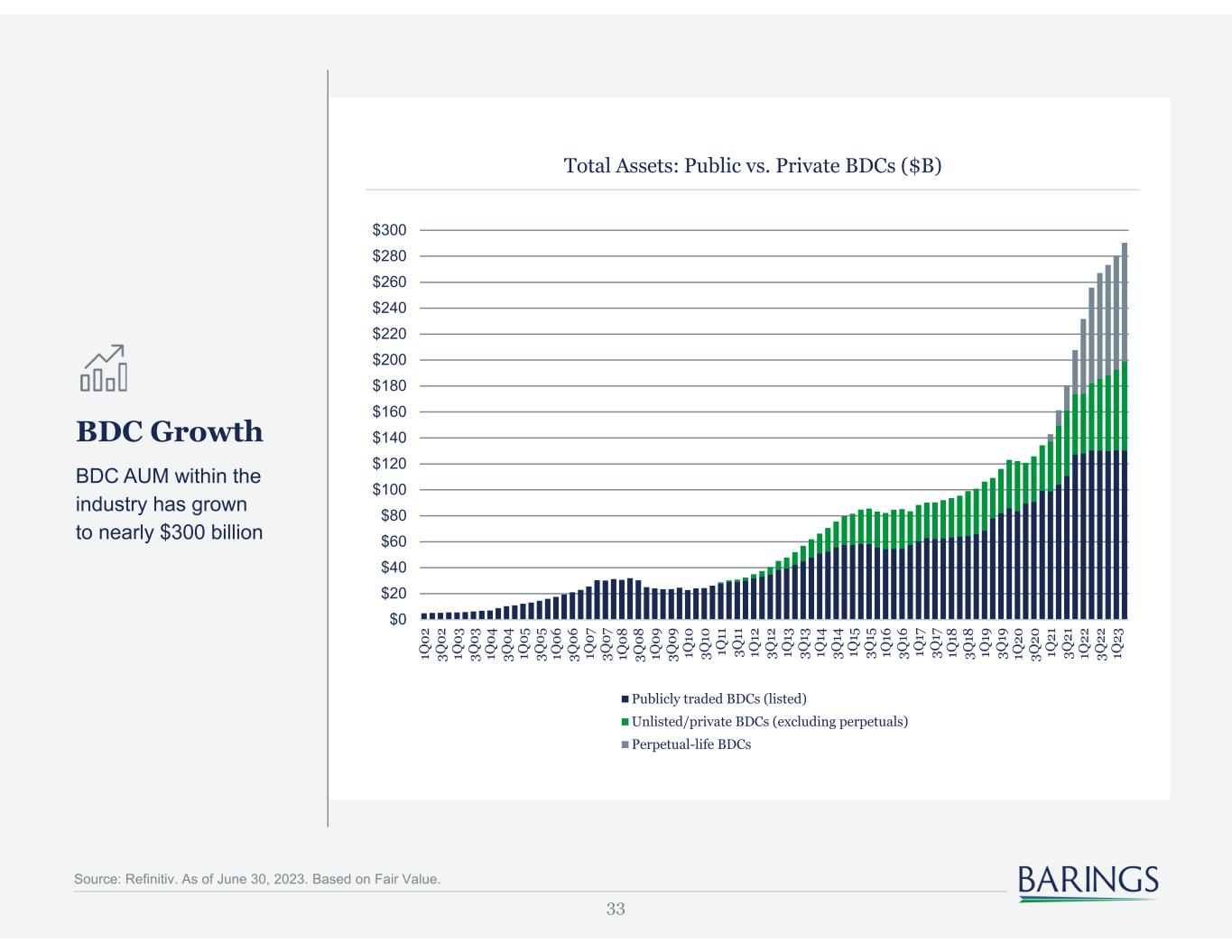

33 BDC Growth BDC AUM within the industry has grown to nearly $300 billion Total Assets: Public vs. Private BDCs ($B) $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 $220 $240 $260 $280 $300 1Q 02 3Q 02 1Q 03 3Q 03 1Q 04 3Q 04 1Q 05 3Q 05 1Q 06 3Q 06 1Q 07 3Q 07 1Q 08 3Q 08 1Q 09 3Q 09 1Q 10 3Q 10 1Q 11 3Q 11 1Q 12 3Q 12 1Q 13 3Q 13 1Q 14 3Q 14 1Q 15 3Q 15 1Q 16 3Q 16 1Q 17 3Q 17 1Q 18 3Q 18 1Q 19 3Q 19 1Q 20 3Q 20 1Q 21 3Q 21 1Q 22 3Q 22 1Q 23 Publicly traded BDCs (listed) Unlisted/private BDCs (excluding perpetuals) Perpetual-life BDCs Source: Refinitiv. As of June 30, 2023. Based on Fair Value.

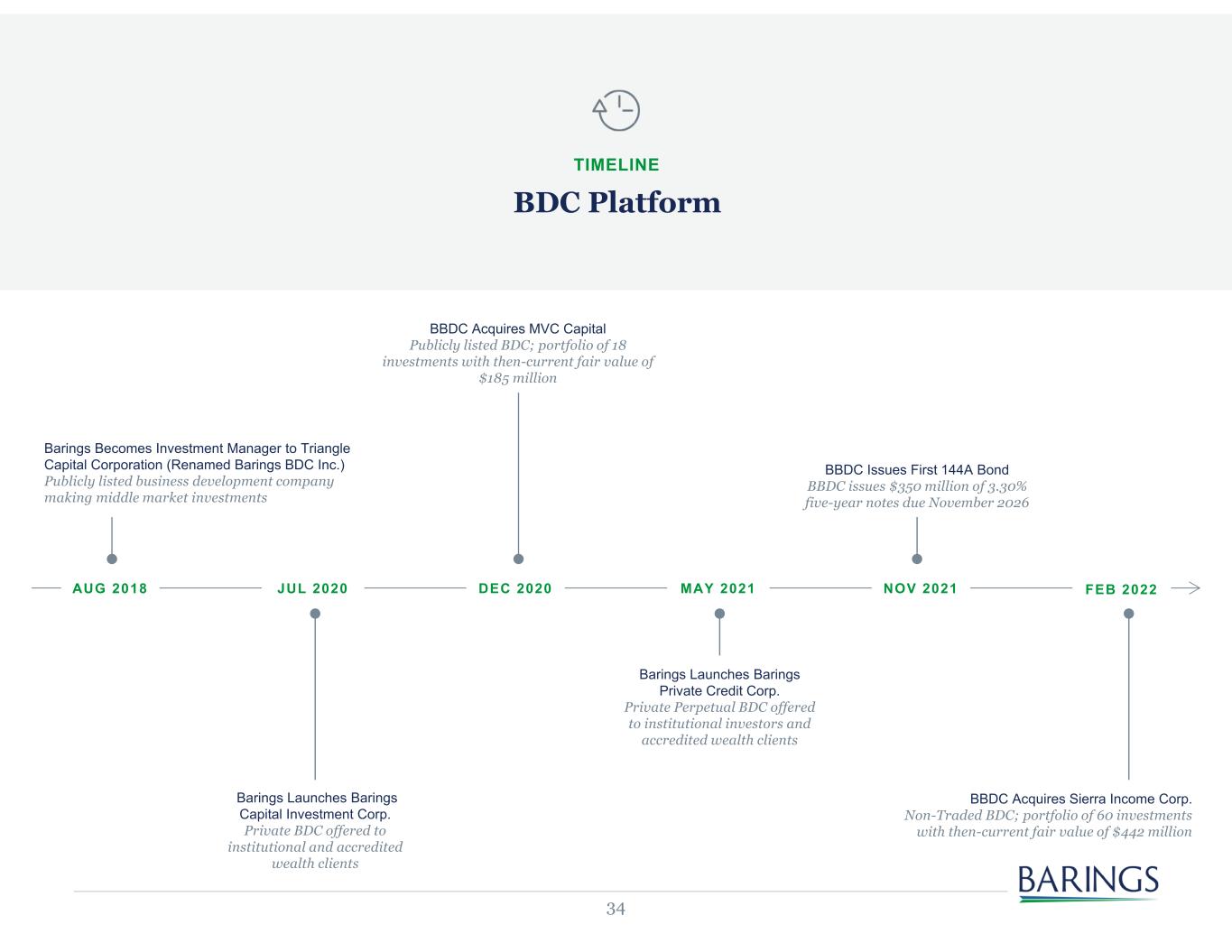

34 BDC Platform TIMELINE AUG 2018 MAY 2021JUL 2020 DEC 2020 Barings Becomes Investment Manager to Triangle Capital Corporation (Renamed Barings BDC Inc.) Publicly listed business development company making middle market investments Barings Launches Barings Private Credit Corp. Private Perpetual BDC offered to institutional investors and accredited wealth clients FEB 2022NOV 2021 BBDC Acquires MVC Capital Publicly listed BDC; portfolio of 18 investments with then-current fair value of $185 million Barings Launches Barings Capital Investment Corp. Private BDC offered to institutional and accredited wealth clients BBDC Issues First 144A Bond BBDC issues $350 million of 3.30% five-year notes due November 2026 BBDC Acquires Sierra Income Corp. Non-Traded BDC; portfolio of 60 investments with then-current fair value of $442 million

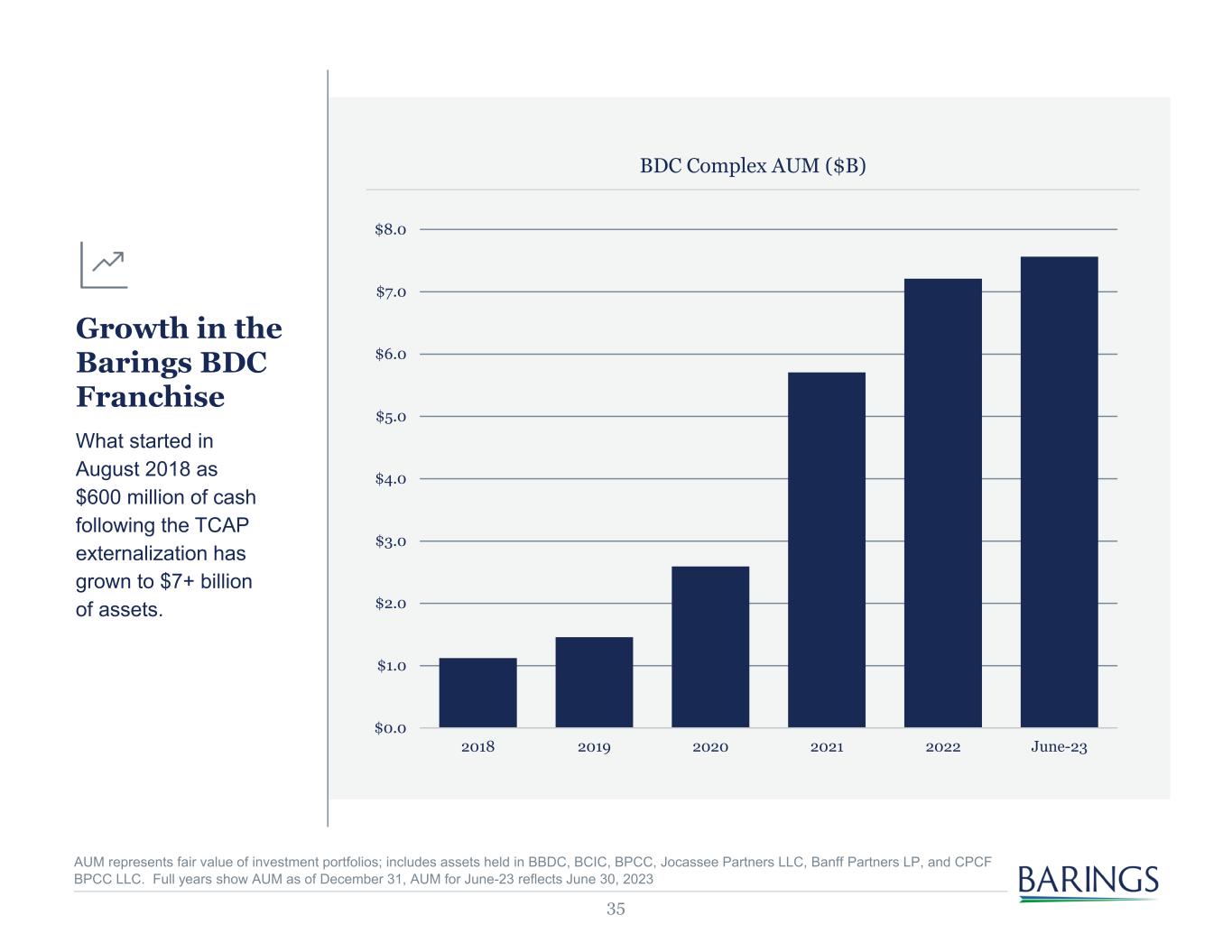

35 BDC Complex AUM ($B) Growth in the Barings BDC Franchise What started in August 2018 as $600 million of cash following the TCAP externalization has grown to $7+ billion of assets. $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 2018 2019 2020 2021 2022 June-23 AUM represents fair value of investment portfolios; includes assets held in BBDC, BCIC, BPCC, Jocassee Partners LLC, Banff Partners LP, and CPCF BPCC LLC. Full years show AUM as of December 31, AUM for June-23 reflects June 30, 2023

