10-K: Annual report pursuant to Section 13 and 15(d)

Published on February 22, 2024

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended |

|||||

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| For the transition period from to | |||||

Commission file number 814-00733

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|||||||

|

|

(Zip Code)

|

|||||||

| (Address of principal executive offices) | ||||||||

Registrant’s telephone number, including area code:

(704 ) 805-7200

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes R No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes R No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| þ |

Accelerated filer ¨

|

Non-accelerated filer | ☐ | Smaller reporting company | |||||||||||||||||||

| Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|||||||||||||||||||||||

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting firm that prepared or issued its audit report. R

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No R

The aggregate market value of the common stock held by non-affiliates of the registrant (assuming solely for the purpose of this disclosure that all executive officers, directors and 10% or more stockholders of the registrant are “affiliates”) as of June 30, 2023, based on the closing price on that date of $7.84 on the New York Stock Exchange, was $724,112,122 .

The number of shares outstanding of the registrant’s common stock on February 22, 2024 was 106,067,070 .

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to the registrant's 2024 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission within 120 days following the end of the registrant's fiscal year, are incorporated by reference in Part III of this Annual Report on Form 10-K as indicated herein.

BARINGS BDC, INC.

TABLE OF CONTENTS

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2023

| Page | ||||||||

| PART I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 1C. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | [Reserved] |

|||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| PART IV | ||||||||

| Item 15. | ||||||||

2

FORWARD-LOOKING STATEMENTS

Some of the statements in this Annual Report on Form 10-K constitute forward-looking statements because they relate to future events or our future performance or financial condition. Forward-looking statements may include, among other things, statements as to our future operating results, our business prospects and the prospects of our portfolio companies, the impact of the investments that we expect to make, the ability of our portfolio companies to achieve their objectives, our expected financings and investments, the adequacy of our cash resources and working capital, and the timing of cash flows, if any, from the operations of our portfolio companies. Words such as “expect,” “anticipate,” “target,” “goals,” “project,” “intend,” “plan,” “believe,” “seek,” “estimate,” “continue,” “forecast,” “may,” “should,” “potential,” variations of such words, and similar expressions indicate a forward-looking statement, although not all forward-looking statements include these words. Readers are cautioned that the forward-looking statements contained in this Annual Report on Form 10-K are only predictions, are not guarantees of future performance, and are subject to risks, events, uncertainties and assumptions that are difficult to predict. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the items discussed in Item 1A entitled “Risk Factors” in Part I of this Annual Report on Form 10-K and in Item 1A entitled “Risk Factors” in Part II of our subsequently filed Quarterly Reports on Form 10-Q or in other reports we may file with the Securities and Exchange Commission (“SEC”) from time to time. Other factors that could cause our actual results and financial condition to differ materially include, but are not limited to, changes in political, economic or industry conditions, including the risks of a slowing economy, rising inflation and risk of recession and volatility in the financial services sector, including bank failures; the interest rate environment or conditions affecting the financial and capital markets; the impact of global health crises on our or our portfolio companies’ business and the U.S. and global economies; our, or our portfolio companies’, future business, operations, operating results or prospects; risks associated with possible disruption due to terrorism in our operations or the economy generally; and future changes in laws or regulations and conditions in our or our portfolio companies’ operating areas.

Any forward-looking statements included in this Annual Report on Form 10-K are based on our current expectations, estimates, forecasts, information and projections about the industry in which we operate and the beliefs and assumptions of our management as of the date of this Annual Report on Form 10-K. We assume no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless we are required to do so by law. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including subsequent annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

3

PART I

Item 1. Business.

Organization

We are a Maryland corporation incorporated on October 10, 2006. We currently operate as a closed-end, non-diversified investment company and have elected to be treated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). We have elected and intend to qualify annually for federal income tax purposes to be treated as a regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”).

Our headquarters are in Charlotte, North Carolina, and our Internet address is www.baringsbdc.com. We are not including the information contained on our website as a part of, or incorporating it by reference into, this Annual Report on Form 10-K. We make available free of charge through our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to these reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (the “SEC”). Copies of this Annual Report on Form 10-K and other reports are also available without charge upon written request to us.

The Asset Sale and Externalization Transactions

In April 2018, we entered into an asset purchase agreement (the “Asset Purchase Agreement”), with BSP Asset Acquisition I, LLC (the “Asset Buyer”), an affiliate of Benefit Street Partners L.L.C., pursuant to which we agreed to sell our December 31, 2017 investment portfolio to the Asset Buyer for gross proceeds of $981.2 million in cash, subject to certain adjustments to take into account portfolio activity and other matters occurring since December 31, 2017 (such transaction referred to herein as the “Asset Sale Transaction”). Also in April 2018, we entered into a stock purchase and transaction agreement (the “Externalization Agreement”), with Barings LLC (“Barings” or the “Adviser”) through which Barings agreed to become our investment adviser in exchange for (1) a payment by Barings of $85.0 million, or approximately $1.78 per share, directly to our stockholders, (2) an investment by Barings of $100.0 million in newly issued shares of our common stock at net asset value (“NAV”) and (3) a commitment from Barings to purchase up to $50.0 million of shares of our common stock in the open market at prices up to and including our then-current NAV per share for a two-year period, after which Barings agreed to use any remaining funds from the $50.0 million to purchase additional newly-issued shares of our common stock at the greater of our then-current NAV per share or market price (collectively, the “Externalization Transaction”). The Asset Sale Transaction and the Externalization Transaction are collectively referred to as the “Transactions.” The Transactions were approved by our stockholders at our July 24, 2018 special meeting of stockholders (the “2018 Special Meeting”).

The Externalization Transaction closed on August 2, 2018 (the “Externalization Closing”). Effective as of the Externalization Closing, we changed our name from Triangle Capital Corporation to Barings BDC, Inc. and on August 3, 2018, began trading on the New York Stock Exchange (“NYSE”) under the symbol “BBDC.”

Prior to the Externalization Transaction, we were internally managed by our executive officers under the supervision of our Board of Directors (the “Board”). During this period, we did not pay management or advisory fees, but instead incurred the operating costs associated with employing executive management and investment and portfolio management professionals. In connection with the closing of the Externalization Transaction, we entered into an investment advisory agreement (the “Original Advisory Agreement”) and an administration agreement (the “Administration Agreement”) with Barings, pursuant to which Barings serves as our investment adviser and administrator and manages our investment portfolio which initially consisted primarily of the cash proceeds received in connection with the Asset Sale Transaction.

MVC Capital, Inc. Acquisition

On December 23, 2020 we completed our acquisition of MVC Capital, Inc., a Delaware corporation (“MVC”) (the “MVC Acquisition”) pursuant to the terms and conditions of that certain Agreement and Plan of Merger (the

4

“MVC Merger Agreement”), dated as of August 10, 2020, with MVC, Mustang Acquisition Sub, Inc., a Delaware corporation and our wholly owned subsidiary (“MVC Acquisition Sub”), and Barings. To effect the acquisition, MVC Acquisition Sub merged with and into MVC, with MVC surviving the merger as our wholly owned subsidiary (the “First MVC Merger”). Immediately thereafter, MVC merged with and into us, with us as the surviving company (the “Second MVC Merger” and, together with the First MVC Merger, the “MVC Merger”).