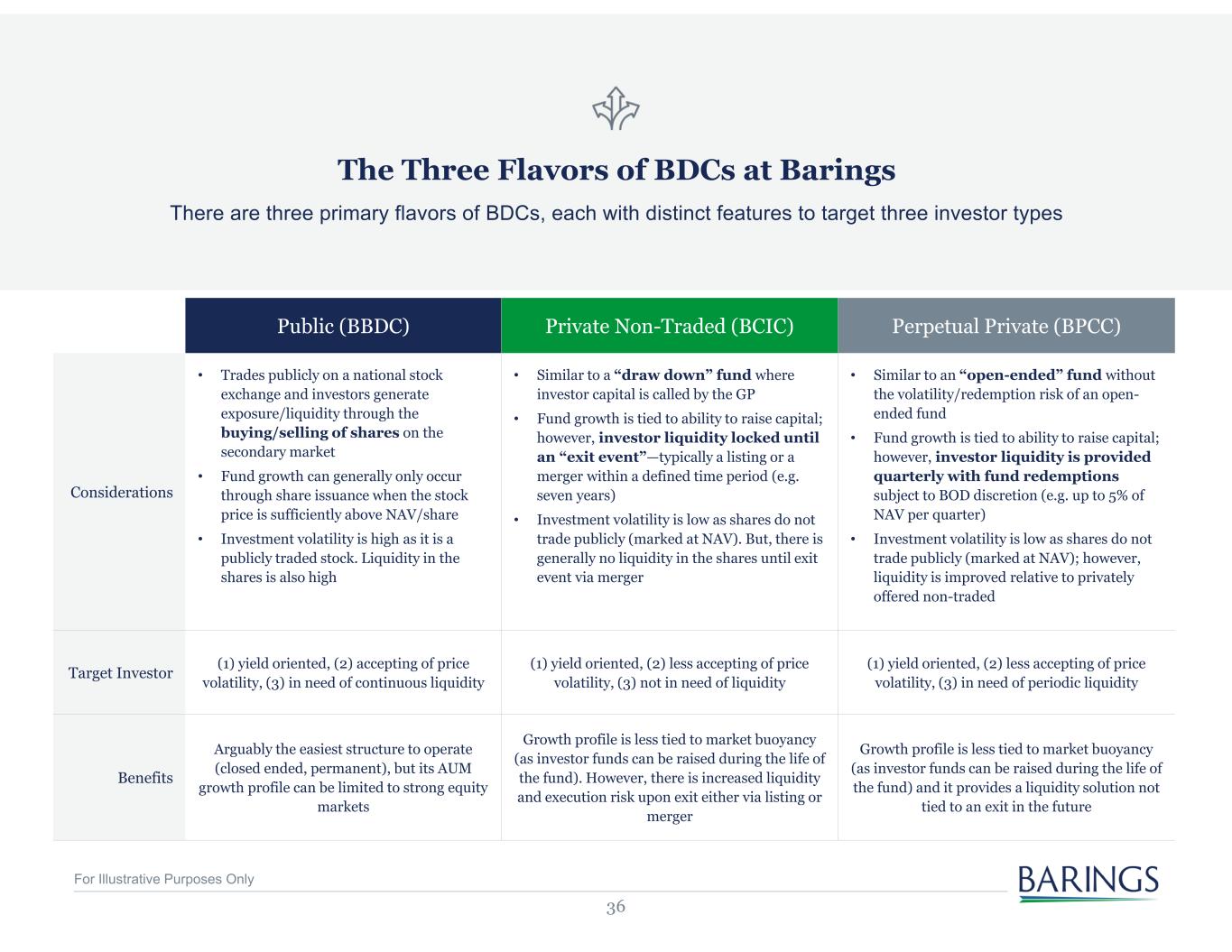

36 There are three primary flavors of BDCs, each with distinct features to target three investor types The Three Flavors of BDCs at Barings Public (BBDC) Private Non-Traded (BCIC) Perpetual Private (BPCC) Considerations • Trades publicly on a national stock exchange and investors generate exposure/liquidity through the buying/selling of shares on the secondary market • Fund growth can generally only occur through share issuance when the stock price is sufficiently above NAV/share • Investment volatility is high as it is a publicly traded stock. Liquidity in the shares is also high • Similar to a “draw down” fund where investor capital is called by the GP • Fund growth is tied to ability to raise capital; however, investor liquidity locked until an “exit event”—typically a listing or a merger within a defined time period (e.g. seven years) • Investment volatility is low as shares do not trade publicly (marked at NAV). But, there is generally no liquidity in the shares until exit event via merger • Similar to an “open-ended” fund without the volatility/redemption risk of an open- ended fund • Fund growth is tied to ability to raise capital; however, investor liquidity is provided quarterly with fund redemptions subject to BOD discretion (e.g. up to 5% of NAV per quarter) • Investment volatility is low as shares do not trade publicly (marked at NAV); however, liquidity is improved relative to privately offered non-traded Target Investor (1) yield oriented, (2) accepting of price volatility, (3) in need of continuous liquidity (1) yield oriented, (2) less accepting of price volatility, (3) not in need of liquidity (1) yield oriented, (2) less accepting of price volatility, (3) in need of periodic liquidity Benefits Arguably the easiest structure to operate (closed ended, permanent), but its AUM growth profile can be limited to strong equity markets Growth profile is less tied to market buoyancy (as investor funds can be raised during the life of the fund). However, there is increased liquidity and execution risk upon exit either via listing or merger Growth profile is less tied to market buoyancy (as investor funds can be raised during the life of the fund) and it provides a liquidity solution not tied to an exit in the future For Illustrative Purposes Only

Platform Investments

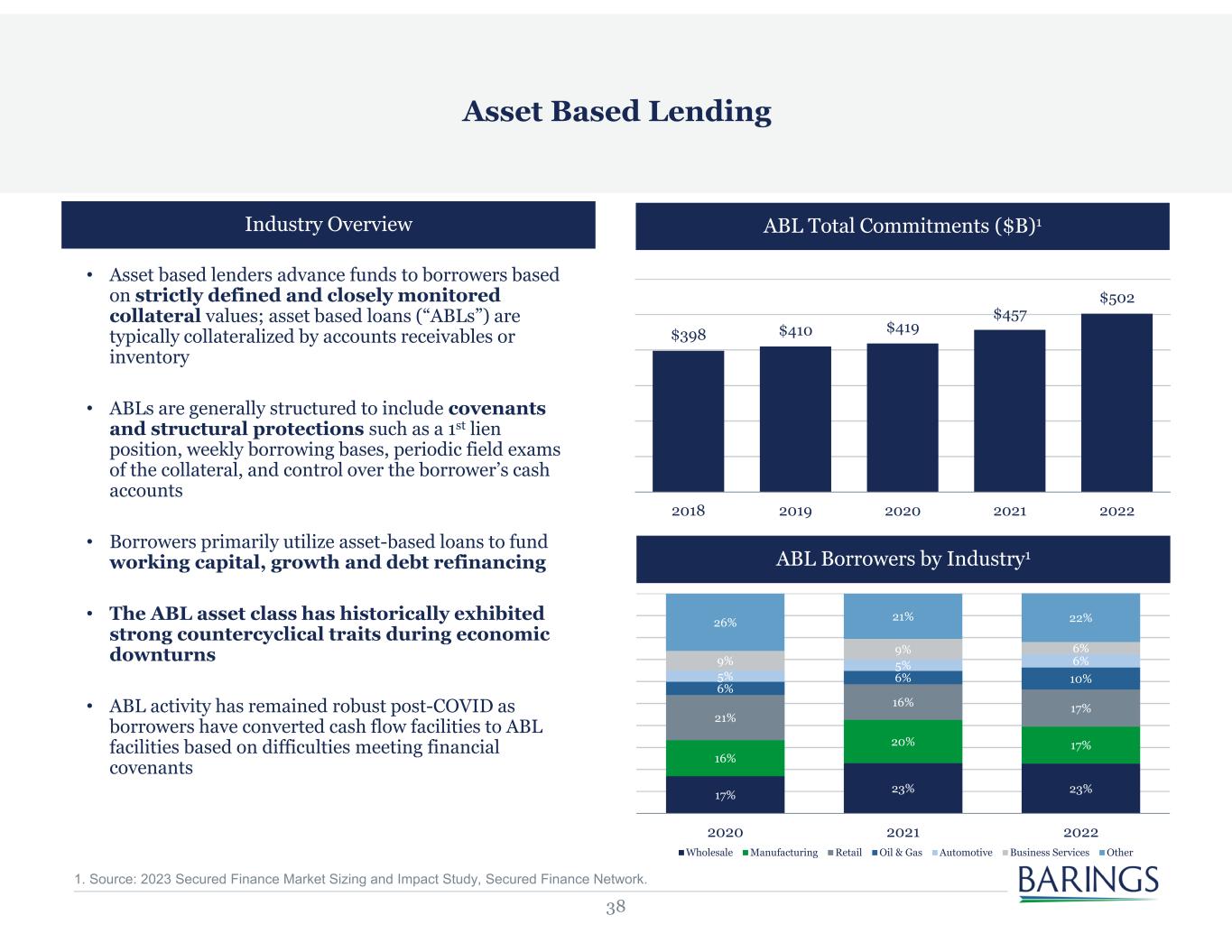

38 $398 $410 $419 $457 $502 2018 2019 2020 2021 2022 Industry Overview • Asset based lenders advance funds to borrowers based on strictly defined and closely monitored collateral values; asset based loans (“ABLs”) are typically collateralized by accounts receivables or inventory • ABLs are generally structured to include covenants and structural protections such as a 1st lien position, weekly borrowing bases, periodic field exams of the collateral, and control over the borrower’s cash accounts • Borrowers primarily utilize asset-based loans to fund working capital, growth and debt refinancing • The ABL asset class has historically exhibited strong countercyclical traits during economic downturns • ABL activity has remained robust post-COVID as borrowers have converted cash flow facilities to ABL facilities based on difficulties meeting financial covenants Asset Based Lending 17% 23% 23% 16% 20% 17% 21% 16% 17% 6% 6% 10%5% 5% 6%9% 9% 6% 26% 21% 22% 2020 2021 2022 Wholesale Manufacturing Retail Oil & Gas Automotive Business Services Other ABL Total Commitments ($B)1 ABL Borrowers by Industry1 1. Source: 2023 Secured Finance Market Sizing and Impact Study, Secured Finance Network.

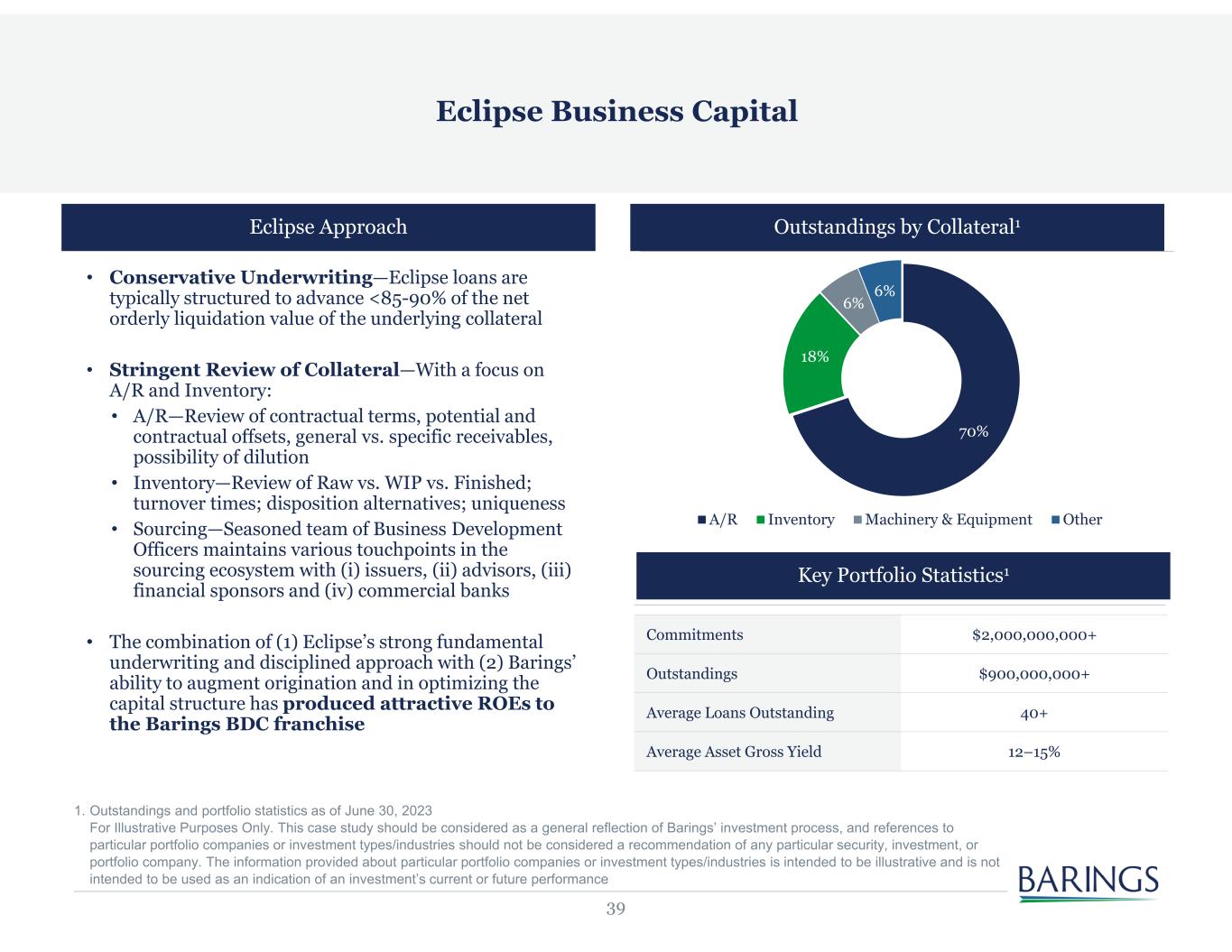

39 Eclipse Approach • Conservative Underwriting—Eclipse loans are typically structured to advance <85-90% of the net orderly liquidation value of the underlying collateral • Stringent Review of Collateral—With a focus on A/R and Inventory: • A/R—Review of contractual terms, potential and contractual offsets, general vs. specific receivables, possibility of dilution • Inventory—Review of Raw vs. WIP vs. Finished; turnover times; disposition alternatives; uniqueness • Sourcing—Seasoned team of Business Development Officers maintains various touchpoints in the sourcing ecosystem with (i) issuers, (ii) advisors, (iii) financial sponsors and (iv) commercial banks • The combination of (1) Eclipse’s strong fundamental underwriting and disciplined approach with (2) Barings’ ability to augment origination and in optimizing the capital structure has produced attractive ROEs to the Barings BDC franchise Commitments $2,000,000,000+ Outstandings $900,000,000+ Average Loans Outstanding 40+ Average Asset Gross Yield 12–15% Eclipse Business Capital 70% 18% 6% 6% A/R Inventory Machinery & Equipment Other Key Portfolio Statistics1 Outstandings by Collateral1 1. Outstandings and portfolio statistics as of June 30, 2023 For Illustrative Purposes Only. This case study should be considered as a general reflection of Barings’ investment process, and references to particular portfolio companies or investment types/industries should not be considered a recommendation of any particular security, investment, or portfolio company. The information provided about particular portfolio companies or investment types/industries is intended to be illustrative and is not intended to be used as an indication of an investment’s current or future performance

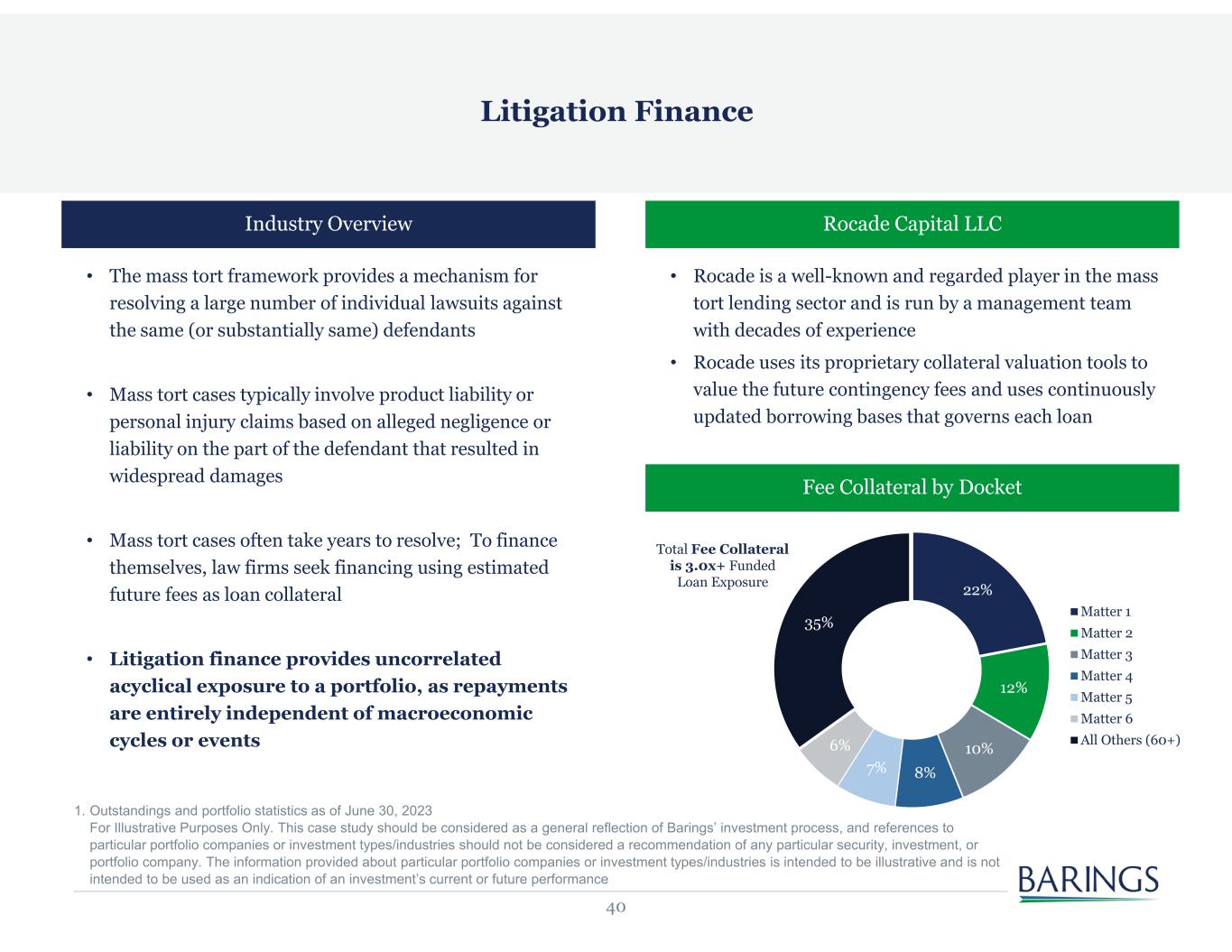

40 Industry Overview • The mass tort framework provides a mechanism for resolving a large number of individual lawsuits against the same (or substantially same) defendants • Mass tort cases typically involve product liability or personal injury claims based on alleged negligence or liability on the part of the defendant that resulted in widespread damages • Mass tort cases often take years to resolve; To finance themselves, law firms seek financing using estimated future fees as loan collateral • Litigation finance provides uncorrelated acyclical exposure to a portfolio, as repayments are entirely independent of macroeconomic cycles or events Litigation Finance Rocade Capital LLC • Rocade is a well-known and regarded player in the mass tort lending sector and is run by a management team with decades of experience • Rocade uses its proprietary collateral valuation tools to value the future contingency fees and uses continuously updated borrowing bases that governs each loan 22% 12% 10% 8%7% 6% 35% Matter 1 Matter 2 Matter 3 Matter 4 Matter 5 Matter 6 All Others (60+) Total Fee Collateral is 3.0x+ Funded Loan Exposure Fee Collateral by Docket 1. Outstandings and portfolio statistics as of June 30, 2023 For Illustrative Purposes Only. This case study should be considered as a general reflection of Barings’ investment process, and references to particular portfolio companies or investment types/industries should not be considered a recommendation of any particular security, investment, or portfolio company. The information provided about particular portfolio companies or investment types/industries is intended to be illustrative and is not intended to be used as an indication of an investment’s current or future performance

Questions

15 Minute Break

Barings BDC, Inc.