In connection with the MVC Acquisition on December 23, 2020, following the closing of the MVC Merger, we entered into an amended and restated investment advisory agreement (the “Amended and Restated Advisory Agreement”) with Barings, effective January 1, 2021, which amended the Original Advisory Agreement to, among other things, (i) reduce the annual base management fee payable to Barings from 1.375% to 1.250% of our gross assets, (ii) reset the commencement date for the rolling 12-quarter “look-back” provision used to calculate the income incentive fee and incentive fee cap to January 1, 2021 from January 1, 2020 and (iii) describe the fact that we may enter into guarantees, sureties and other credit support arrangements with respect to one or more of our investments, including the impact of these arrangements on the income incentive fee cap. See “Management Agreements – Investment Advisory Agreement” in this Item 1 of Part I of this Annual Report on Form 10-K for more information.

In connection with the MVC Acquisition on December 23, 2020, promptly following the closing of the MVC Merger, we entered into a Credit Support Agreement (the “MVC Credit Support Agreement”) with Barings, pursuant to which Barings has agreed to provide credit support to us in the amount of up to $23.0 million relating to the net cumulative realized and unrealized losses on the acquired MVC investment portfolio over a 10-year period. The MVC Credit Support Agreement is intended to give stockholders of the combined company downside protection from net cumulative realized and unrealized losses on the acquired MVC portfolio and insulate the combined company’s stockholders from potential value volatility and losses in MVC’s portfolio following the closing of the MVC Merger. There is no fee or other payment by us to Barings or any of its affiliates in connection with the MVC Credit Support Agreement. Any cash payment from Barings to us under the MVC Credit Support Agreement will be excluded from the incentive fee calculations under the Barings BDC Advisory Agreement (as defined below). See “Note 2. Agreements and Related Party Transactions” and “Note. 6 Derivative Instruments” in the Notes to our Consolidated Financial Statements included in this Annual Report on Form 10-K for more information.

Sierra Income Corporation Acquisition

On February 25, 2022, we completed our acquisition of Sierra Income Corporation, a Maryland corporation (“Sierra”), pursuant to the terms and conditions of that certain Agreement and Plan of Merger (the “Sierra Merger Agreement”), dated as of September 21, 2021, with Sierra, Mercury Acquisition Sub, Inc., a Maryland corporation and our direct wholly owned subsidiary (“Sierra Acquisition Sub”), and Barings. To effect the acquisition, Sierra Acquisition Sub merged with and into Sierra, with Sierra surviving the merger as our wholly owned subsidiary (the “First Sierra Merger”). Immediately thereafter, Sierra merged with and into us, with Barings BDC, Inc. as the surviving company (the “Second Sierra Merger” and, together with the First Sierra Merger, the “Sierra Merger”).

Pursuant to the Sierra Merger Agreement, each share of Sierra common stock, par value $0.001 per share (the “Sierra Common Stock”), issued and outstanding immediately prior to the effective time of the First Sierra Merger (other than shares of Sierra Common Stock issued and outstanding immediately prior to the effective time of the First Sierra Merger that were held by a subsidiary of Sierra or held, directly or indirectly, by us or Sierra Acquisition Sub) was converted into the right to receive (i) an amount in cash from Barings, without interest, equal to $0.9783641, and (ii) 0.44973 shares of our common stock, plus any cash in lieu of fractional shares. As a result of the Sierra Merger, former Sierra stockholders received approximately 46.0 million shares of our common stock for their shares of Sierra Common Stock.

In connection with the Sierra Merger, on February 25, 2022, following the closing of the Sierra Merger, we entered into (1) a second amended and restated investment advisory agreement with Barings (the “Second Amended and Restated Barings BDC Advisory Agreement”), and (2) a credit support agreement (the “Sierra Credit Support Agreement”) with Barings, pursuant to which Barings has agreed to provide credit support to us in the amount of up to $100.0 million relating to the net cumulative realized and unrealized losses on the acquired Sierra investment

5

portfolio over a 10-year period. See “Note 2. Agreements and Related Party Transactions” and “Note. 6 Derivative Instruments” in the Notes to our Consolidated Financial Statements included in this Annual Report on Form 10-K for more information.

Overview of Our Business

Barings focuses on investing our portfolio primarily in senior secured private debt investments in well-established middle-market businesses that operate across a wide range of industries. Barings’ existing SEC co-investment exemptive relief under the 1940 Act (the “Exemptive Relief”) permits us and Barings’ affiliated private and SEC-registered funds to co-invest in Barings-originated loans, which allows Barings to efficiently implement its senior secured private debt investment strategy for us.

Barings employs fundamental credit analysis, and targets investments in businesses with relatively low levels of cyclicality and operating risk. The hold size of each position will generally be dependent upon a number of factors including total facility size, pricing and structure, and the number of other lenders in the facility. Barings has experience managing levered vehicles, both public and private, and will seek to enhance our returns through the use of leverage with a prudent approach that prioritizes capital preservation. Barings believes this strategy and approach offers attractive risk/return with lower volatility given the potential for fewer defaults and greater resilience through market cycles.

Our investment objective is to generate current income by investing directly in privately-held middle-market companies to help these companies fund acquisitions, growth or refinancing. Barings employs fundamental credit analysis, and targets investments in businesses with low levels of cyclicality (i.e., the risk of business cycles or other economic cycles adversely affecting them) and operating risk relative to other businesses in this market segment. The holding size of each position will generally be dependent upon a number of factors including total facility size, pricing and structure, and the number of other lenders in the facility. Barings has experience managing levered vehicles, both public and private, and seeks to enhance our returns through the use of leverage with a prudent approach that prioritizes capital preservation. Barings believes this strategy and approach offers attractive risk/return with lower volatility given the potential for fewer defaults and greater resilience through market cycles. A significant portion of our investments are expected to be rated below investment grade by rating agencies or, if unrated, would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. To a lesser extent, we may make investments in syndicated loan opportunities for cash management and other purposes, which includes but is not limited to maintaining more liquid investments to manage our share repurchase program.

Relationship with Our Adviser, Barings

Our investment adviser, Barings, a wholly-owned subsidiary of Massachusetts Mutual Life Insurance Company, is a leading global asset management firm and is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). Barings’ primary investment capabilities include fixed income, private credit, real estate, equity, and alternative investments. Subject to the overall supervision of the Board, Barings’ Global Private Finance Group (“Barings GPFG”), manages our day-to-day operations, and provides investment advisory and management services to us. Barings GPFG is part of Barings’ $301.1 billion Global Fixed Income Platform (as of December 31, 2023) that invests in liquid, private and structured credit. Barings GPFG manages private funds and separately managed accounts, along with multiple traded closed-end funds and business development companies.