44 Barings BDC, Inc. TIMELINE Barings becomes investment manager to Triangle Capital Corporation, rebrands into BBDC, and deploys cash into broadly syndicated loans (BSLs) PHASE 1: Rotation out of BSLs into Barings- originated private credit $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 $11.00 $12.00 $13.00 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 $2,200 $2,400 $2,600 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 In ve st m en t P or tf ol io ($ M ) Investment Portfolio at Fair Value Net Asset Value Per Share Acquisition Quarters PHASE 2: Growth into optimal size to achieve sufficient diversity, liquidity, and economic benefits PHASE 3: Rotation out of acquired assets into 100% Barings- originated private credit (Ongoing)

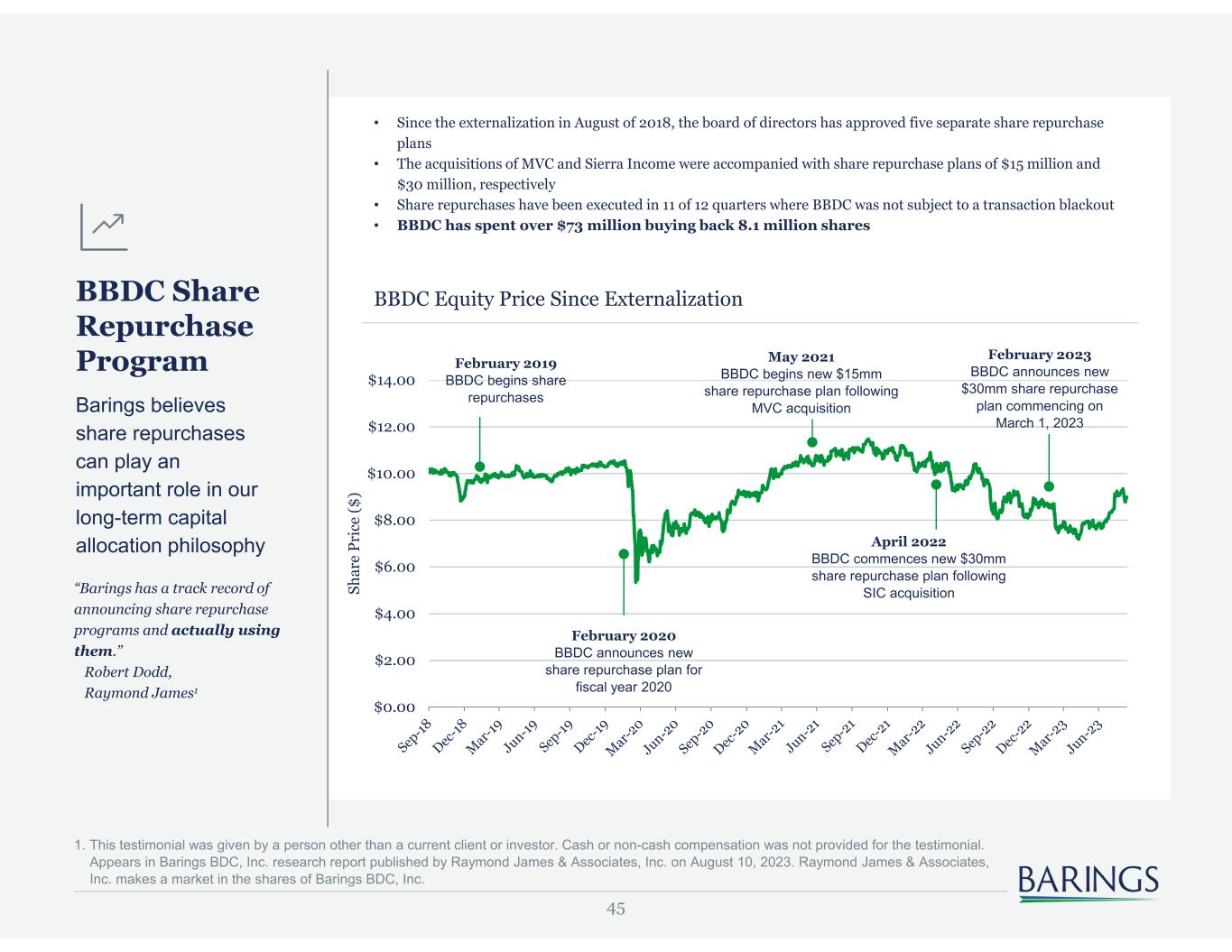

45 • Since the externalization in August of 2018, the board of directors has approved five separate share repurchase plans • The acquisitions of MVC and Sierra Income were accompanied with share repurchase plans of $15 million and $30 million, respectively • Share repurchases have been executed in 11 of 12 quarters where BBDC was not subject to a transaction blackout • BBDC has spent over $73 million buying back 8.1 million shares BBDC Equity Price Since Externalization $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 Sh ar e Pr ic e ($ ) February 2019 BBDC begins share repurchases February 2023 BBDC announces new $30mm share repurchase plan commencing on March 1, 2023 February 2020 BBDC announces new share repurchase plan for fiscal year 2020 May 2021 BBDC begins new $15mm share repurchase plan following MVC acquisition April 2022 BBDC commences new $30mm share repurchase plan following SIC acquisition BBDC Share Repurchase Program Barings believes share repurchases can play an important role in our long-term capital allocation philosophy “Barings has a track record of announcing share repurchase programs and actually using them.” Robert Dodd, Raymond James1 1. This testimonial was given by a person other than a current client or investor. Cash or non-cash compensation was not provided for the testimonial. Appears in Barings BDC, Inc. research report published by Raymond James & Associates, Inc. on August 10, 2023. Raymond James & Associates, Inc. makes a market in the shares of Barings BDC, Inc.

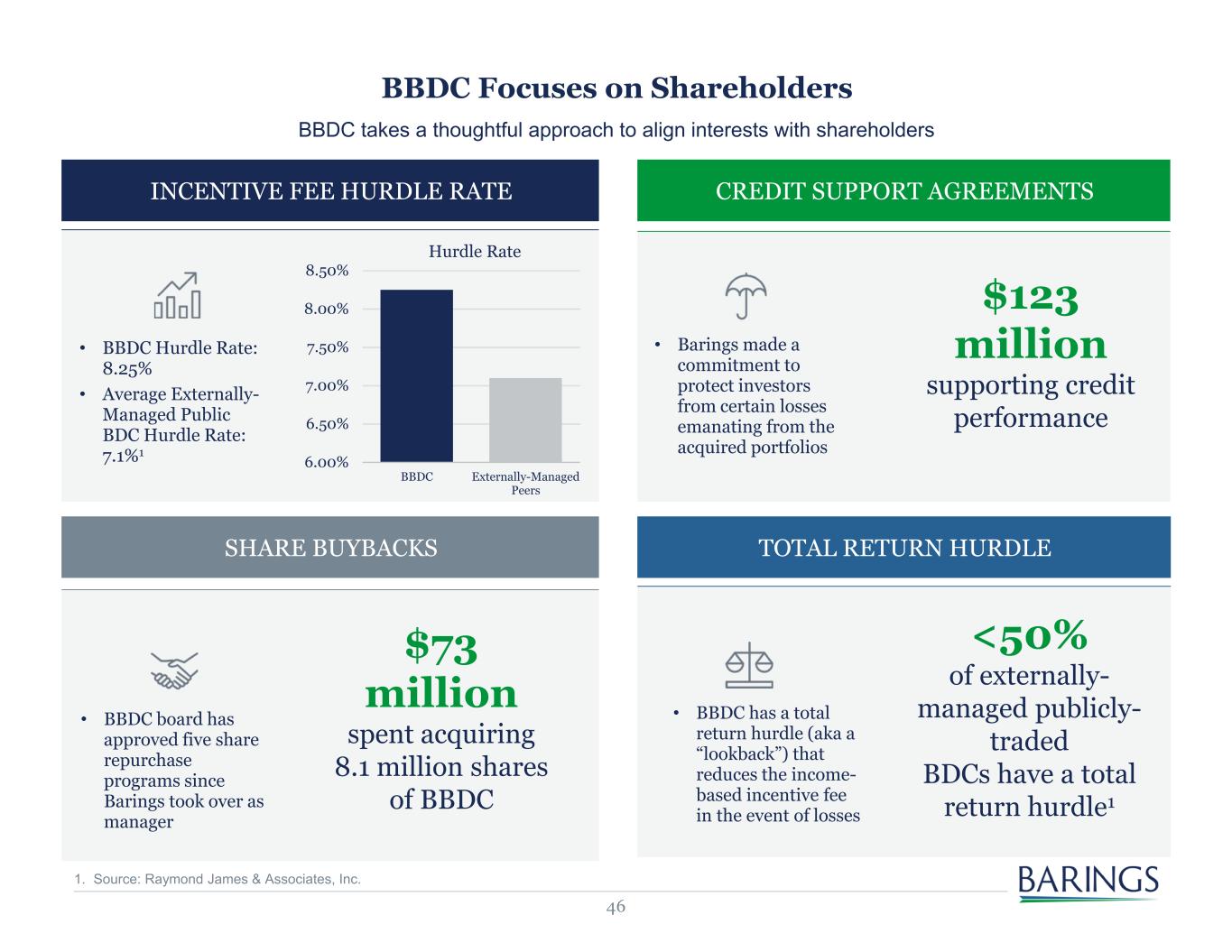

46 SHARE BUYBACKS INCENTIVE FEE HURDLE RATE TOTAL RETURN HURDLE CREDIT SUPPORT AGREEMENTS BBDC Focuses on Shareholders BBDC takes a thoughtful approach to align interests with shareholders 6.00% 6.50% 7.00% 7.50% 8.00% 8.50% BBDC Externally-Managed Peers Hurdle Rate • BBDC Hurdle Rate: 8.25% • Average Externally- Managed Public BDC Hurdle Rate: 7.1%1 • Barings made a commitment to protect investors from certain losses emanating from the acquired portfolios $123 million supporting credit performance • BBDC board has approved five share repurchase programs since Barings took over as manager $73 million spent acquiring 8.1 million shares of BBDC • BBDC has a total return hurdle (aka a “lookback”) that reduces the income- based incentive fee in the event of losses <50% of externally- managed publicly- traded BDCs have a total return hurdle1 1. Source: Raymond James & Associates, Inc.

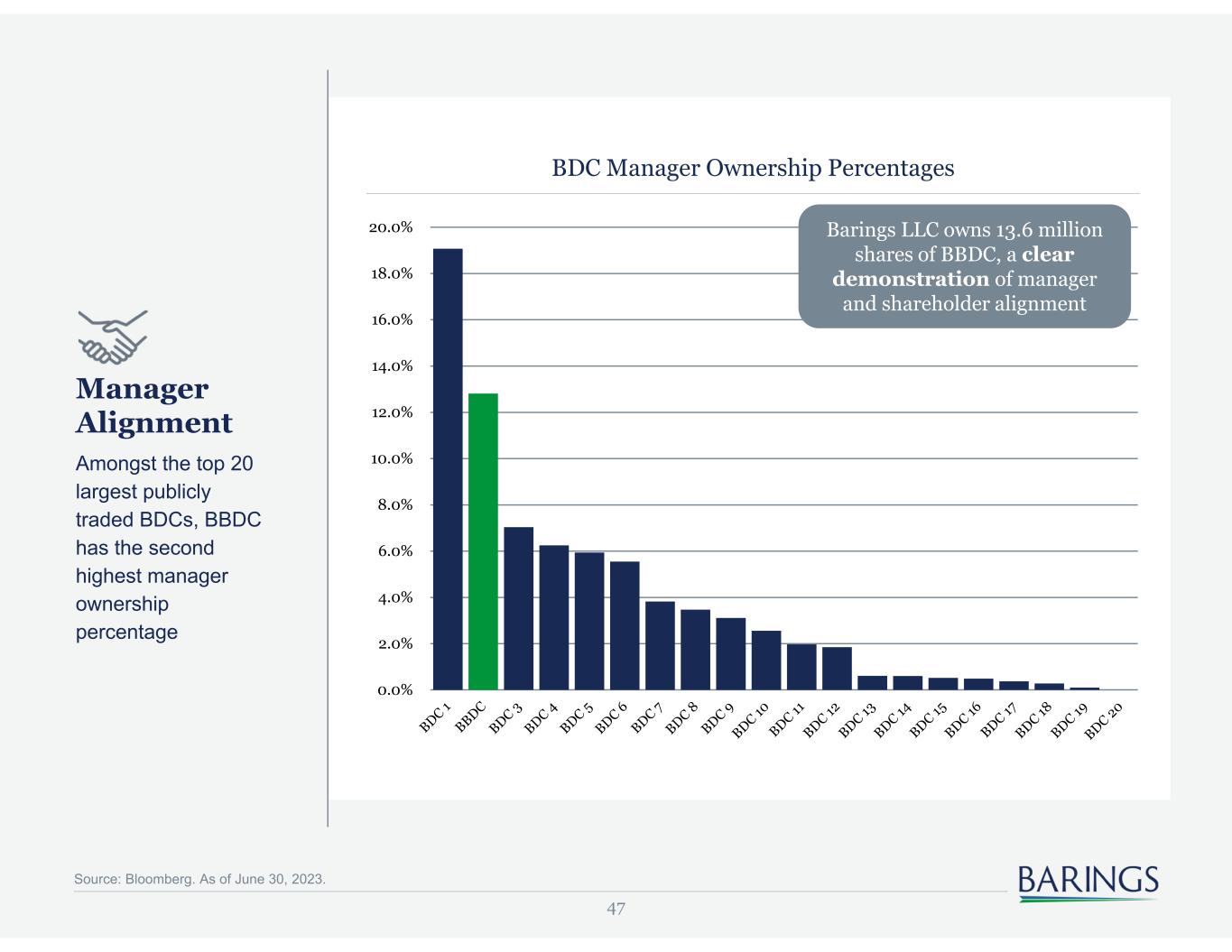

47 Source: Bloomberg. As of June 30, 2023. Manager Alignment Amongst the top 20 largest publicly traded BDCs, BBDC has the second highest manager ownership percentage BDC Manager Ownership Percentages 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% Barings LLC owns 13.6 million shares of BBDC, a clear demonstration of manager and shareholder alignment

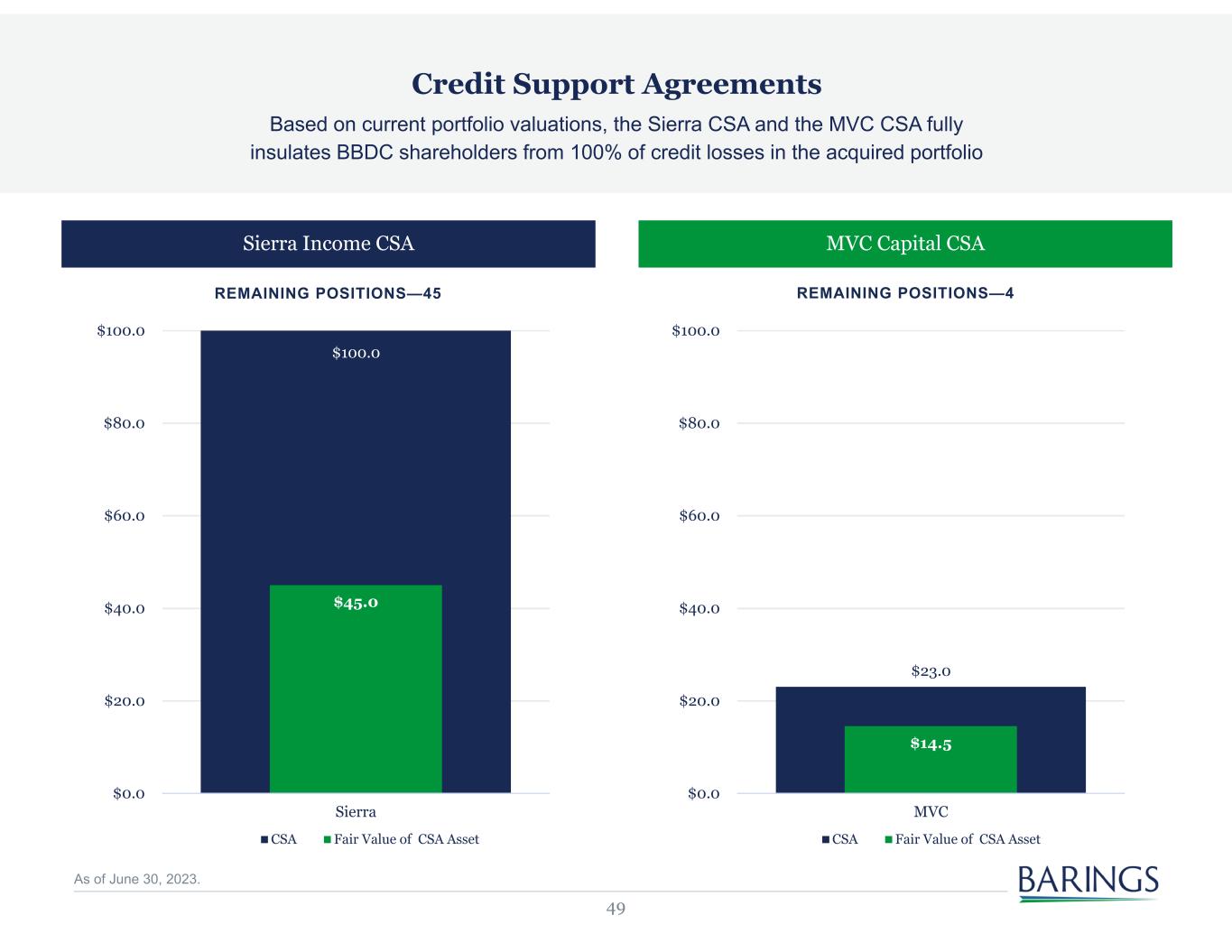

48 Credit Support Agreements What are the Credit Support Agreements (CSAs)? The CSAs are a form of manager support between Barings LLC and BBDC created in connection with the acquisitions of MVC and Sierra. The CSAs insulate shareholders from possible credit losses in the acquired portfolios up to the stated amount of each respective CSA What is the length of each CSA contract (CSA period)? The earlier of when the entire respective MVC/Sierra portfolio has been exited or 10-years from the close of the respective merger What happens if there are net realized and unrealized losses at the end of the CSA period? Barings LLC will absorb the losses up to the maximum amount of the respective CSA How will Barings LLC compensate Barings BDC investors for the losses? First, Barings LLC will waive Incentive and Base Management Fees it is owed by BBDC after the designated settlement date (calendar year following the losses) If CSA protected losses exceed the fees waived, Barings LLC will make a cash payment to BBDC up to the amount of each CSA What is the impact to NAV related to the CSAs? The CSAs are an asset to shareholders and the quarterly change is an offset to unrealized portfolio appreciation and depreciation

49 MVC Capital CSASierra Income CSA REMAINING POSITIONS—4REMAINING POSITIONS—45 Credit Support Agreements Based on current portfolio valuations, the Sierra CSA and the MVC CSA fully insulates BBDC shareholders from 100% of credit losses in the acquired portfolio $100.0 $45.0 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 Sierra CSA Fair Value of CSA Asset $23.0 $14.5 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 MVC CSA Fair Value of CSA Asset As of June 30, 2023.

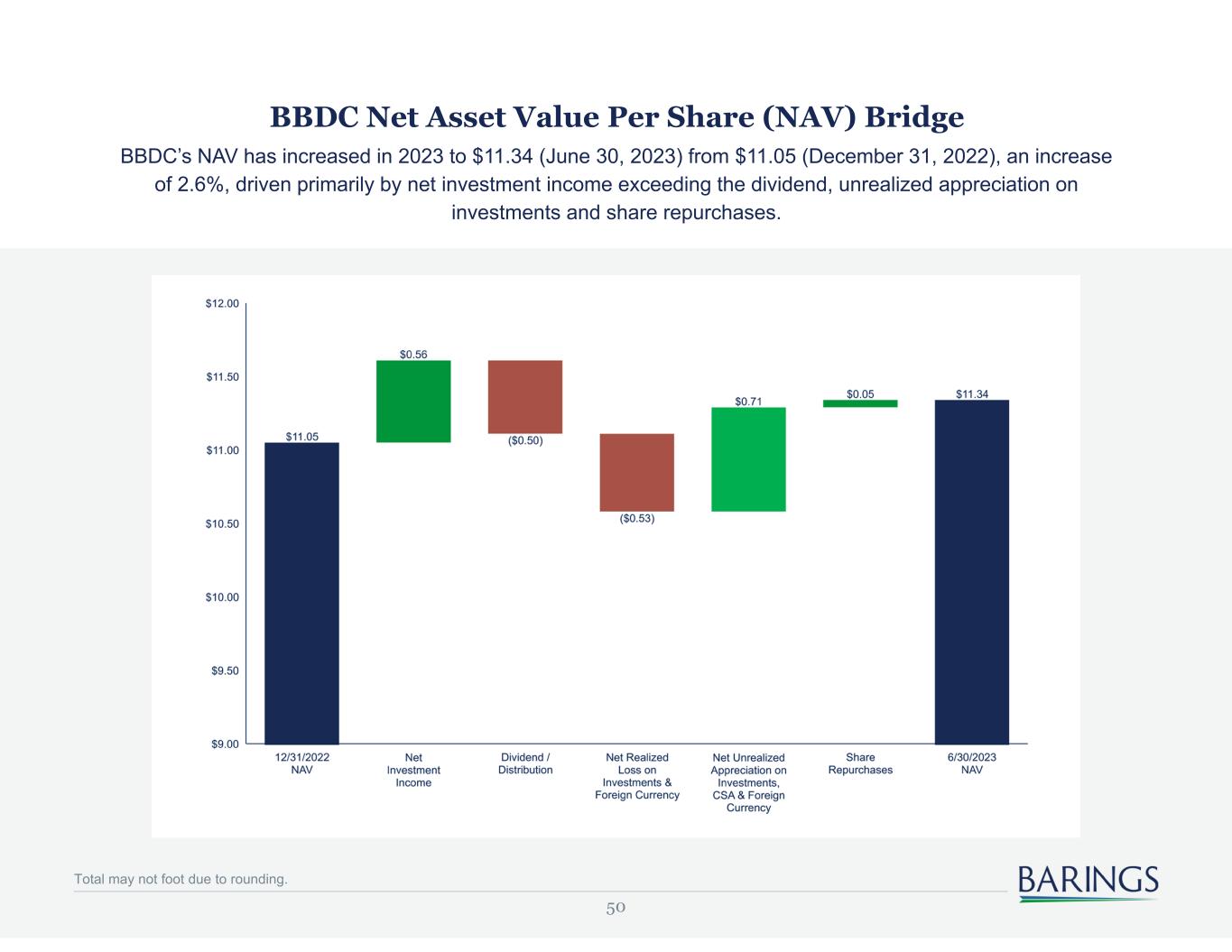

50 BBDC Net Asset Value Per Share (NAV) Bridge BBDC’s NAV has increased in 2023 to $11.34 (June 30, 2023) from $11.05 (December 31, 2022), an increase of 2.6%, driven primarily by net investment income exceeding the dividend, unrealized appreciation on investments and share repurchases. Total may not foot due to rounding.