Among other things, Barings (i) determines the composition of our portfolio, the nature and timing of the changes therein and the manner of implementing such changes; (ii) identifies, evaluates and negotiates the structure of the investments made by us; (iii) executes, closes, services and monitors the investments that we make; (iv) determines the securities and other assets that we will purchase, retain or sell; (v) performs due diligence on prospective portfolio companies and (vi) provides us with such other investment advisory, research and related services as we may, from time to time, reasonably require for the investment of our funds.

6

Under the terms of the Administration Agreement, Barings (in its capacity as our Administrator) performs (or oversees, or arranges for, the performance of) the administrative services necessary for our operation, including, but not limited to, office facilities, equipment, clerical, bookkeeping and record keeping services at such office facilities and such other services as Barings, subject to review by the Board, will from time to time determine to be necessary or useful to perform its obligations under the Administration Agreement. Barings also, on our behalf and subject to the Board’s oversight, arranges for the services of, and oversees, custodians, depositories, transfer agents, dividend disbursing agents, other stockholder servicing agents, accountants, attorneys, underwriters, brokers and dealers, corporate fiduciaries, insurers, banks and such other persons in any such other capacity deemed to be necessary or desirable. Barings is responsible for the financial and other records that we are required to maintain and will prepare all reports and other materials required to be filed with the SEC or any other regulatory authority.

Included in Barings GPFG is Barings North American Private Finance Team (the “U.S. Investment Team”), which consists of 48 investment professionals (as of December 31, 2023) located in three offices in the U.S. The U.S. Investment Team provides a full set of solutions to the North American middle market, including revolvers, first and second lien senior secured loans, unitranche structures, mezzanine debt and equity co-investments. The U.S. Investment Team averages over 20 years of industry experience at the Managing Director and Director level. In addition, Barings believes that it has best-in-class support personnel, including expertise in risk management, legal, accounting, tax, information technology and compliance, among others. We expect to benefit from the support provided by these personnel in our operations.

Stockholder Approval of Reduced Asset Coverage Ratio

On July 24, 2018, our stockholders voted at the 2018 Special Meeting to approve a proposal to authorize us to be subject to a reduced asset coverage ratio of at least 150% under the 1940 Act. As a result of the stockholder approval at the 2018 Special Meeting, effective July 25, 2018, our applicable asset coverage ratio under the 1940 Act has been decreased to 150% from 200%. As a result, we are permitted under the 1940 Act to incur indebtedness at a level that is more consistent with a portfolio of senior secured debt. As of December 31, 2023, our asset coverage ratio was 183.6%.

Our Business Strategy

We seek attractive returns by generating current income primarily from directly-originated debt investments in middle-market companies located primarily in the United States. We also have investments in middle-market companies located outside the United States. Our strategy includes the following components:

•Leveraging Barings GPFG’s Origination and Portfolio Management Resources. As of December 31, 2023 Barings GPFG has over 95 investment professionals located in seven different offices in the U.S., Europe, Australia/New Zealand and Asia. These regional investment teams have been working together in their respective regions for a number of years and have extensive experience advising, investing in and lending to companies across changing market cycles. In addition, the individual members of these teams have diverse investment backgrounds, with prior experience at investment banks, commercial banks, and privately and publicly held companies. We believe this diverse experience provides an in-depth understanding of the strategic, financial and operational challenges and opportunities of middle-market companies.

•Utilizing Long-Standing Relationships to Source Investments. Barings GPFG has worked diligently over decades to build strategic relationships with private equity firms globally. Based on Barings GPFG’s long history of providing consistent, predictable capital to middle-market sponsors, even in periods of market dislocation, Barings believes it has a reputation as a reliable partner. Barings also maintains extensive personal relationships with entrepreneurs, financial sponsors, attorneys, accountants, investment bankers, commercial bankers and other non-bank providers of capital who refer prospective portfolio companies to us. These relationships historically have generated significant investment opportunities. We believe that this network of relationships will continue to produce attractive investment opportunities.

•Focusing on the Middle-Market. We primarily invest in middle-market companies. These companies tend to be privately owned, often by a private equity sponsor, and are companies that typically generate annual

7

earnings before interest, taxes, depreciation and amortization, as adjusted (“Adjusted EBITDA”), of $10.0 million to $75.0 million.

•Providing One-Stop Customized Financing Solutions. Barings believes that Barings GPFG’s ability to commit to and originate larger hold positions (in excess of $200 million) in a given transaction is a differentiator to middle-market private equity sponsors. In today’s market, it has become increasingly important to have the ability to underwrite an entire transaction, providing financial sponsors with certainty of close. Barings GPFG offers a variety of financing structures and has the flexibility to structure investments to meet the needs of our portfolio companies.

•Applying Consistent Underwriting Policies and Active Portfolio Management. We believe robust due diligence on each investment is paramount due to the illiquid nature of a significant portion of our assets. With limited ability to liquidate holdings, private credit investors must take a longer-term, “originate-to-hold” investment approach. Barings has implemented underwriting policies and procedures that are followed for each potential transaction. This consistent and proven fundamental underwriting process includes a thorough analysis of each potential portfolio company’s competitive position, financial performance, management team operating discipline, growth potential and industry attractiveness, which Barings believes allows it to better assess the company’s prospects. After closing, Barings maintains ongoing access to both the sponsor and portfolio company management in order to closely monitor investments and suggest or require remedial actions as needed to avoid a default.

•Maintaining Portfolio Diversification. While we focus our investments in middle-market companies, we seek to invest across various industries and in both United States-based and foreign-based companies. Barings monitors our investment portfolio to ensure we have acceptable industry balance, using industry and market metrics as key indicators. By monitoring our investment portfolio for industry balance, we seek to reduce the effects of economic downturns associated with any particular industry or market sector. Notwithstanding our intent to invest across a variety of industries, we may from time to time hold securities of a single portfolio company that comprise more than 5.0% of our total assets and/or more than 10.0% of the outstanding voting securities of the portfolio company. For that reason, we are classified as a non-diversified management investment company under the 1940 Act.

•Other Investments. To a lesser extent, we will invest opportunistically in assets such as, without limitation, equity, special situations, structured credit (e.g., private asset-backed securities), syndicated loan opportunities, high yield investments and/or mortgage securities. Our special situation investments generally comprise of investments in stressed and distressed corporate debt instruments which are expected to include (but which are not limited to) senior secured loans (including assignments and participations), second lien loans and subordinated debt (including mezzanine and payment-in-kind (“PIK”) securities), secured floating rate notes and secured fixed rated notes, unsecured loans, unsecured senior and subordinated corporate bonds, debentures, notes, commercial paper, convertible debt obligations, equity investments (including preferred stock and common equity instruments), hedging arrangements, other forms of subordinated debt, structured credit (e.g., asset-backed securities) and equity instruments.

8

Investments

Debt Investments

The terms of our directly originated debt investments in middle market companies are tailored to the facts and circumstances of each transaction and prospective portfolio company, negotiating a structure that seeks to protect lender rights and manage risk while creating incentives for the portfolio company to achieve its business plan. We also seek to limit the downside risks of our investments by negotiating covenants that are designed to protect our investments while affording our portfolio companies as much flexibility in managing their businesses as possible. Such restrictions may include affirmative and negative covenants, default penalties, lien protections, change of control provisions, put rights and a pledge of the operating companies’ stock which provides us with additional exit options in downside scenarios. Other lending protections may include term loan amortization, excess cash flow sweeps (effectively additional term loan amortization), limitations on a company’s ability to make acquisitions, maximums on capital expenditures and limits on allowable dividends and distributions. Further, up-front closing fees of typically 1-3% of the loan amount act effectively as pre-payment protection given the cost to a company to refinance early. Additionally, we will typically include call protection provisions effective for the first six to twelve months of an investment to enhance our potential total return.

We continue to invest in predominately senior secured private debt investments in well-established middle-market businesses that operate across a wide range of industries. Senior secured private debt investments are negotiated directly with the borrower, rather than marketed by a third party or bought and sold in the secondary market. We believe senior secured private debt investments may offer higher returns and certain more favorable protections than syndicated senior secured loans. Fees generated in connection with our debt investments are recognized over the life of the loan using the effective interest method or, in some cases, recognized as earned. Terms of our senior secured private debt investments are generally between five and seven years and bear interest between the Secured Overnight Financing Rate (“SOFR”) (or the applicable currency rate for investments in foreign currencies) plus 475 basis points and SOFR plus 675 basis points per annum.

Equity Investments

On a limited basis, we may acquire equity interests in portfolio companies. In such cases, we generally seek to structure our equity investments as non-control investments that provide us with minority rights.

Investment Criteria

We utilize the following criteria and guidelines in evaluating investment opportunities in middle market companies. However, not all of these criteria and guidelines have been, or will be, met in connection with each of our investments.

•Established Companies With Positive Cash Flow. We seek to invest in later-stage or mature companies with a proven history of generating positive cash flows. We typically focus on companies with a history of profitability and trailing twelve-month Adjusted EBITDA ranging from $10.0 million to $75.0 million.

•Experienced Management Teams. Based on our prior investment experience, we believe that a management team with significant experience with a portfolio company or relevant industry experience is essential to the long-term success of the portfolio company. We believe management teams with these attributes are more likely to manage the companies in a manner that protects our debt investment.

•Strong Competitive Position. We seek to invest in companies that have developed strong positions within their respective markets, are well positioned to capitalize on growth opportunities and compete in industries with barriers to entry. We also seek to invest in companies that exhibit a competitive advantage, which may help to protect their market position and profitability.

•Varied Customer and Supplier Bases. We prefer to invest in companies that have varied customer and supplier bases. Companies with varied customer and supplier bases are generally better able to endure economic downturns, industry consolidation and shifting customer preferences.

9

•Significant Invested Capital. We believe the existence of significant underlying equity value provides important support to investments. We seek to identify portfolio companies that we believe have well-structured capital beyond the layer of the capital structure in which we invest.

Investment Process

Our investment origination and portfolio monitoring activities for middle-market companies are performed by Barings GPFG. The investment committee at Barings GPFG is responsible for all aspects of our investment process for investments in middle-market companies; however, other investment committees within Barings are primarily responsible for the investment process for our opportunistic investments in special situations, structured credit (e.g., private asset-backed securities), high-yield investments and mortgage securities. Each of Barings’ investment processes is designed to maximize risk-adjusted returns, minimize non-performing assets and avoid investment losses. In addition, the investment process is also designed to provide sponsors and/or prospective portfolio companies with efficient and predictable deal execution.

Origination

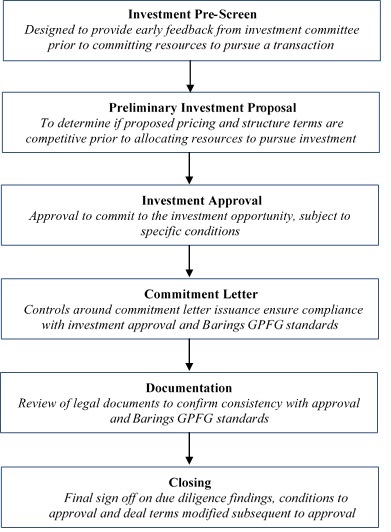

Barings GPFG’s typical origination process for investments in middle-market companies is summarized in the following chart:

10

Investment Pre-Screen

The investment pre-screen process typically begins with a review of an offering memorandum or other high-level prospect information by an investment originator. A fundamental bottoms-up credit analysis is prepared and independent third-party research is gathered in addition to the information received from the sponsor. The investment group focuses on a prospective investment’s fundamentals, sponsor/source and proposed investment structure. This review may be followed by a discussion between the investment originator and an investment group head to identify investment opportunities that should be passed on, either because they fall outside of Barings GPFG’s stated investment strategy or offer an unacceptable risk-adjusted return. If the originator and investment group head agree that an investment opportunity is worth pursuing, a credit analyst assists the originator with preparation of a screening memorandum. The screening memorandum is typically discussed internally with the investment group head and other senior members of the investment group, and in certain instances, the investment group head may elect to review the screening memorandum with the investment committee prior to the preliminary investment proposal.

Preliminary Investment Proposal

Following the screening memorandum discussion, if the decision is made by the investment group head to pursue an investment opportunity, key pricing and structure terms may be communicated to the prospective borrower verbally or via a non-binding standard preliminary term sheet in order to determine whether the proposed terms are competitive.

Investment Approval

Upon acceptance by a sponsor/prospective borrower of preliminary key pricing and structure terms, the investment process continues with formal due diligence. The investment team typically attends meetings with the prospective portfolio company’s management, reviews historical and forecasted financial information and third-party diligence reports, conducts research to support preparation of proprietary financial models including both base case and downside scenarios, valuation analyses, and ultimately, an underwriting memorandum for review by the investment committee. A majority of the votes cast at a meeting at which a majority of the members of the investment committee is present is required to approve all investments in new middle-market portfolio companies.

Commitment Letter

For investments that require written confirmation of commitment, commitment letters are typically reviewed by Barings GPFG’s internal legal team or outside counsel. Commitment letters typically include customary conditions as well as any conditions specified by the investment committee. Such conditions could include, but are not limited to, specific confirmatory due diligence, minimum pre-close Adjusted EBITDA, minimum capitalization, satisfactory documentation, satisfactory legal due diligence and absence of material adverse change. Unless specified by the investment committee as a condition to approval, commitment letters need not include final investment committee approval as a condition precedent.

Documentation

Once an investment opportunity has been approved, negotiation of definitive legal documents occurs, usually simultaneously with completion of any third-party confirmatory due diligence. Typically, legal documentation will be reviewed by Barings GPFG’s internal legal team or by outside legal counsel to ensure that our security interest can be perfected and that all other terms of the definitive loan documents are consistent with the terms approved by the investment committee.