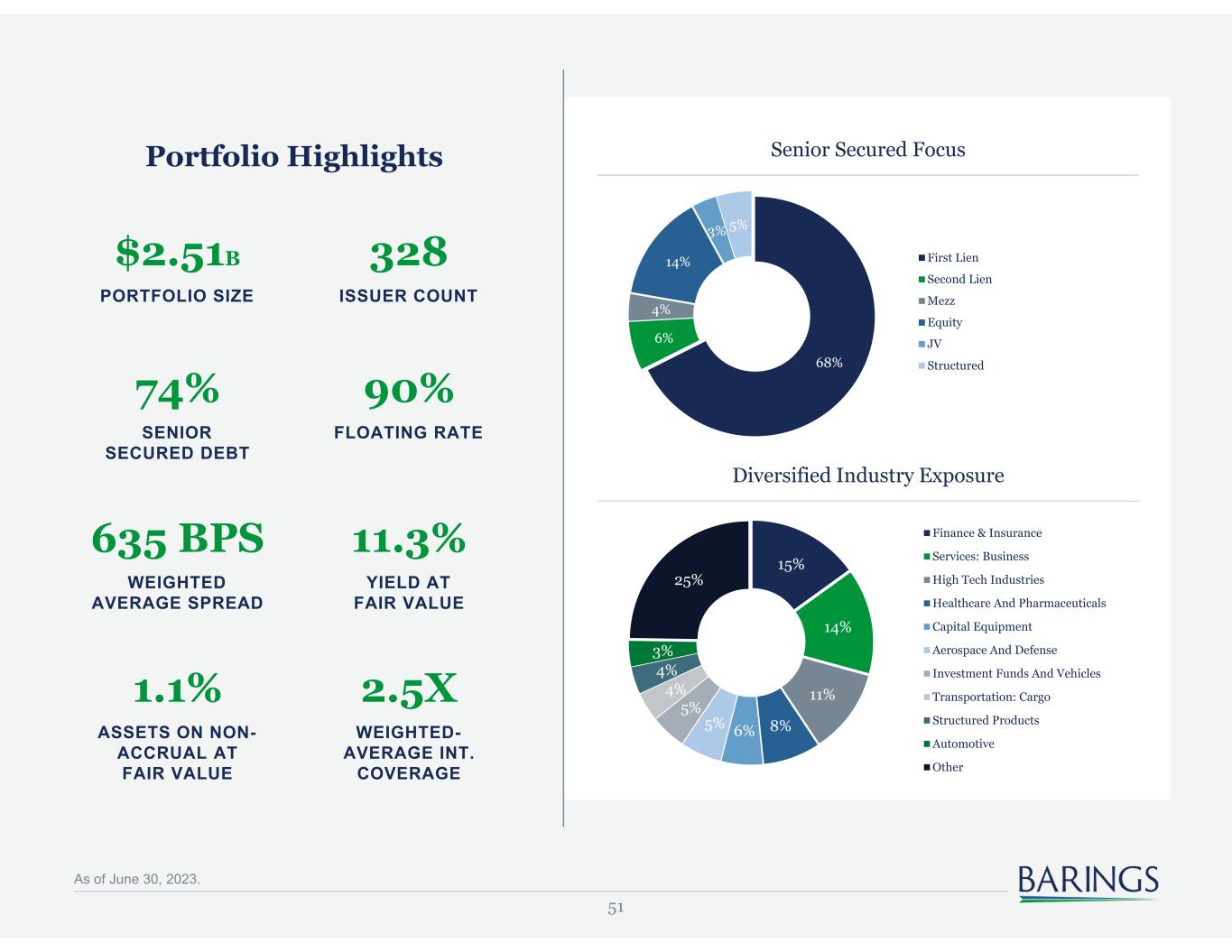

51 Portfolio Highlights $2.51B PORTFOLIO SIZE 328 ISSUER COUNT 74% SENIOR SECURED DEBT 90% FLOATING RATE 635 BPS WEIGHTED AVERAGE SPREAD 11.3% YIELD AT FAIR VALUE 1.1% ASSETS ON NON- ACCRUAL AT FAIR VALUE 2.5X WEIGHTED- AVERAGE INT. COVERAGE Senior Secured Focus Diversified Industry Exposure 68% 6% 4% 14% 3% 5% First Lien Second Lien Mezz Equity JV Structured 15% 14% 11% 8%6%5% 5% 4% 4% 3% 25% Finance & Insurance Services: Business High Tech Industries Healthcare And Pharmaceuticals Capital Equipment Aerospace And Defense Investment Funds And Vehicles Transportation: Cargo Structured Products Automotive Other As of June 30, 2023.

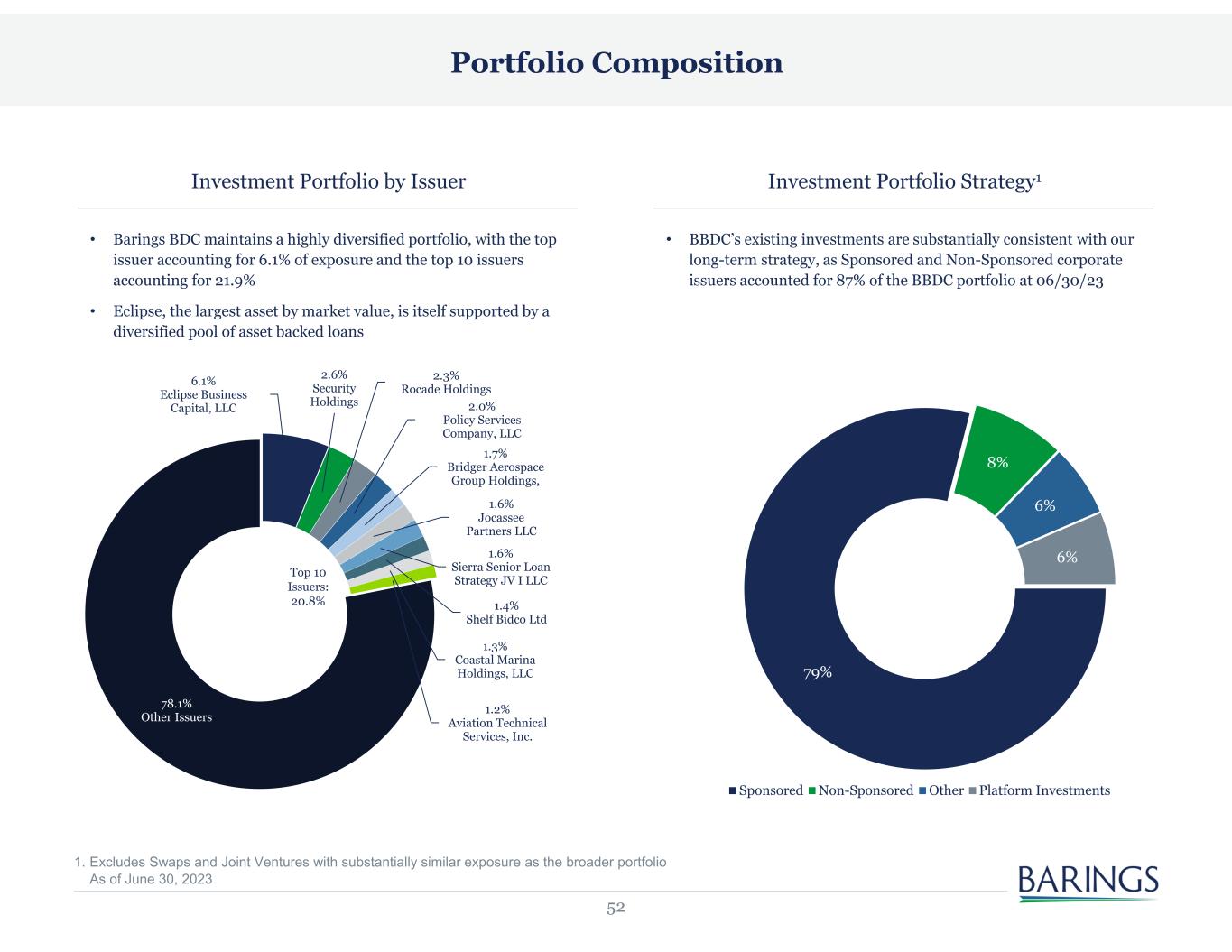

52 Portfolio Composition Investment Portfolio by Issuer • Barings BDC maintains a highly diversified portfolio, with the top issuer accounting for 6.1% of exposure and the top 10 issuers accounting for 21.9% • Eclipse, the largest asset by market value, is itself supported by a diversified pool of asset backed loans 6.1% Eclipse Business Capital, LLC 2.6% Security Holdings 2.3% Rocade Holdings 2.0% Policy Services Company, LLC 1.7% Bridger Aerospace Group Holdings, 1.6% Jocassee Partners LLC 1.6% Sierra Senior Loan Strategy JV I LLC 1.4% Shelf Bidco Ltd 1.3% Coastal Marina Holdings, LLC 1.2% Aviation Technical Services, Inc. 78.1% Other Issuers Top 10 Issuers: 20.8% Investment Portfolio Strategy1 • BBDC’s existing investments are substantially consistent with our long-term strategy, as Sponsored and Non-Sponsored corporate issuers accounted for 87% of the BBDC portfolio at 06/30/23 1. Excludes Swaps and Joint Ventures with substantially similar exposure as the broader portfolio As of June 30, 2023 79% 8% 6% 6% Sponsored Non-Sponsored Other Platform Investments

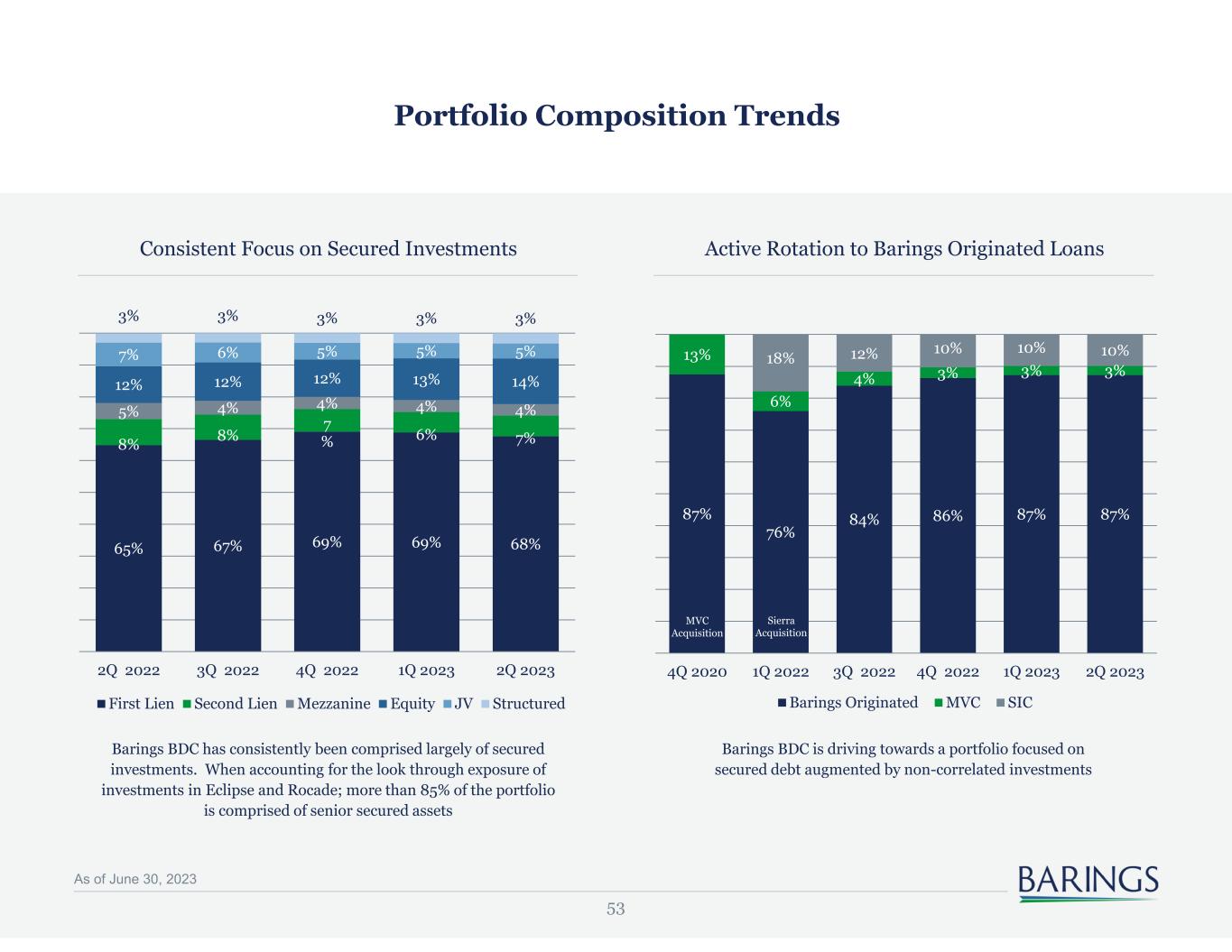

53 Portfolio Composition Trends Consistent Focus on Secured Investments Barings BDC has consistently been comprised largely of secured investments. When accounting for the look through exposure of investments in Eclipse and Rocade; more than 85% of the portfolio is comprised of senior secured assets Active Rotation to Barings Originated Loans Barings BDC is driving towards a portfolio focused on secured debt augmented by non-correlated investments 87% 76% 84% 86% 87% 87% 13% 6% 4% 3% 3% 3% 18% 12% 10% 10% 10% 4Q 2020 1Q 2022 3Q 2022 4Q 2022 1Q 2023 2Q 2023 Barings Originated MVC SIC MVC Acquisition Sierra Acquisition 65% 67% 69% 69% 68% 8% 8% 7 % 6% 7% 5% 4% 4% 4% 4% 12% 12% 12% 13% 14% 7% 6% 5% 5% 5% 3% 3% 3% 3% 3% 2Q 2022 3Q 2022 4Q 2022 1Q 2023 2Q 2023 First Lien Second Lien Mezzanine Equity JV Structured As of June 30, 2023