Closing

A closing memorandum is provided to the investment committee. The closing memorandum addresses final investment structure and pricing terms, the sources and uses of funds, any variances from the original approved terms, an update related to the prospect’s financial performance and, if warranted, updates to internal financial models. The closing memorandum also addresses each of the specific conditions to the approval of the investment

11

by the investment committee, including results of confirmatory due diligence with any exceptions or abnormalities highlighted, and includes an analysis of financial covenants with a comparison to the financial forecast prepared by management.

Portfolio Management and Investment Monitoring

Our portfolio management and investment monitoring processes are overseen by Barings. Barings’ portfolio management process is designed to maximize risk-adjusted returns and identify non-performing assets well in advance of potentially adverse events in order to mitigate investment losses. Key aspects of the Barings investment and portfolio management process include:

•Culture of Risk Management. The investment team that approves an investment monitors the investment’s performance through repayment. We believe this practice encourages accountability by connecting investment team members with the long-term performance of the investment. This also allows us to leverage the underwriting process, namely the comprehensive understanding of the risk factors associated with the investment that an investment team develops during underwriting. In addition, we seek to foster continuous interaction between investment teams and the investment committee. This frequent communication encourages the early escalation of issues to members of the investment committee to leverage their experience and expertise well in advance of potentially adverse events.

•Ongoing Monitoring. Each portfolio company is assigned to an analyst who is responsible for the ongoing monitoring of the investment. Upon receipt of information (financial or otherwise) relating to an investment, a preliminary review is performed by the analyst in order to assess whether the information raises any issues that require increased attention. Particular consideration is given to information which may impact the value of an asset. In the event that something material is identified, the analyst is responsible for notifying the relevant members of the deal team and investment committee.

•Quarterly Portfolio Reviews. All investments are reviewed on at least a quarterly basis. The quarterly portfolio reviews provide a forum to evaluate the current status of each asset and identify any recent or long-term performance trends, either positive or negative, that may affect its current valuation.

•Focus Credit List Reviews. Certain credits are deemed to be on the “Focus Credit List”, or a list of similar meaning and are typically reviewed on a more frequent basis. During these reviews, the investment team provides an update on the situation and discusses potential courses of action with the investment committee to ensure any mitigating steps are taken in a timely manner.

•Sponsor Relationships. For middle-market loans, we invest primarily in transactions backed by a private equity sponsor and when evaluating investment opportunities, we take into account the strength of the sponsor (e.g., track record, sector expertise, strategy, governance, follow-on investment capacity, relationship with Barings GPFG). Having a strong relationship and staying in close contact with sponsors and management during not only the underwriting process but also throughout the life of the investment allows us to engage the sponsor and management early to address potential covenant breaks or other issues.

•Robust Investment and Portfolio Management System. Barings’ investment and portfolio management system serves as the central repository of data used for investment management, including both company-level metrics (e.g., probability of default, Adjusted EBITDA, geography) and asset-level metrics (e.g., price, spread/coupon, seniority). Barings portfolio management has established a set of data that analysts must update quarterly, or more frequently when appropriate, in order to produce a one-page summary for each company, which are used during quarterly portfolio reviews.

Valuation Process and Determination of Net Asset Value

The most significant estimate inherent in the preparation of our financial statements is the valuation of investments and the related amounts of unrealized appreciation and depreciation of investments recorded. We have a valuation policy, as well as established and documented processes and methodologies for determining the fair values of portfolio company investments on a recurring (at least quarterly) basis in accordance with the 1940 Act and FASB ASC Topic 820, Fair Value Measurements and Disclosures (“ASC Topic 820”). Our current valuation policy and processes were established by Barings and were approved by the Board.

12

Under ASC Topic 820, fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between a willing buyer and a willing seller at the measurement date. For our portfolio securities, fair value is generally the amount that we might reasonably expect to receive upon the current sale of the security. The fair value measurement assumes that the sale occurs in the principal market for the security, or in the absence of a principal market, in the most advantageous market for the security. If no market for the security exists or if we do not have access to the principal market, the security should be valued based on the sale occurring in a hypothetical market.

Under ASC Topic 820, there are three levels of valuation inputs, as follows:

Level 1 Inputs – include quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 Inputs – include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

Level 3 Inputs – include inputs that are unobservable and significant to the fair value measurement.

A financial instrument is categorized within the ASC Topic 820 valuation hierarchy based upon the lowest level of input to the valuation process that is significant to the fair value measurement. For example, a Level 3 fair value measurement may include inputs that are observable (Levels 1 and 2) and unobservable (Level 3). Therefore, unrealized appreciation and depreciation related to such investments categorized as Level 3 investments within the tables in the notes to our consolidated financial statements may include changes in fair value that are attributable to both observable inputs (Levels 1 and 2) and unobservable inputs (Level 3).

Our investment portfolio includes certain debt and equity instruments of privately held companies for which quoted prices or other observable inputs falling within the categories of Level 1 and Level 2 are generally not available. In such cases, the Adviser determines the fair value of our investments in good faith primarily using Level 3 inputs. In certain cases, quoted prices or other observable inputs exist, and if so, the Adviser assesses the appropriateness of the use of these third-party quotes in determining fair value based on (i) its understanding of the level of actual transactions used by the broker to develop the quote and whether the quote was an indicative price or binding offer and (ii) the depth and consistency of broker quotes and the correlation of changes in broker quotes with underlying performance of the portfolio company.

There is no single approach for determining fair value in good faith, as fair value depends upon the specific circumstances of each individual investment. The recorded fair values of our Level 3 investments may differ significantly from fair values that would have been used had an active market for the securities existed. In addition, changes in the market environment and other events that may occur over the life of the investments may cause the gains or losses ultimately realized on these investments to be different than the valuations currently assigned. For a discussion of the risks inherent in determining the value of securities for which readily available market values do not exist, see “Risk Factors — Risks Relating to Our Business and Structure — Our investment portfolio is and will continue to be recorded at fair value as determined in accordance with the Adviser’s valuation policies and procedures and, as a result, there is and will continue to be uncertainty as to the value of our portfolio investments” included in Item 1A of Part I of this Annual Report on Form 10-K.

Investment Valuation Process

The Board must determine fair value in good faith for any or all of our investments for which market quotations are not readily available. The Board has designated Barings as valuation designee to perform the fair value determinations relating to the value of these assets. Barings has established a pricing committee that is, subject to the oversight of the Board, responsible for the approval, implementation and oversight of the processes and methodologies that relate to the pricing and valuation of assets we hold. Barings uses independent third-party providers to price the portfolio, but in the event an acceptable price cannot be obtained from an approved external source, Barings will utilize alternative methods in accordance with internal pricing procedures established by Barings’ pricing committee.

13

At least annually, Barings conducts reviews of the primary pricing vendors to validate that the inputs used in the vendors’ pricing process are deemed to be market observable. While Barings is not provided access to proprietary models of the vendors, the reviews have included on-site walkthroughs of the pricing process, methodologies and control procedures for each asset class and level for which prices are provided. The review also includes an examination of the underlying inputs and assumptions for a sample of individual securities across asset classes, credit rating levels and various durations, a process Barings continues to perform annually. In addition, the pricing vendors have an established challenge process in place for all security valuations, which facilitates identification and resolution of prices that fall outside expected ranges. Barings believes that the prices received from the pricing vendors are representative of prices that would be received to sell the assets at the measurement date (i.e. exit prices).