54 Issuer performing materially above expectations1 Issuer performing consistent with expectations2 Issuer performing modestly below expectations3 Issuer performing below expectations4 Non-accrual and/or impairment expected5 Loans on Non-Accrual Portfolio performance is reflected in the shifts between the risk rating categories shown at right Non-Accruals comprise approximately 1.1% of the portfolio Fair Value as of June 30, 2023 Risk Rating Trends 6% 76% 11% 5% 1% 2Q 2023 $43 $20 $17 $24 $29 $27 1.8% 0.8% 0.7% 1.0% 1.1% 1.1% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% $0 $10 $20 $30 $40 $50 $60 $70 $80 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 2Q 2023 Investments on Non-Accrual at Fair Value ($M) % of Total Portfolio As of June 30, 2023

55 Portfolio HighlightsAbout Jocassee Partners LLC • Jocassee has $1.25 billion invested, with a liquid/illiquid split of 34%/66%, respectively • A prudent and flexible investment philosophy combined with an efficient capital structure has contributed to an annualized ROE of 15%+ Key Portfolio StatisticsDiversified Industry Exposure • Joint Venture between BBDC (9%) and South Carolina Retirement System Investment Commission (91%) • Invests primarily in senior secured loans • Flexibility to shift allocations between broadly syndicated loans and directly originated loans • BBDC has funded $35 million of a $100 million discretionary commitment Total Portfolio $1.25 billion Issuers 360 Weighted Average Leverage 5.2x Weighted Average Interest Coverage 3.0x Yield at Fair Value 9.0%+ Seniority 94% First Lien Jocassee Partners LLC 19% 18% 15%10% 8% 6% 5% 4% 3% 3% 9% Technology Consumer Non-Cyclical Capital Goods Consumer Cyclical Communications Transportation Other Industrial Other Financial Insurance Basic Industry Other As of June 30, 2023

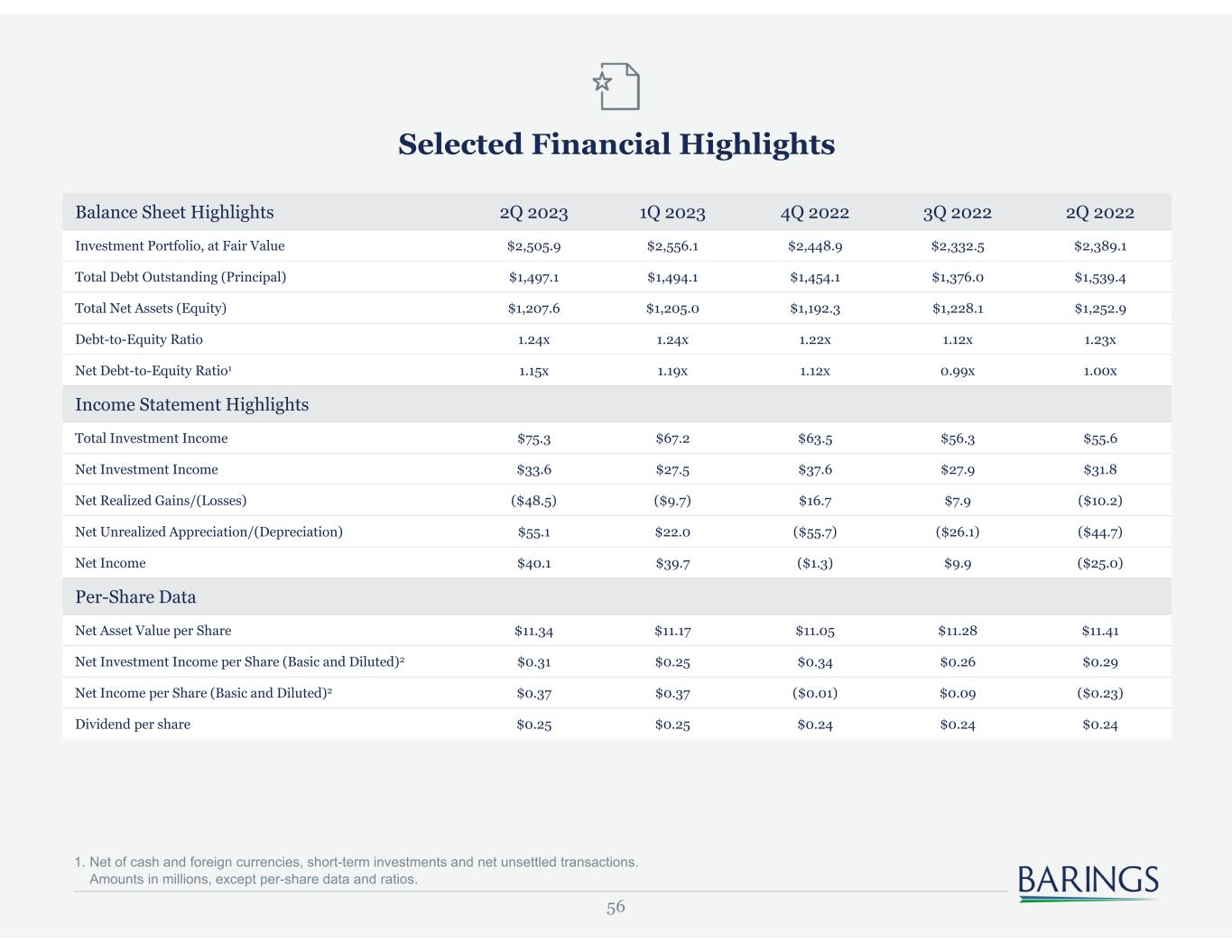

56 Selected Financial Highlights 1. Net of cash and foreign currencies, short-term investments and net unsettled transactions. Amounts in millions, except per-share data and ratios. Balance Sheet Highlights 2Q 2023 1Q 2023 4Q 2022 3Q 2022 2Q 2022 Investment Portfolio, at Fair Value $2,505.9 $2,556.1 $2,448.9 $2,332.5 $2,389.1 Total Debt Outstanding (Principal) $1,497.1 $1,494.1 $1,454.1 $1,376.0 $1,539.4 Total Net Assets (Equity) $1,207.6 $1,205.0 $1,192.3 $1,228.1 $1,252.9 Debt-to-Equity Ratio 1.24x 1.24x 1.22x 1.12x 1.23x Net Debt-to-Equity Ratio1 1.15x 1.19x 1.12x 0.99x 1.00x Income Statement Highlights Total Investment Income $75.3 $67.2 $63.5 $56.3 $55.6 Net Investment Income $33.6 $27.5 $37.6 $27.9 $31.8 Net Realized Gains/(Losses) ($48.5) ($9.7) $16.7 $7.9 ($10.2) Net Unrealized Appreciation/(Depreciation) $55.1 $22.0 ($55.7) ($26.1) ($44.7) Net Income $40.1 $39.7 ($1.3) $9.9 ($25.0) Per-Share Data Net Asset Value per Share $11.34 $11.17 $11.05 $11.28 $11.41 Net Investment Income per Share (Basic and Diluted)2 $0.31 $0.25 $0.34 $0.26 $0.29 Net Income per Share (Basic and Diluted)2 $0.37 $0.37 ($0.01) $0.09 ($0.23) Dividend per share $0.25 $0.25 $0.24 $0.24 $0.24