Our money market fund investments are generally valued using Level 1 inputs and our equity investments listed on an exchange or on the NASDAQ National Market System are valued using Level 1 inputs, using the last quoted sale price of that day. Our syndicated senior secured loans and structured product investments are generally valued using Level 2 inputs, which are generally valued at the bid quotation obtained from dealers in loans by an independent pricing service. Our middle-market, private debt and equity investments are generally valued using Level 3 inputs.

Independent Valuation

The fair value of loans and equity investments that are not syndicated or for which market quotations are not readily available, including middle-market loans, are generally submitted to independent providers to perform an independent valuation on those loans and equity investments as of the end of each quarter. Such loans and equity investments are initially held at cost, as that is a reasonable approximation of fair value on the acquisition date, and monitored for material changes that could affect the valuation (for example, changes in interest rates or the credit quality of the borrower). At the quarter end following that of the initial acquisition, such loans and equity investments are generally sent to a valuation provider which will determine the fair value of each investment. The independent valuation providers apply various methods (synthetic rating analysis, discounting cash flows, and re-underwriting analysis) to establish the rate of return a market participant would require (the “discount rate”) as of the valuation date, given market conditions, prevailing lending standards and the perceived credit quality of the issuer. Future expected cash flows for each investment are discounted back to present value using these discount rates in the discounted cash flow analysis. A range of values will be provided by the valuation provider and Barings will determine the point within that range that it will use. If the Barings pricing committee disagrees with the price range provided, it may make a fair value recommendation to Barings that is outside of the range provided by the independent valuation provider and the reasons therefore. In certain instances, we may determine that it is not cost-effective, and as a result is not in the stockholders’ best interests, to request an independent valuation firm to perform an independent valuation on certain investments. Such instances include, but are not limited to, situations where the fair value of the investment in the portfolio company is determined to be insignificant relative to the total investment portfolio.

For a further discussion of our valuation procedures, see the section entitled “Critical Accounting Policies and Use of Estimates — Investment Valuation” included in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 7 of Part II of this Annual Report on Form 10-K.

Valuation Inputs

The Adviser’s valuation techniques are based upon both observable and unobservable pricing inputs. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect the Adviser’s market assumptions. The Adviser’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the financial instrument. An independent pricing service provider is the preferred source of pricing a loan, however, to the extent the independent pricing service provider price is unavailable or not relevant and reliable, the Adviser will utilize alternative approaches such as broker quotes or manual prices. The Adviser attempts to maximize the use of observable inputs and minimize the use of unobservable inputs. The availability of observable inputs can vary from investment to investment and is affected by a wide variety of factors, including the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets and other characteristics particular to the security.

14

Valuation of Investments in Jocassee, Thompson Rivers, Waccamaw River, Sierra JV and MVC Private Equity Fund LP

As Jocassee, Thompson Rivers, Waccamaw River, Sierra JV and MVC Private Equity Fund LP (each as defined in “Note 3. Investments” in the Notes to Consolidated Financial Statements) are investment companies with no readily determinable fair values, the Adviser estimates the fair value of our investments in these entities using the NAV of each company and our ownership percentage as a practical expedient. The NAV is determined in accordance with the specialized accounting guidance for investment companies.

Quarterly Net Asset Value Determination

We determine the NAV per share of our common stock on at least a quarterly basis. The NAV per share is equal to the value of our total assets minus total liabilities and any preferred stock outstanding divided by the total number of shares of common stock outstanding.

Competition

We compete for investments with a number of investment funds including public funds, private debt funds and private equity funds, other BDCs, as well as traditional financial services companies such as commercial banks and other sources of financing. Some of these entities have greater financial and managerial resources than we do. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider more investments and establish more relationships than we do. Furthermore, many of our competitors are not subject to the regulatory restrictions that the 1940 Act imposes on us as a BDC.

We use the expertise of the investment professionals of Barings to assess investment risks and determine appropriate pricing for our investments in portfolio companies. We believe the relationship we have with Barings enables us to learn about, and compete for financing opportunities with companies in middle-market businesses that operate across a wide range of industries. For additional information concerning the competitive risks we face, see “Risk Factors — Risks Relating to Our Business and Structure — We operate in a highly competitive market for investment opportunities, which could reduce returns and result in losses” included in Item 1A of Part I of this Annual Report on Form 10-K.

Brokerage Allocation and Other Practices

We did not pay any brokerage commissions during the fiscal years ended December 31, 2021, December 31, 2022 and December 31, 2023 in connection with the acquisition and/or disposal of our investments. We generally acquire and dispose of our investments in privately negotiated transactions; therefore, we infrequently use brokers in the normal course of our business. Barings is primarily responsible for the execution of any publicly traded securities portion of our portfolio transactions and the allocation of brokerage commissions. We do not expect to execute transactions through any particular broker or dealer, but will seek to obtain the best net results for us, taking into account such factors as price (including the applicable brokerage commission or dealer spread), size of order, difficulty of execution, and operational facilities of the firm and the firm’s risk and skill in positioning blocks of securities. While we will generally seek reasonably competitive trade execution costs, we will not necessarily pay the lowest spread or commission available. Subject to applicable legal requirements, if we use a broker, we may select a broker based partly upon brokerage or research services provided to us. In return for such services, we may pay a higher commission than other brokers would charge if we determine in good faith that such commission is reasonable in relation to the services provided.

15

Dividend Reinvestment Plan

We have adopted a dividend reinvestment plan that provides for reinvestment of our distributions on behalf of our common stockholders, unless a common stockholder elects to receive cash as provided below. As a result, if the Board authorizes, and we declare, a cash dividend, then our common stockholders who have not “opted out” of our dividend reinvestment plan will have their cash dividends automatically reinvested in additional shares of our common stock, rather than receiving the cash dividends.

No action will be required on the part of a registered common stockholder to have his or her cash dividend reinvested in shares of our common stock. A registered common stockholder may elect to receive an entire dividend in cash by notifying Computershare, Inc., the “Plan Administrator” and our transfer agent and registrar, in writing so that such notice is received by the Plan Administrator no later than three days prior to the payment date fixed by the Board for the dividend. The Plan Administrator will set up an account for shares acquired through the plan for each common stockholder who has not elected to receive dividends in cash and hold such shares in non-certificated form. Upon request by a common stockholder participating in the plan, received in writing not less than three days prior to the payment date, the Plan Administrator will, instead of crediting shares to the participant’s account, issue a certificate registered in the participant’s name for the number of whole shares of our common stock and a check for any fractional share. Those common stockholders whose shares are held by a broker or other financial intermediary may receive dividends in cash by notifying their broker or other financial intermediary of their election.

We intend to use primarily newly issued shares to implement the plan, so long as our shares are trading at or above NAV. If our shares are trading below NAV, we intend to purchase shares in the open market in connection with our implementation of the plan. If we use newly issued shares to implement the plan, the number of shares to be issued to a common stockholder is determined by dividing the total dollar amount of the dividend payable to such common stockholder by the market price per share of our common stock at the close of regular trading on The New York Stock Exchange (the “NYSE”) on the dividend payment date. Market price per share on that date will be the closing price for such shares on the NYSE or, if no sale is reported for such day, at the average of their reported bid and asked prices. If we purchase shares in the open market to implement the plan, the number of shares to be received by a common stockholder is determined by dividing the total dollar amount of the dividend payable to such common stockholder by the average price per share for all shares purchased by the Plan Administrator in the open market in connection with the dividend. The number of shares of our common stock to be outstanding after giving effect to payment of the dividend cannot be established until the value per share at which additional shares will be issued has been determined and elections of our common stockholders have been tabulated.

There will be no brokerage charges or other charges to common stockholders who participate in the plan. However, certain brokerage firms may charge brokerage charges or other charges to their customers. We will pay the Plan Administrator’s fees under the plan. If a participant elects by written notice to the Plan Administrator to have the Plan Administrator sell part or all of the shares held by the Plan Administrator in the participant’s account and remit the proceeds to the participant, the Plan Administrator is authorized to deduct a $15.00 transaction fee plus a $0.10 per share brokerage commission from the proceeds.

Common stockholders who receive dividends in the form of stock generally are subject to the same federal, state and local tax consequences as are common stockholders who elect to receive their dividends in cash. A common stockholder’s basis for determining gain or loss upon the sale of stock received in a dividend from us will be equal to the total dollar amount of the dividend payable to the common stockholder. Any stock received in a dividend will have a holding period for tax purposes commencing on the day following the day on which the shares are credited to the U.S. common stockholder’s account. Stock received in a dividend may generate a wash sale if a common stockholder sold our stock at a realized loss within 30 days either before or after such dividend.

Participants may terminate their accounts under the plan by notifying the Plan Administrator via its website at www.computershare.com/investor, by filling out the transaction request form located at the bottom of their statement and sending it to the Plan Administrator at Computershare, Inc., P.O. Box 43006, Providence, Rhode Island 02940 or by calling the Plan Administrator at (866) 228-7201.

16

We may terminate the plan upon notice in writing mailed to each participant at least 30 days prior to any record date for the payment of any dividend by us. All correspondence concerning the plan should be directed to the Plan Administrator by mail at Computershare, Inc., P.O. Box 43006, Providence, Rhode Island 02940.

Employees

We do not currently have any employees and do not expect to have any employees. The services necessary for our business are provided by individuals who are employees of Barings, pursuant to the terms of the Barings BDC Advisory Agreement and our Administration Agreement. Each of our executive officers is an employee of Barings and our day-to-day investment activities are managed by Barings.

Management Agreements

In connection with the MVC Acquisition, we entered into the Amended and Restated Advisory Agreement following approval of the Amended and Restated Advisory Agreement by our stockholders at our December 23, 2020 special meeting of stockholders. The Amended and Restated Advisory Agreement was approved on September 9, 2020 by the then-current Board, including a majority of the directors on the Board who are not “interested persons,” as defined in Section 2(a)(19) of the 1940 Act (the “Independent Directors”), of the Company or Barings. The terms of the Amended and Restated Advisory Agreement became effective on January 1, 2021. In connection with the Sierra Merger, we entered into the Second Amended Barings BDC Advisory Agreement on February 25, 2022. The Second Amended Barings BDC Advisory Agreement was approved by our Board, including a majority of the Independent Directors of the Company or Barings, on May 5, 2022. On June 24, 2023, we entered into a third amended and restated investment advisory agreement with Barings (the “Barings BDC Advisory Agreement”) in order to update the term of the agreement to expire on June 24 each year subject to annual re-approval in accordance with its terms. All other terms and provisions of the Second Amended and Restated Barings BDC Advisory Agreement between the Company and the Adviser, including with respect to the calculation of the fees payable to the Adviser, remain unchanged under the Barings BDC Advisory Agreement. The Barings BDC Advisory Agreement was approved by our Board, including a majority of the Independent Directors of the Company or Barings, on May 4, 2023 and made to become effective on June 24, 2023.

Investment Advisory Agreement

Pursuant to the Barings BDC Advisory Agreement, Barings manages our day-to-day operations and provides us with investment advisory services. Among other things, Barings (i) determines the composition of our portfolio, the nature and timing of the changes therein and the manner of implementing such changes; (ii) identifies, evaluates and negotiates the structure of our investments; (iii) executes, closes, services and monitors the investments that we make; (iv) determines the securities and other assets that we will purchase, retain or sell; (v) performs due diligence on prospective portfolio companies and (vi) provides us with such other investment advisory, research and related services we may, from time to time, reasonably require for the investment of its funds.

The Barings BDC Advisory Agreement provides that, absent fraud, willful misfeasance, bad faith or gross negligence in the performance of its duties or by reason of the reckless disregard of its duties and obligations, Barings, and its officers, managers, partners, agents, employees, controlling persons, members and any other person or entity affiliated with Barings (collectively, the “IA Indemnified Parties”), are entitled to indemnification from us for any damages, liabilities, costs, demands, charges, claims and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) incurred by the IA Indemnified Parties in or by reason of any pending, threatened or completed action, suit, investigation or other proceeding (including an action or suit by or in the right of us or our security holders) arising out of any actions or omissions or otherwise based upon the performance of any of Barings’ duties or obligations under the Barings BDC Advisory Agreement or otherwise as our investment adviser. Barings’ services under the Barings BDC Advisory Agreement are not exclusive, and Barings is generally free to furnish similar services to other entities so long as its performance under the Barings BDC Advisory Agreement is not adversely affected.

Barings has entered into a personnel-sharing arrangement with its affiliate, Baring International Investment Limited (“BIIL”). BIIL is a wholly-owned subsidiary of Baring Asset Management Limited, which in turn is an indirect, wholly-owned subsidiary of Barings. Pursuant to this arrangement, certain employees of BIIL may serve as

17

“associated persons” of Barings and, in this capacity, subject to the oversight and supervision of Barings, may provide research and related services, and discretionary investment management and trading services (including acting as portfolio managers) to us on behalf of Barings. This arrangement is based on no-action letters of the staff of the SEC that permit SEC-registered investment advisers to rely on and use the resources of advisory affiliates or “participating affiliates,” subject to the supervision of that SEC-registered investment adviser. BIIL is a “participating affiliate” of Barings, and the BIIL employees are “associated persons” of Barings.

Under the Barings BDC Advisory Agreement, we pay Barings (i) a base management fee (the “Base Management Fee”) and (ii) an incentive fee (the “Incentive Fee”) as compensation for the investment advisory and management services it provides us thereunder.