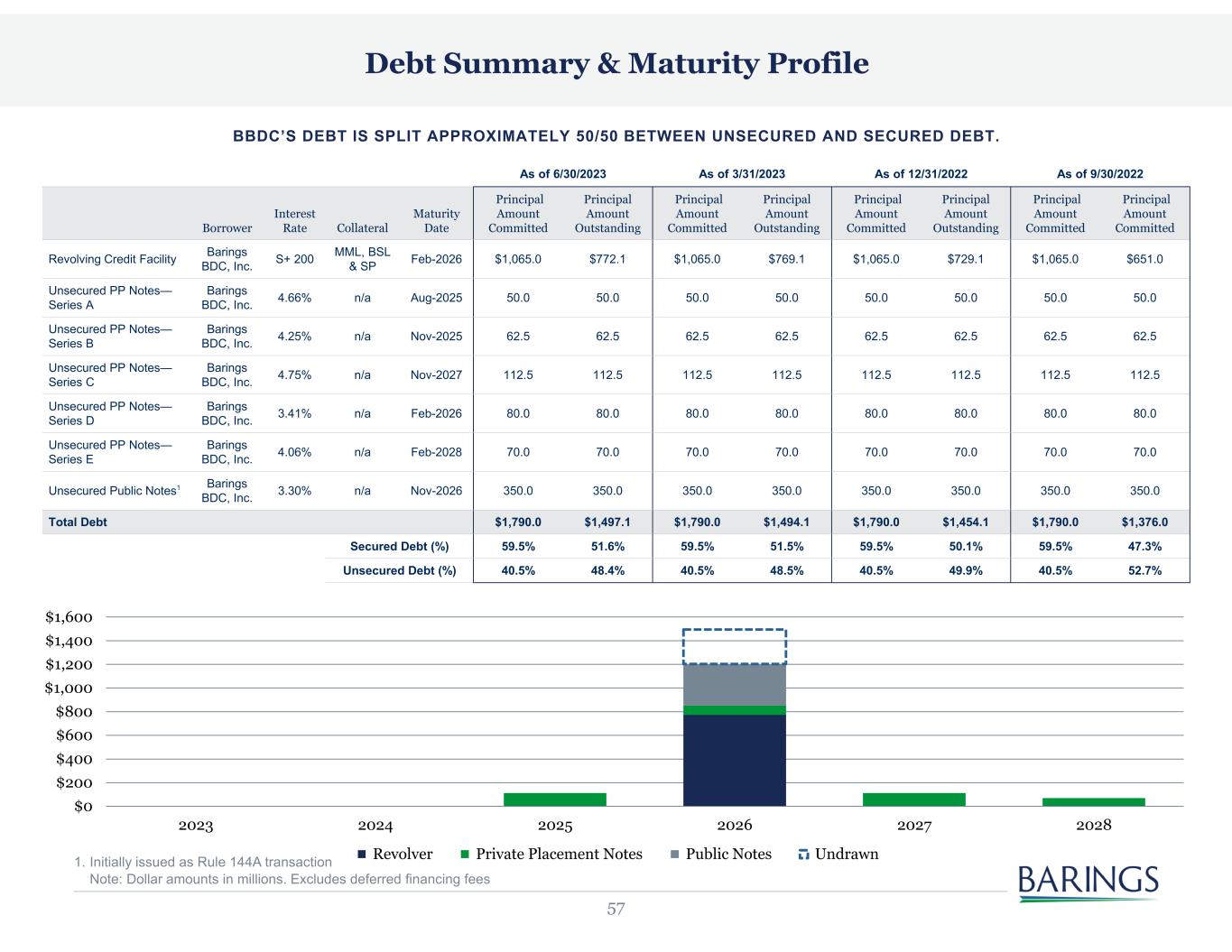

57 Debt Summary & Maturity Profile 1. Initially issued as Rule 144A transaction Note: Dollar amounts in millions. Excludes deferred financing fees BBDC’S DEBT IS SPLIT APPROXIMATELY 50/50 BETWEEN UNSECURED AND SECURED DEBT. As of 6/30/2023 As of 3/31/2023 As of 12/31/2022 As of 9/30/2022 Borrower Interest Rate Collateral Maturity Date Principal Amount Committed Principal Amount Outstanding Principal Amount Committed Principal Amount Outstanding Principal Amount Committed Principal Amount Outstanding Principal Amount Committed Principal Amount Committed Revolving Credit Facility Barings BDC, Inc. S+ 200 MML, BSL & SP Feb-2026 $1,065.0 $772.1 $1,065.0 $769.1 $1,065.0 $729.1 $1,065.0 $651.0 Unsecured PP Notes— Series A Barings BDC, Inc. 4.66% n/a Aug-2025 50.0 50.0 50.0 50.0 50.0 50.0 50.0 50.0 Unsecured PP Notes— Series B Barings BDC, Inc. 4.25% n/a Nov-2025 62.5 62.5 62.5 62.5 62.5 62.5 62.5 62.5 Unsecured PP Notes— Series C Barings BDC, Inc. 4.75% n/a Nov-2027 112.5 112.5 112.5 112.5 112.5 112.5 112.5 112.5 Unsecured PP Notes— Series D Barings BDC, Inc. 3.41% n/a Feb-2026 80.0 80.0 80.0 80.0 80.0 80.0 80.0 80.0 Unsecured PP Notes— Series E Barings BDC, Inc. 4.06% n/a Feb-2028 70.0 70.0 70.0 70.0 70.0 70.0 70.0 70.0 Unsecured Public Notes1 Barings BDC, Inc. 3.30% n/a Nov-2026 350.0 350.0 350.0 350.0 350.0 350.0 350.0 350.0 Total Debt $1,790.0 $1,497.1 $1,790.0 $1,494.1 $1,790.0 $1,454.1 $1,790.0 $1,376.0 Secured Debt (%) 59.5% 51.6% 59.5% 51.5% 59.5% 50.1% 59.5% 47.3% Unsecured Debt (%) 40.5% 48.4% 40.5% 48.5% 40.5% 49.9% 40.5% 52.7% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2023 2024 2025 2026 2027 2028 Revolver Private Placement Notes Public Notes Undrawn

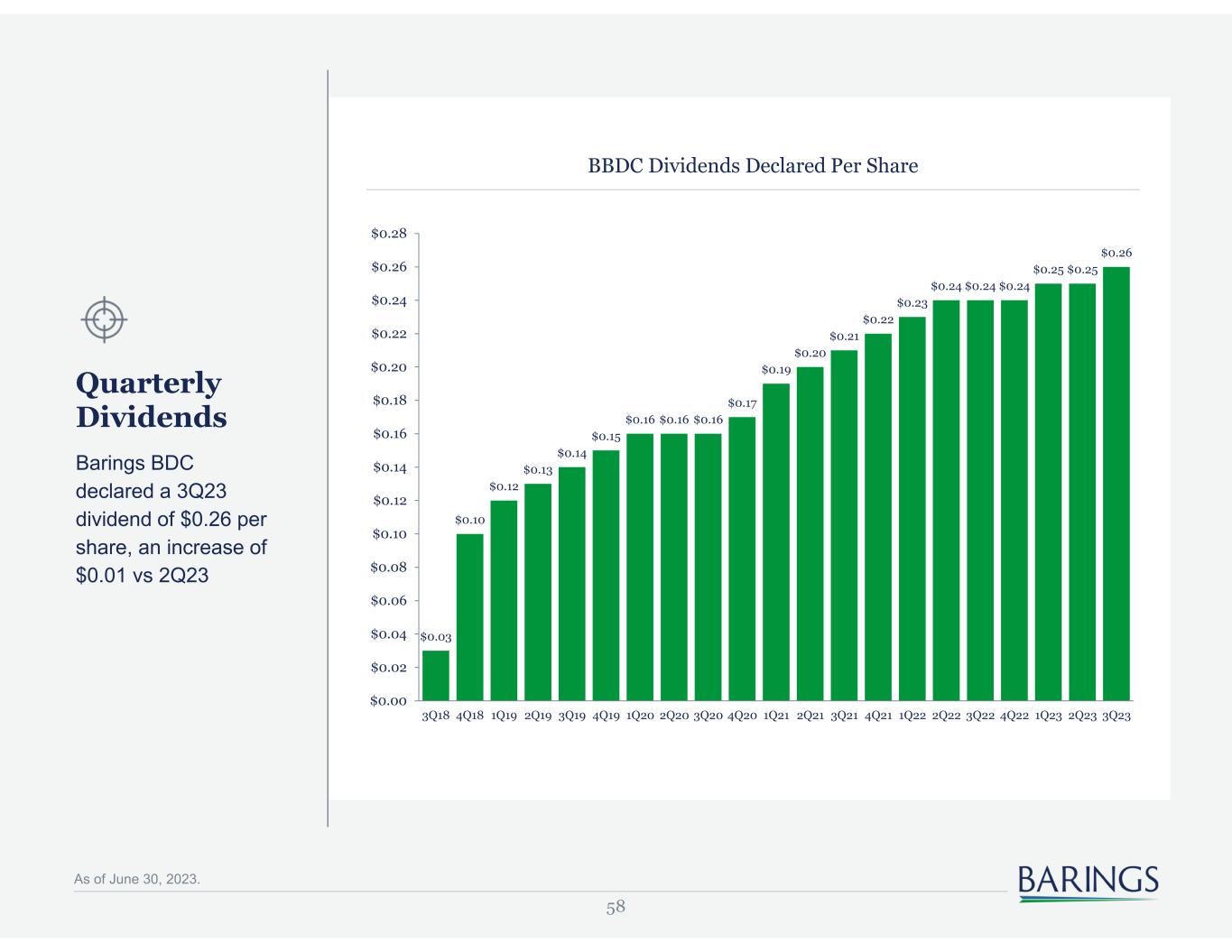

58 As of June 30, 2023. Quarterly Dividends Barings BDC declared a 3Q23 dividend of $0.26 per share, an increase of $0.01 vs 2Q23 BBDC Dividends Declared Per Share $0.03 $0.10 $0.12 $0.13 $0.14 $0.15 $0.16 $0.16 $0.16 $0.17 $0.19 $0.20 $0.21 $0.22 $0.23 $0.24 $0.24 $0.24 $0.25 $0.25 $0.26 $0.00 $0.02 $0.04 $0.06 $0.08 $0.10 $0.12 $0.14 $0.16 $0.18 $0.20 $0.22 $0.24 $0.26 $0.28 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23

Questions

60 Important Information As of June 30, 2023. Barings LLC, Barings Securities LLC, Barings (U.K.) Limited, Barings Australia Pty Ltd, Barings Japan Limited, Baring Asset Management Limited, Baring International Investment Limited, Baring Fund Managers Limited, Baring International Fund Managers (Ireland) Limited, Baring Asset Management (Asia) Limited, Baring SICE (Taiwan) Limited, Baring Asset Management Switzerland Sàrl, Baring Asset Management Korea Limited, and Barings Singapore Pte. Ltd. each are affiliated financial service companies owned by Barings LLC (each, individually, an "Affiliate"), together known as "Barings." Some Affiliates may act as an introducer or distributor of the products and services of some others and may be paid a fee for doing so. NO OFFER: The document is for informational purposes only and is not an offer or solicitation for the purchase or sale of any financial instrument or service in any jurisdiction. The material herein was prepared without any consideration of the investment objectives, financial situation or particular needs of anyone who may receive it. This document is not, and must not be treated as, investment advice, an investment recommendation, investment research, or a recommendation about the suitability or appropriateness of any security, commodity, investment, or particular investment strategy, and must not be construed as a projection or prediction. In making an investment decision, prospective investors must rely on their own examination of the merits and risks involved and before making any investment decision, it is recommended that prospective investors seek independent investment, legal, tax, accounting or other professional advice as appropriate. Unless otherwise mentioned, the views contained in this document are those of Barings. These views are made in good faith in relation to the facts known at the time of preparation and are subject to change without notice. Individual portfolio management teams may hold different views than the views expressed herein and may make different investment decisions for different clients. Parts of this document may be based on information received from sources we believe to be reliable. Although every effort is taken to ensure that the information contained in this document is accurate, Barings makes no representation or warranty, express or implied, regarding the accuracy, completeness or adequacy of the information. These materials are being provided on the express basis that they and any related communications (whether written or oral) will not cause Barings to become an investment advice fiduciary under ERISA or the Internal Revenue Code with respect to any retirement plan, IRA investor, individual retirement account or individual retirement annuity as the recipients are fully aware that Barings (i) is not undertaking to provide impartial investment advice, make a recommendation regarding the acquisition, holding or disposal of an investment, act as an impartial adviser, or give advice in a fiduciary capacity, and (ii) has a financial interest in the offering and sale of one or more products and services, which may depend on a number of factors relating to Barings’ business objectives, and which has been disclosed to the recipient. Any forecasts in this document are based upon Barings opinion of the market at the date of preparation and are subject to change without notice, dependent upon many factors. Any prediction, projection or forecast is not necessarily indicative of the future or likely performance. Investment involves risk. The value of any investments and any income generated may go down as well as up and is not guaranteed. Past performance is no indication of current or future performance. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any investment results, portfolio compositions and or examples set forth in this document are provided for illustrative purposes only and are not indicative of any future investment results, future portfolio composition or investments. The composition, size of, and risks associated with an investment may differ substantially from any examples set forth in this document. No representation is made that an investment will be profitable or will not incur losses. Where appropriate, changes in the currency exchange rates may affect the value of investments. Prospective investors should read the offering documents, if applicable, for the details and specific risk factors of any Fund/Strategy discussed in this document. Target performance is theoretical and illustrative only, and does not reflect actual performance. There is no guarantee that any target performance will be achieved, and actual performance may be significantly lower than target performance for a variety of reasons. Target performance should not be relied upon in making any investment decision. The target performance shown here is based on a proprietary model and relies on various assumptions and inputs, including subjective assumptions, judgments and projections about economic conditions. OTHER RESTRICTIONS: The distribution of this document is restricted by law. No action has been or will be taken by Barings to permit the possession or distribution of the document in any jurisdiction, where action for that purpose may be required. Accordingly, the document may not be used in any jurisdiction except under circumstances that will result in compliance with all applicable laws and regulations. Any service, security, investment or product outlined in this document may not be suitable for a prospective investor or available in their jurisdiction. Any information with respect to UCITS Funds is not intended for U.S. Persons, as defined in Regulation S under the U.S. Securities Act of 1933, or persons in any other jurisdictions where such use or distribution would be contrary to law or local regulation. INFORMATION: Barings is the brand name for the worldwide asset management or associated businesses of Barings. This document is issued by one or more of the following entities: Barings LLC, which is a registered investment adviser with the Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940, as amended (Barings LLC also relies on section 8.26 of NI 31-103 (international adviser exemption) and has filed the Form 31-103F2 in Ontario, Quebec, British Columbia, Alberta, Nova Scotia, Manitoba, New Brunswick, Newfoundland and Labrador, Prince Edward Island and Saskatchewan); Barings Securities LLC, which is a registered limited purpose broker-dealer with the Financial Industry Regulatory Authority (Baring Securities LLC also relies on section 8.18 of NI 31-103 (international dealer exemption) and has filed the Form 31-103F2 in Ontario, Quebec, British Columbia, Alberta, Nova Scotia, Manitoba, New Brunswick, Newfoundland and Labrador, Prince Edward Island and Saskatchewan); Copyright and Trademark Copyright © 2023 Barings. Information in this document may be used for your own personal use, but may not be altered, reproduced or distributed without Barings’ consent. The BARINGS name and logo design are trademarks of Barings and are registered in U.S. Patent and Trademark Office and in other countries around the world. All rights are reserved. 23-3117485