The Base Management Fee is calculated based on our gross assets, including the credit support agreements, assets purchased with borrowed funds or other forms of leverage and excluding cash and cash equivalents, at an annual rate of 1.25%. The Base Management Fee is payable quarterly in arrears on a calendar quarter basis, and is calculated based on the average value of our gross assets, excluding cash and cash equivalents, at the end of the two most recently completed calendar quarters prior to the quarter for which such fees are being calculated. Base Management Fees for any partial month or quarter will be appropriately pro-rated.

The Incentive Fee consists of two components that are independent of each other, with the result that one component may be payable even if the other is not. A portion of the Incentive Fee is based on our income (the “ Income-Based Fee”) and a portion is based on our capital gains (the “Capital Gains Fee ”), each as described below:

(i) The Income-Based Fee will be determined and paid quarterly in arrears based on the amount by which (x) the aggregate “Pre-Incentive Fee Net Investment Income” (as defined below) in respect of the current calendar quarter and the eleven preceding calendar quarters beginning with the calendar quarter that commences on or after January 1, 2021, as the case may be (or the appropriate portion thereof in the case of any of our first eleven calendar quarters that commences on or after January 1, 2021) (in either case, the “Trailing Twelve Quarters”) exceeds (y) the Hurdle Amount (as defined below) in respect of the Trailing Twelve Quarters. The Hurdle Amount will be determined on a quarterly basis, and will be calculated by multiplying 2.0625% (8.25% annualized) by the aggregate of our NAV at the beginning of each applicable calendar quarter comprising the relevant Trailing Twelve Quarters. For this purpose, “Pre-Incentive Fee Net Investment Income” means interest income, dividend income and any other income (including, without limitation, any accrued income that we have not yet received in cash and any other fees such as commitment, origination, structuring, diligence and consulting fees or other fees that we receive from portfolio companies) accrued during the calendar quarter, minus our operating expenses accrued during the calendar quarter (including, without limitation, the Base Management Fee, administration expenses and any interest expense and dividends paid on any issued and outstanding preferred stock, but excluding the Income-Based Fee and the Capital Gains Fee). For the avoidance of doubt, Pre-Incentive Fee Net Investment Income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

The calculation of the Income-Based Fee for each quarter is as follows:

(A) No Income-Based Fee will be payable to Barings in any calendar quarter in which our aggregate Pre-Incentive Fee Net Investment Income for the Trailing Twelve Quarters does not exceed the Hurdle Amount;

(B) 100% of our aggregate Pre-Incentive Fee Net Investment Income for the Trailing Twelve Quarters, if any, that exceeds the Hurdle Amount but is less than or equal to an amount (the “Catch-Up Amount”) determined on a quarterly basis by multiplying 2.578125% (10.3125% annualized) by our NAV at the beginning of each applicable calendar quarter comprising the relevant Trailing Twelve Quarters. The Catch-Up Amount is intended to provide Barings with an incentive fee of 20% on all of our Pre-Incentive Fee Net Investment Income when our Pre-Incentive Fee Net Investment Income reaches the Catch-Up Amount for the Trailing Twelve Quarters; and

18

(C) For any quarter in which our aggregate Pre-Incentive Fee Net Investment Income for the Trailing Twelve Quarters exceeds the Catch-Up Amount, the Income-Based Fee shall equal 20% of the amount of our Pre-Incentive Fee Net Investment Income for such Trailing Twelve Quarters, as the Hurdle Amount and Catch-Up Amount will have been achieved.

Subject to the Incentive Fee Cap described below, the amount of the Income-Based Fee that will be paid to Barings for a particular quarter will equal the excess of the aggregate Income-Based Fee so calculated less the aggregate Income-Based Fees that were paid to Barings in the preceding eleven calendar quarters (or portion thereof) comprising the relevant Trailing Twelve Quarters.

(ii) The Income-Based Fee is subject to a cap (the “Incentive Fee Cap”). The Incentive Fee Cap in any quarter is an amount equal to (a) 20% of the Cumulative Pre-Incentive Fee Net Return (as defined below) during the relevant Trailing Twelve Quarters less (b) the aggregate Income-Based Fee that were paid to Barings in the preceding eleven calendar quarters (or portion thereof) comprising the relevant Trailing Twelve Quarters. For this purpose, “Cumulative Pre-Incentive Fee Net Return” during the relevant Trailing Twelve Quarters means (x) Pre-Incentive Fee Net Investment Income in respect of the Trailing Twelve Quarters less (y) any Net Capital Loss, if any, in respect of the Trailing Twelve Quarters. If, in any quarter, the Incentive Fee Cap is zero or a negative value, we will pay no Income-Based Fee to Barings in that quarter. If, in any quarter, the Incentive Fee Cap is a positive value but is less than the Income-Based Fee calculated in accordance with paragraph (i) above, we will pay Barings the Incentive Fee Cap for such quarter. If, in any quarter, the Incentive Fee Cap is equal to or greater than the Income-Based Fee calculated in accordance with paragraph (i) above, we will pay Barings the Income-Based Fee for such quarter.

“Net Capital Loss” in respect of a particular period means the difference, if positive, between (i) aggregate capital losses on our assets, whether realized or unrealized, in such period and (ii) aggregate capital gains or other gains on our assets (including, for the avoidance of doubt, the value ascribed to any credit support arrangement in our financial statements even if such value is not categorized as a gain therein), whether realized or unrealized, in such period.

(iii) The second part of the Incentive Fee (the “Capital Gains Fee”) is determined and payable in arrears as of the end of each calendar year (or upon termination of the Barings BDC Advisory Agreement), commencing with the calendar year ended on December 31, 2018, and is calculated at the end of each applicable year by subtracting (1) the sum of our cumulative aggregate realized capital losses and aggregate unrealized capital depreciation from (2) our cumulative aggregate realized capital gains, in each case calculated from August 2, 2018. If such amount is positive at the end of such year, then the Capital Gains Fee payable for such year is equal to 20% of such amount, less the cumulative aggregate amount of Capital Gains Fees paid in all prior years commencing with the calendar year ended on December 31, 2018. If such amount is negative, then there is no Capital Gains Fee payable for such year. If this Agreement is terminated as of a date that is not a calendar year end, the termination date will be treated as though it were a calendar year end for purposes of calculating and paying a Capital Gains Fee.

Under the Barings BDC Advisory Agreement, the “cumulative aggregate realized capital gains” are calculated as the sum of the differences, if positive, between (a) the net sales price of each investment in our portfolio when sold and (b) the accreted or amortized cost basis of such investment.

The “cumulative aggregate realized capital losses” are calculated as the sum of the differences, if negative, between (a) the net sales price of each investment in our portfolio when sold and (b) the accreted or amortized cost basis of such investment.

The “aggregate unrealized capital depreciation” is calculated as the sum of the differences, if negative, between (a) the valuation of each investment in our portfolio as of the applicable Capital Gains Fee calculation date and (b) the accreted or amortized cost basis of such investment.

Under the Barings BDC Advisory Agreement, the “accreted or amortized cost basis of an investment” shall mean the accreted or amortized cost basis of such investment as reflected in our financial statements.

19

Payment of Company Expenses